Advertisement

Many advocate that Bitcoin will be legal in bidding in the next 3 years.

Bitcoin gets a lot of support in legalizing tenders

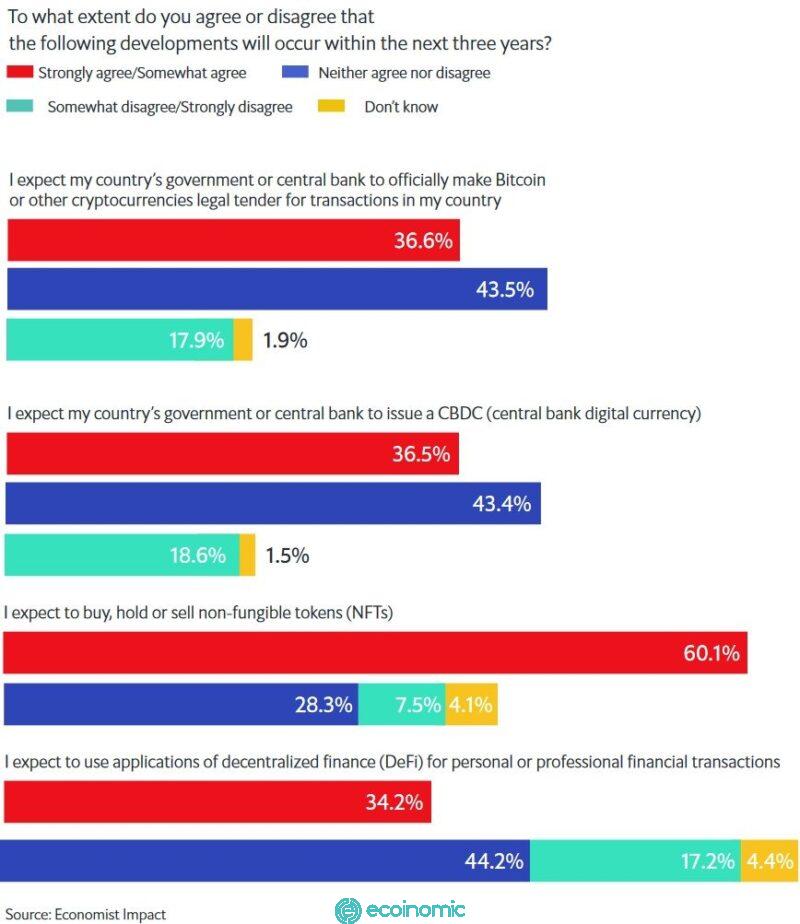

There is a lot of potential in driving a bullish approach to bitcoin (BTC) investments, so it's not hard to understand that only 17.9% of individuals surveyed said they don't expect BTC to be legally tendered for 3 years, according to a recent report prepared by The Economist Group and commissioned by the Crypto.com electronic platform.

The response to the survey was taken from a group of 3,000 people between January and February 2022. About 50% of respondents came from developed economies such as the US, UK, France, South Korea, Australia and Singapore, while the rest came from developing economies including Brazil, Turkey, Vietnam, South Africa and the Philippines.

In response to this comment: "I expect the government or central bank in my country to bring Bitcoin or other cryptocurrencies officially legally tendered in domestic transactions." In the next 3 years, about 36.6% of surveyors strongly or somewhat agree with the idea; 43.4% neither agree nor oppose, Meanwhile, 17.9% said they disagreed in part or completely with this statement.

The bank's own digital currency – is it possible?

A lower percentage of the responses received, about 36.5% said they expected the government or central bank in their country to issue the bank's digital currency (CBDC) in the next 3 years. Only 18.6% were skeptical and said this was likely to happen, while 43.4% had no opinion on the claim.

Notably, the department of many executives (one of the small groups polled) stated firmly that: " CBDCs have the potential to replace physical currencies in their countries: nearly two-thirds (65%) say this is entirely possible, That's more than half (56 percent) confirmed last year," according to the report.

Survey participants demonstrated a similar bullish approach to irreplaceable tokens (NFTs), as about 60.1% said they fully agreed with buying, holding or reselling those assets over the next 3 years. Only about 7.5% said otherwise.

Tobias Adrian, financial adviser and director of the Department of Capital Markets and the International Monetary Fund (IMF), said: "It would be perfectly normal for cash to be replaced by cryptocurrencies in an age when everything is being digitized. In my opinion, this is an understandable development and an inevitable trend in the market."

"It is possible that this form of assets is not yet commonly used, but in principle, the central banking system's ability to convert cash into digital currencies is an anchor, an important bright spot for the economy on the momentum of digital development." Adrian told me more.

Cryptocurrencies continue to be the most popular form of digital payments, as they are used by 13% of survey respondents. This was followed by digital cash flows issued by companies in the technology and financial sectors, with a utilization rate of 12%. Finally, there is the government-issued digital currency with 9% of users. According to the report, this rate has not changed much when compared to the years.

"All respondents have paid for a product or service in the past 12 months using digital payments. Half of them are from developing countries and half are from developed countries," the study added.

Through the survey, it can be seen that the biggest barrier to promoting the adoption of digital currencies into life is similar, but with smaller nuances. For open source digital currencies , such as BTC, the lack of knowledge is one of the reasons why the success rate of use dropped from 51% to 22% compared to the same period last year. The main obstacle now is the need to create a secure enough digital form of personal ID, according to 24.3% of respondents, more than last year's 13% assertion.

For CBDC, the reception of digital cash flows also faces many barriers such as lack of education (27%), low technical proficiency (27%) and unequal accessibility (27%), among other barriers according to the survey.