Advertisement

An article in the Wall Street Journal claimed sales of NFTs were in extremely low declines — in the same week that the top five collections alone accounted for more than $1 billion in major and secondary sales.

The paper cites data from market analysis platform NFT Nonfungible showing that the number of NFT sales has fallen 92% since an all-time high in September 2021. Active wallets on the Ethereum NFT (ETH) market are also said to have fallen by 88% since high growth in November 2021.

Finally, the article concludes: "The NFT market is collapsing."

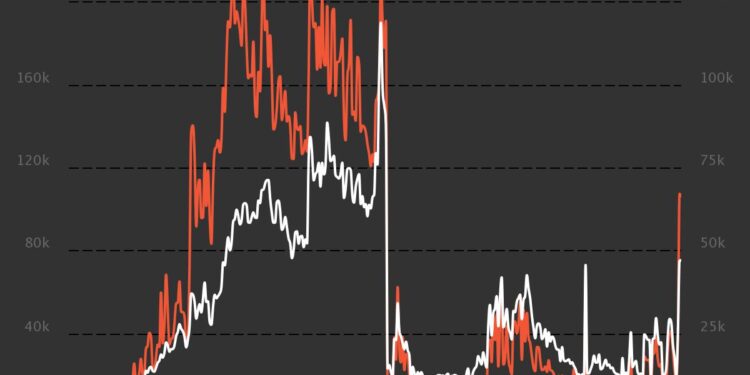

However, onchain data from Dune Analytics' dashboard shows that the NFT market remains strong, with information showing that users and NFT transactions are much higher than what was reported by Nonfungible.

The analysis also showed that the volume per day in USD on Ethereum NFT during the week was one of the highest levels seen since February with the popular opensea market reaching a volume of nearly $550 million on May 1 alone.

Analysis from Tom Schmidt, partner at Venture Capital firm Dragonfly Capital, reveals a similar story when it comes to focusing on OpenSea transactions and USD volumes.

The @WSJ just published an article claiming that NFT transactions are flatlining, which appears to be totally based on incorrect data from https://t.co/LFpkjZGBiI (compare with on-chain @DuneAnalytics data). Did no one bother to check primary sources? Also why not $ volume? pic.twitter.com/WRBw1eChaz

— Tom Schmidt (@tomhschmidt) May 3, 2022

Sub-sectors in the NFT market are emerging and while some areas of the oversaturated market are in recession, others are seeing major gains.

Nansen's analytics platform indexes NFT collections by type showing that NFTs " Blue Chip" – established and highly regarded brands such as Bored and Mutant Ape Yacht Club and Azuki tokens – go far beyond art or gaming tokens.

The Nansen Blue Chip-10 index tracks the top 10 NFT projects up 81% so far this year (YTD), while comparing the leading NFT art and gaming collections is down 39% and 49% YTD, respectively.

The phenomenon of NFT market capital consolidation into the top collections was indicated in an analysis by NFTstatistics.eth, which showed that the top 5 collections are driving the Ethereum NFT market.

This trend continues: BAYC, Azuki, CloneX, Doodles & now Moonbirds separating themselves from everyone else.

I've talked about large-caps outperforming, but it's really the top-5 projects driving all the gains. pic.twitter.com/UsUlwHMJ9M

— NFTstatistics.eth (@punk9059) April 26, 2022

"There's obviously a trend right now that five or six of the most successful projects are outperforming strongly while the rest are in serious decline."

Data from Nonfungible showed a spike on May 1 with the number of sales and wallets operating that day reaching numbers not seen in their data from November 8, 2021 directly correlated with record-breaking (and ethereum-breaking) breaks. The metaverse land of the Otherside project for sale by Yuga Labs once again contradicts the claim that NFT sales are collapsing.

It's unclear why the indisputable data the WSJ relies on is skewed against Dune's data, however it may be due to the inclusion of sales volume from Nonfungible's P2EAxie Infinity game.

Volume for the popular play-to-earn hit an all-time high of over $40 million on November 4, 2021 before gradually declining to current levels of around $500,000 according to CryptoSlam data.

But the widespread demise of a P2E game like NFTstatistics.eth says 'is an extremely different message to 'NFTs are collapsing'.

Their data includes Axie Infinity, such a bad outlier to include pic.twitter.com/xkXihej9kQ

— djohnson.eth (@DJohnson_CPA) May 3, 2022

While the current debate is focused on Ethereum NFTs, Solana is rapidly becoming a popular blockchain for this asset class and the second largest blockchain after Ethereum in terms of NFT sales volume.

Last week, the Solana NFT Okay Bears project topped OpenSea's 24-hour sales tracker for the first time and held fourth place behind Mutant Yacht Club Ape in 7-day sales volume on CryptoSlam with more than $47 million traded.