Advertisement

"Bitcoin could be preparing for a breakthrough in its development thanks to this year's inflation," a Bloomberg analyst said.

In a tweet on March 17, Mike McGlone, senior asset strategist at Bloomberg Intelligence, made a prediction of the future bullish trend of Bitcoin (BTC) amid current macro conditions.

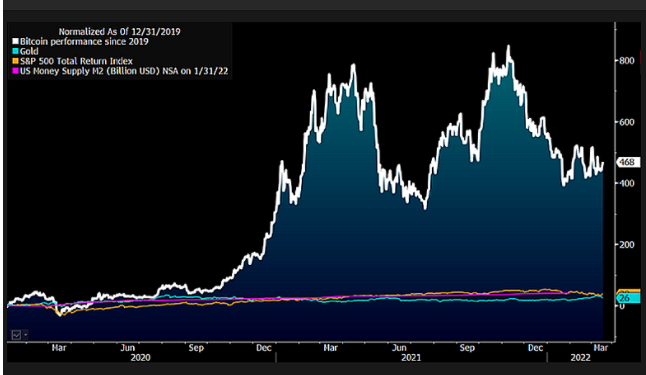

Gold is unlikely to beat Bitcoin this year.

McGlone is steadfast in his confidence in Bitcoin in the face of recent economic volatility, arguing that Inflation will help Bitcoin grow as an asset class, insisting it will even beat gold in interest rates.

"Faced with the Federal Reserve, inflation and war, 2022 may have prepared for a reversal of risky assets and marked another milestone in bitcoin's development," he wrote.

"Bitcoin looks set to relentlessly overtake gold and the stock market amid volatility as the Federal Reserve tries to make another cycle of rate hikes."

This prediction comes after the Federal Reserve unveiled a series of major interest rate hikes, an event that gives a modest but welcome boost to BTC price actions.

Former BitMEX CEO predicts BTC to reach $1 million

McGlone wasn't the only one making this prediction. Arthur Hayes, the former CEO of derivatives exchange BitMEX, issued a warning about what is to come to global financial markets in his latest post.

The Ukraine-Russia war not only contributed to inflationary pressures but was also symbolic because it showed that even the central bank's foreign currency assets could be stolen, he said.

"You can't remove the world's largest source of energy production from the financial system without anticipating serious consequences," he said.

His article is not only about a wide range of macro issues but also predicts the reshaping of the financial system. Bitcoin, like securities and other assets, will suffer heavy losses.

"If you're not ready to take control of your Bitcoin, close your eyes and press the sell button, and focus on the safety of your family from a material and monetary perspective. Waking up a few years after the end of the war would present a situation where hard money instruments would dominate global trading," Hayes wrote.

Ultimately, however, both Bitcoin and gold should play a more important role as value storage tools in the context of less and less participation in the U.S. dollar and euro markets from other governments.

In a situation he predicts could play out in the next decade, an ounce of gold could reach thousands of dollars, while Bitcoin could reach millions.

"For a Bitcoin, I predict it will reach millions. For an ounce of gold, I predict it will reach thousands," he added.

"That's the magnitude of Fiat currency prices in the coming years as global trade is settled through neutral hard money instruments that are not Fiat money secured by Western debt."