Advertisement

Celsius transfers $320 million in cryptocurrencies to FTX

Celsius is facing a liquidity crisis by transferring $320 million in cryptocurrencies from Aave to the FTX exchange, of which $247 wrapped bitcoin.

Speculation in the cryptocurrency community is currently erupting as the project has moved large amounts of WBTC, ETH and other crypto assets. Users criticized Celsius for claiming that the project mismanaged money after the collapse of the TerraUSD stablecoin.

Some people think that if Celsius fails, they will sell a large amount of deposited ETH (stETH). This will make it more dependent on ETH. stETH is a token provided by lender Lido DeFi, which was given as evidence that the user had deposited ETH. It is currently trading about 4.4% lower than ETH.

The token’s unusual moves began at around 18:00 ET on June 12 of Celsius’ main DeFi wallet when it began removing WBTC from Aave , the platform that Celsius uses to make a profit on deposits.

https://twitter.com/MikeBurgersburg/status/1536150279464357889?ref_src=twsrc%5Etfw%7Ctwcamp%5Etweetembed%7Ctwterm%5E1536150279464357889%7Ctwgr%5E%7Ctwcon%5Es1_c10&ref_url=https%3A%2F%2Fwebgiacoin.com%2Ftintuc%2Fcuoc-di-cu-o-do-c-320-trieu-do-la-tien-dien-tu-duoc-gui-den-ftx-viec-rut-tien-cua-nguoi-dung-bi-tam-dung-48193.html

So far, 9,500 WBTC tokens worth about $247 million have been acquired from Aave. After a series of transactions, all those tokens were sent to the FTX exchange for unknown reasons.

In addition to the WBTC, 54,749 ETH worth about $74.5 million were also sent to FTX.

Explaining these moves, Celsius said that it is trying to ensure stable liquidity by replacing many volatile funds such as WBTC and ETH with stablecoins. “We are working with a single focus: protecting and preserving assets to meet our obligations to our customers.”

As of June 12, Celsius has deposited $204 million of USDC stablecoins on Aave. In addition, deposit $10 million along with about 8.2 million DAI stablecoins into Compound, another DeFi lending and deposit platform.

The total of 222 million rearranged stablecoins is approximately the value of the WBTC token that Celsius has removed but still does not match the combined values of WBTC and ETH.

Celsius’ plans for transferring cryptocurrencies remain unclear. Celsius may be selling assets to FTX or betting tokens to the exchange for a profit.

Celsius sent 9,500 WBTC, 54,749 ETH, 375,343 FTT worth $10 million, 2,455 MATIC ($1,158), 260,000 UNI ($1 million), $2 million Pax (USDP) and 300,000 TrueUSD (TUSD) stable coins to FTX.

Celsius CEO Alex Mashinsky has blamed the problems the platform has encountered, including rumors of a default, on dark opportunists on Wall Street.

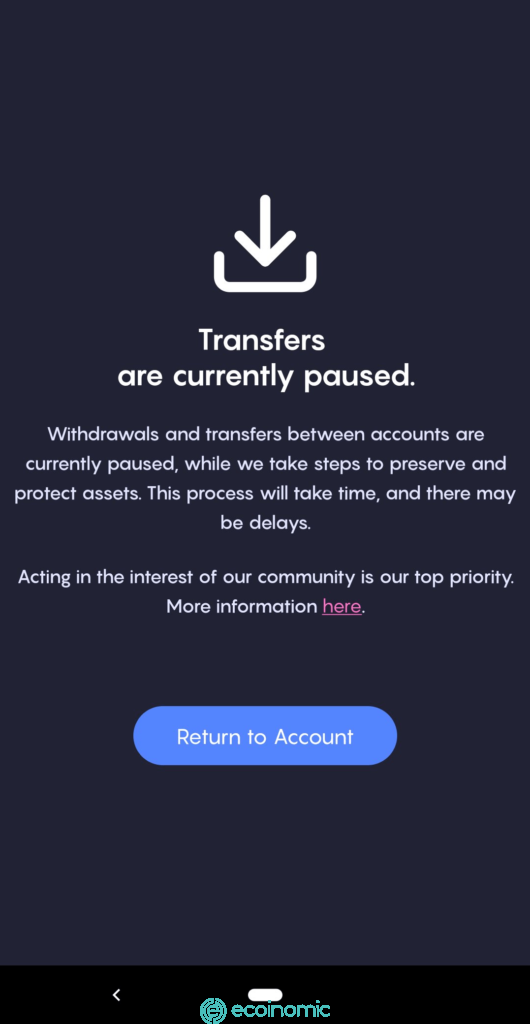

Celsius suspends transfers and withdrawals

On June 12, Celsius halted withdrawals and money transfers between accounts in the face of market pressure as interest rate Inflation risks increased around the world.

Earlier, Bitcoin fell more than 6% to $24,888, its lowest level in 18 months. Ether, the world’s second-largest cryptocurrency, fell more than 8% to $1,311, its lowest level since March 2021.

“We are taking this necessary action to stabilize liquidity and operations while we take steps to preserve and protect assets.

Furthermore, customers will continue to accrue rewards during the pause in line with our commitment to customers.” Celsius shared.

.@CelsiusNetwork is pausing all withdrawals, Swap, and transfers between accounts. Acting in the interest of our community is our top priority. Our operations continue and we will continue to share information with the community. More here: https://t.co/CvjORUICs2

— Celsius (@CelsiusNetwork) June 13, 2022

“Celsius Network is suspending all withdrawals, swaps and money transfers between accounts. Working for the benefit of the community is our top priority. Our operations continue and we will continue to share information with the community.”

Celsius token price drops suddenly

The price of Celsius’ original token, which fell sharply on the news, fell 45% to $0.21 per coin. The price of ether fell below $1,400 a coin on Sunday night.

According to price tracker CoinGecko, the total cryptocurrency Market Capitalization has fallen 7.6 percent to $1.07 trillion in the past 24 hours. CEL, Celsius‘ own token, has fallen more than 60% in the past 12 hours to $0.15.