Advertisement

Where will the market go? Are we in a bear market? How long will it last? It’s hard to say. However, a time like this, when the cryptocurrency market is shaky and directionless, maybe the time to figure out what to do or not to do with your investments.

Crypto Winter

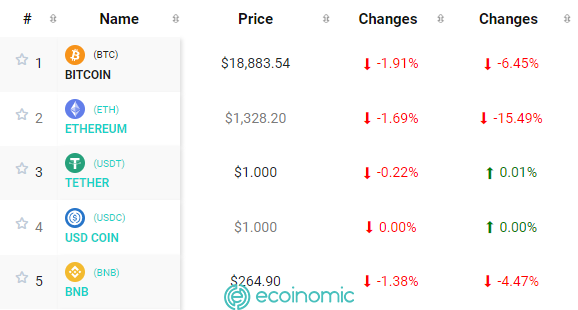

The cryptocurrency market has plummeted this year, with Bitcoin now down more than 70% from its closing record high in November 2021, the crypto winter that began with the collapse of the Terra blockchain in May 2022.

Accordingly, most other important cryptocurrencies are on a downward trend. Ethereum (ETH),the second-largest digital asset, is down 73% from its all-time high. Solana (SOL), Cardano (ADA), and Binance Coin (BNB) are all in red.

This is the latest in a serious cycle of bitcoin declines since 2011 — the fifth notable crash since bellwether’s cryptocurrency to date. Each time, the bitcoin price tends to last three years or more, trading below its previous highs.

But the crypto Bear market in 2022 is completely different. The 40% monthly loss experienced in June was the biggest drop in Bitcoin since September 2011.

While past crashes have been driven by major exchange mining problems such as Mt. Gox and Coincheck and strict regulatory interventions, this year’s crypto winter represents a combination of difficult macroeconomic conditions, political tensions and projects and questionable decisions by the founders of cryptocurrencies.

As fears of an expected rate hike by the Federal Reserve pushing the U.S. economy, the world’s largest, into recession, observers say the current crypto winter is likely to be more vulnerable and last longer, compared previous bear markets.

Overcoming the bear market

This is what you may want to do and avoid doing when you experience a prolonged market downturn.

Continue to invest consistently

Periods of heavy losses, known as bear markets, can be part of cryptocurrency investing and are much more interesting when the market is bullish. Iakov Levin, founder and CEO of cryptocurrency investment platform Midas shared:

“Users can keep a portion of their portfolio in stablecoins to follow a dollar cost averaging (DCA) strategy.”

He said investors can use the funds to purchase core crypto assets such as BTC and ETH, as well as other major first- and second-tier solutions.

“I see the DCA strategy as a six-month to one-year long-term solution. Such a strategy gives users a good entry point and allows them to make satisfactory profits in the next bullish cycle.”

This strategy is a systematic form of investment that is likely to pay off when the market is bearish.

Choose a ‘stable’ digital asset and stick with it

After a bear market, the cryptocurrency market always rises again to cover their losses. For the most part, blue-chip crypto assets tend to have more power in a market rife with tens of thousands of copies.

Chris Esparza, founder and CEO of decentralized finance platform Vault Finance suggests that one proven way to survive the crypto winter is to avoid extremely volatile digital currencies.

“The more stable the digital asset, the harder it is for investors to lose money. Successful investors move away from the prospect of gaining too much during the crypto winter and instead, low-risk investments have guaranteed returns.”

While no crypto asset is free of its inherent volatility and risk, “investment funds should be properly allocated with adequate provision for marginal losses,” Esparza said.

>>> Related: Binance CEO will take advantage of cryptocurrency winter

Rebalance your portfolio

The Bull Market may have unusually increased the percentage of cryptocurrencies in your portfolio.If that’s the case, rebalance your portfolio.Iakov Levin, CEO of Midas Investments, proposes to “sell all digital assets with low liquidity”.

“For example, various altcoins have low caps, up to $100 million – sell if there are no specific basic prerequisites for their growth in the current bear market. Users can also create protected DeFi strategies where they profit when the market is in decline.”

Pay attention to awards

Regardless of how deep the cryptocurrency market’s decline may be, it is important for investors to maintain a view of the long-term fundamentals of investing in this growing industry. Markets have historically bounced back from any recession.

That means don’t panic selling your blue chips or acting rashly. According to Fred Ehrsam, co-founder of Paradigm:

“Since it feels like everything is working during the boom, it’s tempting to want to do everything. Maintain a high standard to change or expand your reach. The same idea holds true in a motorcycle going down. The crypto graveyard is dotted with the rest of the companies that have pivoted away from their core mission in a downward cycle, only to watch with anguish as their ideas start working in the next bullish cycle.”

While Ehrsam’s message may be primarily aimed at the founders of cryptocurrencies, it is also true for casual investors.

>>> Related: Binance sign up for beginners update 2022