What is Symbiosis Finance? Detailed Symbiosis Finance User Guide

Symbiosis Finance is a decentralized multi-chain liquidity protocol that ensures liquidity on Ethereum virtual machines (EVMs) and EVM-incompatible blockchains. Through the Symbiosis Finance protocol, users can convert tokens across the chain but remain the sole owner of the asset with low slippage and high liquidity.

The Symbiosis Finance system allows users to pay for transactions with tokens they use to swap, without using native tokens.

Basic information of Symbiosis Finance

- Website: symbiosis.finance

- Supported Chain: Ethereum, BNB Chain, Avalanche, Polygon

- Supported Wallet: Metamask, Coinbase Wallet, Wallet Connect,…

- Category: Cross-chain

- Feature: Swap, Stuck Transactions, Liquidity Pools, Cross-chain Zaps, Dealing with sTokens,

- Audit: ABDK Consulting

- Availability: Website

Highlights of Symbiosis Finance

- Optimize user experience: With just one click, users can perform cross-chain swaps between EVM virtual machines and EVM-incompatible blockchains without intermediary steps or through additional wallets, without waiting time.

- Completely decentralized: Intermediaries cannot block the Symbiosis protocol or censor user access to the protocol.

- Compatibility: Symbiosis Finance connects popular blockchains, including Ethereum, BNB Chain, Avalanche, Polygon, and scals that support many other blockchains in the future.

- Non-custody: No one has access to user funds, including the Symbiosis team.

- Unlimited Cross-Chain Liquidity: The protocol aims to support all token pairs across all blockchains while providing the best price to enhance credit liquidity.

Mechanism of action of Symbiosis Finance

Symbiosis Finance performs cross-chain swaps with two cases:

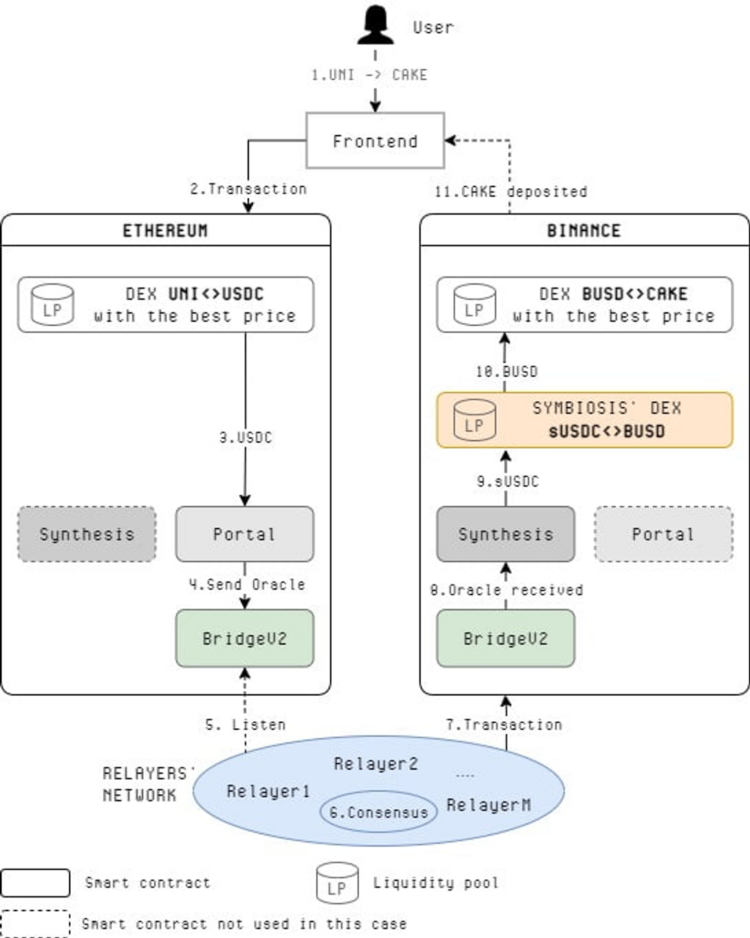

Case 1: Cross-chain swaps from a blockchain with high gas fees to a blockchain with lower gas fees.

For example: Cross-chain revert from UNI ERC20 on Ethereum to CAKE BEP20 on Binance Smart Chain.

At that time, the process of swapping UNI to CAKE will take place as follows: UNI → USDC → sUSDC → BUSD → CAKE

- Users sign and submit transactions containing instructions for the Symbiosis Finance protocol.

- The Symbiosis Finance protocol swaps UNI for USDC on behalf of users with a 1-inch protocol that guarantees the best rates.

- The Symbiosis Finance protocol locks USDCs in one of the Portal smart contracts.

- As soon as the token is locked on Portal, another BridgeV2 Symbiosis Smart contract will announce a cross-chain swap request.

- Relayers reach consensus for this particular event, sign, and send a transaction to Binance Smart Chain.

- The Synthesis protocol on BNB receives information about swapping and minting sUSDC tokens at a 1:1 ratio for USDCc on Ethereum.

- The Symbiosis Finance protocol represents the user on the Liquidity Pool swapping sUSDC for BUSD.

- The Symbiosis Finance protocol represents users swapping BUSD for CAKE with a 1-inch protocol that guarantees the best price.

- As soon as the BUSD → CAKE swap is completed, the CAKE will be sent to the user’s address on BNB.

Case 2: Cross-chain swap from a blockchain with lower gas fees to a blockchain with high gas fees.

For example: Cross-chain revert from CAKE BEP20 on Binance Smart Chain to UNI ERC20 on Ethereum.

Similarly, the CAKE to UNI swap will take place as follows: CAKE → BUSD → sUSDC → USD.

How to use Symbiosis Finance products

Swap

Step 1: Go to WebApp and select the [Swap] tab

Step 2: In the [Transfer from] section, select the network and tokens you want to transfer. If you want to transfer sToken, the corresponding network will have a [Burn] button next to it.

In the [Transfer to] section, select the network and tokens you want to receive back.

When the network switch button is displayed, you click on it and confirm in the connection wallet to switch networks.

Select the [Approve] button to confirm the tokens used and approve the transaction in your wallet.

Step 3: Enter the number of tokens you want to swap.

Step 4: As soon as the transaction is made, press the [Swap] button to confirm the transaction in your connected wallet

Congested transactions

To undo a congested transaction, you need to make sure the wallet is installed and connected to Symbiosis WebApp and that the native account balance is sufficient to pay for the transaction on the source blockchain.

To find and undo a congested transaction, follow these steps:

Step 1: Go to WebApp and click on the page icon in the right corner of the screen. The red number displayed next to this button will indicate the number of congested transactions.

Step 2: The system will display all congested transactions from all blockchains to the wallet address being connected. When you undo a congested transaction, it will be sent to the network where you have not received the token. If you are active on another network, please change the network before undoing the transaction.

Step 3: Select the [Revert] icon to undo the transaction.

Step 4: Confirm the undo operation in your wallet and wait for the undo system within 1-3 minutes to receive the tokens back.

Liquidity pool

Add liquidity

Step 1: Go to WebApp and select the [Pools] tab.

You can switch the extra liquidity modes using the slider next to [Pro].

- Pro mode allows you to receive sToken, providing both types of tokens at the same time at the same time to receive additional bonuses, however the use requires knowledge and takes more time.

- Usually, the system will default to the simplest mode on the display interface that allows users to operate quickly and does not require knowledge of how it works.

Step 2: Identify and select the liquidity pool you want to add liquidity to.

- If the network is operating differently from the liquidity pool’s network, select the [Switch network to <network name>] button.

Step 3: Select the token you want to deposit.

- To see details about the token ratio in the liquidity pool, click the icon next to [Currency Reserves].

- Click the [Get<token>] or [Get <sToken>] button to add stablecoins or sToken to the liquidity pool.

Step 3: Enter the amount of tokens to add to the liquidity pool.

Step 4: Check the details and select the [Add liquidity] button.

Step 5: Confirm the transaction in your wallet, wait for the system to confirm within a few minutes.

Withdraw liquidity

Step 1: Go to WebApp and select the [Pools] tab.

Step 2: Click the [My liquidity] button and select the pool in the list.

Step 3: If the [Remove] button is not visible, you need to switch the active network.

Step 4: Select the [Remove] button.

Step 5: Enter a percentage of assets to be withdrawn or a specific value.

Step 6: Check the details and click [Confirm] to confirm the withdrawal.

Step 7: Confirm the transaction in the wallet and receive the token.

Cross-chain Zaps

Cross-chain Zaps allows users to add liquidity to Symbiosis Finance’s liquidity pool on another blockchain in 1 transaction.

Add liquidity

Step 1: Go to WebApp and select the [Zap] tab.

Step 2: Select the token offered and enter the amount.

Step 3: In the [Supplying to] drop-down menu, select [Symbiosis’ pools] mode to add liquidity to symbiosis’ pool or select [Lending protocols] to add to lending or farming protocols.

The first blockchain shows the location of the liquidity pool, the LP balance shows the number of tokens in the liquidity pool.

Step 4: Choose a liquidity pool.

Step 5: Select [Add liquidity] and confirm the transaction in your wallet.

Exchange for BTC

Symbiosis Finance uses the Ren protocol on BINANCE and POLYGON to conduct BTC exchanges. When the Ren protocol receives renBTC, Ren burns renBTC and sends BTC to the user’s address on the BITCOIN BLOCKCHAIN.

- Step 1: Go to Symbiosis WebApp and select the [Zap] tab.

- Step 2: In the [Transfer from] section, select the token and enter the amount.

- Step 3: In the [Supplying to] drop-down menu, select [Native] mode and select Bitcoin.

- Step 4: Select [Add liquidity] and confirm the transaction in your wallet.

Withdraw liquidity

Zaps does not support liquidity withdrawal.

Conclusion

Symbiosis Finance is an outstanding liquidity solution, increasing capital efficiency, reducing slippage and improving liquidity.