Advertisement

All-time highs from 2017 go back to Bitcoin when BTC price action was irretrievable.

Bitcoin (BTC) started September still trying to consolidate $20,000 support as the bears gained control.

The largest cryptocurrency comes after a sideways weekend with a weekly close almost exactly at the $20,000 mark.

Expectations have fallen further this month — the phenomenon known as “September” typically sees BTC prices lose ground in September — and so far, there’s little evidence that this year will be any different than most previous years.

BTC/USD is down 1.5% in September 2022, and although the losses are quite modest, there are plenty of potential catalysts ahead.

Macroeconomic instability was the leading cause, attention turned to Europe as the energy crisis unfolded and the euro hit a twenty-year low against the US dollar.

Signals of a macro BTC price bottom have emerged in recent weeks, leading some analysts to remain confident about the bullish outlook of the flagship coin.

Consider the five factors that trigger the potential Bitcoin price in the coming week when $20,000 becomes the main focus.

BTC just closed at $20,000

Bitcoin bulls achieved their goal easily this weekend because of a lack of volatility that led to two days of swings around the $20,000 level.

The absence of an overall direction means that the current price forecasts remain intact, even if the weekly close itself continues to cause the market to speculate.

Data from Cointelegraph Markets Pro and TradingView shows that figure is actually $20,000 on Bitstamp, followed by downward price pressure in the first hours of the new week.

However, traders were expecting a retest of the lower levels close to June’s $17,600 level, they saw little reason to change their views.

Going on vacation, lemme know when we reclaim 20.7k and head to 23k-ish. Thanks frens $BTC https://t.co/biYiFrDm4t

— CrediBULL Crypto (@CredibleCrypto) September 4, 2022

Popular crypto trader Il Capo reiterated his plan for a short-term price drop to $23,000, followed by a reversal to $16,000.

Meanwhile, trader Cheds confirmed that the 4-hour chart continues to fluctuate after bouncing from the lowest level during the weekly closing period.

Meanwhile, in its latest update, TMV Crypto revealed a downtrend on the same timeframe, highlighting the Relative Strength Index (RSI) data.

“H4 RSI is bearish at the moment, $19,700 will be the level BTC must break through in August and close to the July low of $18,777,”

“If the bulls can break through $19,986.5 as support then BTC will be able to reach $20.8.”

Meanwhile, data from the analytical resource on the Material Indicators series shows that the bulls are still “fighting” for $20,000 at the close, with new bid support entered just below on Binance’s order book.

Prolonged European energy crisis

On macro markets, the Federal Reserve will look this week at the next important economic data to be released on September 13 as a print of the Consumer Price Index (CPI) for September 8.

However, there is little opportunity for financial traders to rest, as events in Europe could be the cause of further volatility.

As of September 5, the euro is trading at its lowest level against the US dollar since September 2002, surpassing $0.99.

The weakness comes from the instability of the energy market. Russia’s planned reopening of the Nord Stream 1 gas pipeline over the weekend has unexpectedly changed its mind on maintenance issues, with gas supplies now reportedly suspended indefinitely.

Then came the news that the European Union planned to implement Russia’s energy price cap with the G7, to which Russia responded with a threat to stop energy imports.

As a result, the gas market is surging again, having previously plummeted from record highs.

European Gas jumps as much as 35% as #Russia keeps Nord Stream link shut. Now up 21%. pic.twitter.com/2SVRbOijKX

— Holger Zschaepitz (@Schuldensuehner) September 5, 2022

Arthur Hayes, the former CEO of derivatives giant BitMEX described the euro as going into a “doom loop” over the weekend. through. He hypothesized:

1. The liquidity of the USD increases to reduce the value of the dollar and help Europe afford its energy import bill

2. Europe reached an agreement with Russia. I guess the 3rd option is to turn off heating in industrial and residential areas.”

It is at such levels of crisis that even PlanB, creator of Bitcoin price models from Stock-to-Flow has suggested that buying opportunities should come second to underlying demand, even if BTC/USD reaches near two-year lows.

US dollar surpasses two-decade high

Last week, cryptocurrencies and risk assets in general continued to play out in the form of the strength of the US dollar.

The US Dollar Index (DXY) has reached a twenty-year high.

With that said, DXY passed 110 for the first time since June 2002 this week. The euro is just one of many victims of the dollar’s rampant rally.

Scott Melker, trader and host of the popular podcast known as “The Wolf of All Streets,” summed it up over the weekend.

“$DXY is currently breaking the multi-decade resistance at 110. $BTC is consolidating and breaking its daily bearish flag 2 weeks ago,”

“It’s hard to see a bullish case here if the DXY continues. I expect a price drop on stocks and cryptocurrencies. ”

$DXY fresh local highs https://t.co/jIFEdQyp97 pic.twitter.com/XljPW18vdP

— Cheds (@BigCheds) September 4, 2022

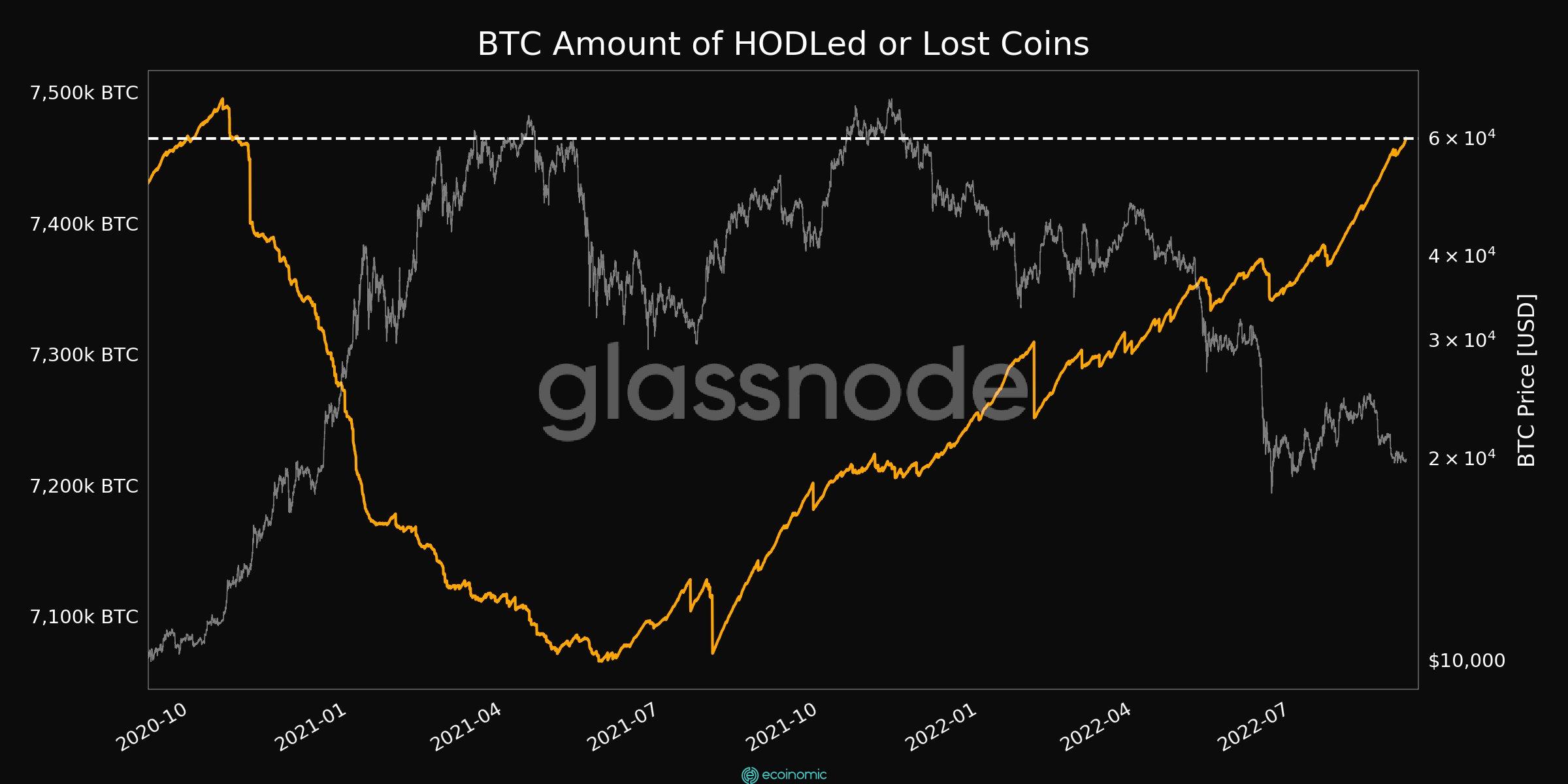

Hodlers continue to gain strength

In classic Bear market style, long-term holders (LTH) are beginning to weather the BTC price storm and set records in the process.

Data from online chain analytics firm Glassnode this week confirms that even coins last purchased just a year ago are slowly becoming dormant.

Buyers, despite the unrealized losses, are still refusing to speculate.

The percentage of BTC supply currently fixed in its wallet for a year or more reaches a new all-time high of 65.78%.

Glassnode also showed that 2022 saw a marked growth of HODL trajectories lasting a year or more, indicating an increase in determination in the majority of LTH’s.

Chart of the amount of BTC inactive for a year at the same time, an additional metric, the number of coins held or cut off from circulation, in general, reached its highest level in almost two years.

Currently, the total number of coins lost is 7,464,791 BTC.

Meanwhile, last week, Whalemap noted that the spot Bitcoin price has fallen below the actual price of one- to two-year-old coins.

“There are only 3 times in the history of $BTC that it is below the actual price of 1-2 year holders. Now it’s 3rd”

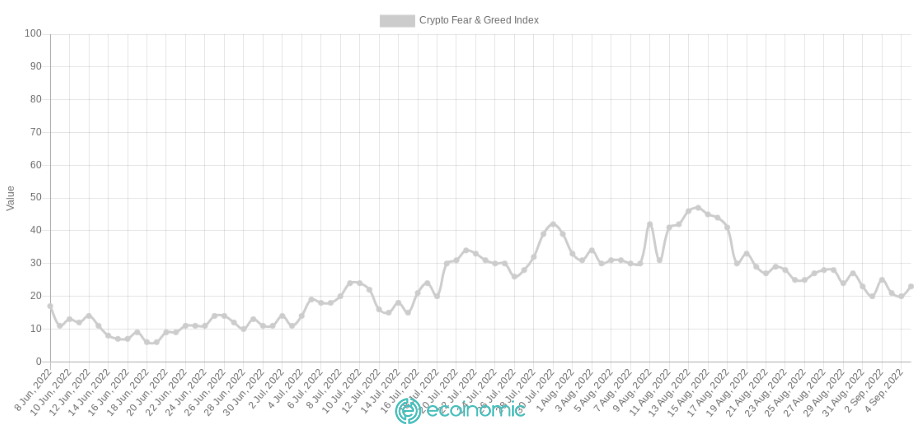

Market sentiment hits 6-week low

Overall, it seems that the cryptocurrency market has fully returned to the bullish phase, which began in the second half of July.

This has been demonstrated by the Crypto Fear & Greed Index, a measure of sentiment that only reached 20/100 over the weekend.

The last time 20/100 surfaced was on July 18.

Meanwhile, at the end of last month, PlanB described the current market sentiment as fearful of the gap between spot and actual prices.

This will not stay blue forever. Macro and markets may be different, but humans don't change, human behavior is driven by greed (red) and fear (blue). pic.twitter.com/gTh6hMg70P

— PlanB (@100trillionUSD) August 29, 2022