Advertisement

The cryptocurrency market fell over the weekend in reaction to Fed Chairman Jerome Powell’s speech in Wyoming.

Bitcoin is down 4.98 percent over the past seven days at the time of writing, according to CoinGecko. The cryptocurrency is currently trading at $20,087. Meanwhile, Ether is down 5.32%, trading below $1,500, at $1,492. Bitcoin fell below $20.00 on Saturday, after slipping below $1,500.

Other notable losses include Uniswap down more than 15% over the past week, while Solana and Avalanche are both down less than 10%. Several tokens have bucked the trend over the past seven days, including EOS and Polygon – up 8.3% and 5.2%, respectively.

However, overall the market is trending downward as it begins to fall below the global Market Cap of $1 trillion. The decline in cryptocurrency prices was generally in line with traditional financial markets, as the Nasdaq fell nearly 4%, while the S&P 500 posted its biggest daily decline in more than 2 months, falling 3.37% on Friday.

Fed chief troubles cryptocurrency market

Block asked Garett Jones, an associate professor of economics at George Mason University, what the Fed’s rate hikes mean for Inflation and digital assets. According to Jones, the majority of cryptocurrencies act like speculative assets, meaning that they are useful and similar to a “super-risky stock.”

Typically, he said, stocks will suffer when the Fed decides to fight inflation, and Wall Street has either forgotten how hard it has been for wealthy nations to fight 5% to 10% inflation or simply convinced itself that “this time has been different.”

Jones concluded that, if rich countries try to reduce inflation to 6%, then the unemployment rate will rise and a recession will occur.

“The best way to cut that cost in half or more is to quickly cut out the Band-Aid, so while Powell’s speech on Friday was a shock to new traders, it’s a good sign and they need to be ready to move through this. Another sign that the recession won’t be bad if he approaches more slowly. “

Technical downturn?

While many commentators are working on the assumption that the U.S. is not in recession, there is most likely more macroeconomic uncertainty ahead. In addition to the energy crisis in Europe and the crisis of China’s reserve assets, the US economy is in a technical recession.

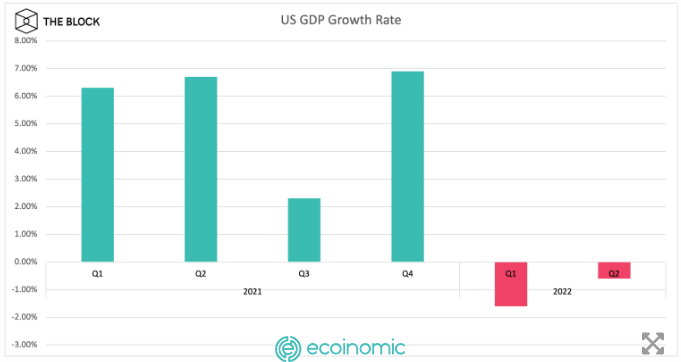

After contracting 1.6 percent in the first quarter, the U.S. economy shrank 0.6 percent in the following quarter, according to U.S. Bureau of Economic Analysis data.

This is a technical recession (by some definitions), although the recession in the US is officially released by the National Bureau of Economic Research (NBER) and is not necessarily determined by revised GDP data.

The NBER website says that, while most recessions consist of two or more consecutive quarters of decline, there are exceptions.

“For example, in 2001, the recession did not include two consecutive quarters of real GDP declines. During the recession from its peak in December 2007 to its bottom in June 2009, real GDP declined in the first, third and fourth quarters of 2008 and in the first and second quarters of 2009. “

So, if the U.S. economy avoids the current downturn, there could be further macroeconomic uncertainty ahead as the Fed moves against inflation. This can lead to more risky behavior in the market.