Advertisement

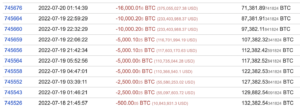

In particular, Bitinfocharts data shows that the world’s largest non-exchange Bitcoin whale sold over 46,000 BTC in two days valued at $1.08 billion based on the price of Bitcoin at press time of $23,500.

On July 18, a series of sales that first offloaded $15,500 BTC were the first to start the transaction. 500 BTC were sold in the first significant transaction, followed by 2,500 BTC in the second and third, then 5,000 BTC in the fourth and fifth.

With two transactions totaling 10,000 and 20,000 Bitcoin on July 20, the whale had already escalated the unloading of Bitcoin as of July 19. The whale’s balance after the trades is 71,381.898 BTC.

Motivation behind the Bitcoin sale

The Bitcoin community will typically be investigating the reasons behind selling such a big portion of the asset, given that whale activity has been shown to affect the asset’s price.

Notably, whales’ sales of Bitcoin occasionally give the market adverse momentum, suggesting that the present capacity to stabilize over $20,000 may only be temporary. The whale made money by selling the Bitcoin in spite of the cryptocurrency market drop.

The whale is probably an early Bitcoin adopter who bought the item at a lower price since Bitcoin addresses are anonymous. Similar to that, the anonymous holder’s liquidation may have been motivated by the need to raise funds.

Impact on whale concentration

It’s important to note how the recent whale concentration has been impacted by the wider bitcoin market collapse. Finbold noted in April that the number of Bitcoin whales had decreased by almost 5% in just four days. The price of Bitcoin continued to fall after the first plunge, eventually tanking below $20,000 at one point.

In addition, 16 Bitcoin whales sold their Bitcoin during the same week in April when the asset required powerful investors to drive the price higher.