Advertisement

Ecoinomic will guide Binance futures and Binance margin trading in the most detailed way

Binance Margin and Binance Futures are two popular forms of cryptocurrency trading on Binance exchange. Many investors, especially in the Vietnamese market, prefer to use these two trading forms because of the high leverage and huge profits.

However, not all investors have a good knowledge of these forms. In the following article, Ecoinomic will guide Binance futures and Binance margin trading in the most detailed way.

If you don’t have a Binance account yet, you can check out our Binance registration and KYC guide for a 20% lifetime trading fee discount!

What is Binance Margin Trading?

Binance Margin is a form of asset trading using funds provided by third parties. When using margin, traders are able to buy more coins or tokens than using only the capital in their account.

Margin is a way to optimize investment performance. This tool provides an opportunity to increase profits if the price of the token or coin purchased by the investor rises above the interest rate of the margin loan that they have to pay for the exchange. However, using leverage will increase the losses that investors suffer if the price movement of the coin is incorrectly predicted.

To start Margin trading, investors have to transfer coins to Margin wallet as collateral to Borrow more BUSD, USDT, BNB, BTC, ETH, DOGE (applicable to SHIB/DOGE pairs). The price movement of the margin market is actually the price movement of the spot market (Spot trading).

The leverage in Binance Margin trading is fixed by 2 modes Cross Margin 3x and Isolated 10x

Cross Margin 3x:

- Maximum leverage 3x

- When the margin level ≤ 1.3, a Margin call will be triggered

- When the margin level ≤ 1.1, traders will liquidate all assets to repay loans

Isolated 10x:

- Maximum leverage 10x

- When LR < ML ≤ MCR, a margin call will be triggered

- When ML ≤ LR, the liquidation engine will be triggered

ML – Margin Level

LR – Liquidation Ratio

MCR – Margin Call Ratio

What is Binance Futures Trading?

Binance Futures is a trading platform within Binance ecosystem that allows investors to trade contracts representing cryptocurrencies they don’t directly own.

In essence, when participating in Futures, you only own a contract that agrees to buy or sell a specific cryptocurrency for a future date. This is also the interpretation for the name “Futures”. To put it simply, Futures trading means predicting the upward or downward price change of a contract in the future.

In the Spot market, you only make profit by buying a coin at a low price and selling at a high price, most of your profits come from trading during market uptrend period. In contrast, Futures allows you to trade two-way that means you can long (buy) when expecting the price will rise and Short (sell) when predicting a price drop. You can also both long and short a contract.

During the downtrend period, Futures is the most preferred trading form because it can make a profit even when the market falls sharply.

There are two types of futures trading on Binance: USD(S)-M and COIN-M.

- Binance USDⓈ-M includes: USDT perpetual contract, USDT delivery contract and BUSD perpetual contract

- Binance COIN-M consists of COIN-M perpetual contract and COIN-M delivery contract

| USD(S)-M | COIN-M | |

| Mortgage | USDT, BUSD | Cryptocurrencies |

| Margin Type | Isolated/Cross | Isolated/Cross |

| Cross Collateral | Have | Don’t have |

| Maturity | Quarterly and permanent | Quarterly, bi-quarterly and permanent |

| Advantages | – Calculate profits in Fiat currency

– Reduce the risk of large price fluctuations when the market is sharply volatile |

Don’t need to sell cryptocurrency at a compromise price

Don’t need to convert any holdings to USDT |

Related: What are Futures? What is Margin? Compare Margin and Futures

Difference between Binance Cross Margin and Binance Isolated Margin

| Cross Margin | Isolated Margin |

| Can trade all trading pairs supported by cross margin | Each trading pair is a separate, unrelated account |

| Guaranteed cross between trading pairs | Each trading pair has an independent position, which cannot be cross-deposited |

| Liabilities and risk ratio are calculated based on the total account cross margin (all open orders). Unpaid loans will be included in the risk ratio | Liabilities and risk ratios are calculated according to each trading pair. Net asset in each Isolated account is only used to margin 1 trading pair |

| Upon liquidation, all orders are closed | When liquidating, do not affect other open orders |

| Only assets in Cross Margin accounts are allowed as collateral, can’t deposit assets in other wallets | The remaining assets in the Isolated account cannot be used to cover losses for open trading pairs |

Pros and cons of Binance Margin and Binance Futures

Advantages of Binance Margin and Binance Futures

Binance Margin

- High liquidity, leading trading volume

- Supports more than 600 trading pairs

- Reasonable transaction fees

- Have an insurance fund to protect assets when your capital is lower than 0

- High security, safety

- There is a Pause function to avoid traders trading too much

- Huge profits

Binance Futures

- Large leverage up to 125 times

- Fast execution mechanism, 100,000 orders/sec

- Futures anti-addiction notice: When traders suffer consecutive losses, the platform will have a reminder message and advise them to stop trading

- The fund protects users from losses during trading and limits the number of liquidations that occur in case automatic liquidation removes leverage

- ADL – Auto-Deleveraging indicator (4 exclamation points symbol) your position is in the liquidation queue that automatically removes leverage. This is an important indicator to follow when trading during a high market volatility period

- Pause time function

- Huge profits

Cons of Binance Margin and Binance Futures

Both of these trading forms have a high-risk ratio. Traders can lose assets when using large leverage.

Differences Between Binance Margin and Binance Futures Trading

| Binance Margin | Binance Futures | |

| Leverage factor | The leverage level is fixed and unchangeable, including cross 3x and isolated 10x | Can change the leverage coefficient, flexible leverage up to 125 times |

| Market | Placing orders on the spot market | Placing orders on the derivatives market |

| Transaction fees | Charge according to Spot trading | Funding rate |

| Risk | High, however less risky than Binance Futures | Very high risk |

| Borrow money | Calculate interest from the next hour and must repay the borrowed amount | No loan repayment |

How to Trade Binance Margin

Margin Trading on Binance consists of 4 steps: Open a Margin account > Transfer assets to a Margin account for collateral > Auto Borrow and Trade > Auto Repay

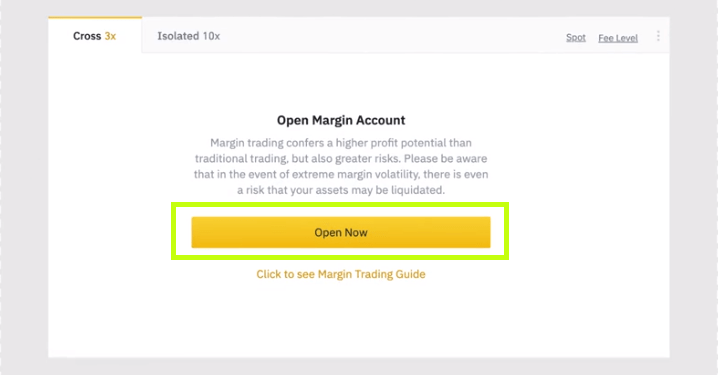

Open a Binance Margin Account

For newbies who have not traded margin, it is mandatory to create a margin trading account. This process is very simple, just click on the “Open Now” box and the system automatically opens a new margin trading account.

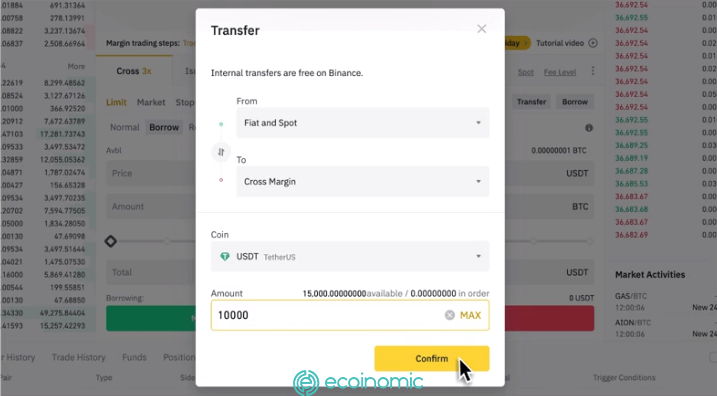

Transfer funds to Binance Margin account as collateral

Transfer coins from Fiat and Spot wallets or Futures wallet to Cross Margin wallet/Isolated Margin wallet. Enter the amount to transfer, click “Confirm” to finish.

In the figure below, Ecoinomic transfers 10,000 USDT from Spot wallet to Cross Margin wallet as collateral. This 10,000 USDT is instantly deposited into a cross-margin account.

Note that you will not be charged fees for transferring coins between wallets on Binance.

Automatic Borrowing and Margin Trading on Binance

In this article, Ecoinomic will guide you to buy and sell coins on Binance Margin with a full range of Market, Limit and Stop-Limit Orders.

If you do not understand the concept and how to use these orders, please read more this article below:

>>> Click to learn: Different types of orders when trading cryptocurrencies

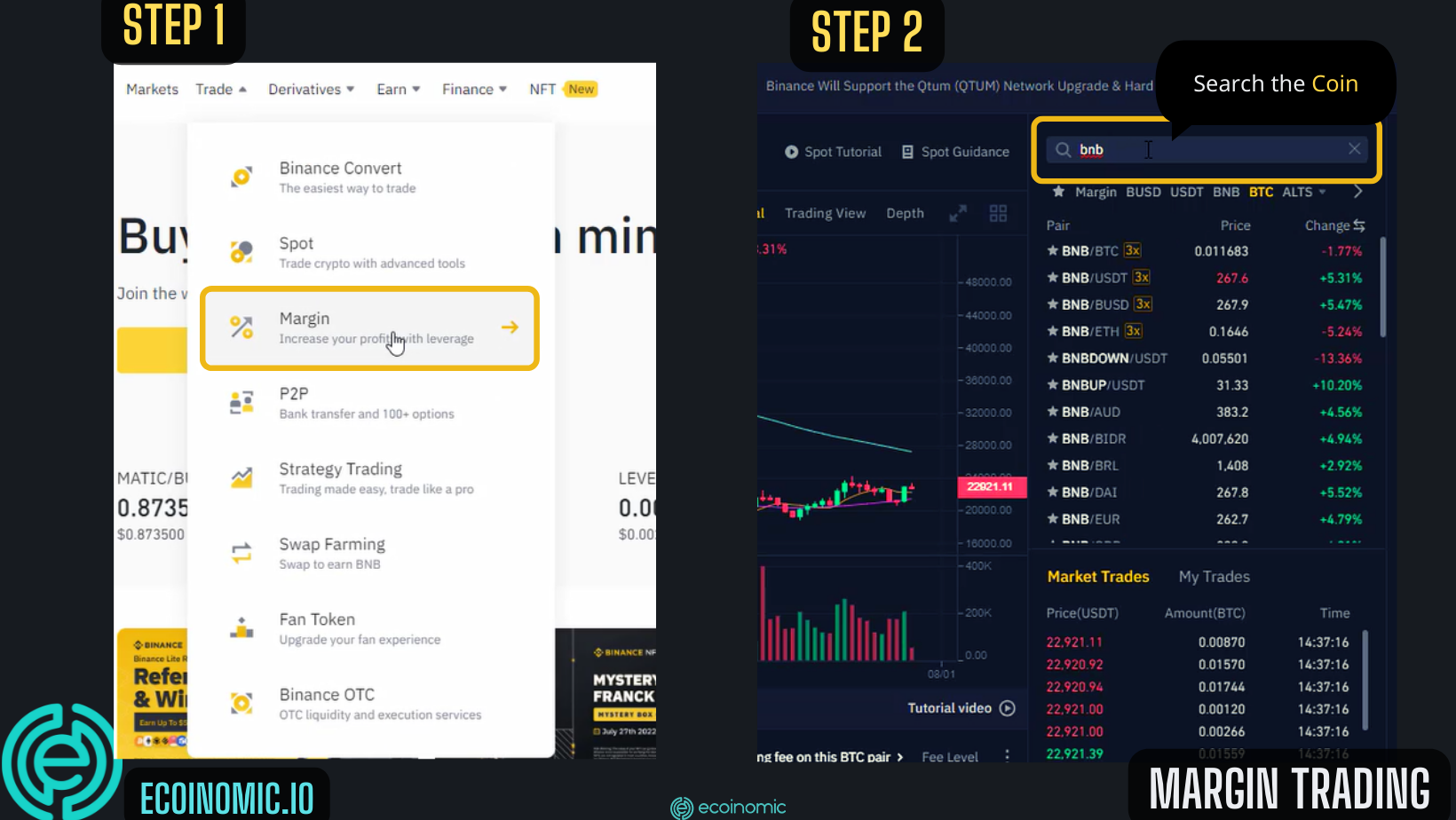

To start margin trading, follow these steps:

First, on the Binance homepage, select Trade → Margin. Then, find the coin you want to trade on the search bar.

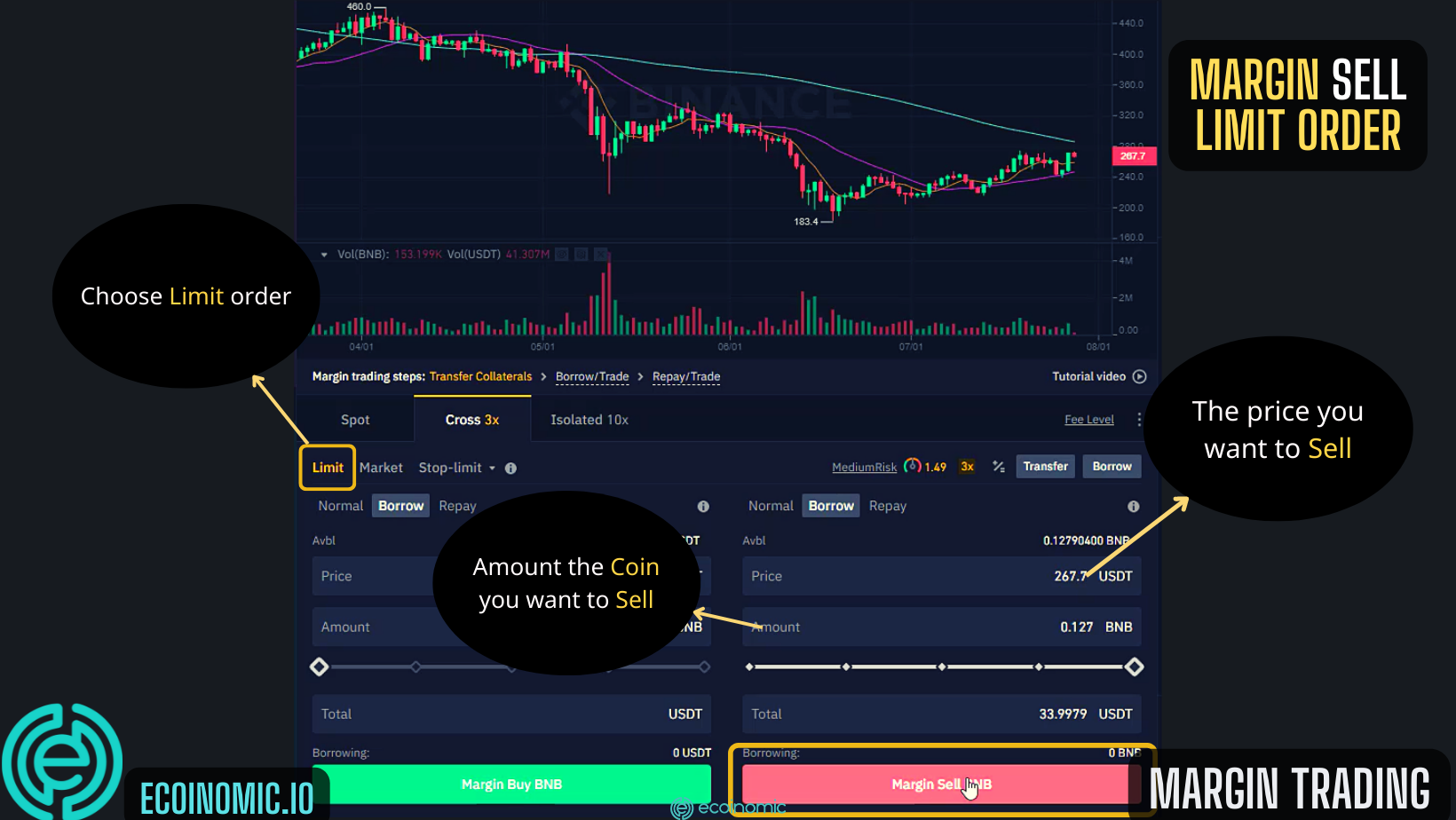

Binance Margin trading with Limit orders

After completing the above 2 steps, the Margin trading interface will appear. Select the Limit order and choose “Borrow” to borrow coins and raise capital.

You can choose the Cross 3X or Isolated 10X leverage mechanism. Thoroughly analyze and fill in the price you want to buy in the “Price” box. Select the number of coins in the “Amount” section. Check the price carefully, then click on “Margin Buy BNB” to place an order.

In the example below, after the order is executed, Ecoinomic will buy 0.128 BNB at a limit price of 267.7 USDT with collateral of 34.29943382 USDT and automatically borrow 22.83245539 USDT

Similarly, you select the number of coins you want to sell, check the price carefully and click “Margin Sell BNB”.

Binance Margin Trading with Market Orders

In the Margin trading window, select the Market order and select the number of coins you want to buy. However, in a Market order, the buy price will automatically be matched at the nearest price. Select “Margin Buy BNB” to place an order.

Selling coins with Market orders is similar to a buy order. You must also fill in the amount of coins you want to sell and press the “Margin Sell BNB” button.

Trade Binance Margin with Stop-Limit orders

To trade margin with this order, select stop-limit mode.

Buy stop limit order

In the illustration below, when technical analysis, Ecoinomic predicts that the BNB price will bounce up and break the 265 USDT mark, it will open a long position with a stop price of 265 USDT and a limit price of 267.9 USDT. As soon as BNB reaches 265 USDT or surpasses this price, a Limit order to buy BNB at 267.9 USDT will be automatically triggered. The order can be placed at the price of 267.9 USDT or lower.

In the process of actual trading, the buying force overwhelms the selling force with a very large buying volume, causing the price to bounce sharply and increase too quickly compared to the limit price you choose, then you will not be able to buy in the full amount as initially planned.

Sell stop limit order

After successfully buying and owning BNB in the wallet, Ecoinomic will sell these BNB to make a profit. To avoid losses when the price falls back to the purchased price zone, you should use a Stop-Limit order.

Set the Stop price to 273 USDT and the Limit price to the price at which you bought BNB. For example, if you bought BNB at 267.9 USDT, the Limit price here is 267.9 USDT. If the price reaches 273 USDT, a sell order for BNB at 267.9 USDT will be automatically placed. The order will be executed at the price of 267.0 USDT or higher.

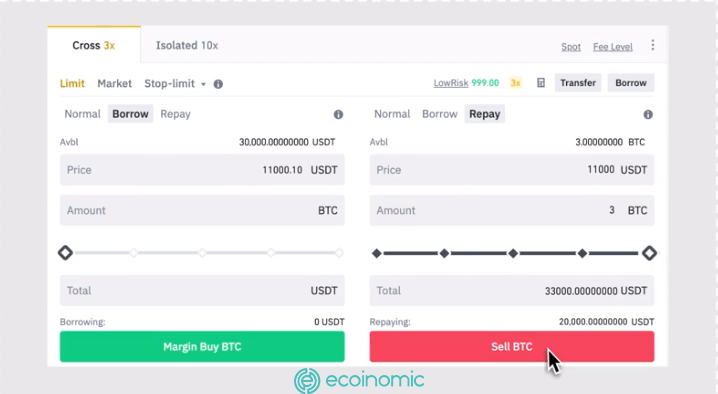

Repay when borrowing money on Binance Margin

After the transaction is over, you need to return the previously borrowed amount to the exchange. In the Margin trading interface, select “Repay”.

Assuming you borrowed 20,000 USDT from the exchange and the BTC price is now 11,000 USDT, you enter this price in the “Price” box. Enter the amount you want to pay and select “Sell BTC”. Once the order is completed, 20,000 USDT borrowed will be automatically repaid.

You will have to pay exactly that coin you borrowed and it cannot be replaced with another coin. You have to pay interest first and then pay the principal. It is possible to repay the debt in parts, but the system will based on the remaining unpaid debt to calculate interest in the next hour.

When trading, if you lose and are unable to fully repay the borrowed amount, the systems will not automatically deduct from the user’s wallet. To repay the debt, you must deposit additional funds into the margin trading account.

How to Trade Binance Futures

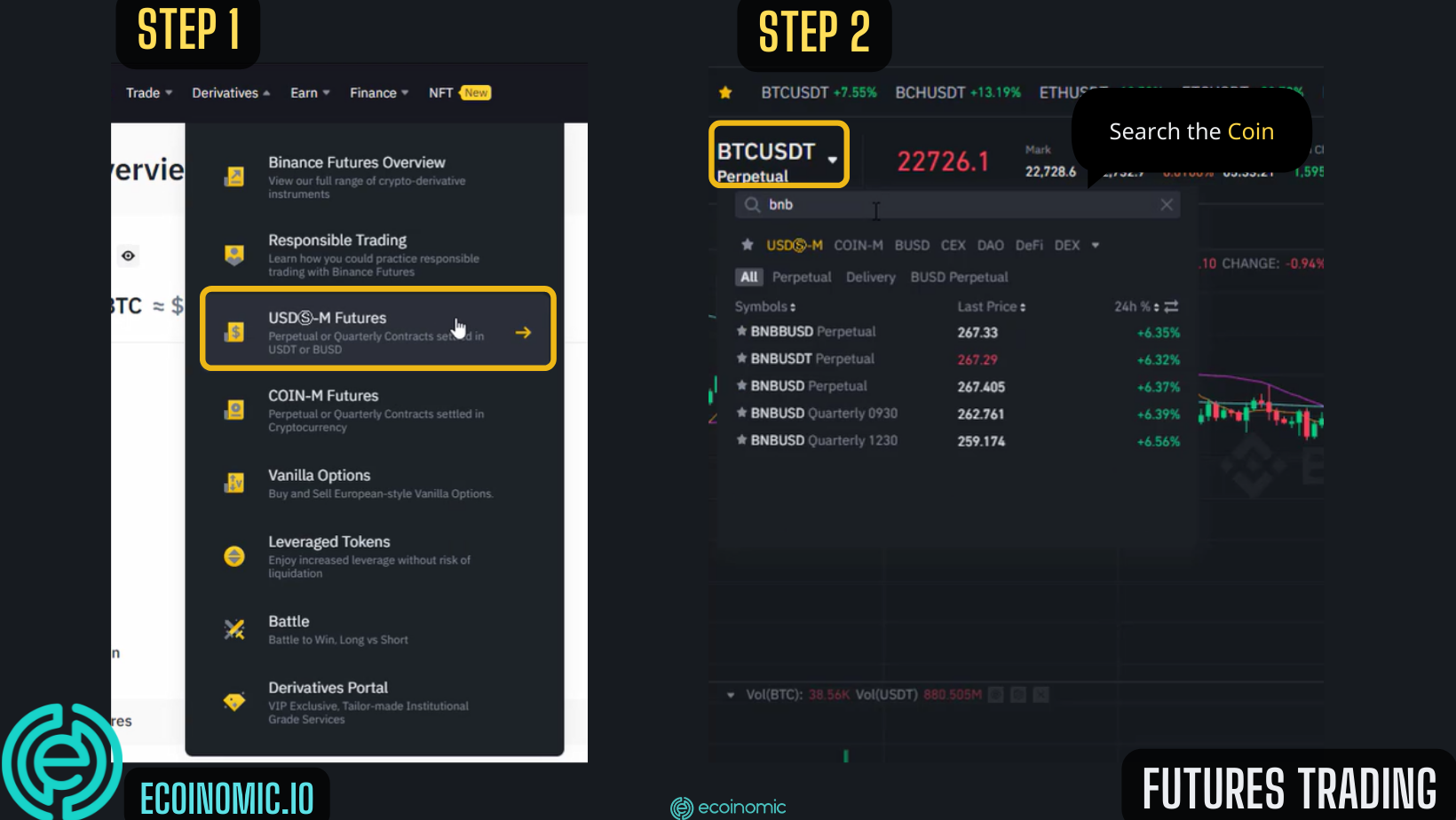

To trade Futures, on the Binance homepage, select “Derivatives”, then select “USDⓢ-M Futures”. Then, find the name of the contract you want to trade in the search bar.

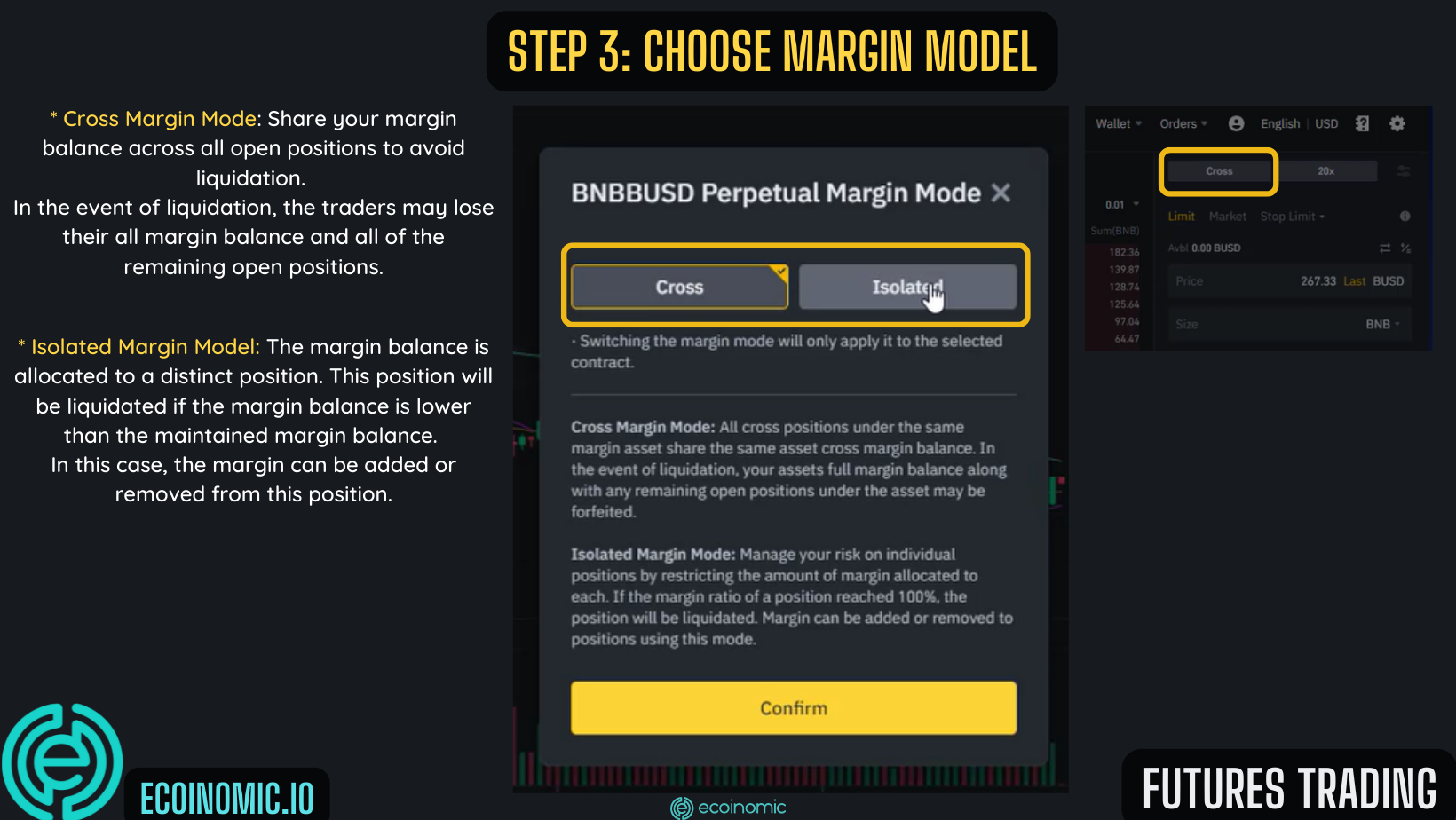

Similar to Margin, Binance Futures also has two mechanisms: Cross or Isolated. In this step, consider carefully and choose the trading mechanism that suits your capital. If you don’t know, read the comparison above.

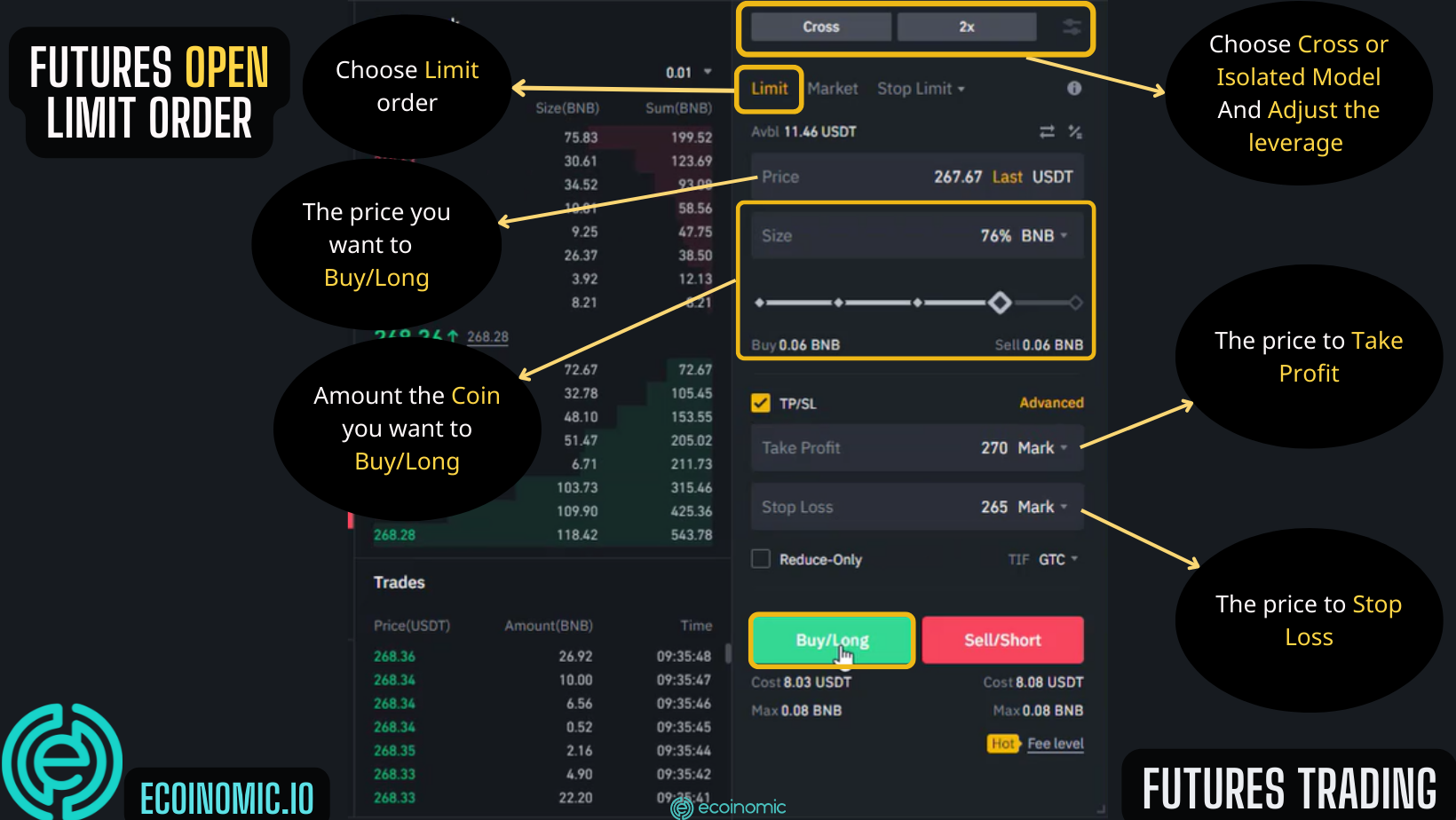

Binance Futures trading with Limit Orders

At the Binance Futures trading interface, you need to choose and set up a lot of information:

Choose the margin mode as Cross or Isolated, then choose the appropriate leverage. Buy limit orders on Binance Futures are the same as limit orders you execute in spot and margin markets. However, within the scope of this article, Ecoinomic will guide you to set up 2 more orders:

- Take Profit Order – TP (Take Profit)

- Stop Loss Order – SL (Stop Loss)

If you don’t know anything about TP/SL orders, refer to the following article: How to set Stop Loss and Take Profit on Binance

In the order list, select Limit, enter the order price and the amount to trade.

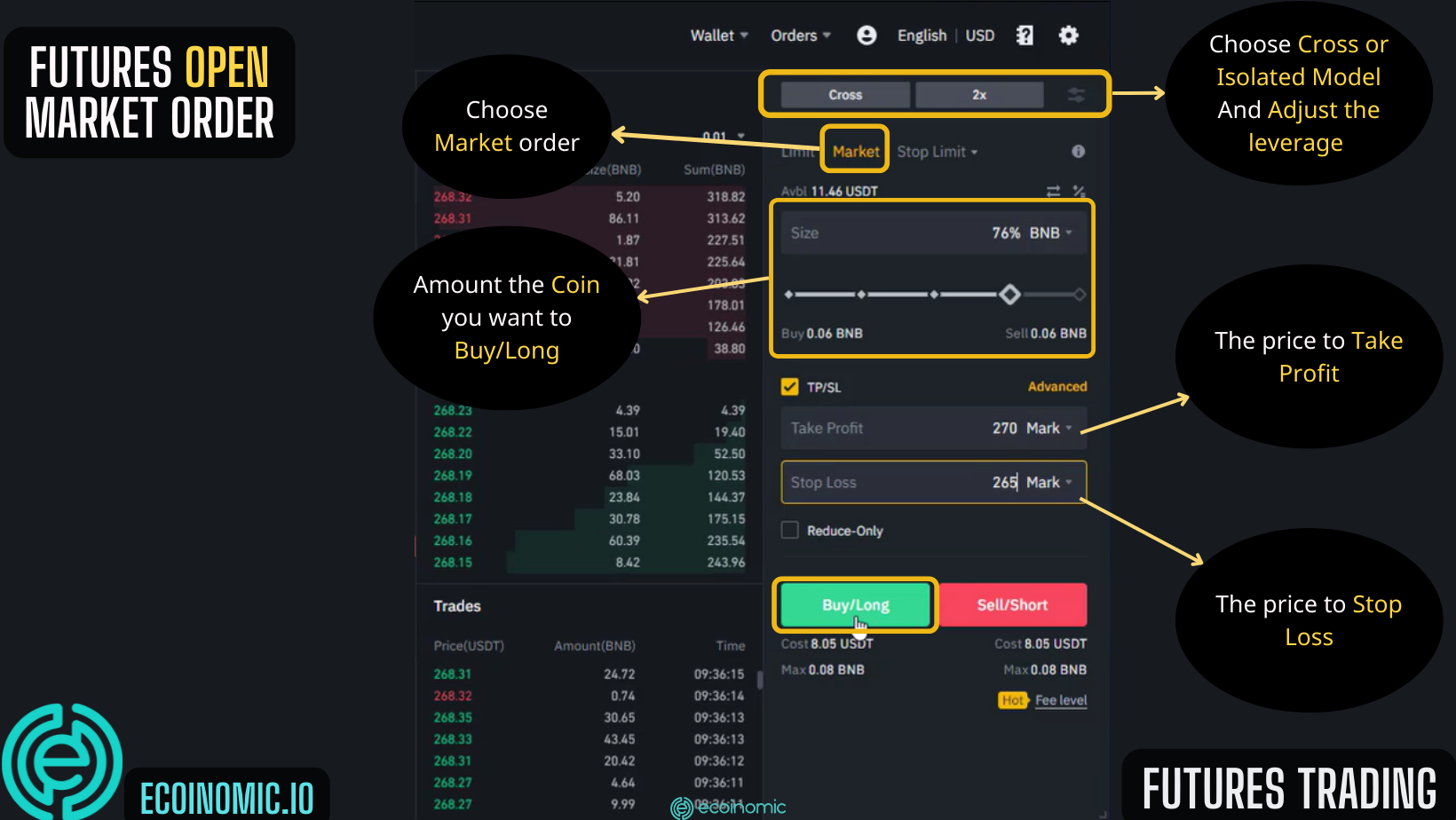

Binance Futures Trading with Market Orders

The operation to place this order is similar to limit orders, but in the first step, choose a Market order instead of a Limit order.

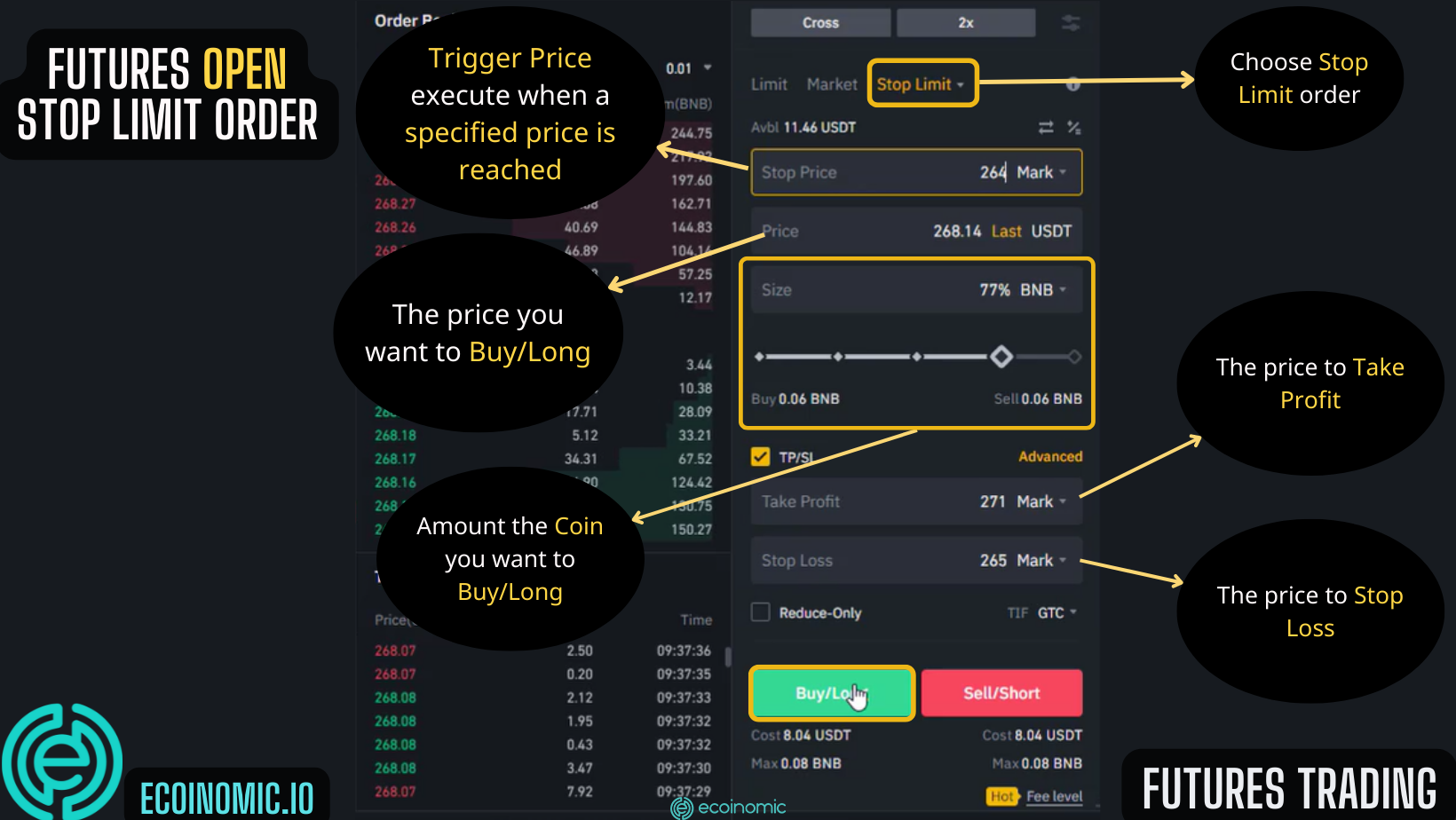

Binance Futures Trading with Stop Limit

When trading Binance Futures, select the Stop Limit order. The rest of the information you set up is similar to the orders above.

Note: When trading, the contract price reaches a specific stop price, the Stop Limit order will buy or sell at the limit price or at a better price.

Close a position on Binance Futures

You can close all open positions by clicking on “Close All Positions” or if you do not want to close all positions, click on each order to close. When choosing to close all positions, all open orders are automatically placed at the market price. If you want to close the position of a separate contract, you can place a market or limit order.

Conclusion

Ecoinomic has provided an overview of two popular cryptocurrency trading forms as well as a guide to trading Binance Margin and Binance Futures. Using leverage has the potential to bring great profits to investors but it is also a double-edged sword, you can lose everything and go into debt at any time. Be alert when participating in the fierce financial market.

Sign up for Binance and explore margin trading now!