Advertisement

MEXC Futures trading

MEXC Margin Trading

Similarities between MEXC Margin and MEXC Futures

Advantages of MEXC Margin and MEXC Futures

- Make two-way profits when the market rises or falls.

- Exactly forecasting of market trends can increase profits significantly.

- Diversify your portfolio

- Large leverage helps you make huge profit with small capital

- Good liquidity

Disadvantages of MEXC Margin and MEXC Futures

The higher the leverage, the easier the liquidation.

The difference between Margin and Futures

| Margin | Futures | |

| Leverage ratio | Each trading pair will be a separate leverage radio

Fixed ratio in 2x, 4x, 4x, 10x |

Leverage ratio can be changed flexibly according to trading needs.

The leverage level is very high, the maximum ratio is 125x |

| Market | Price volatility base on the spot market | Trading in the derivatives market. Market volatility will be simulated based on spot markets, but with large spreads. The data is calculated based on the amount of copper and the expected price of buyers and sellers. |

| Costs | Have to pay interest to the exchange

Interest is calculated after each successful borrowing hour |

Zero interest

Funding rate will be charged |

| Level of risk | Less risky than MEXC Futures | Higher risky than MEXC Margin |

Related: What is Futures? What is margin? Compare Margin and Futures

Guide to trading MEXC Futures

To trade Futures on MEXC you need to follow the steps:

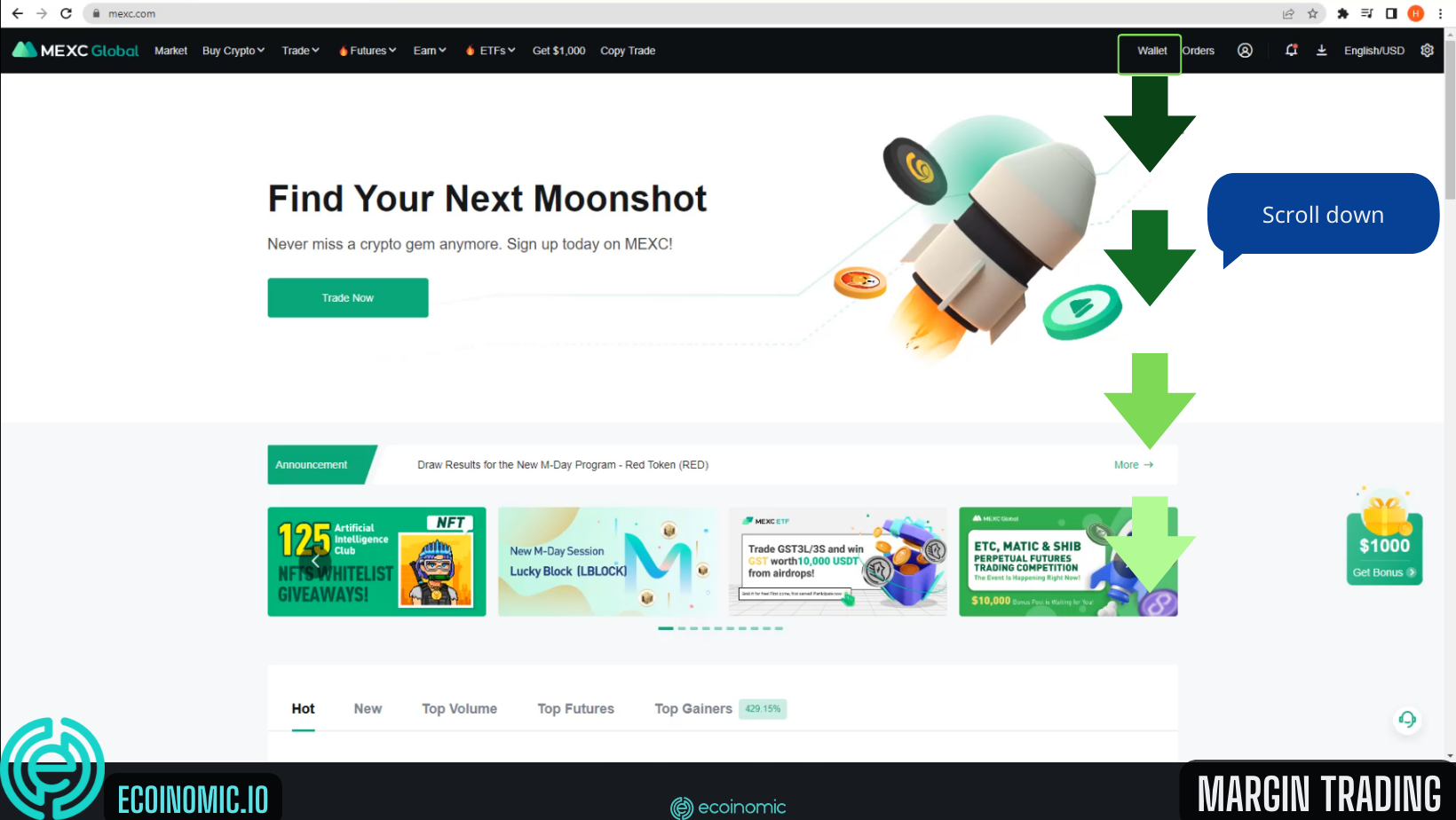

Step 1: First, you need to transfer your funds to your futures wallet. Go to the MEXC homepage, select “Wallet” ⇒ “Overview”.

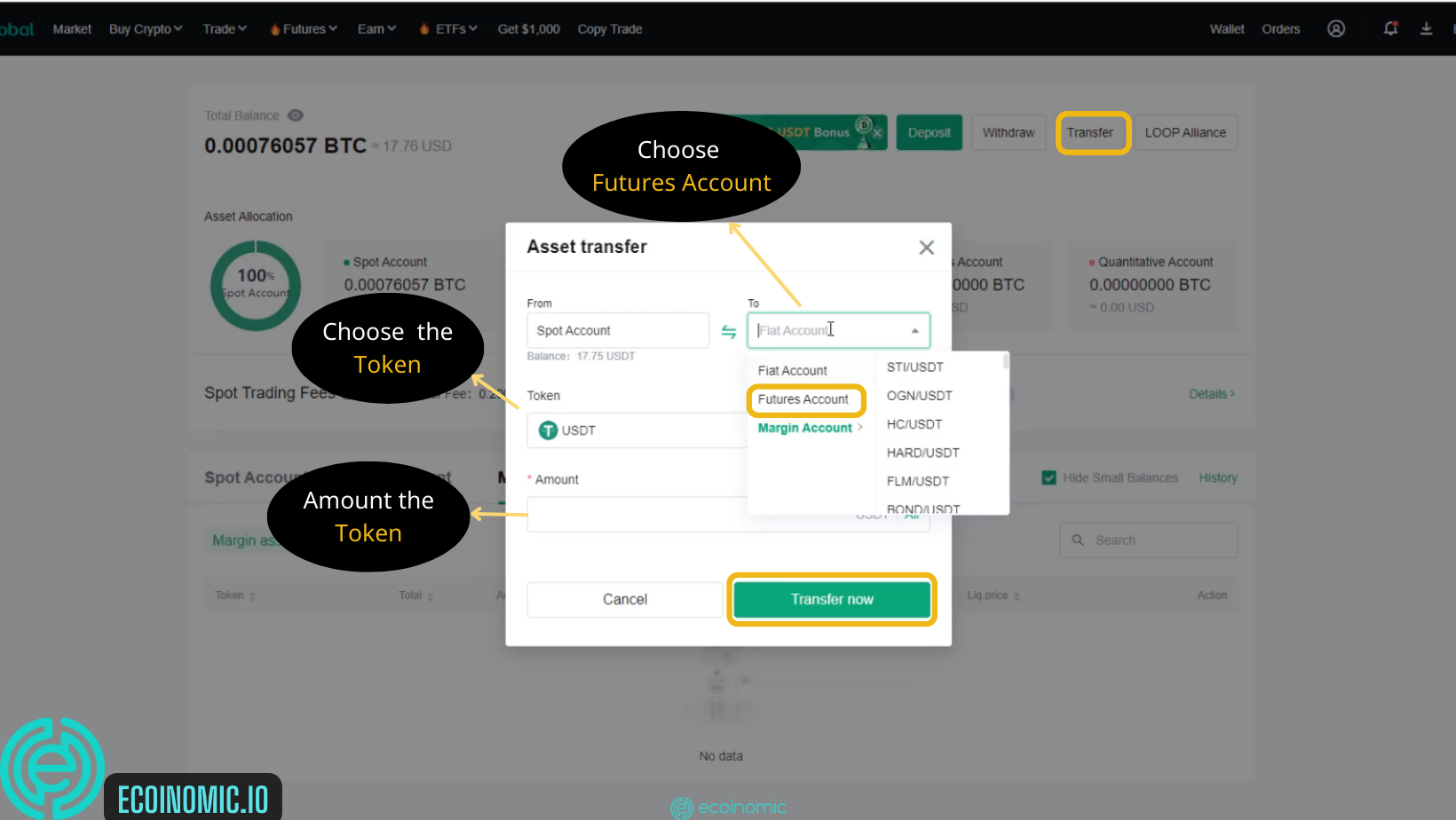

Step 2: First select “Transfer”.

Under “To” section, select your Futures account.

At the “Token” section, select the token you want to trade.

At the “Amount” section, select the amount of Coin/Token you want to trade.

Once you have selected, click on “Transfer now” to complete the transfer process to the Futures wallet.

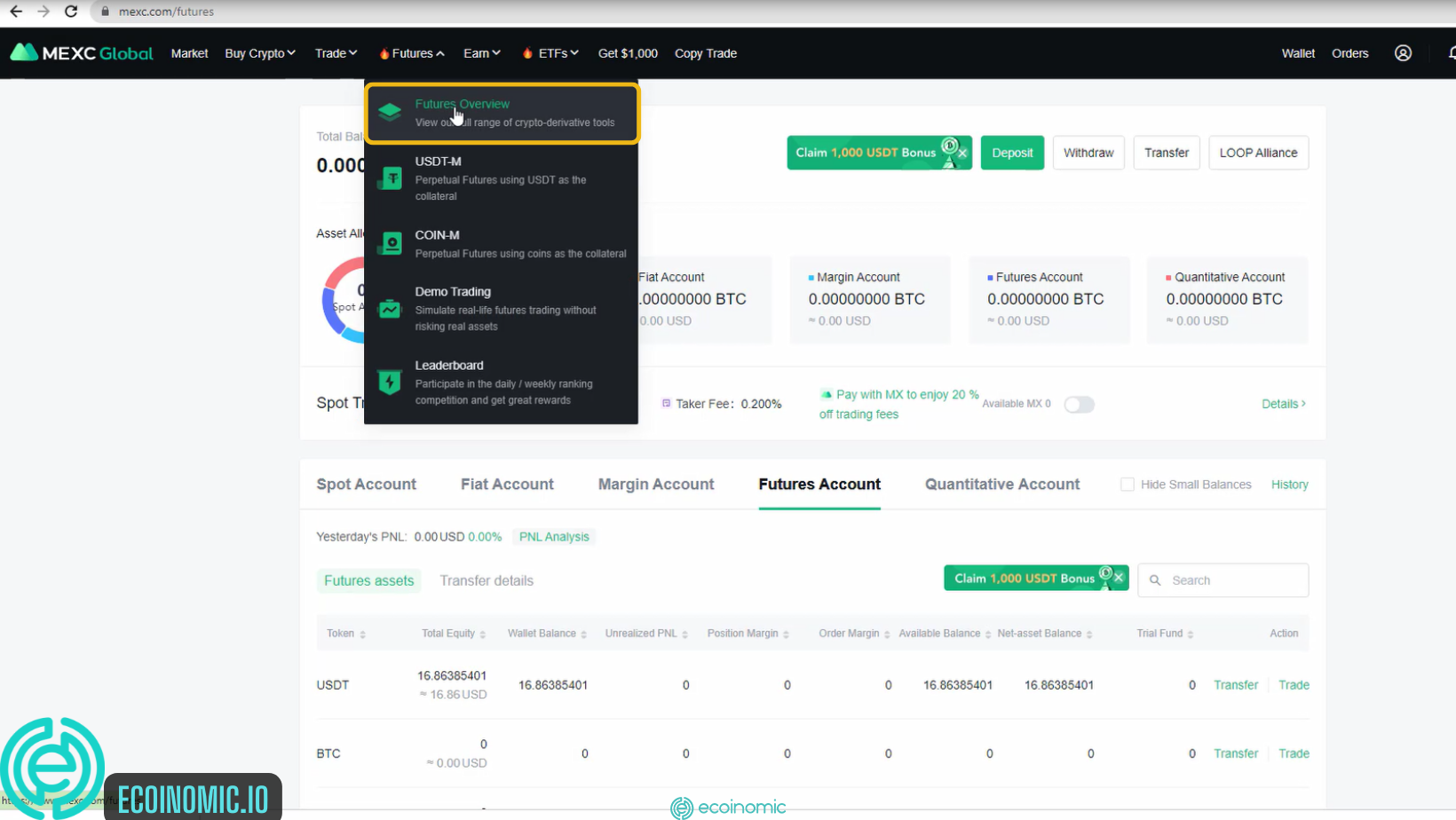

Step 3: To start executing Futures orders, select “Futures Overview”

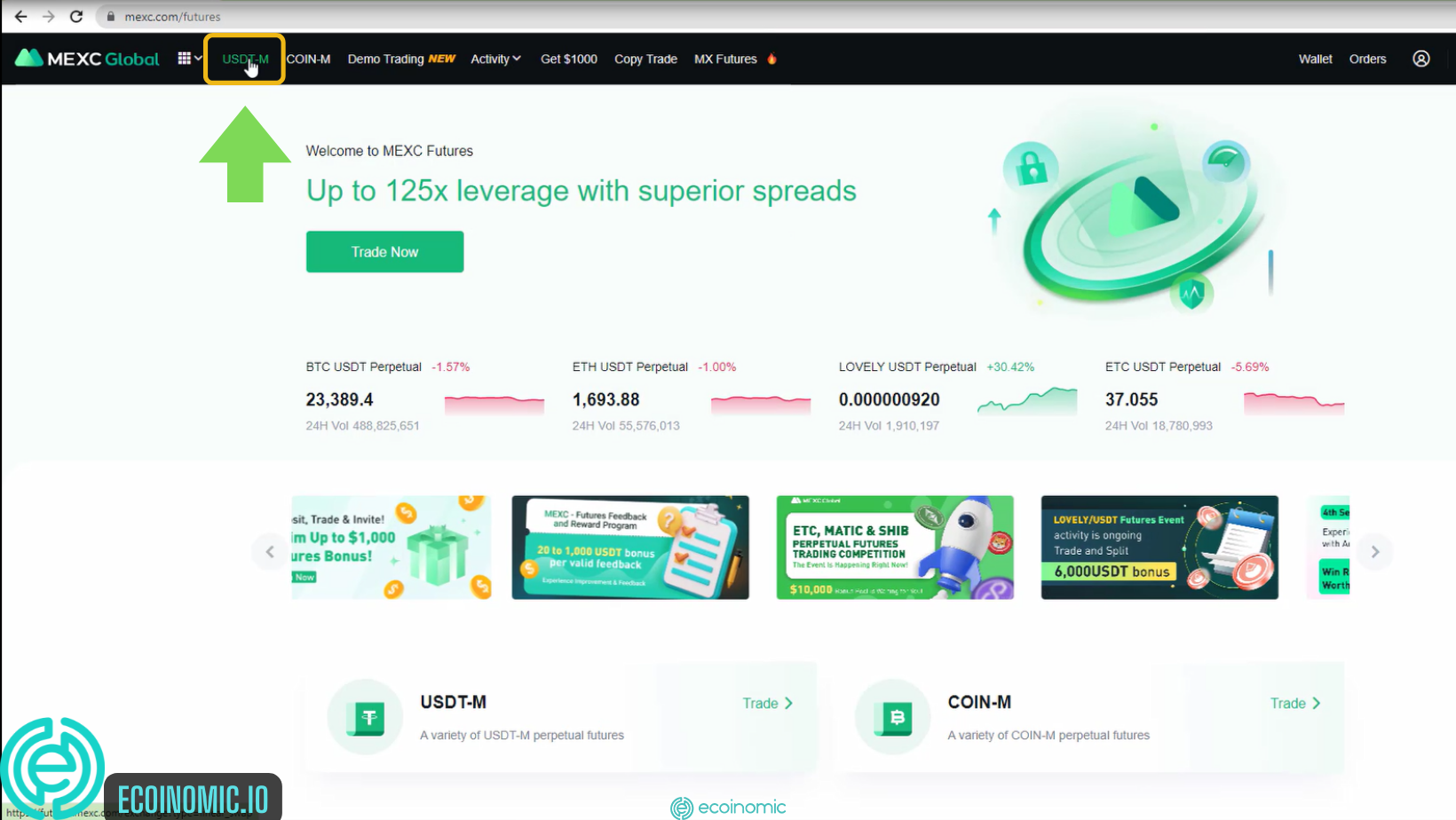

Step 4: Select “USDT-M”

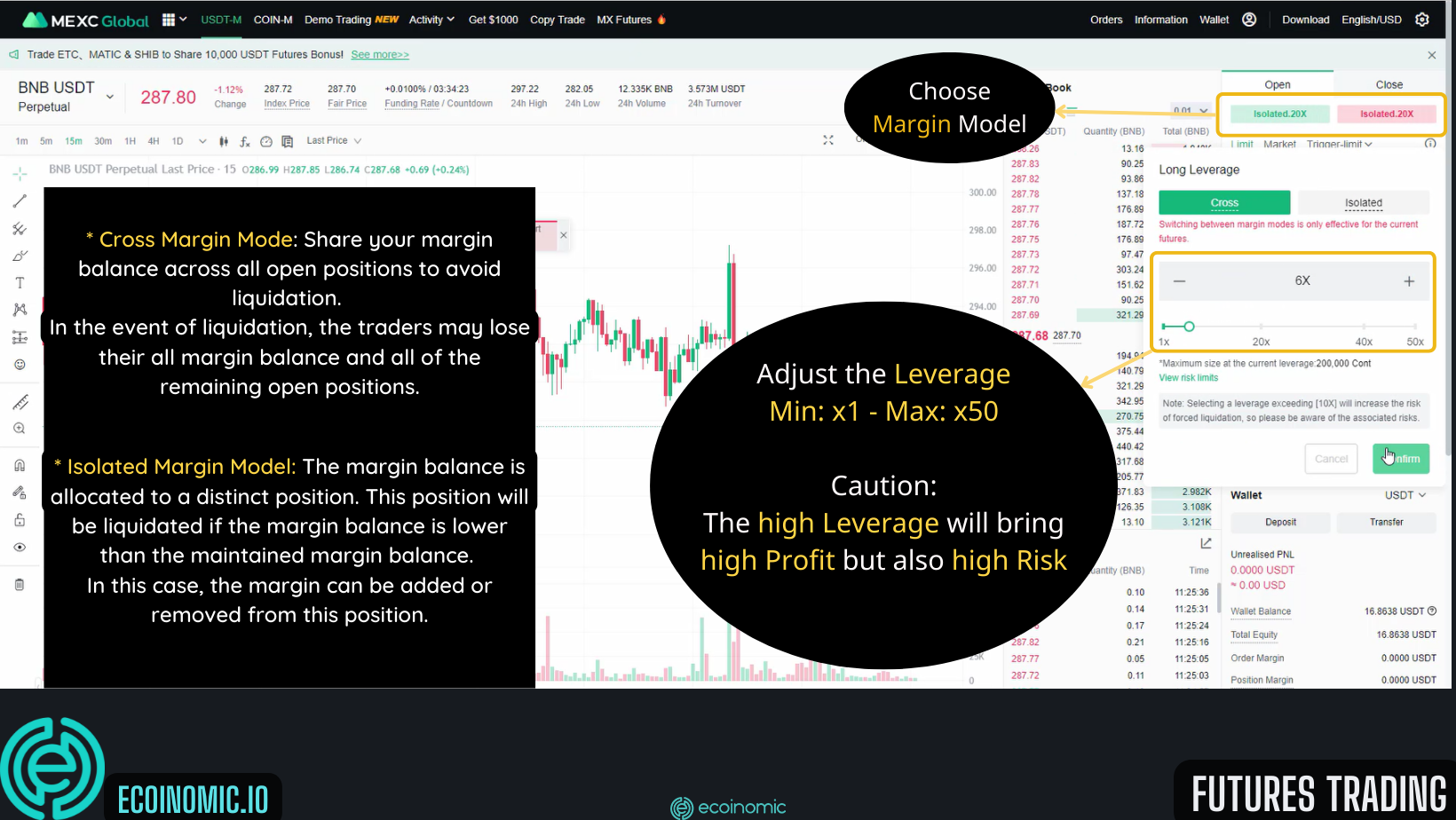

Step 5: At Margin Model, there will be two forms you can choose: Cross Margin and Isolated Margin.

- Cross will use the entire balance in the margin account to avoid liquidation of the position.

- Isolated will only use a certain amount of funds when opening a position. You can neither add collateral nor lose all assets in the Margin account. This will have no effect on the entire remaining balance in your account.

After choosing between Cross and Isolated, you need to choose a reasonable leverage for trading, ranging from 1x-125x. The maximum leverage varies depending on the contract pair

- Note: The higher the leverage, the higher the profit. However, if you predict the wrong trend, you will deal with risk of burning your account. Before your assets are liquidated, you will receive a Call Margin message from the platform. If you do not deposit more funds into your account to maintain the position, the system will automatically liquidate your position.

Step 6: To open Long position, select “Limit” order.

At the “Price” section, select the price you want to buy. When the market price matches the selected price, the system will automatically execute the order.

At “Amount” section, select the amount you want to buy.

“Take profit”: select the price you want to take profit. When the market price reaches this price, the system will automatically take profit for you.

“Stop loss”: when the market price drops to the price you want to stop loss, the system will automatically sell immediately.

The purpose of these features is to control risks for investors.

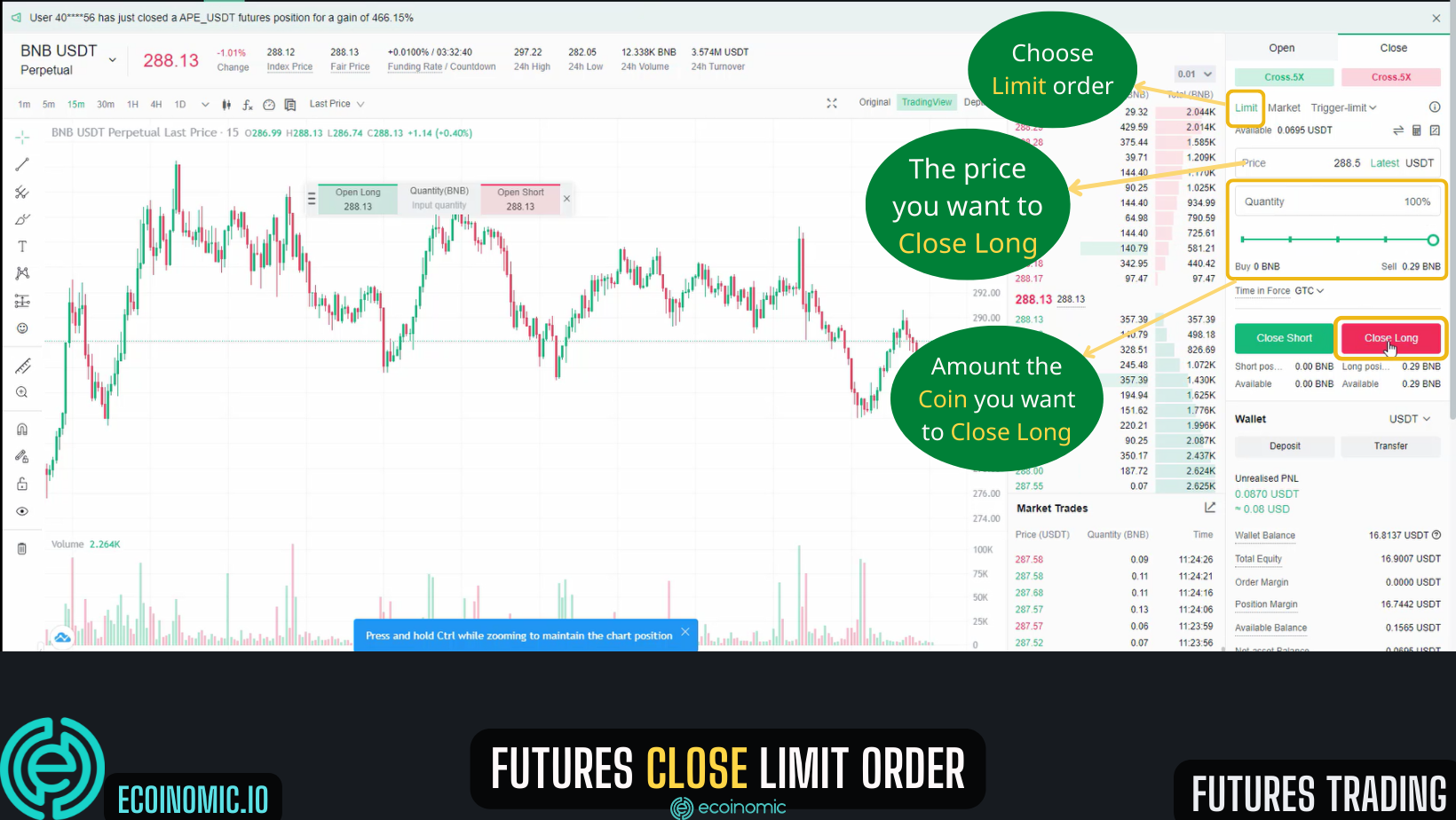

To close the position you just opened, select “Limit”.

At “Price” section, select the price you want to close.

At “Amount” section, select the amount you want to close.

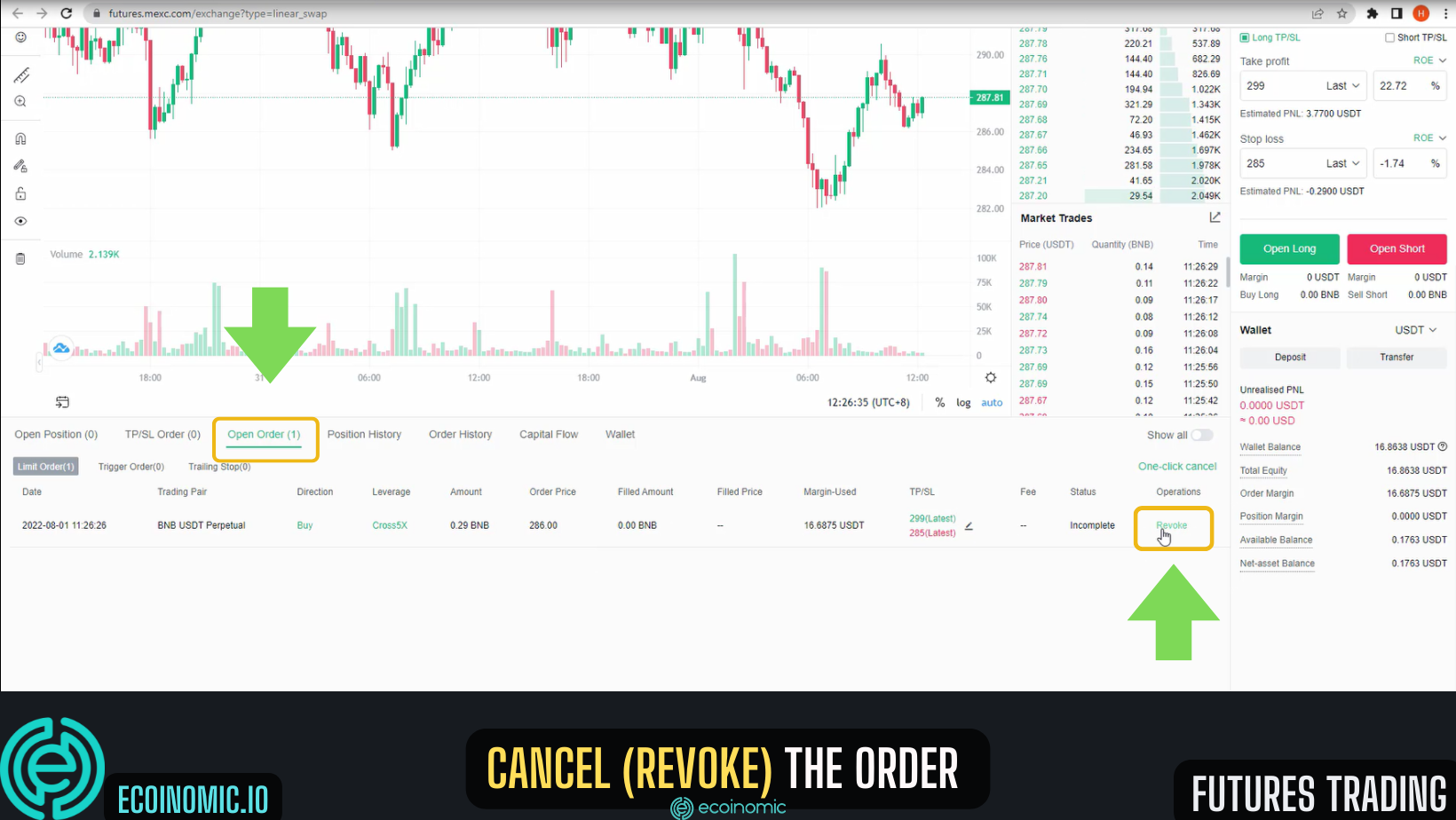

Step 7: To cancel the order just placed, select “Open Order” then click “Remote”

Guide to MEXC Margin trading

To start margin trading on MEXC you need to follow the steps:

Step 1: First, you need to transfer your funds to your Futures wallet.

Go to the MEXC homepage, select “Wallet” ⇒ “Overview”.

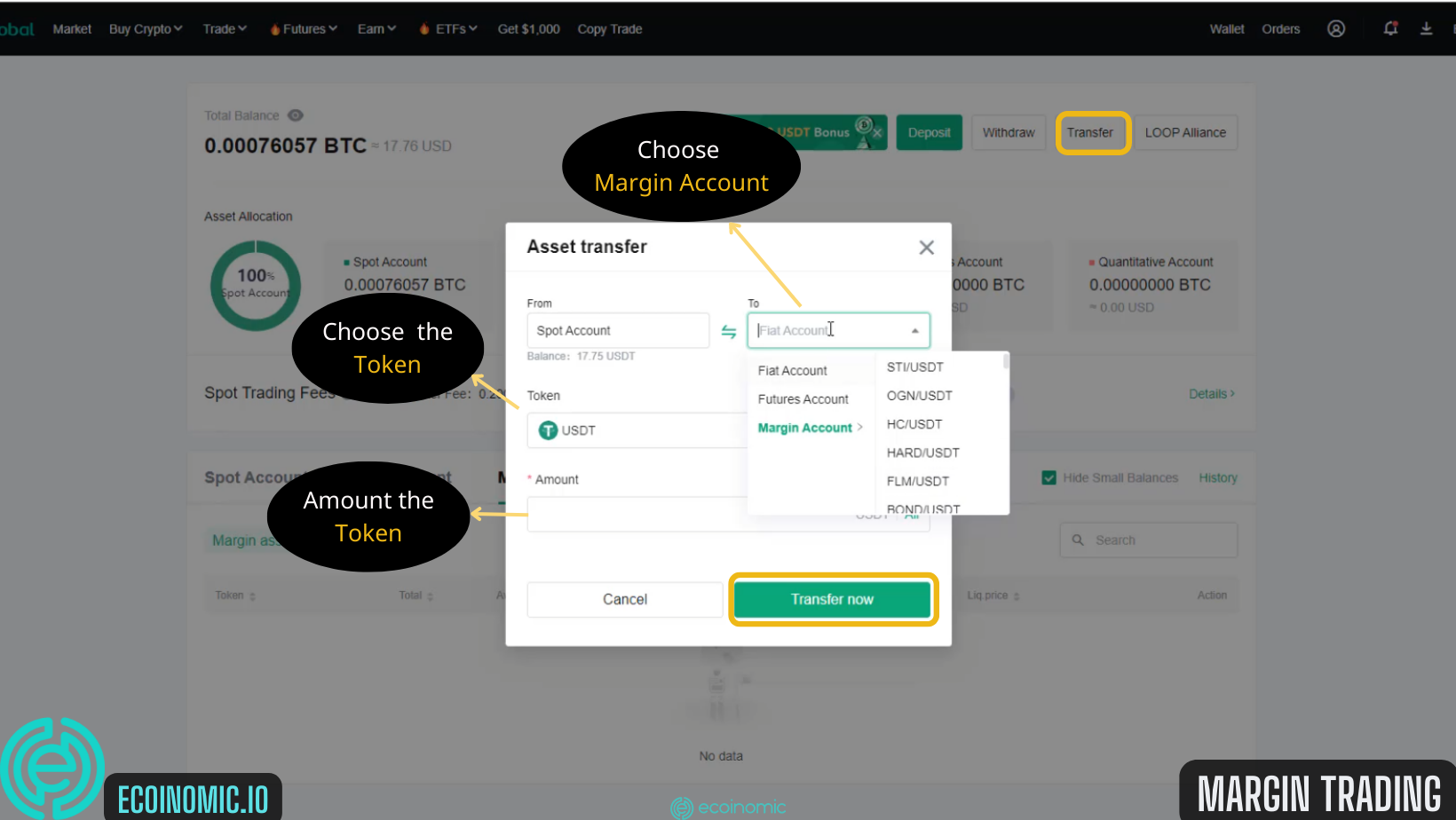

Step 2: Select “Transfer” to start transferring funds to Margin wallet.

At the “To” section, select margin account.

At the “Token” section, select the Coin/Token you want to trade.

At the “Amount” section, enter the amount.

After you have selected, click on “Transfer now” to complete the process of transferring funds to margin wallet.

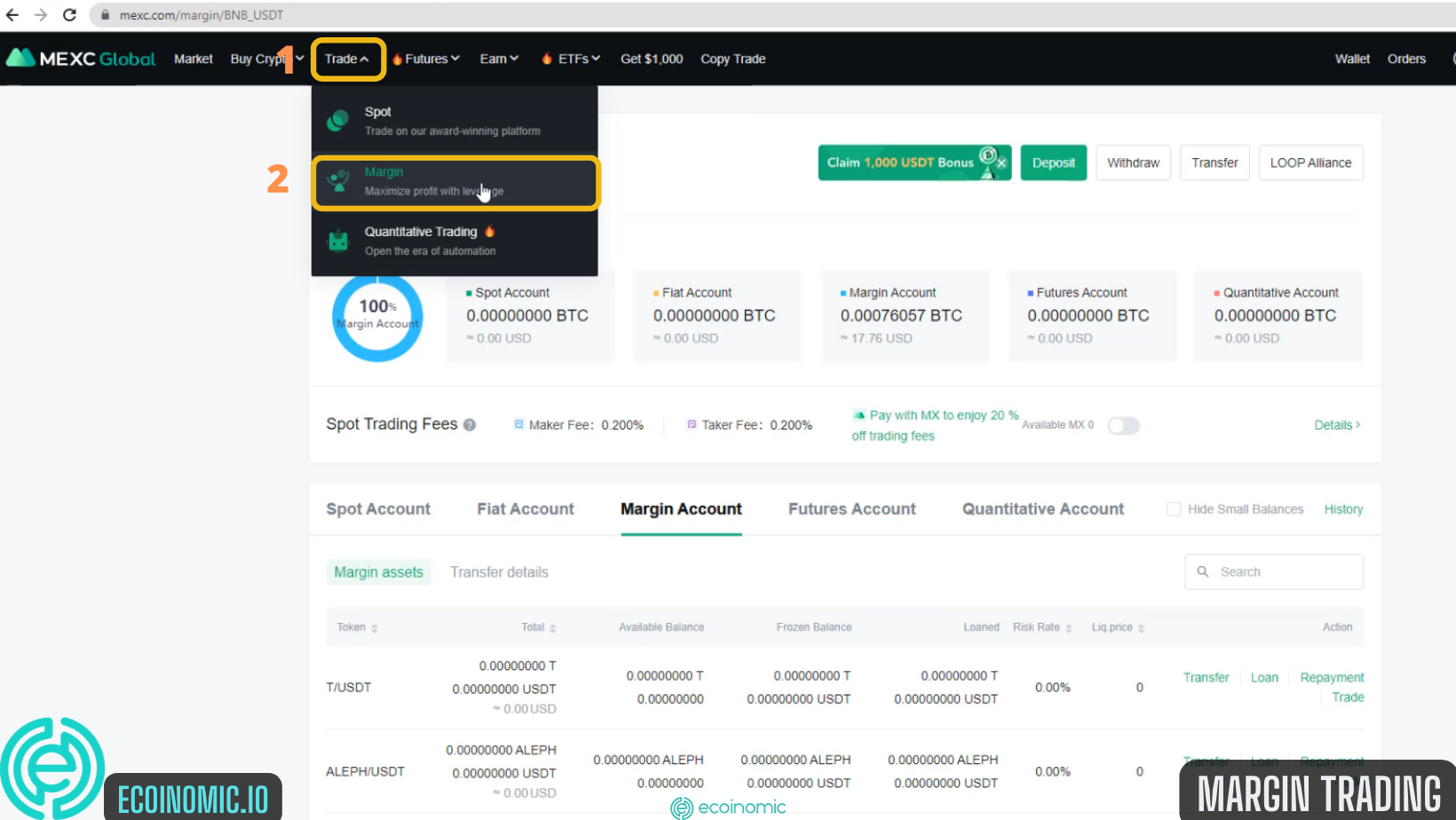

Step 3: Select “Trade” ⇒ “Margin”

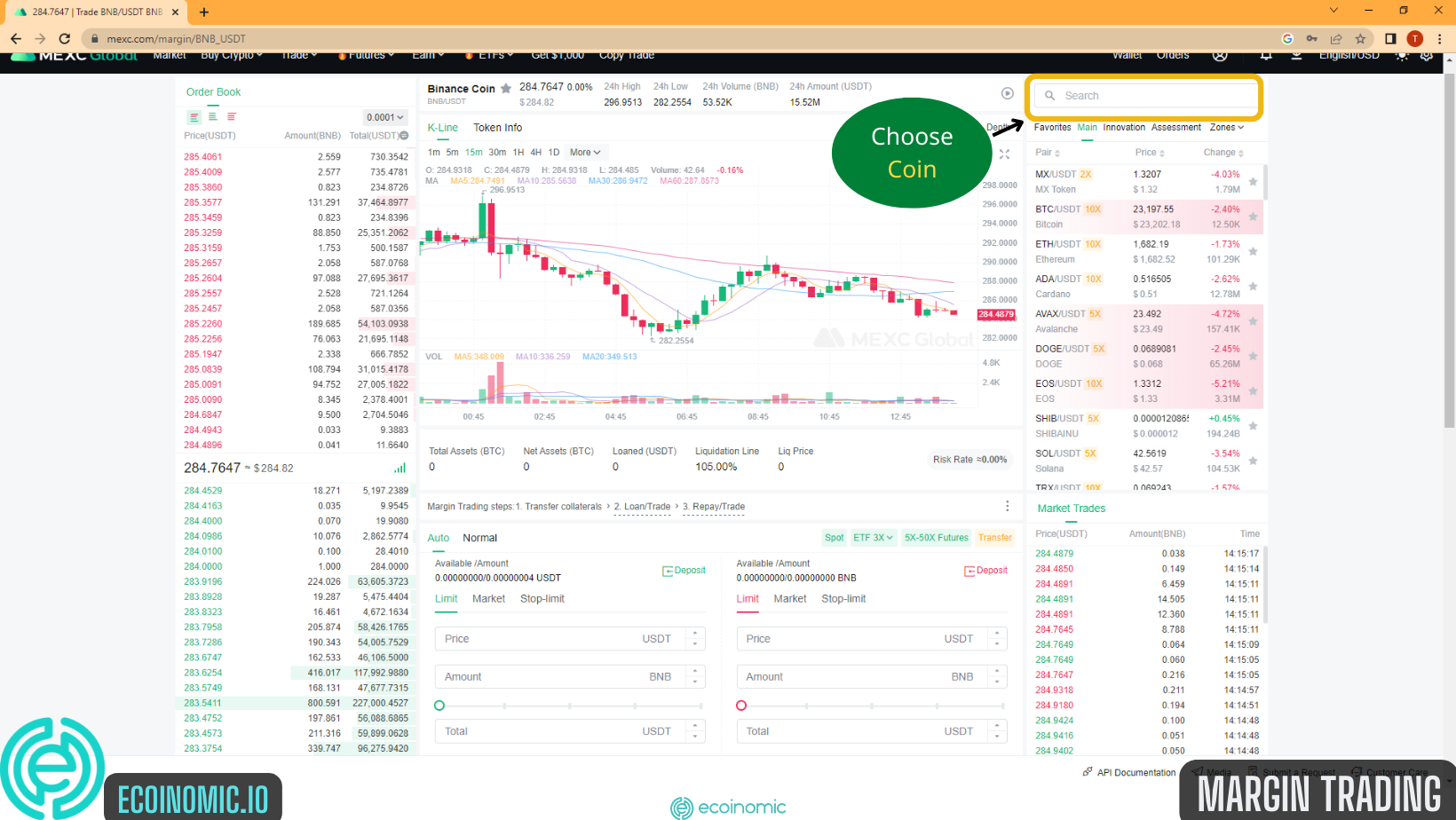

Select the coin you want to trade at the “Search” section with a magnifying glass icon.  Step 4: To open a Long position, select “Limit” order.

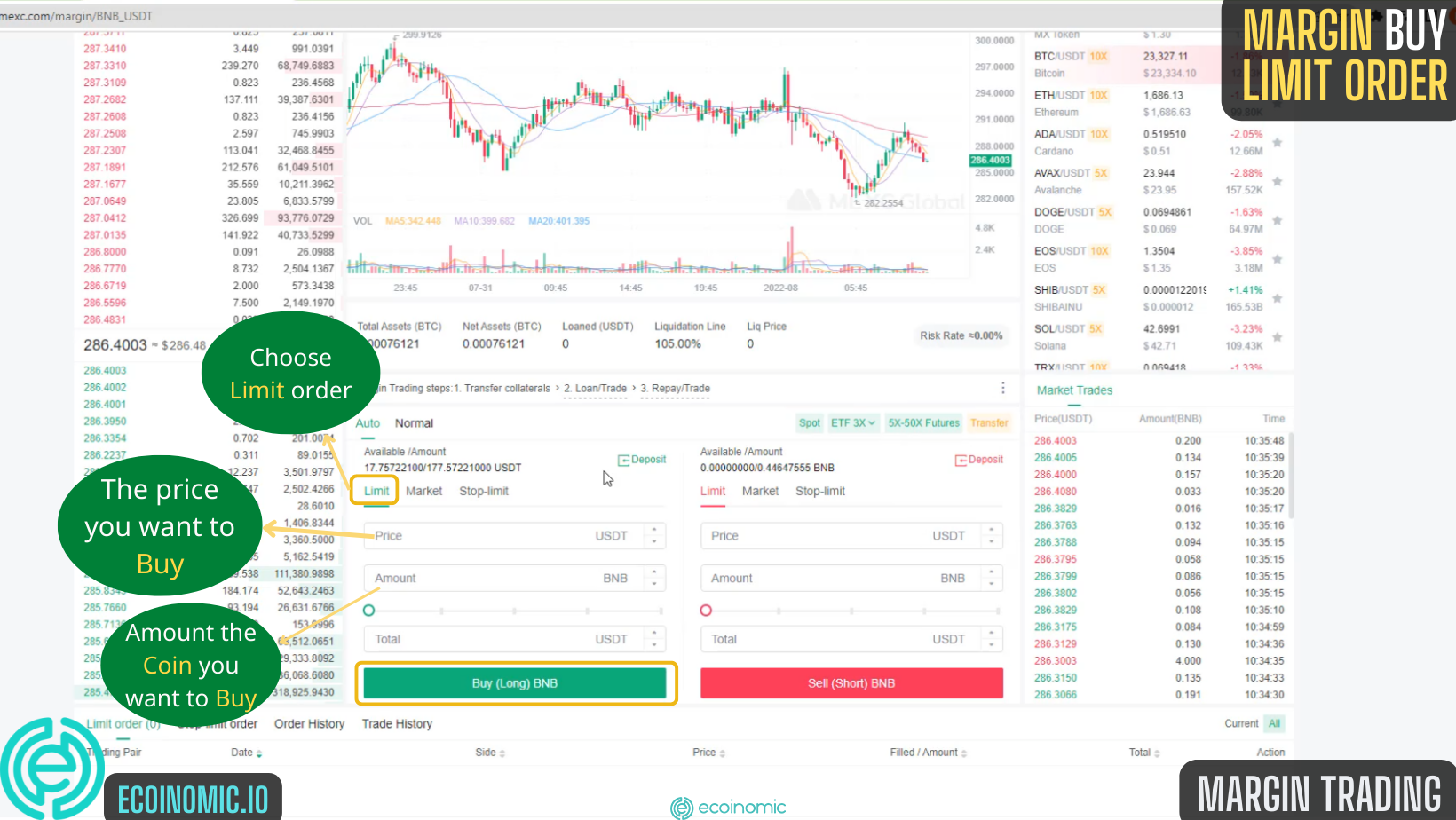

Step 4: To open a Long position, select “Limit” order.

At “Price” section, select the price you want to buy.

At “Amount” section, select the amount you want to buy.

Then click “Buy(Long)” to place an order

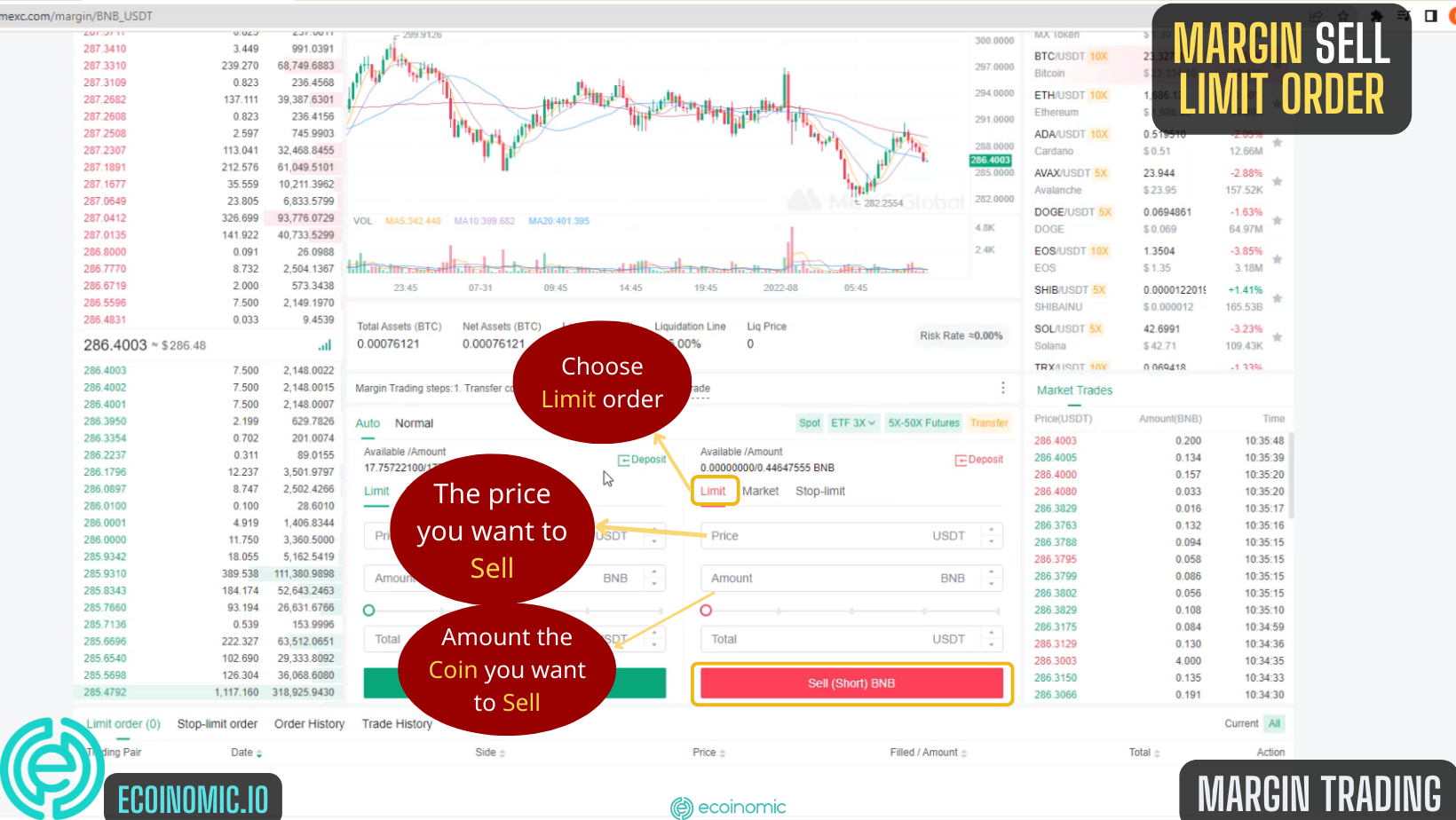

To open a “Short” position, select “Limit” order.

At “Price” section, select the price you want to sell.

At “Amount” section, select the amount you want to sell.

Finally, click “Sell (Short)” to place an order and wait for the system to match.

Conclusion

The above article is the most detailed guide on how to trade Mexc Margin and Mexc Futures. Ecoinomic.io hopes that traders can gain a better understanding of these features to make inform investment decisions and earn great profits when participating in derivatives and margin trading.

Related: Binance Registration Guide for Beginners (20% lifetime trading fees discount)