Advertisement

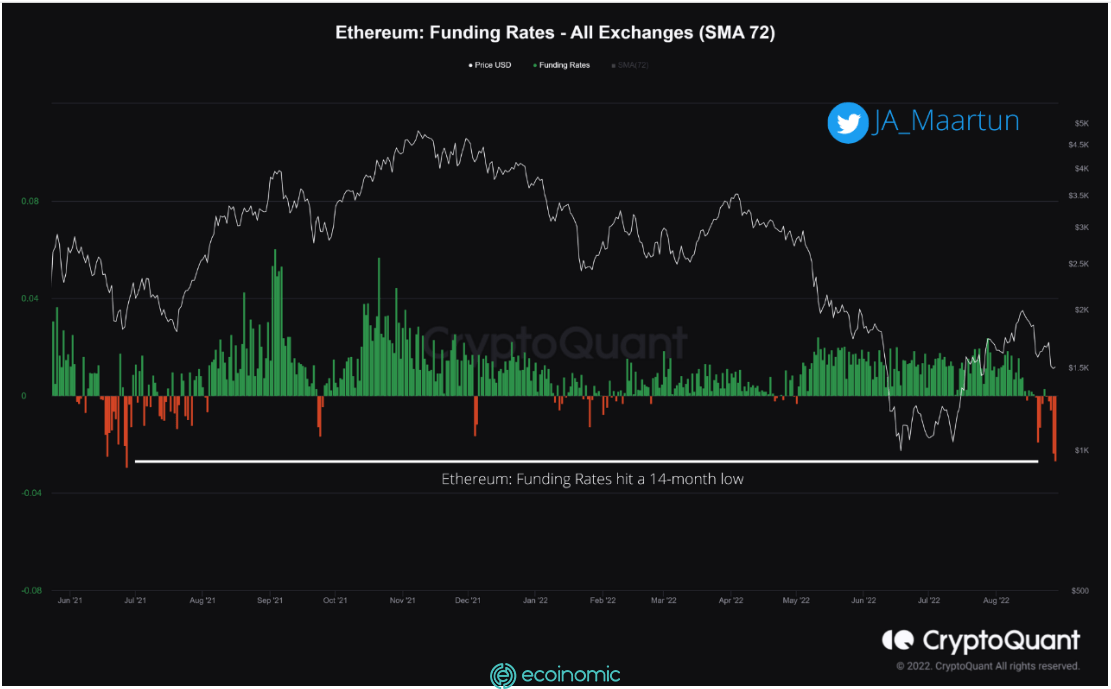

On-chain data shows that Ethereum funding rates have now fallen to a 14-month low, which could precipitate a short-term squeeze in the market.

Ethereum’s funding rate reaches a negative value

As pointed out by an analyst in a post on CryptoQuant, eth funding rates are currently at the lowest value since July 7, 2021.

The “funding rate” is an indicator that measures the periodic fees that traders in the Ethereum futures market are exchanging with each other.

When the value of the index is negative, it means that short-selling traders are paying a premium to long-term traders to hold their positions. This trend generally indicates that bearish sentiment is more dominant in the current market.

On the other hand, the positive values of the indicator imply that the Long order is overwhelming the Short order. Naturally, that’s positive news for a bull market.

Ethereum’s funding rate has declined recently and has now reached a very high negative value.

The current value of the indicator is the lowest since Last July, about 14 months ago.

At that time, these values led to a short price squeeze taking place in the market that caused the price of cryptocurrencies to rise.

In a short time, the value of Ethereum increases due to excessive overuse of leverage that will liquidate a large number of short positions. These liquidations pushed prices even higher, resulting in even more short positions being liquidated. In this way, the liquidations will combine to create a large price squeeze.

In a short time, the value of Ethereum increases due to excessive overuse of leverage that will liquidate a large number of short positions. These liquidations pushed prices even higher, resulting in even more short positions being liquidated. In this way, the liquidations will combine to create a large price squeeze.