Financial turbulence in the UK following last month’s announcement of unfunded tax cuts has caused a spike in trading of crypto against the British pound.

UK government bonds and the pound have tumbled since Chancellor of the Exchequer Kwasi Kwarteng’s Sept. 23 “mini budget.” The surge in yields on longer-term government debt spilled over into a crisis for pension funds as they were forced to rapidly adjust their portfolios — before the Bank of England (BOE) responded with a package of bond buying to ease the pressure.

British assets fell again today after BOE Governor Andrew Bailey cautioned pension funds that support will end in three days. A later report from Financial Times, citing bankers briefed by the BOE, said the emergency bond-buying program could continue past this week’s deadline

Crypto volumes increase against GBP

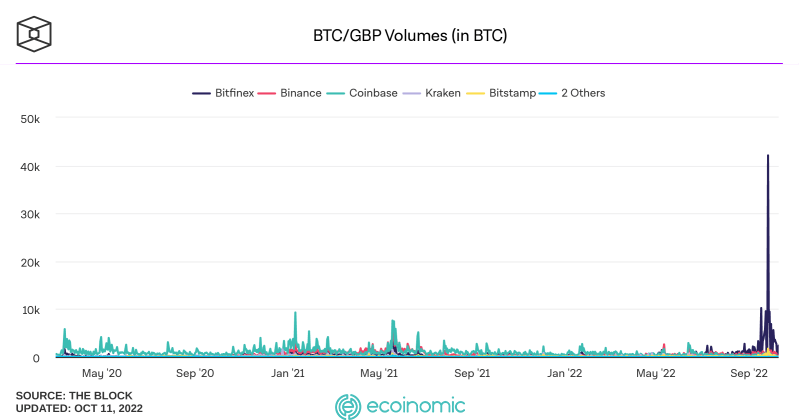

This turmoil in the UK has coincided with a notable increase in bitcoin trading against the nation’s currency. Volume increases have been particularly clear on the centralized crypto exchange Bitfinex.

BTC/GBP volume, measured in BTC, has increased alongside financial worries in the UK

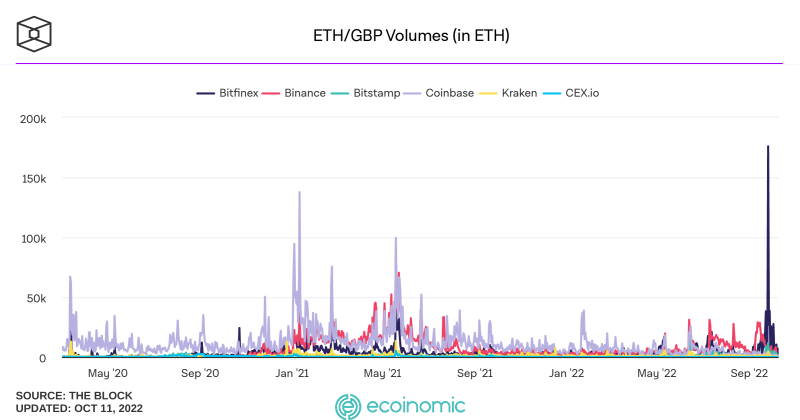

Additionally, ether volumes have increased against the pound — most notably, again, on Bitfinex.

There has also been a notable increase in ETH/GBP volume, measured in ETH

Just arbitrage?

While some are speculating that this data shows UK investors are fleeing into crypto, that may not necessarily be the case.

“Ultimately, when GBP is volatile, some traders could make more money arbitraging against BTC/USD pairs,” explained The Block’s VP of Research, Larry Cermak.

“So it doesn’t necessarily mean people are buying BTC or ETH and dumping GBP,” he continued. “It could also just mean market makers and traders are trying to Arbitrage the difference.”