Advertisement

Bitcoin has recorded sluggish performance this week, with the red being mostly on the 7-day chart. The aforementioned price drop has sparked some speculation in the market about what will happen next. As always, the opinions of the crypto community are varied.

While some believe that a trend reversal is possible in the coming days, some reports suggest the opposite. At the time of writing, Bitcoin is trading at $20,010, having fallen by more than 5% in just the past 7 days with a Market Cap of over $384 billion.

Bears are holding the market

Recently, Dan Lim, an analyst with CryptoQuant pointed out in his analysis that the likelihood of Bitcoin falling further is very high due to a number of objective reasons, mainly due to falling market conditions.

Percent of 1W ~ 1M $BTC is 3.8%

"This indicator is the ratio of BTC that are 1 week to 1 month old after purchase, and is data that can be viewed as a basis for short-term buying."

by @DanCoinInvestorRead More👇https://t.co/mDk9DvjkxA pic.twitter.com/P5MrquOciY

— CryptoQuant.com (@cryptoquant_com) August 26, 2022

The Analyst also added that:

“When the Bear market starts, most people keep buying without realizing that it’s a bear market. But if the bear market lasts for a long time, most people get tired and stop buying.”

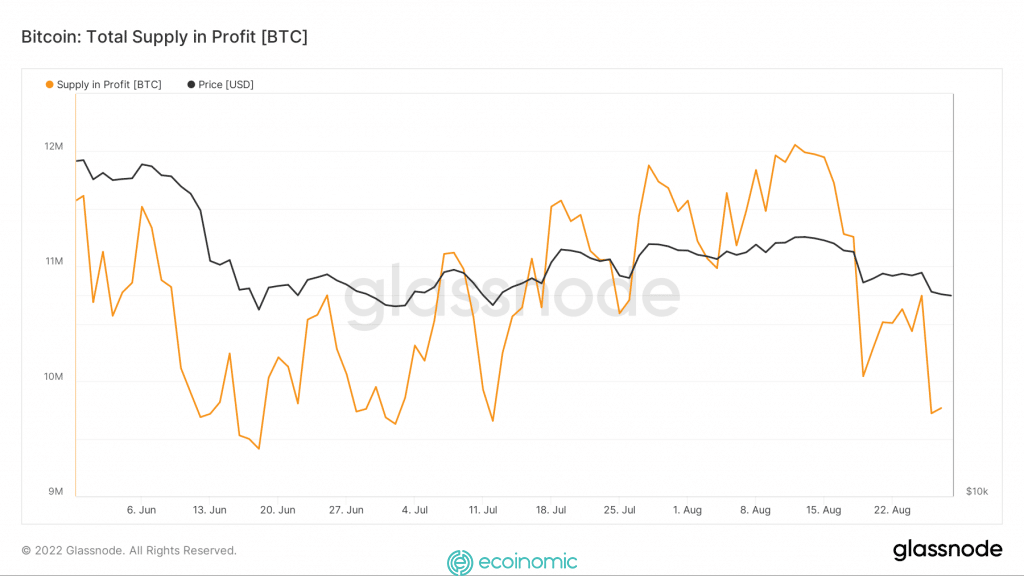

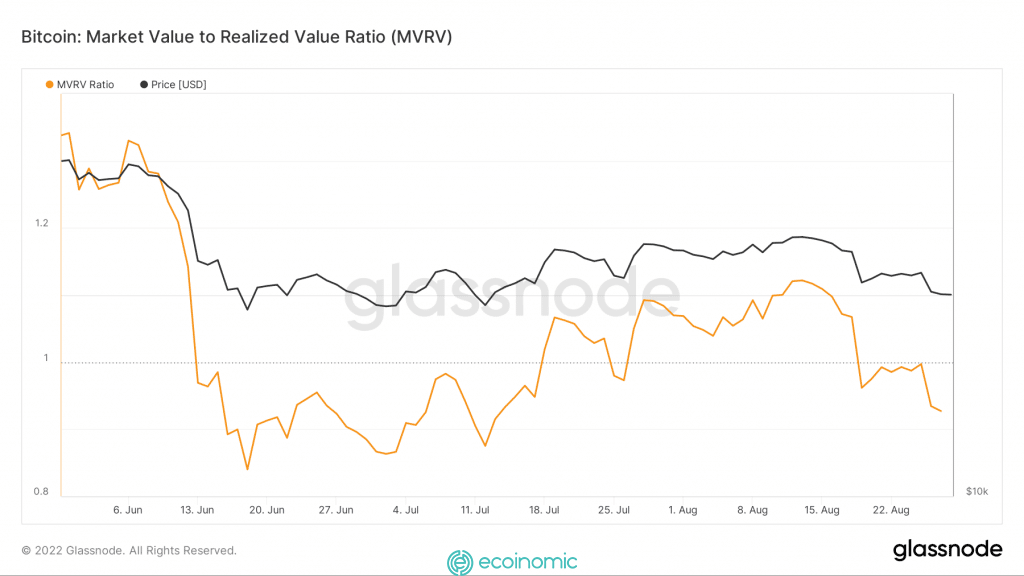

This prediction seems to be true, as several indices have supported the possibility that bitcoin’s price will continue to fall. For example, Bitcoin’s supply in profitability hit its lowest level this month on August 28 after plummeting since mid-August.

Recently, bitcoin withdrawals from exchanges have also decreased significantly. This indicates a bearish trend.

A look at the future of Bitcoin

Looking at the 4-hour chart of BTC, bears dominate the market, as the majority of candlesticks are colored red. Bollinger Bands think that the price of BTC is in a high volatility zone. These may soon lead to a price decline, thus minimizing the chances of a price increase in the short term.

Although the aforementioned figures, analysis, and charts all forecast bearish market conditions, a few indicators highlight the small possibility that the market will reverse.

According to the MACD indicator, the blue line is approaching the red line which may lead to a crossover in the uptrend in the coming days.

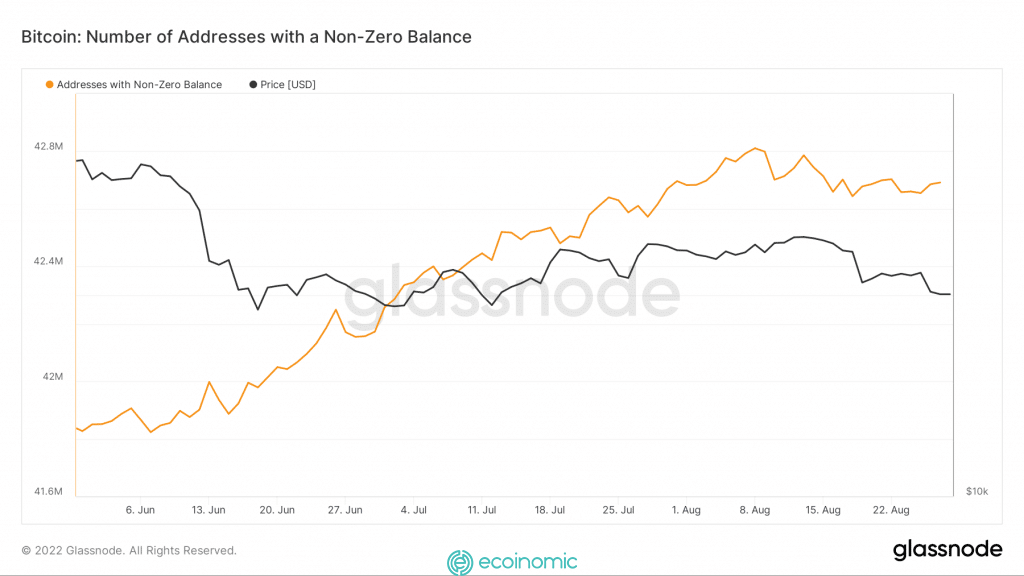

In addition, the total number of addresses of Bitcoin with a balance other than 0 indicates steady growth over the months. This goes against Bitcoin’s price performances and shows investors’ confidence in the coin.