Advertisement

LBank is an emerging name in the global cryptocurrency market. This is a new cryptocurrency exchange established in 2015 with a relatively diverse ecosystem. LBank Futures is one of the outstanding products among them. In the following article, Ecoinomic.io will introduce the LBank Futures and how to trade with this feature.

If you do not have an LBank account, please refer to How to use and register for LBank most detailed 2022

What is LBank Futures Trading?

In essence, LBank Futures is similar to other exchanges. It also allows LBank customers to execute futures contracts. Investor profits come from the market’s price movement on a particular coin, over a certain period of time. What makes LBank Futures different from other forms of trading? The answer to the question is, that the trader does not necessarily own the coin but can still make a profit from it.

Advantages of LBank Futures

- As margin trading with leverage, the coefficient of leverage is a decisive factor in the profits and risks that an investor can gain or face. The extent of these factors depends on the price movements of the spot market.

- Trading Futures in general and LBank Futures, in particular, help investors diversify their investment portfolio, even with a small amount of capital.

- Traders can diversify their positions with two different leveraged trading mechanisms:

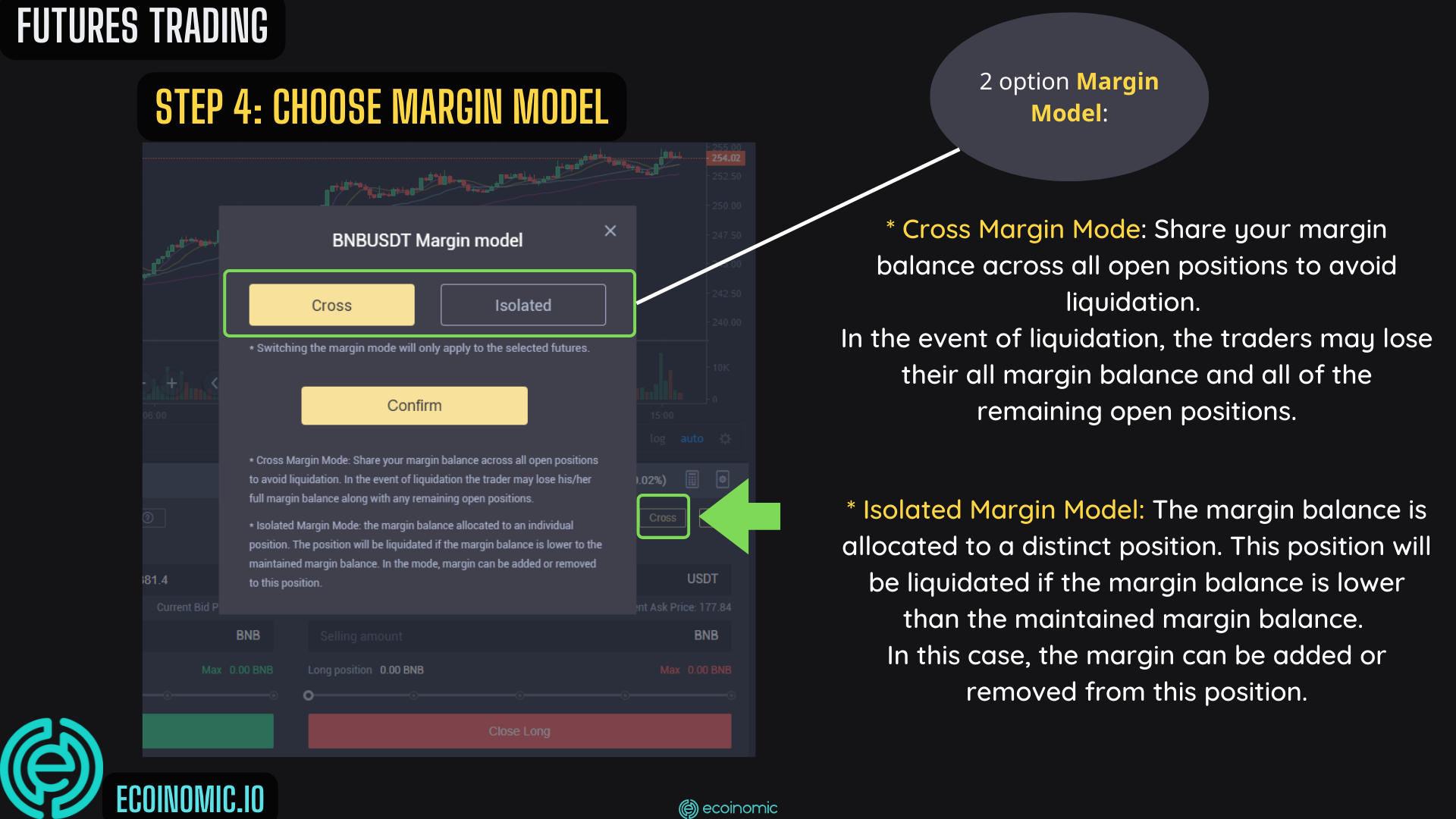

– Cross: The position will automatically use all your capital for Margin or Futures trading (Margin/Futures account balance) to cover losses and minimize the risk of account burnout. For example, if your Margin/Futures account balance is $1000, you choose to trade with a margin of $100. In case the position is at risk, the position will automatically deduct from the remaining $900 in the account. To put it simply, $900 is the amount of capital used to collect losses. Until the funds in your account run out, your position will be liquidated.

– Isolated: The position will be limited to the amount you initially spend. This avoids the risk of losing money. An example similar to the above, if you use the Isolated mechanism and unfortunately take a risk and liquidate your position, your loss will be only $100. However, you can still adjust your position or cover your losses by adding or subtracting capital to the position from the remaining $900 balance in your account.

Disadvantages of Lbank Futures

- Futures trading has a very high-risk ratio. The higher the leverage you use, the higher the risk of the account being liquidated.

- If you are an undersized investor, you risk a quick liquidation because of the shark’s price manipulation.

LBank Futures Trading Guide

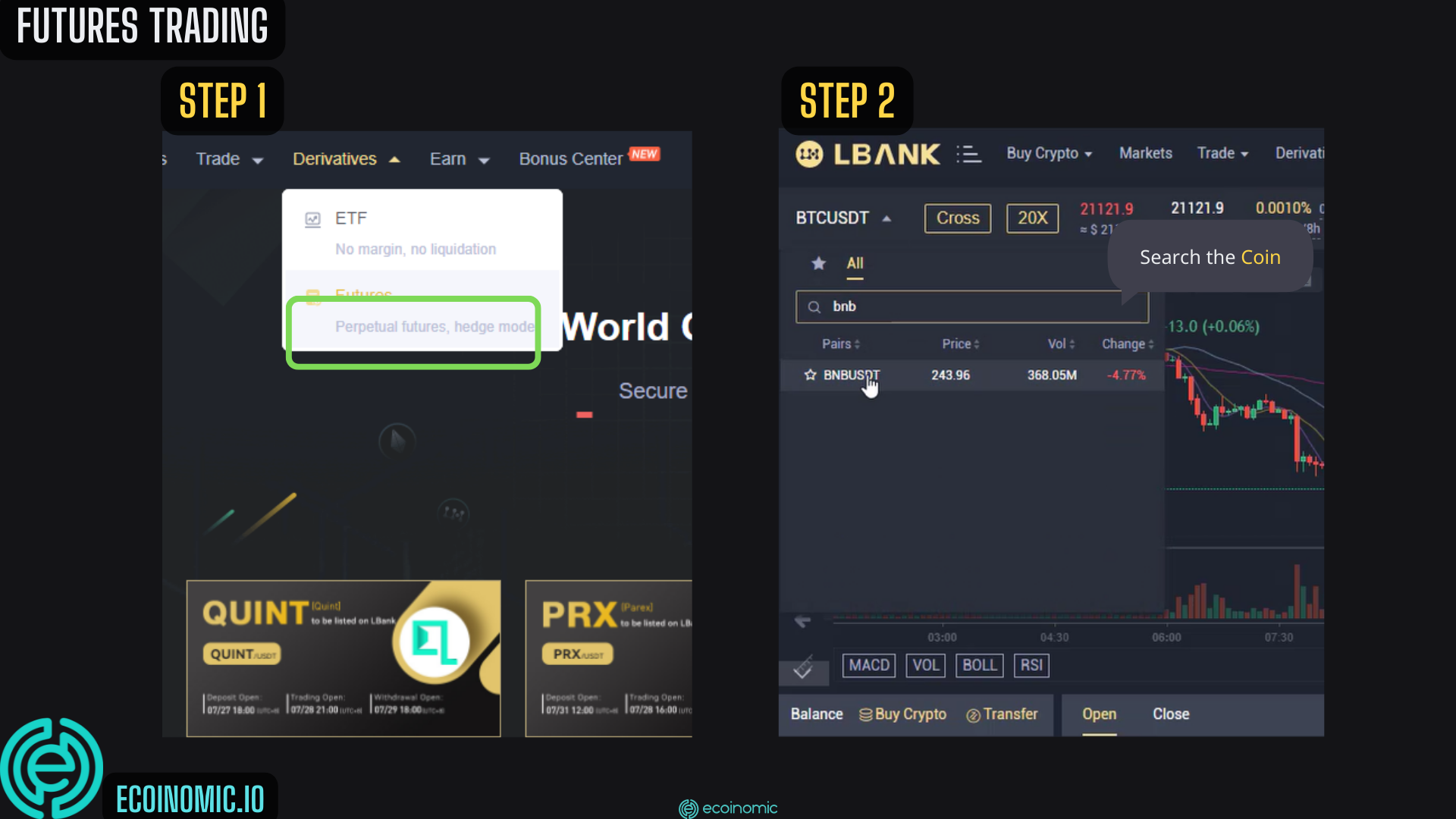

Step 1: On the LBank homepage, select Derivatives, then select Futures.

Step 2: The LBank Futures interface appears, here search for the name of the coin you want to trade in the search bar.

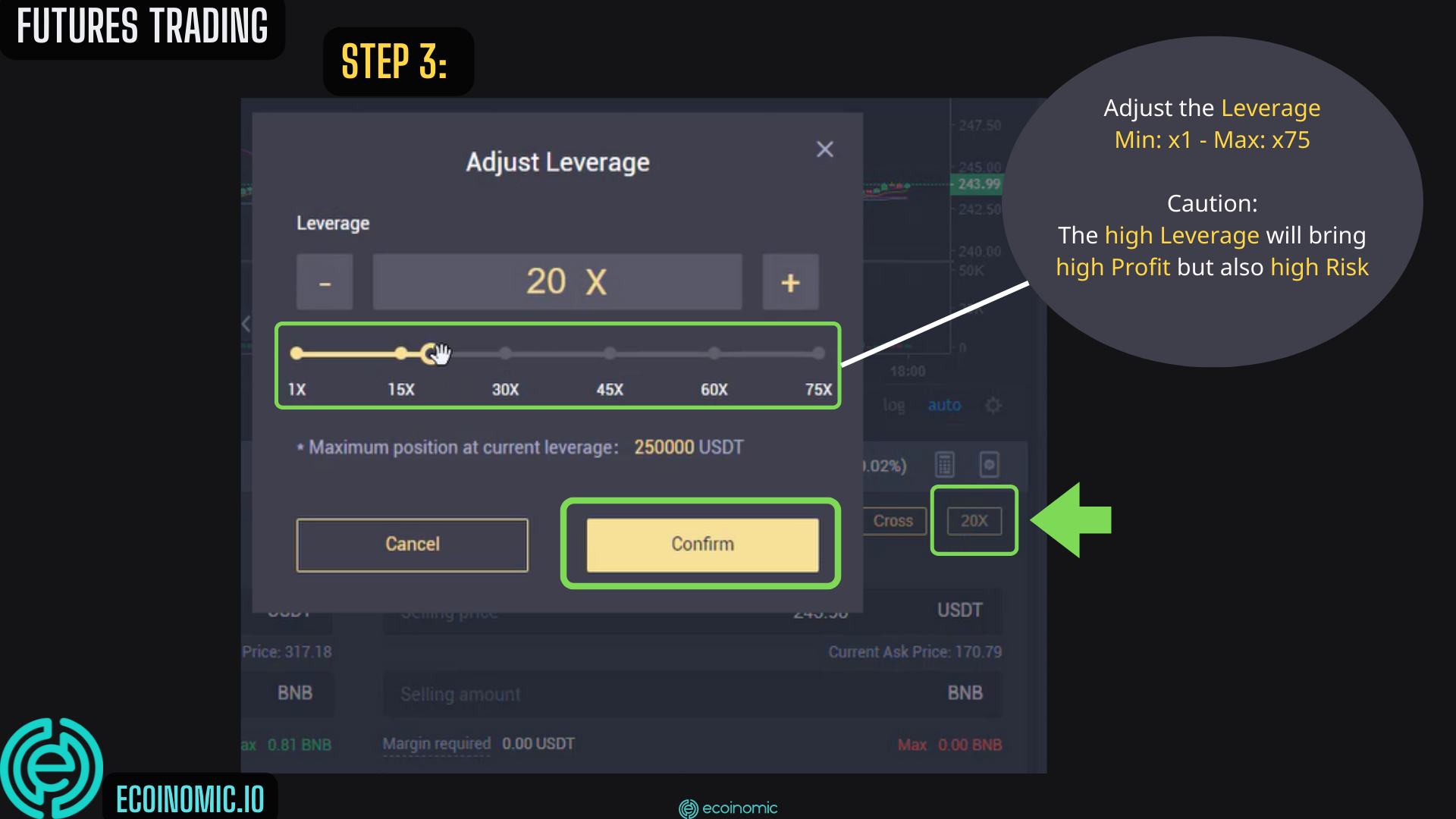

Step 3: Adjust the leverage by pressing the (+), (-) sign, or dragging the lever bar below. The minimum leverage factor is x1 and the maximum is x75. Then click Confirm.

Please pay attention that, the higher the leverage ratio, the higher the profit earned on successful trading, and vice versa.

Step 4: Select the LBank Futures trading mechanism: Cross or Isolated. Then click Confirm.

Trade LBank Futures with Limit orders

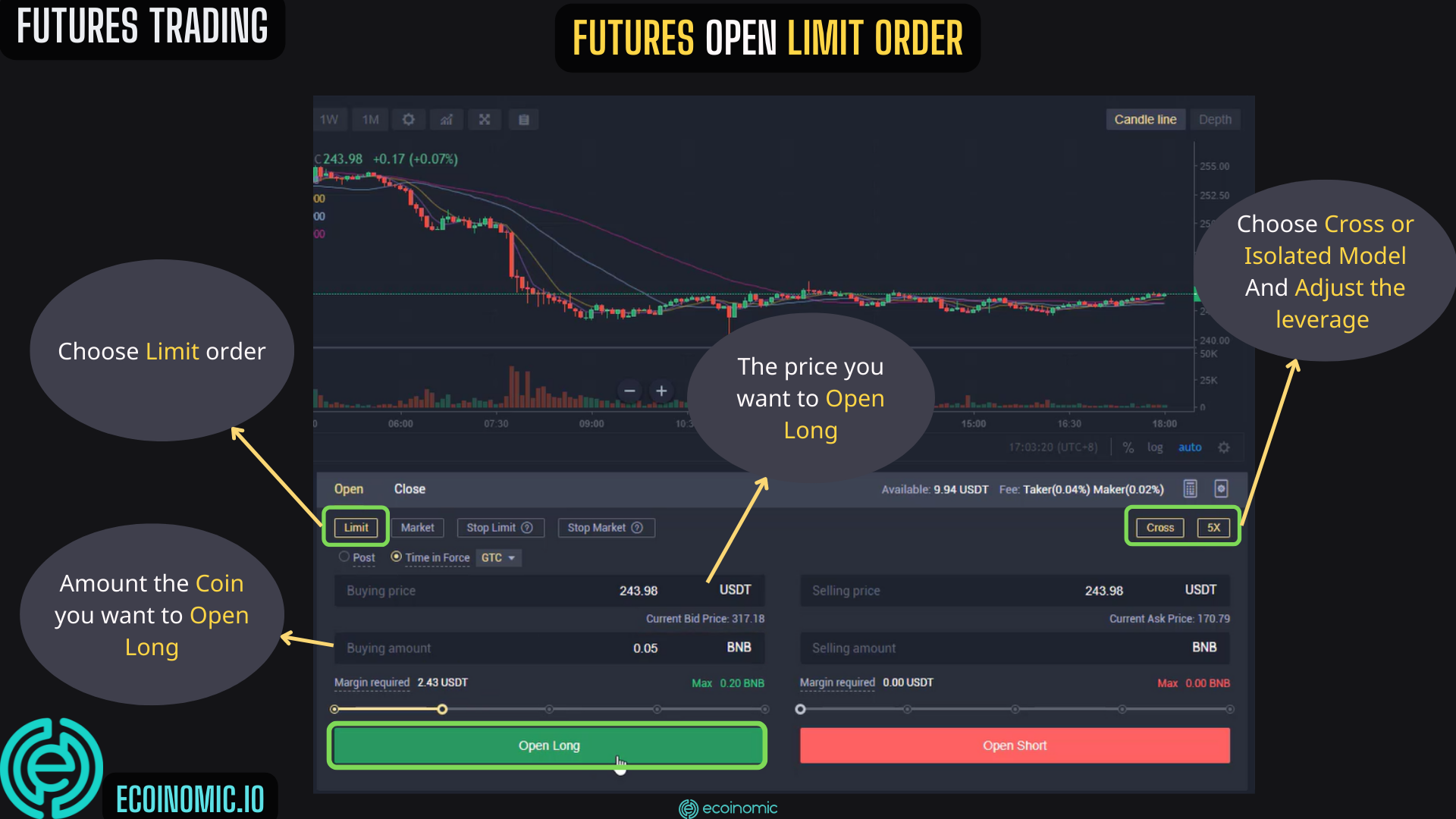

Open a Limit order

At the LBank Futures trading interface, select Limit order. Choose a trading mechanism and set the leverage factor. Enter the amount of coins you want to make a trade, check the price carefully, and click Open Long.

Close a Limit order

Also in the Limit order window, click Close to proceed with the order closing. Enter the amount of coins you want to trade, check the selling price and click Close Long.

Trade LBank Futures with Market orders

Open a Market Order

Click on the Market order at the LBank Futures trading interface. Here, you also choose the trading mechanism and set the leverage factor. Enter the amount of coins you want to open and click Open Long.

Close a Market Order

Select the Close item to proceed with the closing of the Market order. Then, enter the amount of coins you want to sell and press Close Long.

Trade LBank Futures with Stop Limit

Open Stop Limit order

Select the Stop Limit order at the LBank Futures trading interface and select Open to open the order. Enter the amount of coins you want to buy, and set the price limits:

- Buying Price is the price that you want to buy.

- Trigger Price is the price at which when the market price reaches that level, the order is automatically executed.

Check the information carefully and press Open Long.

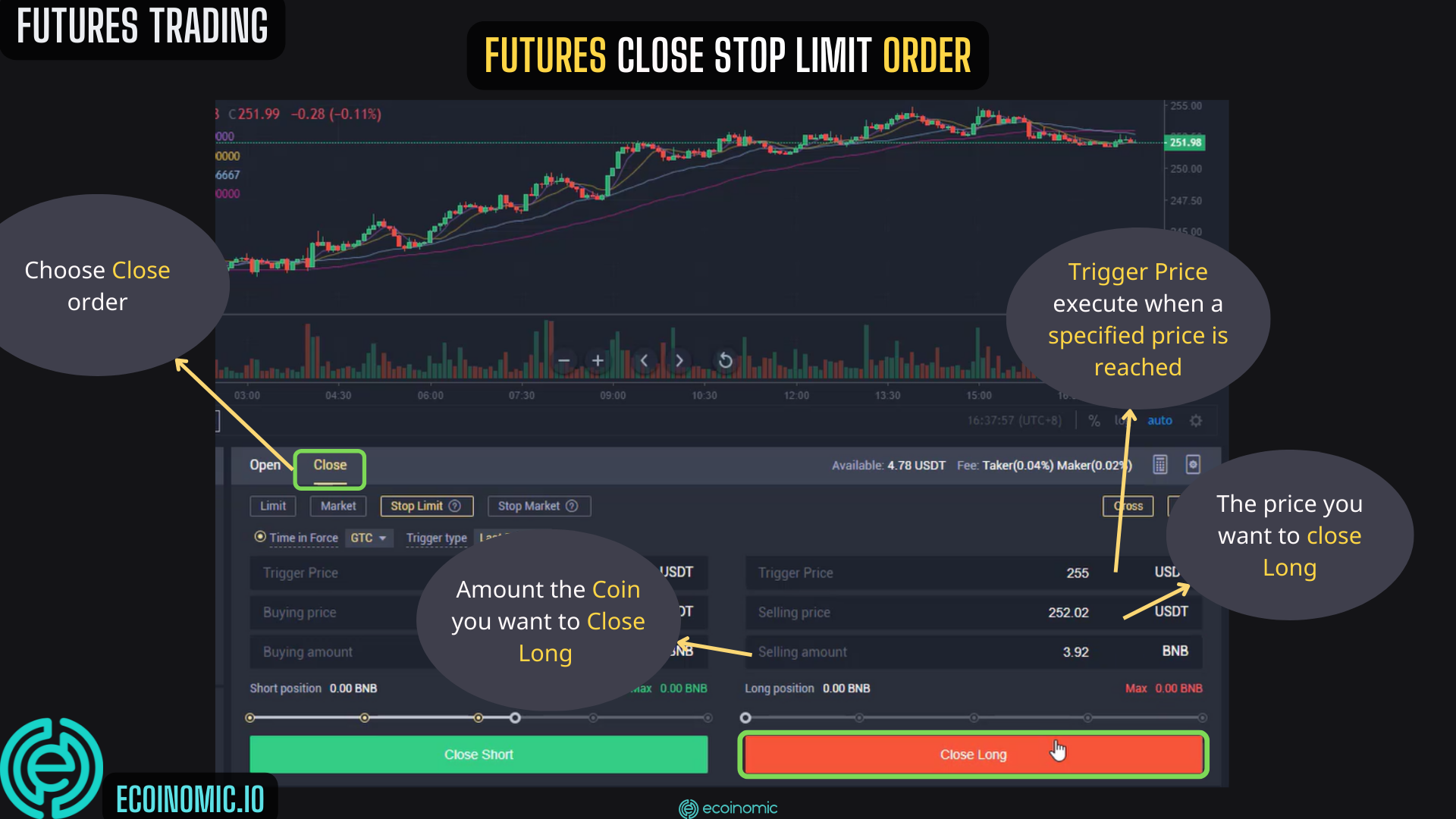

Closing a Stop Limit order

Select Close to proceed to close the order and sell the coin. You have to also enter the number of coins it wants to sell and set price limits. Then click Close Long.

Conclusion

The above article is the most detailed guide on how to trade LBank Futures on LBank exchange. Although it brings high profits, the potential risks of this form of trading are also great, especially for inexperienced traders. Therefore, to go the long way with the market and gain sustainable long-term profits, market knowledge is still the most important factor. Ecoinomic.io wishes traders the best investment decisions.

See more: What is Futures? What is margin? Compare Margin and Futures