Advertisement

Integrating a chain into its Staking solution may be one of the best operations Lido Finance [LDO] could have done. The multi-chain staking liquidity platform hosts several chains including Ethereum [ETH], Solana [SOL], and Terra Classic [LUNC].

However, recent staking activities on LDO may not be something that excites participants.

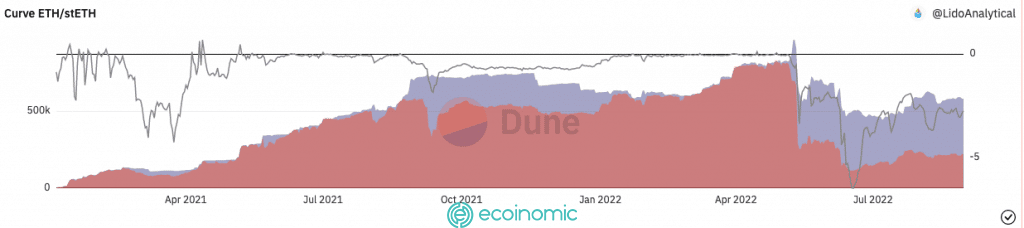

This is because the recent staking of ETH on the LDO protocol has been slow. While evaluating the staked Ethereum [stETH] pool, it was observed that the CurveETH/stETH section remains the most active despite being associated with several withdrawals.

Based on the Dune report, eth/stETH curve reserves have increased by 2.14% over the past seven days. In addition, the total amount of ETH staking was 13.39 million – up 0.33% from a week earlier.

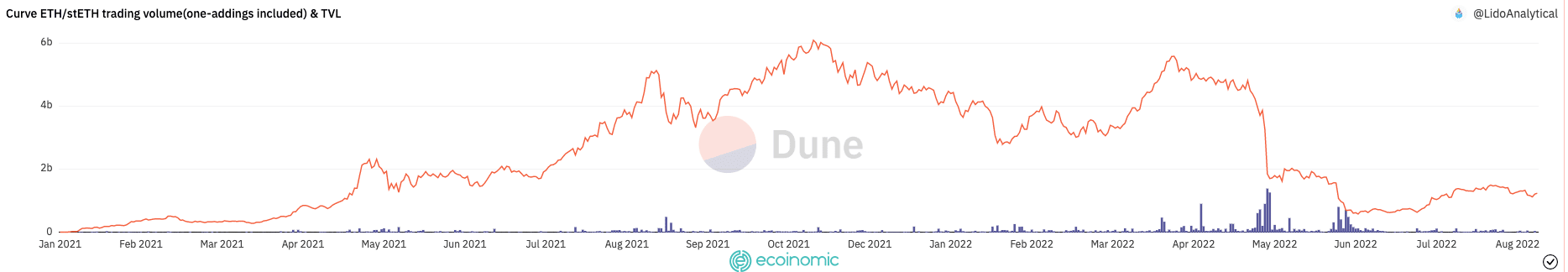

In addition, Lido’s offers for August were very positive as it reached 2.5 million LDO, worth $6.12 million. All this used to happen with the ETH/stETH Curve pair. Proves the pair has achieved most of the LDO offers. At the time of writing, the preferential performance was 7.32% with 581,738 stETH allocated.

On the other hand, the stETH / ETH exchange rate fell to 0.9693. The pair recorded cash flow from the LDO liquidity group. Curve’s ETH/stETH trading volume spiked, then rose in the Total Locked Value (TVL) chart.

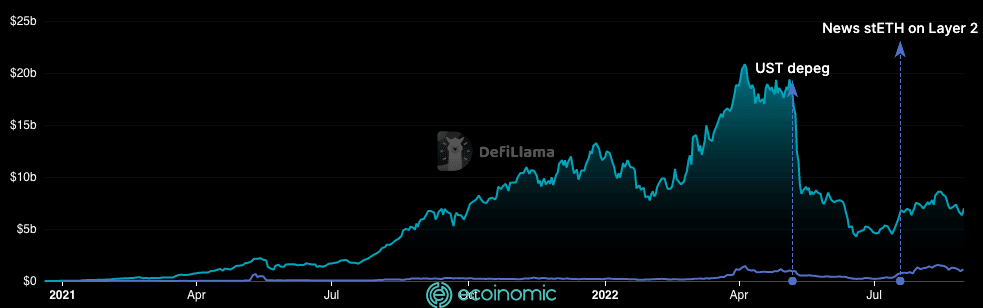

In the last 24 hours, the TVL rankings have changed significantly, LDO being one of the beneficiaries.

According to DeFiLlama, LDO is currently second according to TVL, behind only MakerDAO [MKR]. At the time of writing, LDO TVL is up 9.30% from the previous day with a value of $7 billion.

With this increase, can the LDO achieve the same TVL increase as it did about a month ago?

At the time of writing, LDO is one of the best-performing cryptocurrencies of the last 24 hours. CoinMarketCap data shows the LDO up 16.88% to $1.88 in 24 hours.

In addition, its volume increased by more than 100% to 158.84 million. With TVL rising, LDO short-term traders can expect the bullish move to remain the same.