Advertisement

In May, a worrying event in the stablecoin sector was that Terra’s UST lost a 1:1 peg on the dollar. This is a consequence of the demolition of the peg, which leads to the destruction of the legitimacy of Terra. After this fierce carnage, USDT and USDC survived.

However, different stablecoins have to put in a lot of effort to fill the void it leaves behind. According to a source of reports, the DOLLAR (USDC) is taking the lead in this race. According to the market value capitalization, USDT is now ranked third and USDC is ranked fourth soon after.

Usdc will “dethrone” USDT

According to data published by Arcane Research, usdc’s market valuation is now more than $54.8 billion, 30 days earlier it fell by almost 1.6%. While USDT’s Market Capitalization stood at $65.6 billion and during the same period, it also fell 1.5%.

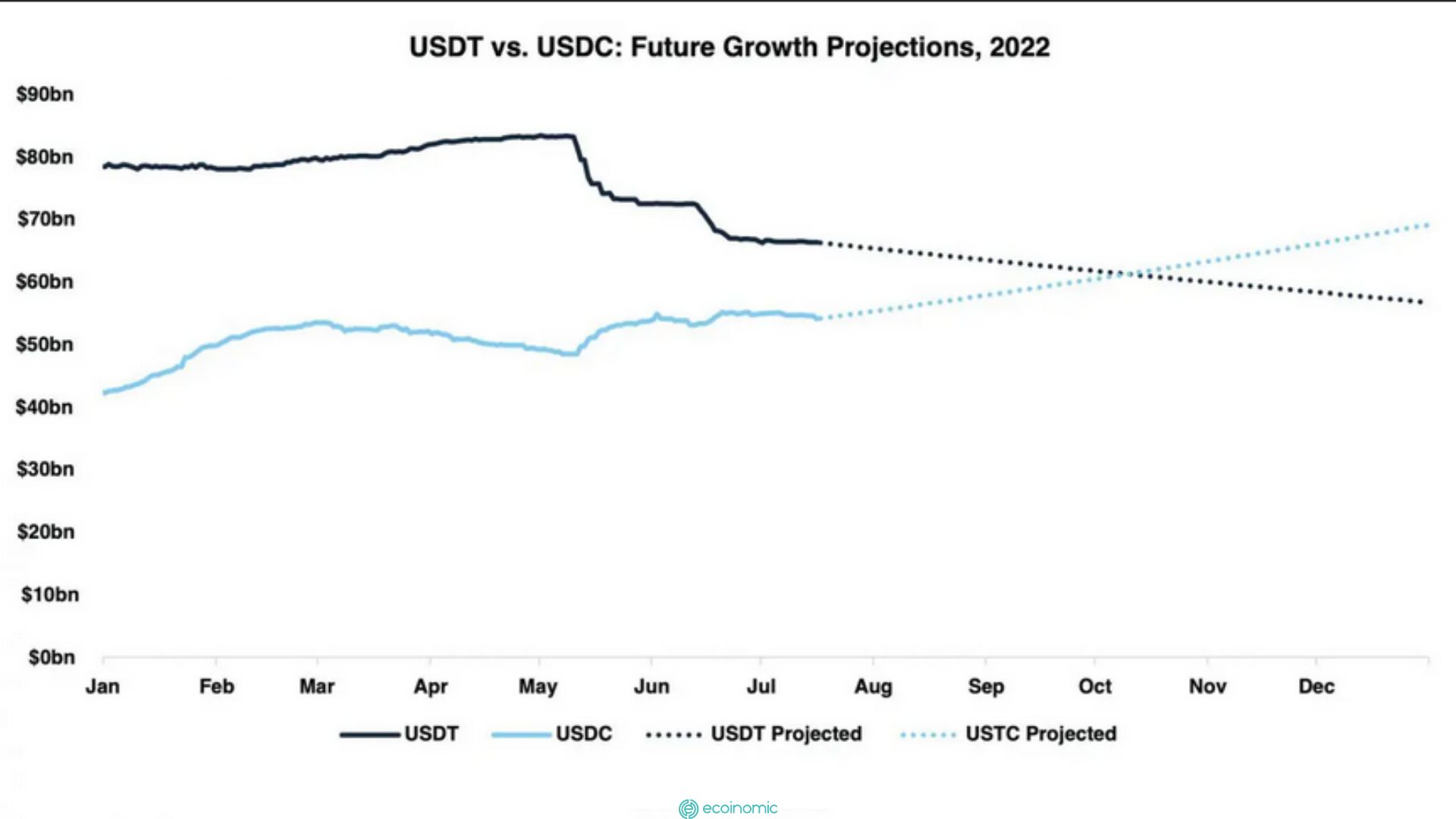

In the Arcane announcement it was commented that this stablecoin bubble has been expanding for a period of time. In the first 4 months of 2022, stablecoins had a good period of activity before the onset of a reversal trend that shook the market.

Based on the current growth rate, USDC is likely to overtake USDT. USDC’s growth rate reached 70.4% while USDT’s growth rate fell to 28.7%. It is expected that in October 2022, the USD will overtake Tether and become the most stable currency if the exchange rate holds up as it is. USDC’s market capitalization will exceed the $61.3 billion mark.

At the beginning of 2022, Tether accounted for 47.5% of the market while USDC only had 25.8%. However, after the first 6 months of 2022, Tether’s position has decreased to 43.8%, USDC has increased to account for 36.3%.

Expecting USDT to crash

In addition to the important criteria that Arcane put forward to demonstrate why USDC will surpass Tether, there are a number of other aspects to mention.

Firstly, because of the lack of transparency about its investments and projections Tether has received a lot of criticism. Besides, Tether’s audits have lacked the consistency required. This factor has made tether’s position more and more ambiguous.

Secondly, in terms of investments as well as its storage USDC is assessed to have more openness and there are periodic audits. This will help investors feel safe and trust it more. Monthly audits are conducted by USDC’s parent company, Center, and a partnership between Circle, Coinbase, and Bitmain.

Currently, in some countries there has been a review of stablecoin regulations. This will help the coin to have the most audit and transparency. This can also become the copper with the most users.

While USDC is highly controlled because it is more centralized, USDT can only go through the blockchain to track information. It can be seen that in the ongoing stablecoin race, USDC is gaining a lot of dominance.

>> See also: FTX review 2022: The simplest way to apply for FTX for newbies.