Advertisement

Although when investing, profits are impossible to guarantee absolutely, arbitrage trading can bring you closer to your goal of getting the desired profit. This is a strategy that works on price differences between markets and has a relatively low level of risk. In this article, Ecoinomic.io will help you understand what Arbitrage is and how arbitrage is trading.

What is Arbitrage?

Arbitrage is understood as the difference between the highest and lowest prices of buyers and sellers in an order book. In the cryptocurrency market, spreads occur due to prices between different exchanges.

In theory, any possible price difference between two cryptocurrency exchanges provides an opportunity to implement an arbitrage trading strategy. This strategy is very popular among traders and is often a tool used by large financial institutions.

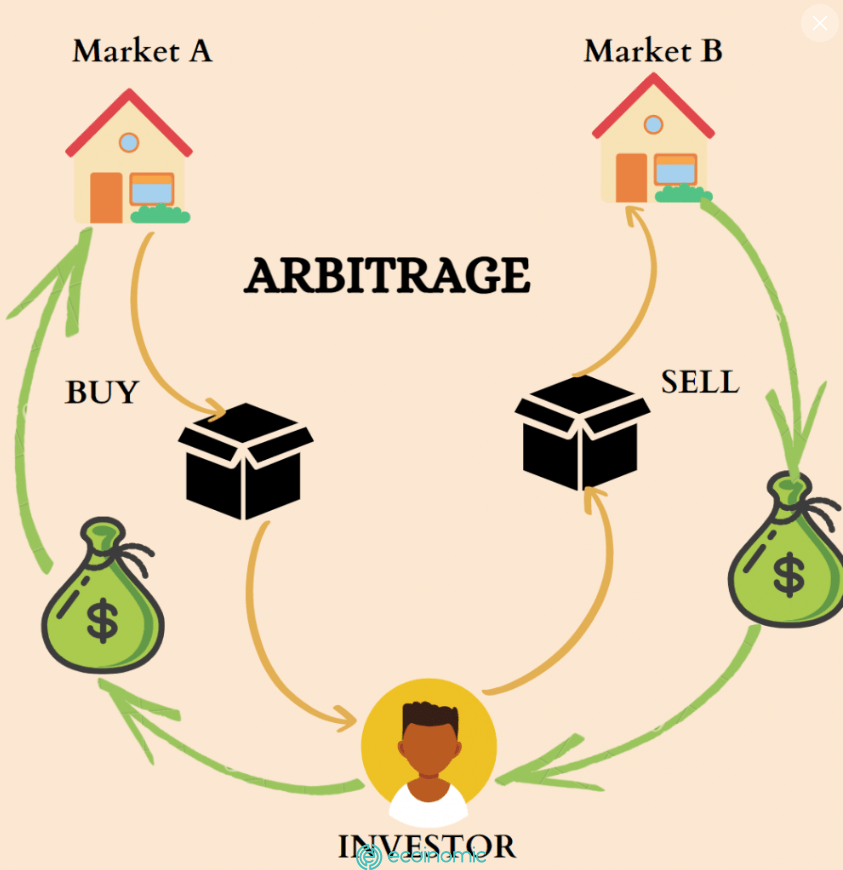

Arbitrage is done by buying an asset on one market and selling that asset on another at the same time in order to profit from the spread that occurs. The main way is to buy and sell the same asset classes on many different exchanges.

The difficulty of implementing this strategy lies not only in detecting spreads but also in quickly executing trades. Other traders in the market can also detect the difference, so the opportunity to make a profit usually happens very quickly.

These transactions are usually very low risk, along with the profit margins earned are not much. This means that arbitrage traders often participate with a huge amount of capital to make significant profits.

Arbitrage Trading Methods

Talking about the Arbitrage strategy, there are many different ways that the trader community around the world is using. However, with the cryptocurrency market as a whole, people are currently adopting a few popular Arbitrage strategies:

Arbitrage between exchanges

This is the most common type of arbitrage trading. This form takes place when a trader buys a cryptocurrency on one exchange and sells the currency itself on another exchange. The transaction price can quickly change. Prices will always be most accurate in exchanges with high volume & liquidity such as Binance, FTX, compared to brokers with lower trading volumes such as MEXC, Hotbit, Phemex,…

Looking at the order book of a digital currency on many different exchanges, you will notice that at the same time, the price is hardly the same. This is the key point that arbitrage traders take advantage of to make a profit.

Arbitrage Funding Rate

The arbitrage funding rate is another popular type of arbitrage trading strategy used by cryptocurrency derivatives traders.

In this form, traders buy a cryptocurrency and protect themselves against price fluctuations with a futures contract with the same currency that has a lower funding rate than the cost of buying cryptocurrency. In this case, the fee is understood as any amount that the trader may incur.

Assuming you are holding an amount of Ethereum, at the price of ETH now, you can be completely satisfied with their value, however, the price of ETH could fluctuate very sharply in the future.

In this case, you decide to sell a shorting contract with the value of an Ethereum investment to protect yourself from market fluctuations.

In the case of that contract, the funding rate is 2%. This means that when you own Ethereum you will get 2% without any price risk. This is also an opportunity to make a profit from trading in price differences.

Triangle Arbitrage

For this type, traders detect price differences between three different cryptocurrencies and conduct trading to exchange them in a loop.

To put it more simply: You understand that there will be many trading pairs: BTC/ETH, ETH/BNB and BNB/BTC. The idea of this type comes from taking advantage of the price difference between currencies and trading back and forth between 3 pairs to earn interest.

For example, you can trade in a loop like this: Use BNB to buy Bitcoin, then use Bitcoin to buy Ethereum and finally use Ethereum to buy BNB. When the relative value between Ethereum and Bitcoin does not match the value of each of those currencies to BNB, then the price difference exists.

An example of Arbitrage Crypto

Arbitrage on a centralized exchange – CEX

For example, let’s say the current Aptos (APT) token price on Binance is $9.2655 and $9.2795 on MEXC. In this case, traders can spot this spread and buy APT on Binance then sell it on MEXC to pocket the $0.014 spread (without trading fees).

At first glance, this may seem like a small amount of money, but think about it, if you trade with a large amount, surely the profit from eating the price difference is not small at all.

Arbitrage between exchanges

This arbitrage opportunity frequently occurs on decentralized exchanges or automated market makers (AMMs), which use automated and decentralized programs called smart contracts to determine the prices of cryptocurrency trading pairs.

Arbitrage traders can intervene and conduct cross-exchange transactions between a Decentralized exchange and a centralized exchange if the prices of cryptocurrency trading pairs differ markedly from the spot prices on the centralized exchange.

For example, the price of ETH on Uniswap is $1543.90, and on MEXC it is $1546. At this point, traders can swap ETH on Uniswap and then bring it to MEXC to sell and enjoy the spread profit.

The risks of Arbitrage

While arbitrage trading strategies have relatively low risks, that doesn’t mean it’s absolutely safe. There is no risk that there will be no profit, and that is always the case. For arbitrage trading, the biggest risk is execution risk.

This means that the moment the spread ends before the trade is completed results in zero or even negative profits. It is caused by slippage, slow execution speed, unusually high transaction costs, spikes in volatility, etc.

Liquidity risk is also a matter of note. This happens when the market is not liquid enough for you to enter and exit trades to complete arbitrage trades. If you are using leverage instruments, such as futures contracts, margin issues can also have an impact if the trade moves against your prediction.

Risk management is always necessary in any case.

Conclusion

Arbitrage is great for traders in the cryptocurrency market. Making good use of the opportunity with the right amount of capital will help you make a profit at a relatively low-risk cost. In Defi, you can combine using Flash loans to Borrow a large amount of capital in a short time to help Arbitrage.

However, the risks involved should also be taken into account, although some still call this a “risk-free profit” or a “guaranteed profit”. Although “relatively low”, these risks are enough to make traders fail without any vigilance.