Advertisement

In this article, we will learn an overview of what Liquidity Pools, how Liquidity Pools works, as well as its importance in DeFi and some related popular applications.

What is liquidity pool?

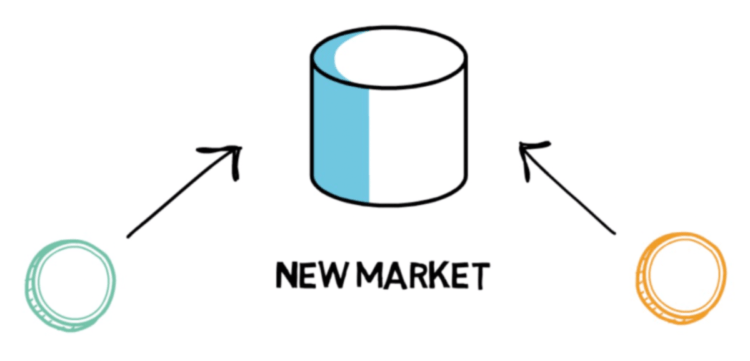

A Liquidity Pool is a group of coins or tokens locked in a smart contract. Overall, liquidity pool is an incredibly simple concept that can be used in many different ways.

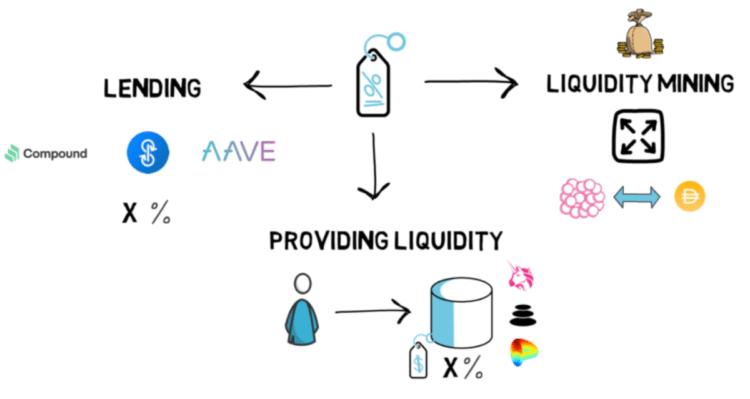

Example: Liquidity Pool is used to facilitate trading between assets on a Decentralized exchange (DEX), lending protocols, Yield farming, Synthetic Assets,…

Liquidity Pool is one of the underlying technologies behind DeFi’s current success. They facilitate the movement of digital assets in an automated and permissionless manner through the use of liquidity groups.

How liquidity pool works

One of the most important groups of people to recommend that the Liquidity Pool works effectively is the ones who provide liquidity to that Liquidity Pool, also known as the Liquidity Provider.

Therefore, liquidity pools in cryptocurrencies, if they want to operate effectively, they need to be designed with appropriate incentives for Liquidity Providers to offer their assets into the Liquidity Pool. That’s why most liquidity providers in the crypto market earn trading fees and Yield Farming rewards from the decentralized exchanges they offer liquidity on.

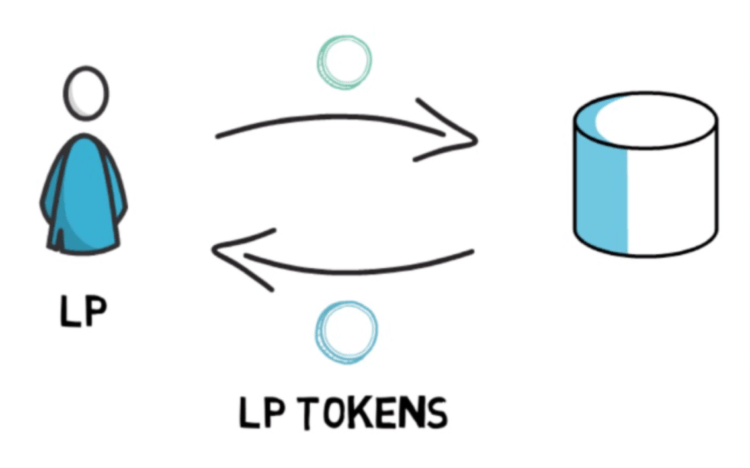

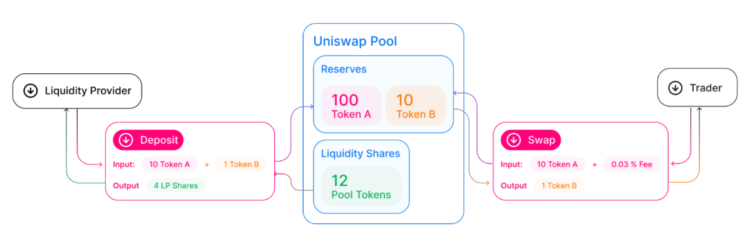

When a user provides liquidity to the pool, the liquidity provider usually receives the LP token back. LP tokens represent their asset stake in the common pool, and they can also be used throughout the DeFi ecosystem with a variety of capabilities.

For the Liquidity Pool of the Automated Market Generator (AMM), when a transaction occurs, a transaction fee is retained in the Liquidity Pool and distributed proportionally among lp token holders.

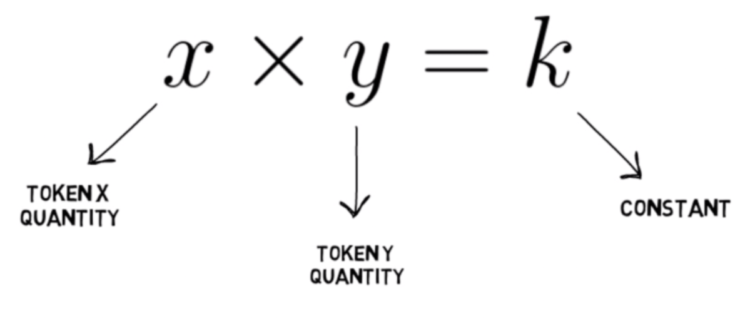

The Liquidity Pools in the AMM also maintain market value for tokens in the pool thanks to the AMM algorithms. Liquidity Pools in different protocols can use slightly different algorithms.

Example: Liquidity Pool Uniswap uses a constant product formula (x*y=k) to maintain the price ratio to the number of tokens in the Pool.

Why is liquidity pool important in crypto?

Before the Liquidity Pool, the liquidity of the crypto market was heavily influenced by centralized exchanges (CEX) and traditional market makers. At that time, liquidity was concentrated only on some of the top coins & tokens such as BTC, ETH, and LTC,… LTAs (Long tail Assets) in a state of low liquidity or lack of liquidity make it very difficult to trade them.

Liquidity Pool was born with the aim of solving the problem of the illiquid market by encouraging users themselves to provide cryptocurrency liquidity and receive back the part that is usually part of the transaction fee.

In addition, trading with Liquidity Pool protocols such as Uniswap, Sushiswap, and… Do not require buyers and sellers to match orders like orders. This means that users can simply exchange their tokens and tokens in the pool using user-provided liquidity and transact through smart contracts.

This makes the liquidity pool a great solution for payments in crypto especially for LTAs, opening up a host of other use cases for crypto.

Popular applications of Liquidity Pool in DeFi

Liquidity Pools play an essential role in the DeFi decentralized financial ecosystem – especially when it comes to decentralized exchanges (DEX). They provide the liquidity, speed, and convenience needed for the DeFi ecosystem.

In AMM’s, Liquidity Pool is a mechanism by which users can pool their assets into DEX smart contracts to provide liquidity to that asset. Users can then easily trade these tokens back and forth with each other. The more assets in the Pool, the more liquidity, the easier it becomes to trade on decentralized exchanges.

To create a better trading experience, different protocols offer even more incentives for users to provide liquidity to the platform by providing more tokens to LP holders, a method known as yield farming.

In the DeFi market there are many platforms that deploy Yield farming that allow you to earn rewards when providing liquidity So how does a cryptocurrency liquidity provider choose where to place their funds?

Liquidity tanks are the basis of automated profit-generating platforms such as yearn, where users can add their money to the tanks and then receive interest.

This is where yield aggregators & yield optimizers come into play, users can deposit their tokens into the pools and then receive automatic interest rates. Besides, platforms like Yearn Finance even automate risk selection to allocate your tokens to different DeFi investments to provide liquidity and returns.

Another popular application of Liquidity Pool is used in lending & debt protocols. Users deposit tokens into the platform as collateral and can Borrow another asset class from the platform for use for their own purposes, and loan fees and loan fees will be determined by the supply and demand of that asset class. In addition, when a user deposits an asset, they will also receive another token that represents ownership of their assets.

Liquidity Pool Risks

Like everything in DeFi, they also carry risks. Besides the usual Defi risks such as Smart contract errors, administrative locks, and system risks (bugs). They also have to add two new risks of impermanent losses and liquidity pool hacking.

If you provide liquidity for an AMM, you’ll need to know about a concept called Impermanent loss (IL) or impermanent loss. In short, this is the loss in dollars of adding liquidity to an AMM versus just holding that token.

Related: [Kickback Rate 20%] Binance Sign Up For Beginners Update 2022