Web3 publishing platform Paragraph has raised $1.7 million in a pre-seed funding round led by Lemniscap. Other investors in the round include FTX Ventures, Binance Labs, GCR and Seed Club Ventures, according to a company release.

Founded by Colin Armstrong in 2021, Paragraph is a publishing platform that helps web3 writers, DAOs and NFT communities monetize their content through an all-in-one newsletter service.

Paragraph aims to challenge legacy publishing giants by offering web3 tools for content creation. Instead of paid subscriptions on a web2 newsletter platform, such as Substack, Paragraph enables content creators and community builders to manage their audience through memberships using either NFTs or ERC-20 tokens.

These memberships create new opportunities for engagement — whether that’s gating content with NFTs or rewarding token holders to incentivize growth — according to the company. Creators can either leverage their own NFTs or ERC20 tokens or choose to mint directly on Paragraph for a 3% fee.

“We actually feel that Substack is ripe for disruption,” said Shaishav Todi, a partner at Lemniscap, in an interview with The Block. “We think a more equitable monetization, ownership and distribution is required.”

Every introduction Lemniscap made, the funds wanted to invest, Todi also claimed. “We actually made introductions to five or six funds on the first three days,” they said. “By the fourth day, everyone was wanting to invest, and he was oversubscribed.”

Paragraph has already secured several strategic partnerships with Coinvise, Clubs.link, Unstoppable Domains and Farcaster, the company said in the release.

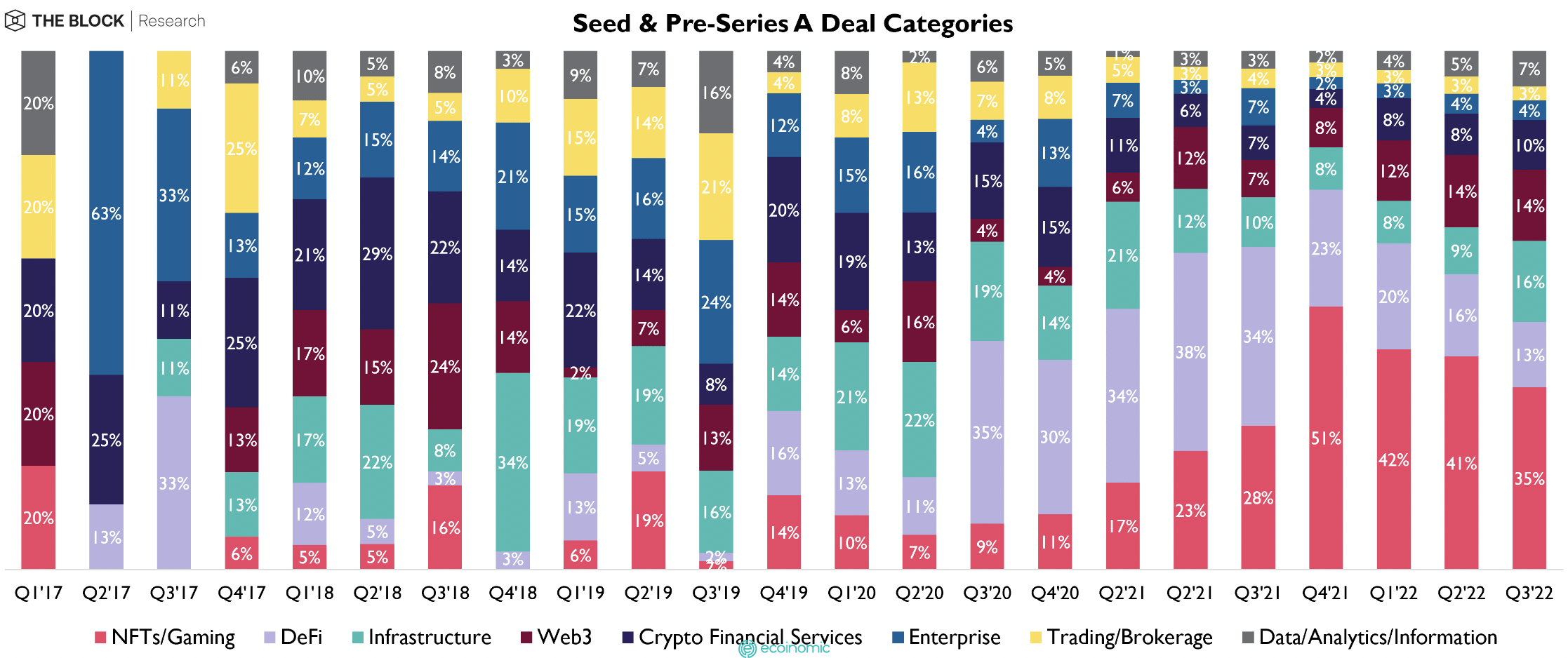

Seed & Pre-Series A Deal Categories from The Block Research

Leading crypto companies are increasingly becoming interested in media and publication tools.

Alameda Ventures recently backed Trustless Media, a web3 media company that aims to leverage NFTs to build community-owned content. Meanwhile, Binance Labs’ parent company, Binance, agreed to make a $200 million investment in the news publication Forbes.

Web3 deals made up 14% of the seed and pre-seed blockchain venture deals last quarter, according to The Block Research.