Advertisement

MicroStrategy could sell up to $500 million in Class A common stock and could buy more Bitcoin.

A new prospectus filed with the Securities and Exchange Commission (SEC) says the company has signed an agreement with dealers Cowen and Company and BTIG to sell up to $500 million in shares with the goal of being able to acquire more Bitcoin.

“We intend to use net proceeds from this offering for general corporate purposes, including the acquisition of Bitcoin, unless otherwise indicated in the applicable prospectus supplement.” “We have not determined how much net proceeds will be specifically used for any particular purpose.”

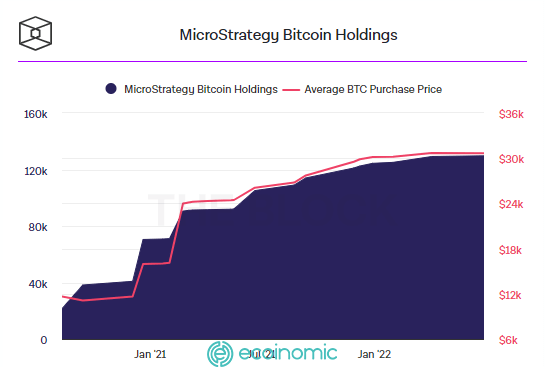

MicroStrategy has begun adding more Bitcoin to its balance sheet under former Bitcoin CEO and investor Michael Saylor. The billionaire resigned last month but continues to chair the investment committee. Incoming CEO Phong Le said the company still plans to hold Bitcoin for the long term. The comments came as MicroStrategy revealed losses of more than $900 million due to the sharp downturn in the cryptocurrency market and the plunge in Bitcoin price.

The business strategy section of the filing states: “We have not set a specific target for the amount of Bitcoin we wish to hold, and we will continue to monitor market conditions to determine whether to engage in additional financing to purchase additional Bitcoin.”

Bitcoin has been trading up 10%, above $21,000, at the time of this writing.

In another development, Saylor is facing a lawsuit from a Washington, D.C.-based lawyer over alleged tax fraud. MicroStrategy was also named in the lawsuit for allegedly assisting Saylor.