Advertisement

The explosion of decentralized finance allows KYC-free trading to grow rapidly in liquidity and volume. In particular, OpenLeverage will be a promising name to truly build DeFi’s vision in accessing global finance.

What is OpenLeverage (OLE)?

OpenLeverage is an escrow trading protocol that takes advantage of available resources from DEX platforms such as UniSwap, SushiSwap,… allows traders who do not need KYC to still be able to trade to buy or sell any trading pair on the system efficiently and securely.

How OpenLeverage (OLE) works

Decentralized margin trading

Margin trading is a method of trading assets using funds provided by third parties. When compared to conventional trading accounts, margin accounts allow traders to access larger amounts of capital, allowing them to take advantage of their positions. Basically, margin trading amplifies trading results so that traders can get bigger returns when trading successfully.

In centralized cryptocurrency markets, borrowed funds are usually provided by an intermediary, such as an exchange or centralized broker. However, in a decentralized cryptocurrency trading environment, money is often provided by other anonymous users who earn interest based on market demand for margin funds.

Borrowers and transactions will be anonymous but transparent and in line with the rules defined in the smart contract. All funds are held in smart contracts until all conditions are met to close appropriate trading and lending positions

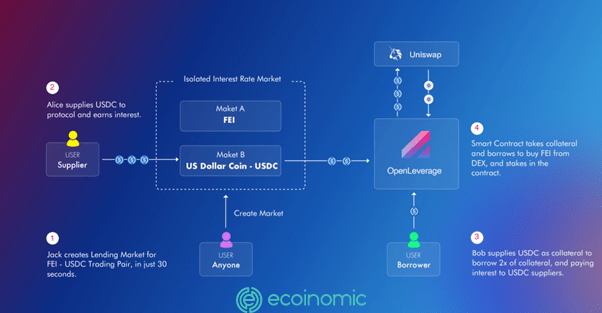

Anyone can create loan groups for a specific pair on DEX.

worksFor example: You are interested in trading leverage on fei/USDC pairs, so you can create two lending groups for Uniswap’s FEI/USDC pair. Anyone can create separate groups for users to lend or Borrow for margin transactions.

Next, users can provide liquidity in the FEI group → USDC, which means lending FEI to buy USDC. Or users can choose to offer liquidity in the USDC group → FEI means lending USDC to buy FEI. The lender will receive variable interest rates based on the use of the group. This is similar to how the Compound protocol works.

Lenders receive interest in LToken, which can then be deposited back to other Yield Farms for additional rewards.

Traders can choose to borrow from one of the two groups to swap to another token as a leverage position. In this example, the trader borrows USDC by offering the same amount of USDC as collateral to make a 2X margin transaction, swapping into FEI positions with Uniswap’s liquidity groups, and being locked in smart contracts. By leveraging liquidity on DEX, OpenLeverage does not have to create separate liquidity or order books to trade leverage.

10% of the interest rate is obtained from the group and 1/3 of the transaction fee of the pair is set aside as insurance to compensate the lender if the loan occurs insolvency.Moreover, each lending group will have 20% interest incurred as a provision.

After the trader closes the position, the protocol will swap the FEI position back to USDC by returning the loan at an interest rate, which will return the deposit plus or minus any gains or losses to the trader.

To avoid quick lending attacks, in protocol design no open, close, or liquidation activities can be performed in the same transaction. Liquidation activity occurs in two transactions to avoid attackers manipulating prices, triggering liquidation for profit, or creating tiered liquidation events.

Highlights of OpenLeverage

The features of OpenLeverage

- Margin trading with liquidity on DEX, connecting traders to trade with the most liquid decentralized markets such as Uniswap, Pancakeswap,…

- Lending Pools has separate risks, there are two distinct groups for each pair and different risk and interest rate parameters, allowing lenders to invest at a risk-reward ratio.

- Calculate the risk with the AMM price in real time and calculate the ratio of collateral to the AMM price in real time for any pair available on the DEX.

- The two phases of Liquidation, which force liquidation, must be completed in two transactions to avoid flash lending attacks and tiered liquidation events.

- LToken is an interest-bearing token for each lending group, allowing token integration with projects.

- OLE Token belongs to the administrative token and is minted using the protocol, which allows owners to vote, bet to receive rewards and protocol privileges.

- The user interface is very intuitive and friendly designed for decentralized margin trading.

Some special features make OpenLevarage the most scalable

- Anyone can create loan groups for any trading pair available on the DEX, with default interest and risk parameters, which the community can change through the management process.

- Lenders can earn higher yields by depositing assets into the lending pool, making interest on the loan assets, receiving OLE rewards, or receiving rewards by resetting their LTokens to participate in the reward programs of other projects.

- Traders can borrow and trade all with one click in a single trade.

- Projects can integrate with the OpenLeverage protocol to facilitate leverage trading on specific trading pairs by integrating LToken.

- Liquidators can trigger liquidation to earn rewards based on gas prices if the ratio of the transaction’s secured assets falls below the market limit.

The same project

- Dydx

- Perp.finance

Development roadmap

Q3/2021:

- Launch products on Ethereum

- Uniswap V2 & V3 Integration

Q4/2021:

- Integration with more DEX, Margin Trading with Aggregate Liquidity

- Layer 2 solutions on Arbitrum and Optimist

Q/2022 and the future

- Token Launch

- Loss risk insurance

- Limit orders for margin trading

- Decentralized asset management

- Yield Farm Altcoin based on leverage

- Leverage basket trading

- Delta Netual strategy with options

Partners and investors

OpenLeverage received $1.8M from investors such as Signum Capital, LD Capital, FBG Captital, Continue Capital, YBB Foundation, MDEX, AKG Ventures, and Mr. Block.

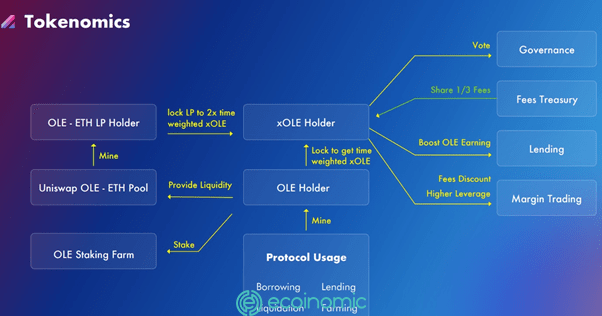

Tokenomics

- OLE is the project’s governance token, which is minted using the protocol, which allows owners to vote, bet to receive rewards and protocol privileges.

- Fees Treasury: One-third of the pair’s transaction fees are set aside as insurance to compensate the lender if the loan fails to maintain the group’s solvency.

- Boost OLE Earnings: Increase OLE income by lending.

- Fees Discount Higher Leverage – Makes the discounted cost leverage higher.

Information about OLE tokens

- Token Name: OpenLeverage.

- Ticker: OLE.

- Blockchain: updating…

- Token Standard: ERC -20

- Contract: updating…

- Token Type: Governance.

- Total Supply: 100,000,000 OLE

- Circulating Supply: Updating

How to allocate OLE tokens

OLE tokens are allocated as follows:

OLE Token Storage Wallet

OLE tokens are stored using wallets with the ERC-20 platform.

Conclude

To understand what OpenLeverage compares to other Dex protocols and exchanges that stand out from, check out the comparison table below:

Here’s all the basic information to help you get the most overview of the OpenLeverage project. Hopefully the article will help you in the process of research and investment.

Related: What Are The Differences Between Investment And Speculation?