Daily volumes in trading of FTX’s Dollar Spot Index have declined following a period of volatility in foreign exchange markets.

The new perpetual contract is based on the so-called FTX Dollar Spot Index and went live on October 3. It tracks the performance of a basket of leading global currencies against the U.S. dollar, including the euro, Japanese yen, Canadian dollar, and British pound.

Trading in the index came in just above $1 million on its first day of trading, raising to $1.25 million on day two before trending downwards, according to The Block’s Data Dashboard.

Trading volumes were as low as $52,600 on Saturday before recovering somewhat to just over $122,000 on Sunday. Volumes tripled on Monday to a little over $368,000, while open interest — the value of all outstanding contracts — is $777,000.

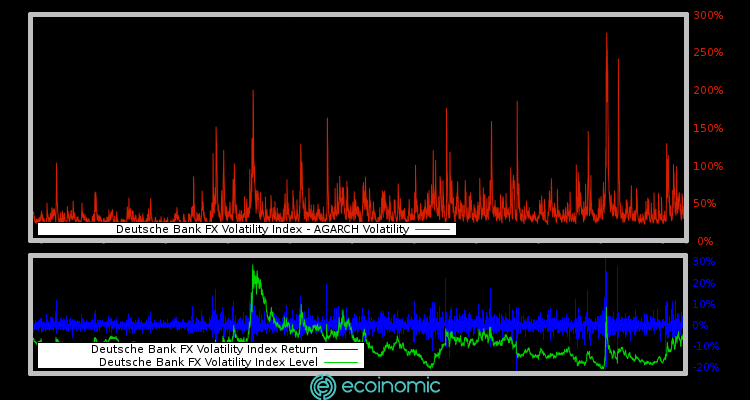

The lack of volume could be linked to waning volatility in foreign exchange markets, according to the Deutsche Bank FX Volatility index.

The launch came amid a sustained period of volatility in foreign exchange markets. Both the British pound and the Chinese yuan fell to record lows versus the U.S. dollar in the same week.

The pound has largely recovered since, although JPMorgan analysts say the damage done by the Treasury’s budget could permanently scar U.K. bonds, known as gilts.

This, coupled with Thursday’s Inflation data out of the U.S, may be cause for further volatility in FX markets as equities and cryptocurrencies have been pummeled by recent data releases.