Advertisement

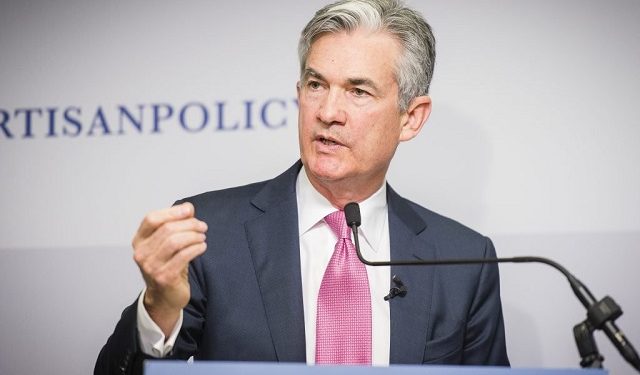

Fed Chairman Powell's "hawkish stance" could affect cryptocurrencies

Analysts said the resilience of BTC is quite difficult if the Fed continues to stick to its plan, along with tightening monetary policy until Inflation is tame and stabilized again.

The "hawkish stance" indicates that the central bank's top priority is to keep inflation low. During such a period, the central bank is willing to raise interest rates to limit the money supply and thus reduce demand. Hawkish policy also indicates monetary tightening policy. A rate cut is almost certain for such a period of time. When the central bank raises interest rates or 'tightens' monetary policy, banks also raise interest rates on loans to end borrowers, which in turn will limit demand in the financial system.

The biggest reflection in the cryptocurrency market is Bitcoin (BTC), which has seen positive movements immediately following the Fed's decisions in March. Some investors are ready to use Bitcoin as a shield to be able to prevent and hold back inflation.

According to Jerome Powell, chairman of the Federal Reserve, the value of BTC is still up 8% from more than a week earlier, the index is currently around the region of $ 43,922.64. Powell also suggested to the National Association of Business Economists earlier this week that progress should be accelerated so that the currency could return to neutrality.

Overall, cryptocurrency prices can be lowered when affected by the Fed's hawkish stance.

Forex CEO Marc Chandler said, "Digital currencies act as a risky product rather than a shield to prevent an outbreak of inflation."

At the end of 2021, it is possible to see a sharp fluctuation in the price of BTC compared to the traditional stock market, the transaction rate is reduced to nearly 30%, while the inflation rate has increased to the highest level in 40 years.

However, in 2022 and 2023, the fed's interest rate is currently 2.75%. This shows that the Fed is ready to overcome what it considers neutrality to be able to contain inflation in the near future.

Economists say the central bank's main job is to focus on the country's economic development, as well as maximizing employment.

In recent years, the focus has shifted as the Fed "underestimates" the pace of inflation. And until now, inflation is a problem that is of interest to all people around the world, even if this information does not bring positive to the market.

The flow of institutional investment in cryptocurrencies is increasing, which means that there will be more and more links to traditional financial markets. This factor will also help cryptocurrency transactions to be more correlated than the stock market.