Advertisement

Bitcoin (BTC) hit the $20,000 mark after a year and a half making mining — the ecosystem's most important job — an expensive one. However, if history repeats itself, BTC investors could witness another epic rally that once helped Bitcoin reach an all-time high of $69,000.

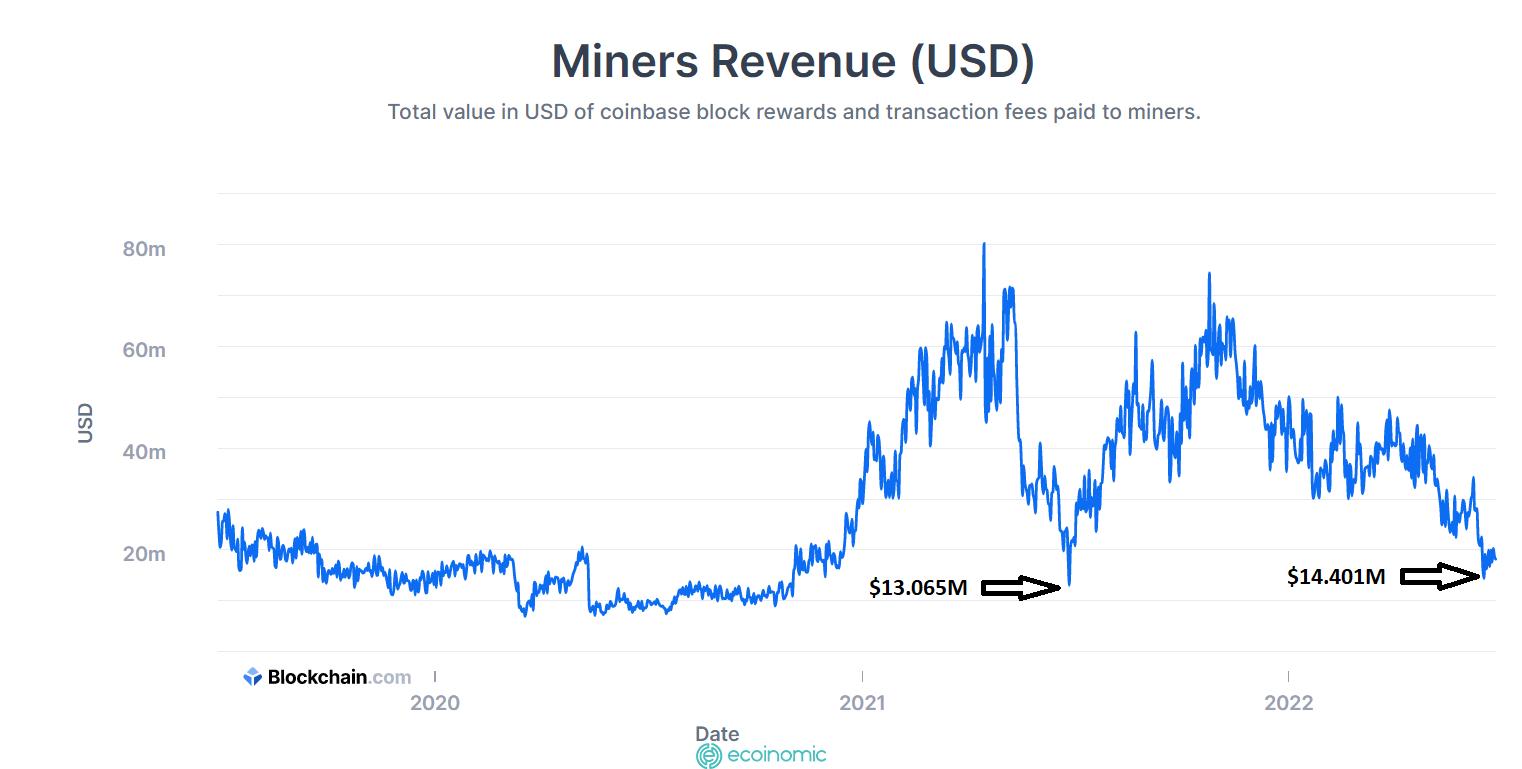

Changes in the price of Bitcoin will directly affect the earnings of miners, who earn fixed block rewards as well as transaction fees in BTC to run their mining operations. In June 2022, total mining revenue fell below the $20 million range, with Blockchain.com data recording a lowest drop of $14,401 million on June 17.

As can be seen, the recent drop in Bitcoin mining revenue was last witnessed a year ago when the total value increased to $13.065 million on June 27, 2021 – back when BTC traded at around $34,000. What followed was Bitcoin's epic five-month rally backed by pro-crypto initiatives such as El Salvador's BTC adoption and crypto-friendly regulations on a global scale.

Despite the conflicting sentiments about the recovery of the cryptocurrency ecosystem, short-term investors are said to have stepped up their investment efforts in the Bear market context as they realize their long-term dream of owning 1 BTC. Global economic downturns, geopolitical tensions, a declining cryptocurrency economy like Terra (LUNA) and an ongoing pandemic have prevented the Bitcoin ecosystem from unleashing its true potential.

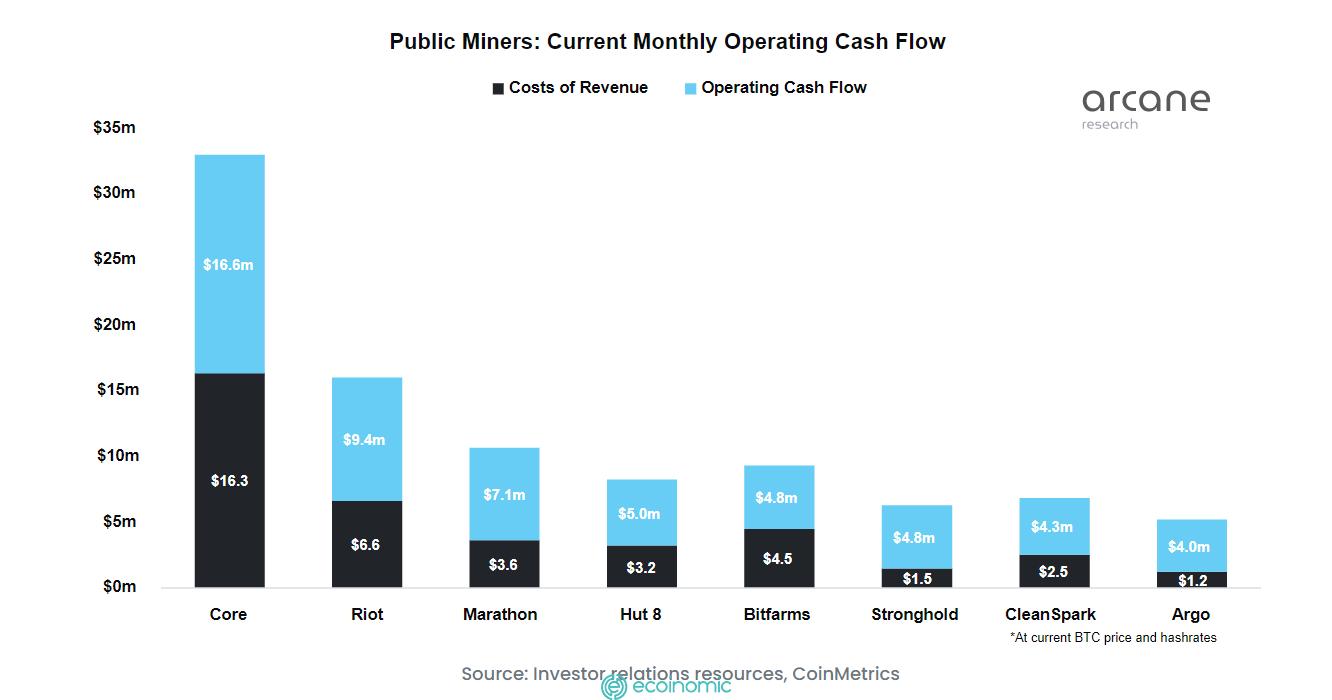

A report shared by cryptocurrency-focused financial services firm Arcane crypto has revealed the potential of some public bitcoin miners to survive in the ongoing bear market. The key to bitcoin miners' survival lies in the delicate balance between revenue and operating cash flow.

Based on the report, Argo, CleanSpark, Stronghold, Marathon and Roit are the best positioned miners that can sustain the cryptocurrency winter. At the same time, core's main player has almost matched its operating expenses with its total revenue.

Bitcoin mining hardware and storage company Compass Mining has also lost one of its Maine-based storage facilities after failing to pay its electricity bill.

Effective June 14th @compass_mining facility hosting agreement in Maine was terminated by @dynamics2k for failure to pay power consumption charges. 6 late payment and 3 non payments. @MiningScandals pic.twitter.com/cSfnWMmqTY

— DynamicsMining (@DynamicsMining) June 27, 2022

Dynamics Mining, the owner of the mine storage facility, alleges that Compass Mining has six late payments with three non-payments related to utility bills and storage fees. Specifically, "all you pay is $250,000 for 3 months of power consumption."

>> See also: The easiest MEXC Registration Guide to understand