Advertisement

In the crypto world, projects are often funded through foundations and community token sale events. The project team will use the proceeds to develop the product. But what happens if all investors decide to sell their tokens at the same time?

While researching and investing in projects, we often come across the concept of cliffing and vesting. In this article, Ecoinomic.io will explore these two concepts and discuss the importance of cliffing & vesting when deciding to invest in projects.

What is Cliffing?

Cliff is the period during which the token is locked. During this time, no tokens were distributed. The token lock-up time is usually calculated from the TGE moment – the time when a project starts creating tokens on the blockchain.

Typically, the cliff will apply to tokens allocated to teams, advisors or strategic investors, giving buyers peace of mind that they will not be “discharged” after the token is issued.

For example, “Project team tokens have 12 months” means that the first 12 months the team will not receive tokens, and tokens will be distributed from March 13.

Not all projects have a cliff time, depending on the object and goal of the project, the token lock time will vary.

What is Vesting?

Vesting is the process of unlocking tokens, in which the vesting period is the period during which the token is paid in installments, until the final moment of receiving the entire token.

For example, “Vesting: 40% of tokens unlocked at the time of TGE and 60% of tokens in the next 3 months”, means that at the time the project starts creating tokens, you will receive 40% of the purchased tokens, and receive 20% of the tokens per month for the next 3 months.

Distinguish between Cliffing and Vesting

The two concepts Cliffing and Vesting both talk about the token being locked for a certain time, but there are still some basic differences to distinguish Cliffing and Vesting.

Cliffing: All tokens are locked during cliffing

Vesting: A part of tokens is unlocked from the beginning of vesting, the remaining amount of tokens is still locked and the unlocking will follow the project’s vesting schedule and distributed in batches until the distribution of all tokens is completed.

How does vesting work?

When a project schedules vesting and starts creating tokens on the blockchain, it creates a Smart contract to establish the conditions of the token locking process.

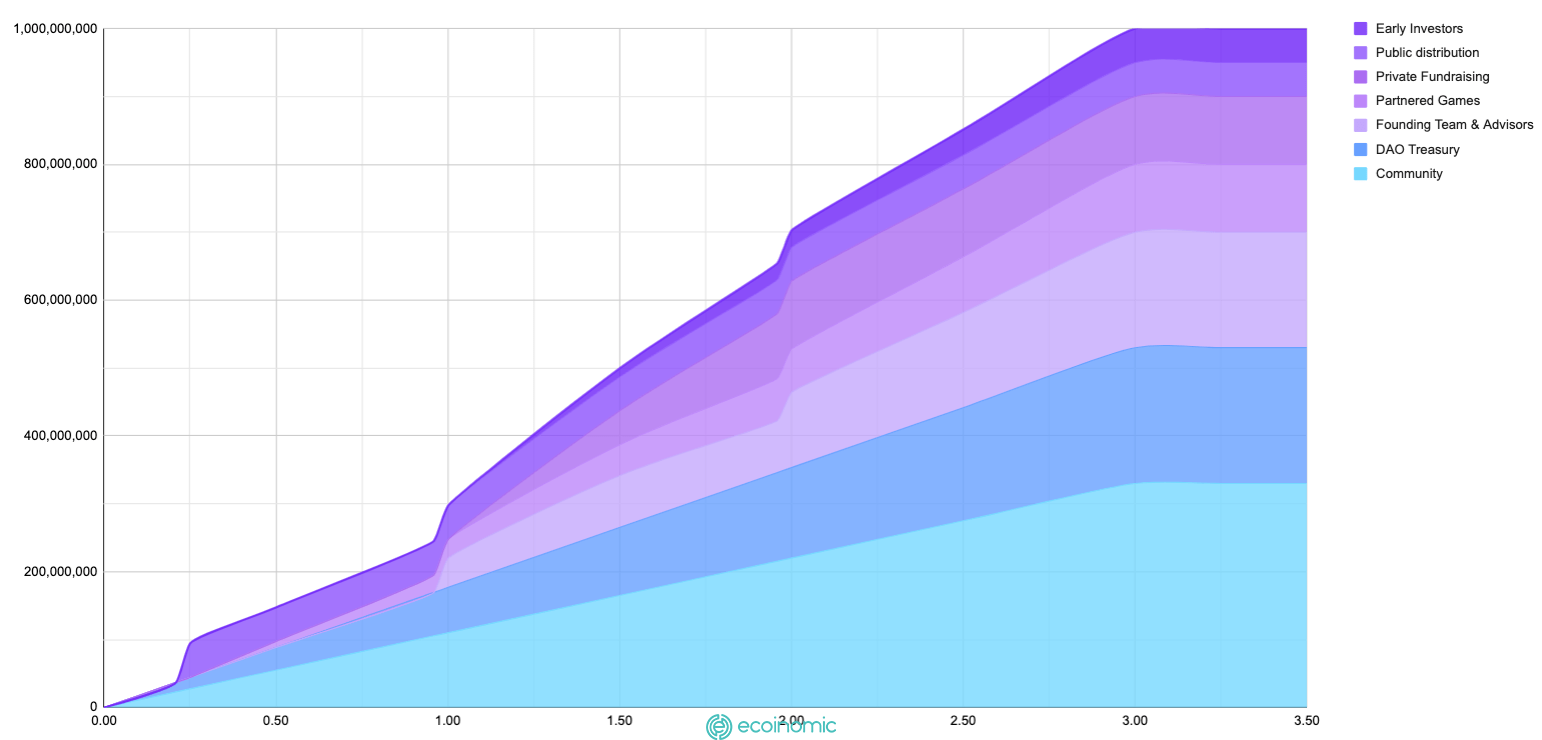

Token vesting schedules are communicated to users on social media channels, or often included in the project’s whitepaper. Upon satisfaction of the previously set time and conditions, the amount of tokens locked in the contract will be allocated.

Each project is free to decide how long its vesting will be, as well as how it will issue tokens. Once the tokens are unlocked, the token holder receives the tokens and has full control over the sale or transfer of these tokens. There are 2 ways to receive tokens depending on the project:

Manual vesting: when the token is unlocked, users receive their tokens manually by visiting the project’s website or a third party, usually launchpad to claim (receive) tokens to the wallet.

Automated vesting: tokens will be automatically distributed to the user’s wallet when the unlocking period reaches.

>>> Related: What is an IEO?

Vesting classification

Linear vesting

Linear vesting is the simplest way to set up a project’s token vesting schedule. Tokens are distributed in equal parts for a certain period of time.

For example, “Linear vesting 100% tokens within 10 months”, i.e. every month 10% of the tokens will be unlocked and last for 10 months.

Graded vesting

Graded vesting allows projects to choose the frequency of distribution of custom tokens, the amount of tokens unlocked varies in each batch.

For example, the calendar vests 10% of tokens in the first month, 20% in the second month, and 70% in the next 2 months.

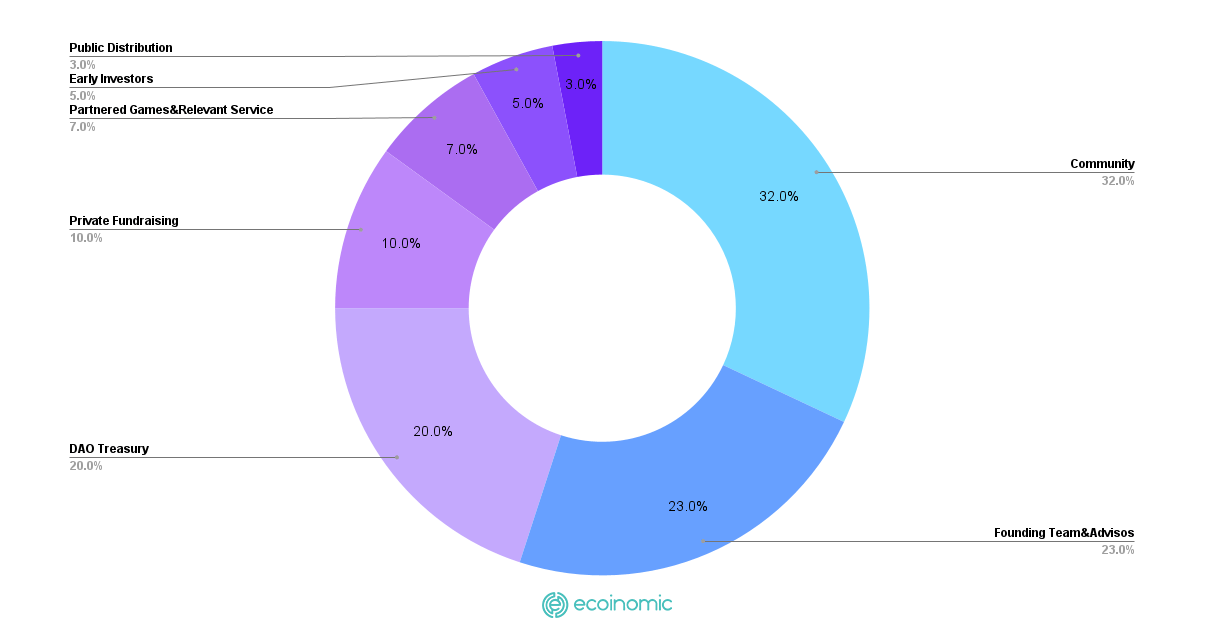

People interested in vesting

The first are early-stage investors who buy the project’s tokens in private funding rounds (private rounds or community rounds).

The second is the members of the project team, the advisory board and its partners as motivations for their loyalty and contribution to the project.

In addition, the token payment schedule is also information that many traders and holders are interested in to monitor the price movement of the project token.

The importance of cliffing and vesting

Ensure the stability of the token price

When a project implements TGE and starts listing tokens on exchanges, some investors tend to sell tokens at that moment to make short-term profits. This caused the token price to plummet and created a negative impact on the development of the project.

More seriously, when investors owning large amounts of project tokens, it is easy to manipulate the token price in the market, causing sharp fluctuations in the token supply, affecting the interests of other investors who want to hold tokens for the long term.

For that reason, a reasonable vesting schedule will help ensure the price stability of the project token, ensure the interests of investors and contribute to the development of the project in a sustainable way.

Protect investors against market fluctuations

The cryptocurrency market is always highly volatile, receiving all tokens during a downtrend will decrease in value, and not everyone has the patience to hold tokens and wait until the token rises in price.

The schedule of token allocations over different months will help minimize the risk of market volatility. When you lock a token for a predetermined period of time, you have more time to gain benefits when the token price rises.

Create motivation to develop the project

These pre-sale events are usually run before a project is fully launched, and the scheduled token lock-in gives the team the time and budget they need to complete their product development.

A portion of the token is allocated to the project development team and partners to help motivate them to contribute and stick with the project.

Normally, this token will be locked for a period of 1-2 years, helping them to be more responsible for the project, as well as creating trust for investors, avoiding the situation of fraudulent projects and project teams discharging tokens that cause the token to drop in price.

On the other hand, the vesting schedule for investors also helps the project build community and use this time to increase visibility and attract a large number of people interested in the product they are building.

Conclusion

Learning about cliffing and vesting is an integral part of analyzing the potential of the project and making investment decisions. A good token vesting history is important for the project to grow and attract investors and the community.

Through this article, Ecoinomic.io wishes to help you gain more knowledge about investing as well as choose projects with suitable vesting schedules.

>>> See also: What is Binance Launchpad? The opportunity to multiply your profits