Advertisement

Terra price (LUNA2) has recovered sharply in 9 days after falling to an all-time low of $1.62.

On June 27, LUNA2's exchange rate reached $2.77 per token, thus producing a 70% recovery when measured from the mentioned low. However, the token was trading 77.35% lower than its record high of $12.24, which was set on May 30.

Luna2's recovery reflects a similar retracement moving elsewhere in the cryptocurrency industry with leading crypto assets Bitcoin (BTC) and Ether (ETH) rising about 25% and 45% over the same period.

LUNA2 price hike could trap buyers

The recent buy in the LUNA2 market may trap buyers, as it comes as part of a broader corrective trend.

Specifically, LUNA2 seems to be forming the Bear Flag pattern, a further bearish setup that appears when the price keeps heading upwards inside a parallel ascending channel after experiencing a major bearish run.

The Bear Flag pattern settles after the price breaks below the channel's lower trendline. According to the rule of technical analysis, their analysis brings the price up to the level at the same length as the size of the previous downward move (known as the flagpole), as shown in the chart below.

LUNA2 is currently trading near the upper trendline of the Bear Flag model (around $2.40), which may experience an imminent pullback against the lower trendline of the near$2 model.

If accompanied by an increase in volume, a prolonged price correction would put LUNA2 at risk of falling to $1.30, down nearly 50% from the June 2 price.

LUNA2 is at risk.

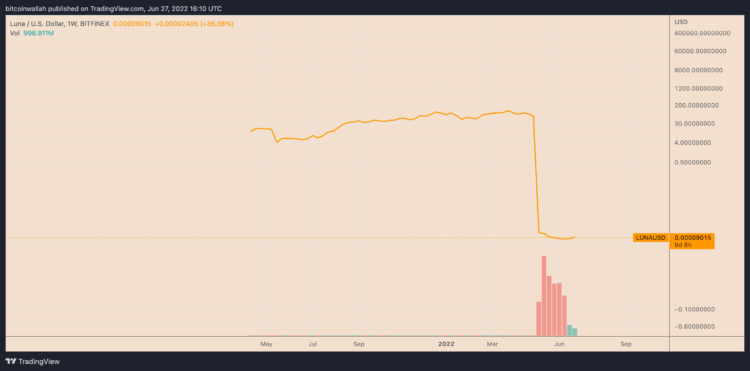

LUNA's quiet technical outlook also bears its hallmarks from its controversial history.

Notably, LUNA2 emerged in late May as a means to compensate investors who suffered losses in the collapse of the terra algorithm stablecoin, now known as TerraClassic USD (USTC).

Meanwhile, the almost worthless old version of LUNA2, called LUNA, began trading as an independent token under the brand that was renamed "Terra Classic (LUNAC)."

LUNA2 opened on the major trading platform with a 483% rapid rise to $12.24, only to give up all profits in a major correction move that followed. Mati Greenspan, founder of cryptocurrency research firm Quantum Economics, noted that no one rightly wanted to invest in LUNA2 after LUNAC's collapse.

That leaves LUNA2 out of the hands of hardcore holders who want to fully recover their Terra losses, and speculators who want to over-leverage on its daily price movements.

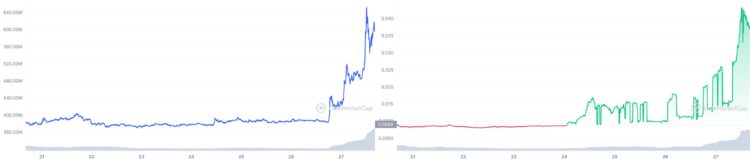

Interestingly, such speculations also lead to higher market capitalizations of LUNAC and USTC.

Similarly, USTC's market valuation increased from $13 million to $96 million in the same period.

>>Supem: Will the MATIC's 71% increase be enough to sustain the medium- and long-term HODLer interest rate.

___

Twitter: https://twitter.com/Ecoinomic_io

Twitter: https://twitter.com/Ecoinomic_io

Telegram: https://t.me/+XqnDmxy-bz0wMTE1

Telegram: https://t.me/+XqnDmxy-bz0wMTE1

Group: https://www.facebook.com/groups/655607162536305

Group: https://www.facebook.com/groups/655607162536305

Fanpage: https://www.facebook.com/Ecoinomicio-103081639081992

Fanpage: https://www.facebook.com/Ecoinomicio-103081639081992