Advertisement

With the fluctuations in global financial markets and the close relationship with the activities of countries, cryptocurrencies are becoming increasingly popular and well-received. The following article explains and distinguishes the common terms in the market: HODL, BUIDL, Hold coin, and Trade coin.

If you are new to the cryptocurrency market and are struggling to find your investment direction, this article belongs to you.

What does HODL mean?

Origin of the term HODL

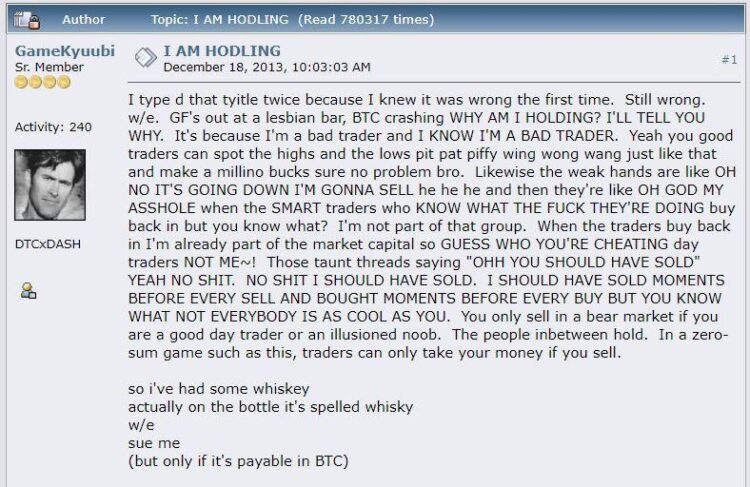

The original HODL was essentially a typo. It was first used by a user named GameKyuubi on BitcoinTalk on 12/18/2013. The post was titled “I AM HODLING.” Later, the GameKyuubi explained that:

I typed letter the D twice, because for the first time I knew I was writing it wrong. However, then I still misspelled it.

At the time, BTC experienced a crisis, when the price of this coin dropped by more than 50% to only 500 US dollars. Earlier, BTC had a price move that skyrocketed from $130 to $1,130.

Then the user added: BTC crashing WHY AM I HOLDING? I’LL TELL YOU WHY. It’s because I’m a bad trader and I KNOW I’M A BAD TRADER.

Since then, in the cryptocurrency market, HODL is a term for investors who maintain their cryptocurrency holdings, refusing to sell them no matter how the price of the asset changes. This action usually appears in Bear markets.

Later, the term HODL was seen as an acronym for “Hold On for Dear Life”. The above phrase refers to not selling no matter how volatile the market is and how prices go up and down.

HODL has even become an investment strategy for those who admit that they cannot make short-term trades. This term inspired the creation of a similar term, BUIDL. Details of this term will be explained later.

Meaning of HODL

Far from simply being a misspelled English verb, used to refer to long-term coin holdings, HODL actually has implications for cryptocurrency investing.

Simplify investment activities

That’s right! Investors hardly have to care about the timing of purchases, transaction costs, or market analysis. They simply store long-term cryptocurrency assets similar to assets of long-term value. However, in order to invest effectively, investors still have to consider choosing assets that really have long-term value and store them in the safest way.

Reduce stress and negativity when investing

Unlike traders, investors following the HODL strategy can save time by not having to regularly monitor price chart types. Investors also do not need to be too stressed or negative when the price of the asset moves in an unfavorable direction.

In fact, many investors, despite choosing this investment strategy, are still too focused on price charts. So they still have a lot of negative emotions when the price falls. The stress and pressure at that time were the cause of the wrong investment decisions.

Less dependent on market trends and fluctuations

Market trends and volatility are key factors that lead to trader activity. And of course, their decisions are not always correct, which leads to losses. However, with HODL, investors can overlook the risks associated with misjudging market trends.

What does BUIDL mean?

Origin of the term BUIDL

Similar to HODL, BUIDL is a distortion of the word “Build”. The term is used as a call to join hands to build and contribute to the blockchain and cryptocurrency ecosystem, rather than just holding assets and doing nothing else.

BUIDL has really become a movement that calls on market participants to actively apply and improve the ecosystem, instead of just accumulating or trading simply.

Vitalik Buterin, founder of the Ethereum blockchain mentioned the term BUIDL when referring to the development of this ecosystem in a state on Twitter in 2018 to promote his platform.

Changpeng Zhao, CEO of the world’s largest cryptocurrency exchange, Binance also uses the term to urge crypto participants to contribute to the ecosystem rather than just buying and HODL.

Meaning of BUIDL

Promote the development of the cryptocurrency ecosystem

Cryptocurrency is a high-tech space. However, a participant in the BUIDL movement does not have to be a senior programming expert. The BUIDLers are simply people who use cryptocurrencies for specific purposes, use smart contracts, beta tests, write content, play blockchain games, and use cryptocurrency wallets or any other product that can promote the blockchain and the cryptocurrency ecosystem in general.

Support projects

Besides, the explosion of the DeFi ecosystem over the years along with the significant increase in the number of cryptocurrency projects requires active user participation and contribution. Even in some projects, user contribution is the decisive factor, creating the success of that project.

Huge ecosystems like Bitcoin or Ethereum can operate on their own and create a “playground” for participants. However, for small startup projects, the contribution of the community is also the determining factor in whether the project has enough potential to start or not.

Hold coin, Trade coin

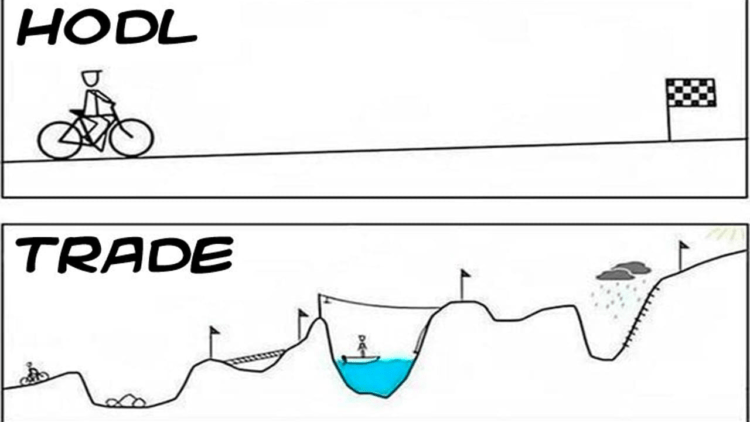

Simply, the Trade coin is a short-term investment, and the HOLD coin is a long-term investment.

Trade coins make a profit of just a few percent or a few tens of percent on a single trade. On the contrary, when having found a potential coin and persevered in waiting, the holder of the coin can receive an increase of a dozen, hundreds, or thousands of times the initial capital spent.

- Profit targets:

Holder/Hodler: large profits, usually over 100%, and usually spot trading.

Trader: smaller and only short-term profits with leveraged trades.

- Market view

As mentioned above, traders have a short-term view of the market with many charts: H1 (1 hour), H4 (4 hours) and the highest is D (day).

In contrast, holders use a minimum chart of H4, usually D. Some investors even analyze the market on charts W (week) and M (month).

- How to analyze

Hodlers often use fundamental analysis to consider the potential of the project, rarely using technical analysis.

In contrast, traders often use technical analysis to look at market movements, rarely using fundamental analysis.

Hold coin

Many people also use the word “hold” (not misspelled) to refer to the act of holding coins long-term. Investors will evaluate the profitability potential of the coin in the long term, which can be calculated on a monthly to multi-year basis. At some point, when the price of the asset held reaches the expected level, the investor will sell it for getting a profit.

Therefore, holding coins require investors to have a long-term market vision as well as confidence and persistence in the face of fluctuations, even bad market fluctuations.

Trade coin

In short-term trading, the trader is required to have the knowledge, and ability to read and analyze charts at timeframes in order to evaluate the market and find entry points. It can be said that Trade coin does not necessarily depend on the development potential of the coin, but mainly depends on the rise and fall of the market and the trader’s ability to judge the trend. A trader can even profit from a falling coin if he sees it early and enters the order accordingly.

Conclusion

It can be judged that HODL and BUIDL are two opposing terms. However, cryptocurrency market participants can split their investment capital for both of these methods. Part of that is a long-term, stable investment. The rest is a contribution to the development of the project as well as the cryptocurrency market as a whole.

In short, regardless of the investment school, market participants are still required to have knowledge as well as the vision of the market to make accurate investment decisions and minimize risks that may be encountered.