Advertisement

World’s top banks have exposure to around $9 billion worth of cryptocurrencies

A recently published study by the Basil Committee on Banking Supervision (BCBS) has revealed that the world’s top banks have exposure to around $9 billion worth of cryptocurrencies, including Polkadot ($DOT), Cardano ($ADA), and $XRP.

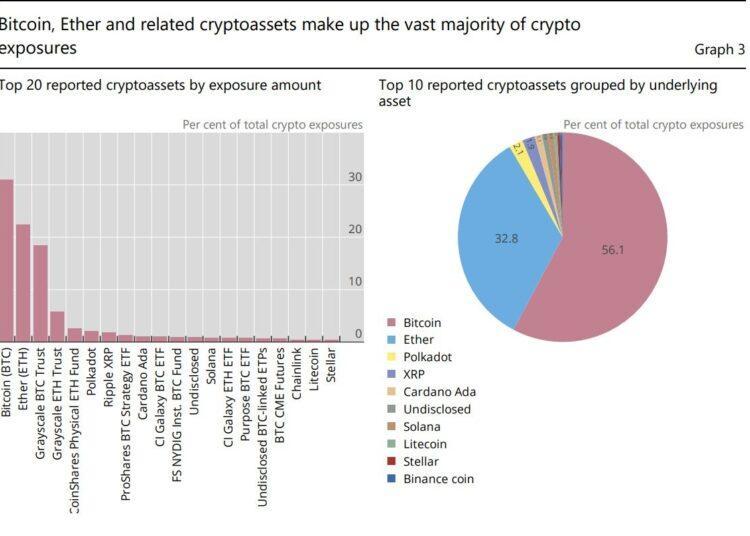

According to the study, titled “Basil II Monitoring report” from the Bank of International Settlements (BIS), the two largest cryptocurrencies by market capitalization, Bitcoin ($BTC) and Ethereum ($ETH) are the ones banks are most exposed to, with the flagship cryptocurrency making up 31% of the reported crypto exposure, and ETH making up 22% of it.

BTC and ETH combined notably make up “almost 90% of reported exposures,” while other popular cryptocurrencies were also included in the report. Polkadot ($DOT) made up 2% of reported exposure, while $XRP made up around the same percentage. Cardano’s $ADA token made up 1% of exposure, as did Solana ($SOL).

Other cryptocurrencies in the report were Litecoin ($LTC) with 0.4% of reported exposure, and Stellar ($XLM), with around 0.4% of exposure as well.

The study detailed that total cryptocurrency exposures from banks made up around €9.4 billion, equivalent to roughly $9.2 billion. This means that cryptoasset exposure “make up only 0.14% of total exposures on a weighted average basis across the sample of banks reporting exposures.”

The report added that when considering the whole sample of banks included in the report, the amount shrunk to 0.01% of total exposures.

These banks’ exposure to the cryptoasset sectors was divided into three categories: cryptocurrency holdings and lending, clearing and market-making services, and custody, wallet, or insurance services.

Banks activity exposed to crypto

The largest activity adding to banks’ crypto exposure was custody or wallet-related services. These financial institutions’ exposure is likely related to cryptocurrency investments from institutional investors gaining exposure to the space without managing their own private keys.

Throughout the month of September, added to bets against the flagship cryptocurrency Bitcoin ($BTC) by buying up products shorting BTC, while also betting on products offering exposure to $XRP, $ADA, and multiple assets.

According to CryptoCompare’s latest Digital Asset Management Review report, for the first time in two years, the average daily volumes for all exchange-traded products (ETPs) on the report dropped below $100 million after falling nearly 80% from this year’s high recorded in January.

The report details that institutional investors looking to gain regulated exposure to the digital asset space are “likely to turn to the growing number of crypto investment products” such as those contained in the report, and adds that these make “crypto more accessible to investors because they can be traded on traditional stock exchanges.”

Per the report Short Bitcoin Products, which “correspond to the inverse (-1x) of the daily performance of the Bitcoin futures index” saw a rise in their assets under management in September, with the ProShares Short Bitcoin Strategy ETF (BITI) seen an AUM rise of 43.9% to $98.8 million, while the 21Shares Short Bitcoin ETP (SBTC) saw an increase of $18.9 million.

Source: cryptoglobe.com

>>> Related: LBank Futures Trading Guide most detailed 2022