Advertisement

Shiba Inu [SHIB] expectations soared last week largely due to community expectations for the Shiba Eternity game. However, as of now, this phenomenon has gradually decreased. And SHIB’s price action has also lost momentum and returned to a bearish trajectory over the past five days.

There are a few reasons why Shiba Inu can’t achieve a significant price increase or massive volume increase from the attraction of Shiba Eternity. One of those reasons may be that the game may not have enough traction to drive demand for tokens. Shiba Eternity games are still new and it may take some time before SHIB demand and tokens are burned.

Is SHIB “buying rumors selling the news”?

There was a momentary positive moment last weekend. SHIB’s weighted sentiment index flashed signs of a spike in prices over the weekend. However, it also quickly returned to bearish signs.

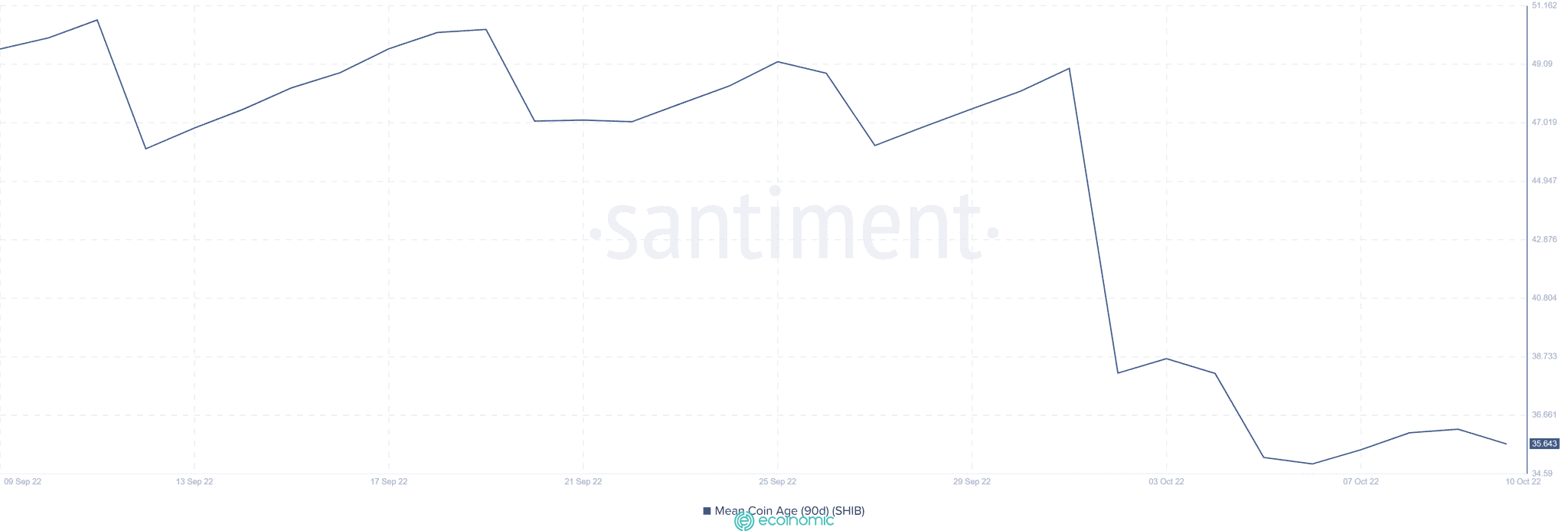

SHIB’s weighted sentiment has returned to negative territory at the time of writing and is tilted toward the downside. The coin’s 90-day continued decline near the lower four-week range also reinforced bearish signs.

This drop is a sign that investors are selling off coins that have been previously bought within the past three months. Selling pressure is a significant “frictional force” for any bullish volume, thus limiting the upward momentum.

The cause of the aforementioned selling pressure is that Shiba Inu’s flagship addresses have been shut down for the past four weeks. Supply due to these top non-exchange addresses fell from SHIB 599.28 trillion in early October to SHIB 598.98 trillion on October 9.

Despite the outflow of money from the largest non-trading addresses, SHIB somehow managed to stay above the lows in September. This may be because demand in the market is still good. The distribution of Shiba Inu supplies suggests that various whales are increasing their balances.

Unfortunately for SHIB holders, large accounts holding trillions of coins were sold periodically. As a result, the price action of the token has been reduced. Shiba Inu trades at $0.0000108 at the time of writing.

Now that the cause of SHIB selling pressure has been identified, it may be easier for investors to lookout. The best time to observe bullish activity may be when large accounts stop reducing the number of their coins.

In addition, investors can look for other coins with positive signals and great demand in the market. Such cases will likely benefit the bulls.

See also: Bitcoiner claims to have found ‘long-lost Bitcoin Satoshi code’