Advertisement

The global market in general and the cryptocurrency market, in particular, are going through a dark period.

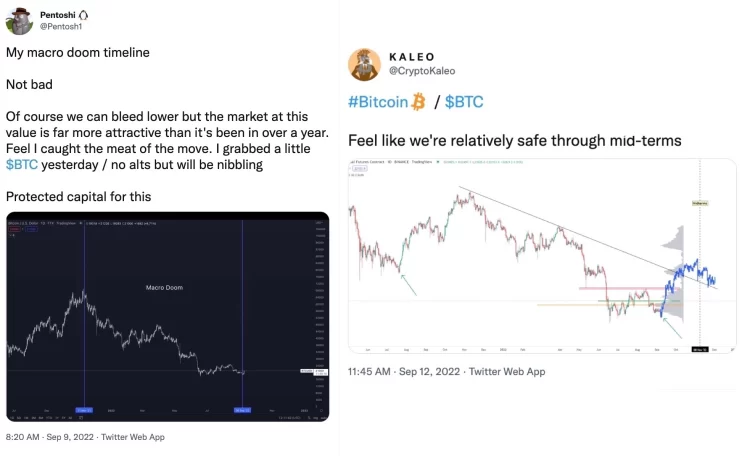

“We are feeling relatively safe through the midterms,” Twitter’s “CryptoKaleo” — also known simply as “Kaleo” — wrote in a Sept. 12 tweet to his 535,000 followers, referring to the November U.S. midterm elections. The prediction comes with a chart that predicts the bitcoin (BTC) price will rise 50 percent from last week’s $20,000 mark to the $34,000 mark before the end of the year.

“Of course, we can lower the rate,” one influencer, Pentoshi wrote on September 9 to thank his 611,000 followers on Twitter. “But the current market is also much more attractive than it has been in more than a year. […] I made a little $ BTC yesterday/with no altcoins but it’s okay.

“It’s those assessments that come from researchers who have correctly guessed past market periods. One of them, Charlie Shrem is looking to sell his “investment calendar” and assure readers that a major cryptocurrency “bull run” can begin tomorrow.” It’s not hard to come across Bull Market predictions, like predictions that Bitcoin is on the cusp of a 400 percent rally and will reach an all-time high of $80,000 and a Market Cap of $1.5 trillion — $500 billion more than what it is in global circulation.

It is good that this investor has an optimistic attitude, even if he is only among influencers and is looking for interaction and customers. Unfortunately, the negative fluctuations of the macroeconomy “paint” a picture that is probably a lot more bleak.

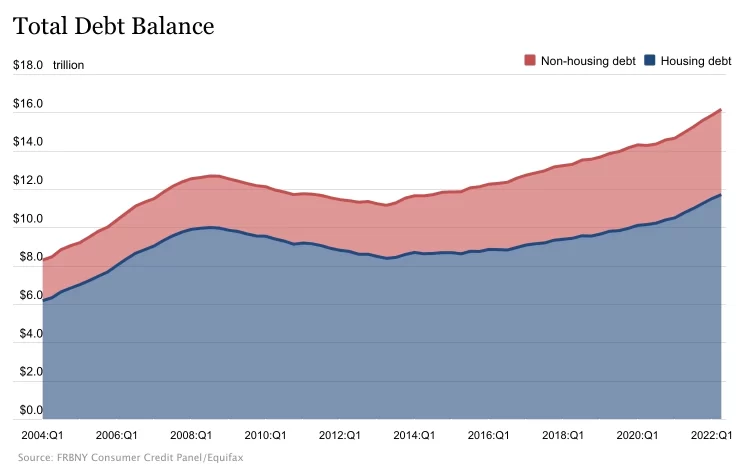

In response to the dismal economic situation, FedEx said it is planning to take measures including closing 90 locations by the end of the year. The good news is: that Americans are so burdened with debt that it’s unlikely they’ve planned to “visit” any of those locations. Consumer debt reached $16.15 trillion in Q2 2022, figures from the Federal Reserve Bank of New York noted in an August report. That amounts to more than $48,000 per man, woman, and child in the United States — a total of $330 million.

[caption id="attachment_17335" align="aligncenter" width="750"] Total Consumer Debt by Americans

Total Consumer Debt by Americans

The total consumer debt of Americans with a national median income of $31,000, equates to a debt-to-income ratio of 154%. If you want to account for more than $30 trillion in debt held by the federal government, you can add another $93,000 per person — a total of $141,000 and a debt-to-income ratio of 454%. (The numbers obviously get worse if you only take into account the fact that only 133 million Americans were employed full-time as of March 8).

While policymakers lack sound arguments to explain government debt, they are more concerned with consumer debt. “I’m telling the American people that we’re going to control inflation,” President Joe Biden said in an interview with CBS on Sunday. This led researchers to wonder if the president was trying to give priority to the Federal Reserve’s announcement this week of a 100 basis point increase in the federal funds rate. Such a move will likely put the market in a predicament from which it will not be able to recover for some time.

Ironically, even that move may not be enough to tame Inflation in the short term. Considering the rapid rise in debt, it’s probably no surprise that inflation rose more than 8% in August compared to the same period last year. Americans may not have much money left, but that fact hasn’t dampened demand. No matter how the Fed gives the index, the support still comes from credit. The bank noted that credit card debt in the second quarter had the largest year-over-year percentage increase in more than 20 years.

That’s the difficulty. No matter how quickly coalitions move toward debt distribution, it’s unclear when asset prices will rise. A high level of debt means less money to buy things. The Federal Reserve is trying to increase the cost of debt services, which means less money to buy things. Forcing Americans into an economic downturn to reduce costs means people have less money to buy things. Failure to control inflation and letting the cost of basic goods and services continue to rise is caused by an energy crisis in Europe over which financial regulators have little control. This means having less money to buy anything else.

It’s possible that this scenario is similar to the one Elon Musk said in June that he has “extremely bad feelings” about the economy. Other observers have offered even darker views, including Rich Dad, author Robert Kiyosaki of Poor Dad. “The biggest bubble is about to burst,” Kiyosaki wrote on Twitter on May 4.

WIley COYOTE moment coming. Biggest Bubble Bust coming. Baby Boomer’s retirements to be stolen. $10 trillion in fake money spending ending. Government, Wall Street & Fed are thieves. Hyper-inflation Depression here. Buy gold, silver, Bitcoin before the coyote wakes up. Take care

— therealkiyosaki (@theRealKiyosaki) April 16, 2022

Admittedly, Kiyosaki’s assessment is somewhat contrary to the expectations of pessimists. Economic catastrophe will lead to widespread declines in asset prices, including the prices of gold, silver, and Bitcoin. A more optimistic forecaster hopes that Americans will learn from their mistakes, spending next year repaying debt and tackling severe inflation by 2024.

In either case, one thing is certain: Neither cryptocurrencies nor any other asset class has been able to reach record increases. If you want to prosper through investing in the coming year, it’s better to start learning how to take short positions from optimists who have little understanding of the market.