Advertisement

Up until now, the Bear market has always had the challenge of navigating traders and usually the indicator determines the timing of good orders, but it is impossible to predict how long the cryptocurrency winter will last. Recently, Bitcoin has shown signs of recovering above the critical price at $20,000. This can also be a sign that many traders have seen the bottom of the market. The analysis of the data suggests that this short-term recovery does not have enough macro evidence that there will be a new trend changing.

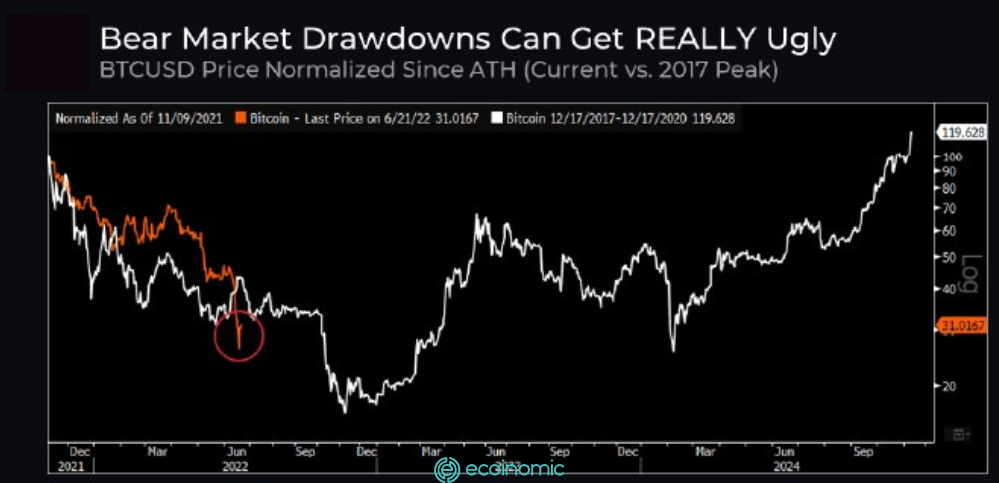

10,000 In a recent report by cryptocurrency research firm Delphi Digital indicated there must be more caution before making investment decisions in the face of the current market situation. It suggests that "We may need to suffer a lot before we believe the market is at the bottom." Comparing the two prices between the current decline and the market's peak in 2017, it can be seen that the market may continue to fall in the short term.

highs In bear markets, the price of Bitcoin has once dropped up to 80% since the top to the last bottom. According to Delphi, if politely repeats itself again, it is very likely that the BTC price will reach a low of just over $10,000 and drop another 50% for the current levels.

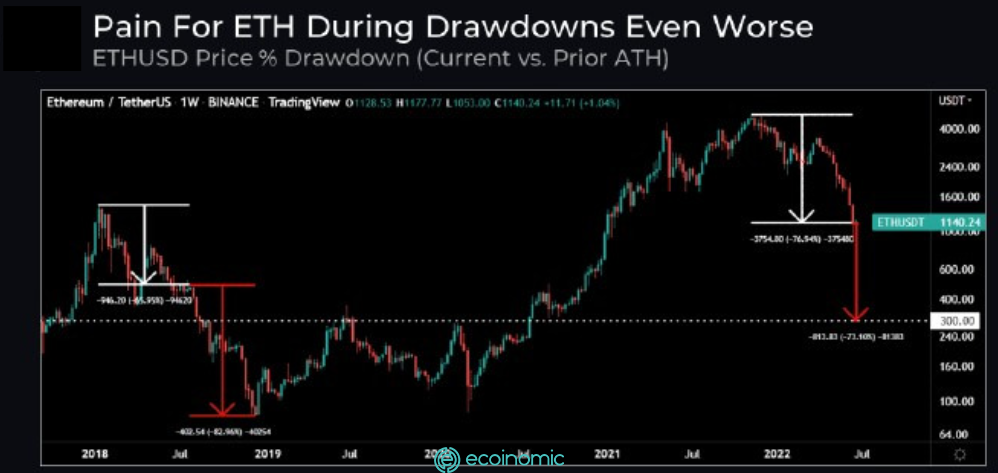

Expectations for Ether (ETH) were worse than the bear market in the years before it saw its price drop by as much as 95% from its peak. If the same situation occurs during this time, it is very likely that the price of Ether will hit as low as $300.

Delphi Digital said, "If the price of Bitcoin does not hold at $14,000 to $16,000 in the support range, it is very likely that investors will face some pretty high risks." >> See more: The easiest CoinEx Subscription Guide

Delphi Digital said, "If the price of Bitcoin does not hold at $14,000 to $16,000 in the support range, it is very likely that investors will face some pretty high risks." >> See more: The easiest CoinEx Subscription Guide

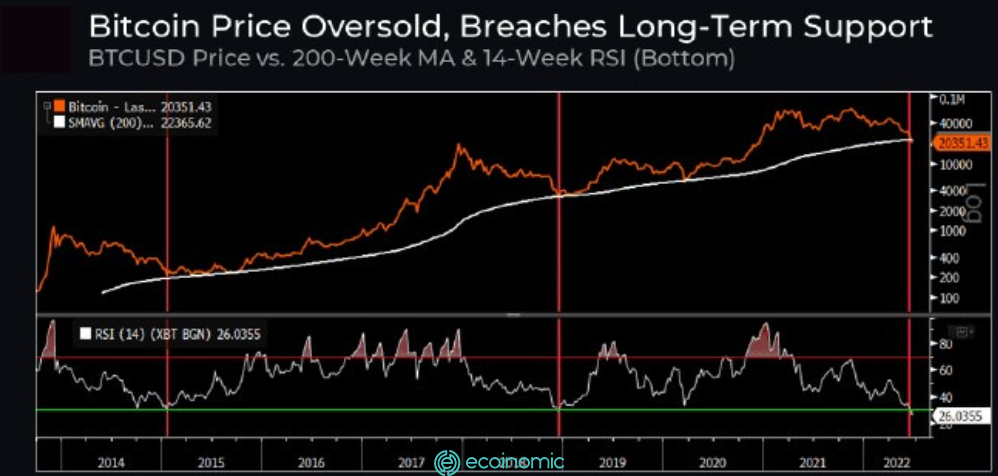

Bitcoin is oversold and has prevailed.

In the current market, for traders looking for a bottom position, it is very likely that the bottom of the previous market will coincide with harsh selling conditions." According to the weekly chart, Bitcoin's recent 14-week RSI plummeted to 30, which is the third time in its history that two previous appearances have hit the bottom of the market.

A lot of people think that this is the right time to re-enter the market. However, Delphi has issued a warning to those waiting for a "V-shaped" recovery. As in two similar cases before, over a period of several months, BTC traded with a sideways fluctuating margin before starting a strong recovery.

SMA Since March 2020, Bitcoin has broken the SMA 200 for the first time. In the previous few weeks in the bear market, BTC also only traded hovering at this level, which suggests that it is likely that the market will soon be able to find a bottom of the market.

The last speculation.

What the market is looking for is a final speculation to mark the end of the bear market and the start of the next new cycle.

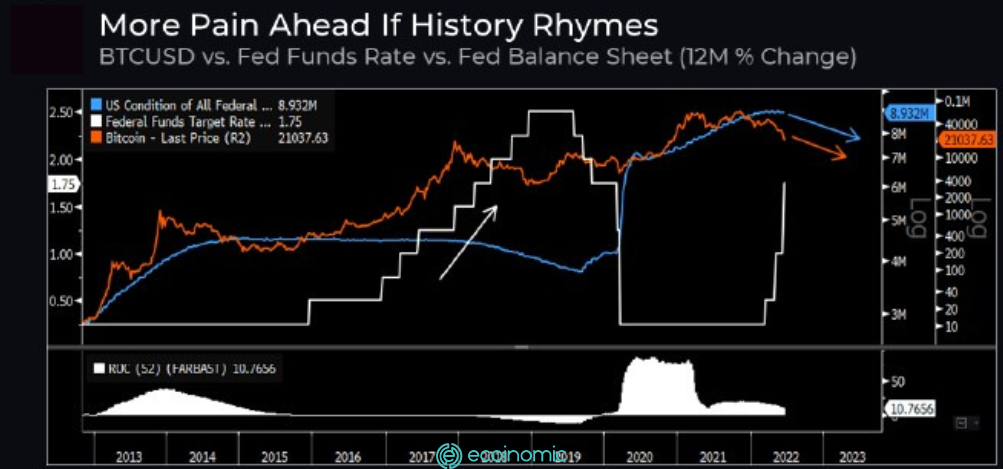

Since the Covid-19 pandemic in March last year, expectations in the market have been falling and reaching low levels but have not yet reached the depths of despair in 2018.

Since the end of 2021, the weakness in the cryptocurrency market has been clearly noticed but the real reasons for the market crash include Inflation and interest rates at the same time rising.

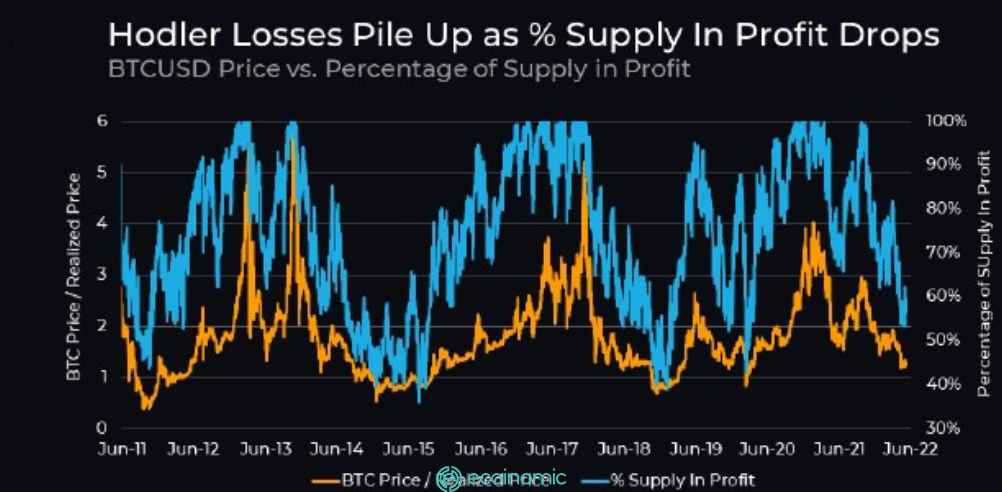

The final data shows that the final investment event needs to happen with the percentage of the return of the same Bitcoin source and reach a low of 40% compared to the past.

According to data from Glassnode, the figure is currently at 54.9%, which adds certainty to the view that the market could experience another drop before the bottom appears.

>> See also: Easy to understand MEXC Registration Guide

—

Telegram: https://t.me/+XqnDmxy-bz0wMTE1

Group: https://www.facebook.com/groups/655607162536305

Fanpage: https://www.facebook.com/WikiBinancecom

Twitter: https://twitter.com/wikibinancevn