Advertisement

Referring to the new trend in the field of decentralized finance (DeFi) recently, it is impossible not to mention Real yield. The concept has generated a wave of debate among investors, about whether the trend is really the new standard of DeFi.

Specifically, DeFi protocols will pay profits in major cryptocurrencies such as Bitcoin and Ethereum or stablecoins such as USDC or BUSD. These funds are believed to be from the actual turnover of the protocols and staking or locking governance tokens.

So what is the reason for investors to be interested in this new trend? In this article, we will discuss Real Yield, see how this trend is developing and what its potential looks like in the future.

What is Real Yield?

Real Yield is an emerging trend in the DeFi space. Recently, it has been mentioned with derivatives and options, especially in the whitepaper of projects in the Arbitrum ecosystem.

In fact, Real Yield is very similar to a stock dividend. With Real Yield, investors put money into DeFi protocols through an investment, which divides them a portion of the revenue based on the initial investment amount.

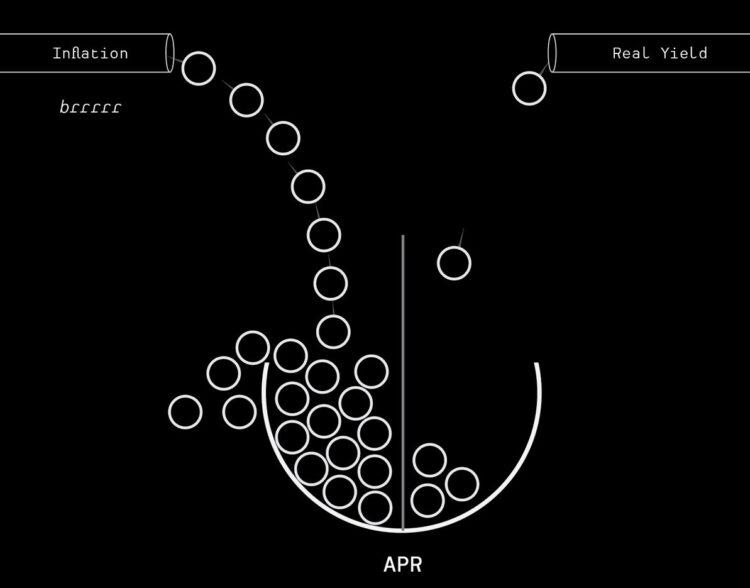

The main difference between Real Yield and other trends in DeFi is in the “Real” factor. In the period of rapid DeFi development in the period of 2020 – 2021, many protocols are profitable for users but with a form far different from Real Yield.

During the period just mentioned, yields typically fluctuate in the four-figure range or even higher than protocols that pay users through a continuous cycle of token emissions. Even in the context of token inflation, this form still attracts a lot of investors with huge capital. However, when the market showed signs of decline last spring, the cryptocurrency market began to experience a layered effect that caused the value of many tokens to “collapse”, and investors could not receive their returns either.

Besides, when DeFi was in its infancy, many users committed to participating in the project in the form of yield farming. And what is the result? DeFi became a “wasteland” after the rise of the bear market. At this time, investors are trying to look for signs of price increase, such as through the Real Yield trend – which is considered to be capable of “watering” the DeFi land at the moment.

See also: What you need to know about cryptocurrencies and inflation

The origin of Real Yield

This trend originated from a series of famous KOLs on the Twitter platform in April 2022. Often, when talking about DeFi, many people immediately think of attacks, rug pull, token inflation, price dumps, and products that are not highly applicable. However, the Real Yield trend opens up to investors a new perspective on the decentralized finance market, which is different from the traditional financial market, TradFi. In particular, the trend is characterized by projects that fully meet the following conditions:

- Have a clear product

- Someone clearly

- The project is required to generate revenue

Outstanding projects that meet the above requirements can be mentioned as GMX, GNS, Dopex,…

The development of Real Yield

At the time this trend became known, a cryptocurrency project to be able to generate Real Yield was forced to generate a profit source large enough to share with users, instead of paying users for emission tokens. At the present time, the project is required to meet the following conditions:

- Have a clear product

- Have regular loyal users

- There is revenue from users but not from token inflation

- Revenue sharing with long-term token holders

Currently, Real Yield has two types of projects:

- The project directly generates revenue and divides them among token holders.

- The intermediary project is responsible for synthesizing the user’s idle capital, to implement strategies to optimize the profits earned from projects that are considered Real Yield.

How did the Real Yield trend come about?

A significant concern at the moment is that the Real Yield trend is acting as a form of signaling a positive trend to investors rather than an indicator that the protocol is actually moving in that direction.

For example, in the past, market analysts relied on TVL (Total Value Locked) to evaluate DeFi projects. This is an indicator that measures the size of the ecosystem but does not provide complete details about the status of the entities in that ecosystem.

Due to the huge profits obtained during the DeFi summer, many people engage with the protocols superficially and do not really drive TVL value. Besides, TVL does not reflect in detail on operating costs as well as other issues related to capital efficiency.

At the moment, Real Yield can help the community find a more comprehensive indicator. However, risks are unavoidable, and this is possible with a protocol that issues tokens with the aim of acquiring stablecoins and then selling them to users. And this action is disguised as if it brings real profit to the investor.

The protocols can keep emissions low and pay real yield to attract stakers. However, this only significantly increases the emissions that follow, and of course, users have now locked down their investments.

In fact, Real Yield also has a number of other problems, including the fact that startups generally need capital and pay returns to investors just for the purpose of attracting new investors, similar to the Ponzi scheme.

Why is Real Yield considered the new standard for DeFi?

The main reason is that users in the DeFi space have been distracted by tokens and services that provide unsustainable annual returns. Such models are so popular that they create a protocol that is liquid, has users, and has a high TVL.

However, what is considered attractive to those traders is actually maintained through “fake profits,” namely token emissions. In simpler terms, such projects will require users to mint the protocol’s native tokens and pay rewards with the tokens themselves.

In some ways, this seems of little interest, as long as the token price continues to rise and there is the ability to pay an annual yield as a percentage to users. In fact, this rarely happens, taking profits, changing sentiment and attractive profits on DEX exchanges are factors that cause positive price trend reversals.

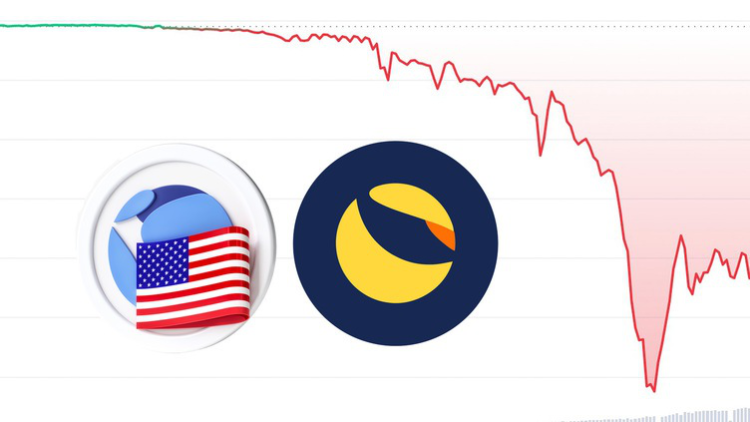

After that, projects are forced to issue more tokens to increase profits and maintain the ecosystem. This reduces the value of tokens, further causing many investors to stop investing and triggering the “death spiral” of the ecosystem.

Projects operating in this type often have a short lifespan and cause serious collapse consequences. The demise of the Terra ecosystem, followed by TerraUSD and LUNA, is one of the prominent “fake profit” projects.

Therefore, the Real Yield was born as a new standard of the decentralized finance space. Real profit projects use a value accumulation mechanism based on a real, stable and loyal user base.

DeFi protocols drive the Real Yield

Below is information about some of the DeFi protocols that contributed positively to the growth of the Real Yield trend.

Synthetix (SNX)

Synthetix is one of the early protocols in the decentralized finance space. This is the protocol that allows investors to trade derivatives of their crypto assets. After consolidating and perfecting its tokenomics, the protocol was developed on the Ethereum blockchain and provided real profits to users.

Synthetix pays a return of about 53%. This return comes from staking rewards paid in the protocol’s tokens and stablecoins such as sUSD obtained from trading fees on the exchange.

GMX (GMX)

GMX is a Decentralized exchange (DEX) that has been in operation since 2021. Recently, the exchange recorded its governance token trading at an all-time high. GMX’s two native tokens are GLP and GMX, which represent assets available on the platform and governance tokens.

This exchange pays a 14% Annual Percentage Rate (APR) to GMX holders which is 14% to GLP holders. Profits come from the revenue sharing on the platform, not from token inflation.

Dopex (DPX)

Dopex is a DEX that focuses on Options and allows people to earn real income. The platform’s Single Staking Option Vaults tool is similar to other single-staking vaults. Besides, users can also bet on changes in interest rates with the Interest Rates Options feature as well as other derivatives.

Dopex is considered a real yield provider with some of the staking yield coming from the inflationary emissions of the platform’s native tokens. Those investors who are willing to lock veDPX, are given a 4-year vote-by-vote trust platform with a 22% APY.

Investment opportunities with Real Yield projects

Real Yield is a trend that satisfies the needs of users. The conditions for a Real Yield project help users have a more positive view of the crypto space in general and DeFi in particular.

In terms of investment opportunities with Real Yield projects, it is not difficult to assert that they come from ecosystem-leading projects, such as Dopex or GMX as the first projects of this trend. Investors need to carefully study the operating model of these projects to stay ahead of the market when the Real Yield really booms.

Conclusion

Real Yield is the welcome trend with the goal of stable DeFi development. The past year has been a difficult period for cryptocurrencies as the market recorded a series of scandals. This has caused investor confidence to drop significantly. Therefore, it is no exaggeration to comment that the Real Yield was born to open up expectations and reinforce investors’ belief in the return of their investment before pouring money into a certain project.

However, many investors remain skeptical of this trend, especially its sustainability. And time will be the most accurate answer!

See also: Yield Farming, Staking, And Liquidity Mining – The Secret to DeFi Success