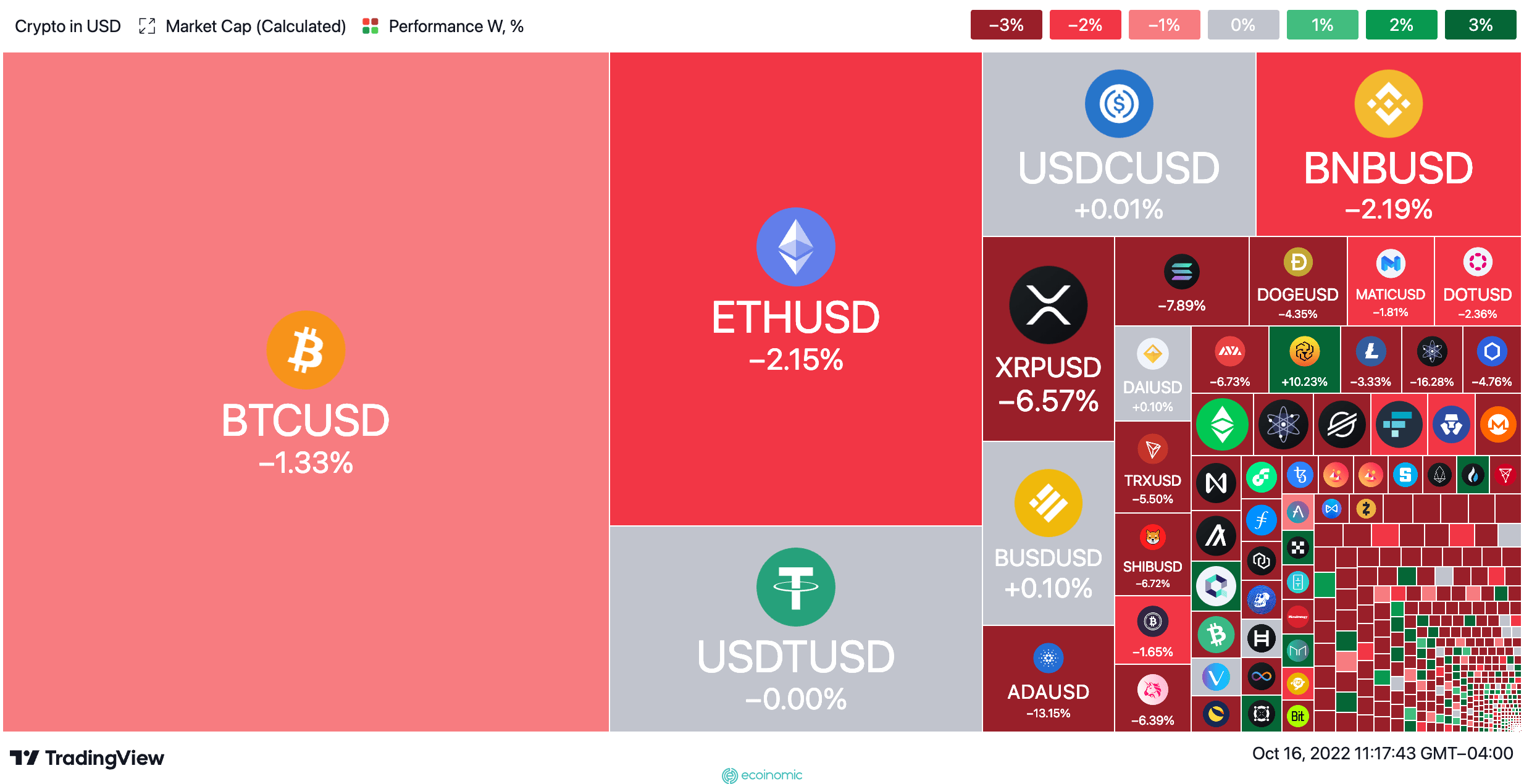

Bitcoin and ether edged lower this week after whipsawing on Thursday following the latest inflation figures out of the U.S.

Bitcoin was trading at $19,135 today, down 1.33% over the past week, while ether shed 2.15% in the same period to trade at $1,284, according to data via Coinbase.

Meanwhile, altcoins suffered heavier losses throughout the week, with ADA trading down more than 13% at $0.36 and SOL losing 7.89% to trade at $29.95.

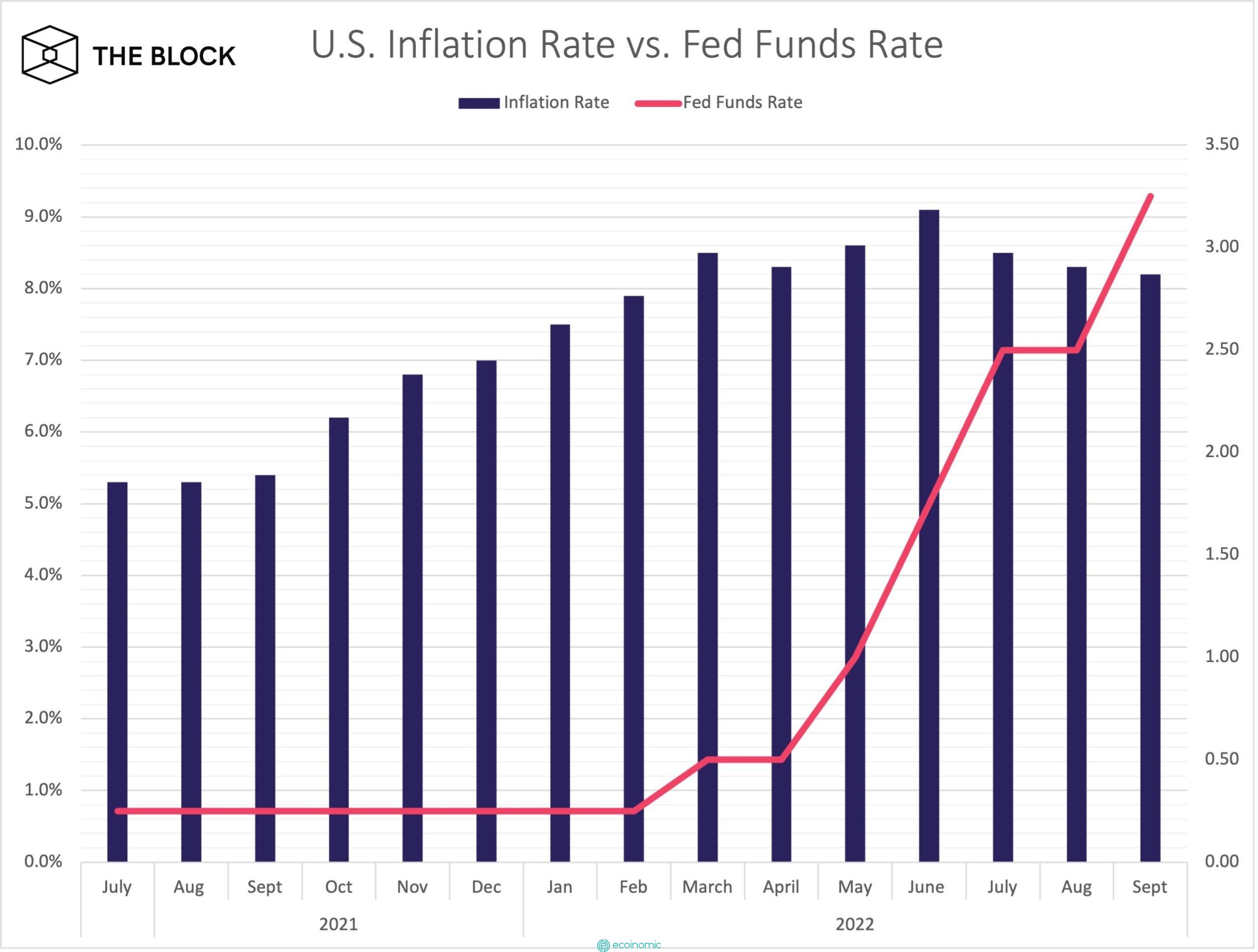

U.S. inflation comes in hot

U.S. inflation data came in hotter-than-expected on Thursday as core inflation hit a 40-year high.

Inflation was up 0.4% month-on-month from August and the year-on-year reading was 8.2%, according to the latest CPI data. Meanwhile, core inflation came in at 6.6% year-on-year — the biggest increase since 1982.

Thursday’s data suggests the Fed won’t curb its interest rate hikes anytime soon, with the market now pricing in a 97% chance of a 75 basis points increase at the next meeting in November, according to the CME’s FedWatch tool.

While fear continues to mount, markets don’t seem to be predicting a 100 basis point raise from the Fed just yet, Youwei Yang, chief economist at Bit Mining told The Block.

“We probably won’t see anything like a disorderly dump of stocks, but rather some highly leveraged portfolios decreasing their risk exposures to avoid more extreme volatility. The market overall has been gradually dropping year to date, despite a few small rallies, and many contrarians have already called this the bottom,” Yang said.

source: bls.gov/cpi/

A 75 basis point rate hike would bring the target Fed Funds rate to 3.75-4%, from its current position of 3-3.25%, as seen above and according to data via the Bureau of Labor Statistics and the U.S. Federal Reserve.

The target rate is expected to climb well above 4% by the end of the year. JPMorgan’s Marko Kolanovic said on Monday that the Fed policy rates may approach 5% next quarter.