Advertisement

Like all altcoins, ATOM price fell as BTC, ETH last week, but its 35% rebound is attracting more intention.

ATOM price recover

This week Cosmos native token – ATOM price appears to be following this path, and the altcoin is showing a bit of strength with a 35% gain since Aug. 22.

Let’s take a look at ATOM price compare to BTC in the Binance price chart above.

Since 18/8, BTC fall -11% and still have not recover yet. ATOM price also witness a fall of -15% from 18/8 to 19/8, however, ATOM price has recover and increase over 30% up to now – 26/8

What traders need to find out is whether ATOM’s upside momentum is simply the result of a “stable” market and Bitcoin and Ether trading in a relatively predictable range, or if there is some Cosmos-related set of fundamentals that validate the current move and warrant opening a swing long.

Besides Binance, ATOM is also being listed on other famous exchanges FTX, Coinex, Kucoin, MEXC and Houbi

Why ATOM price increased

Analysts at VanEck, a multibillion-dollar asset management fund, think ATOM price will have a 160x increase by 2030.

“Based on our discounted cash flow analysis of potential Cosmos ecosystem value in 2030, we arrived at a $140 price target for the ATOM token, with downside to $1. With ATOM’s price at $10 as of 8/2/2022, we like the 14-1 odds presented and believe this is a buying opportunity for the token.”

Cosmos – ATOM competitive edge

VanEck analysts Patrick Bush and Matthew Sigel cite the advantage of Cosmos is its Inter-Blockchain Communication Protocol (IBC).

“Separate Cosmos SDK blockchains can open up communication channels to exchange data, messages, tokens and other digital assets.”

According to 2 analysts, “IBC architecture then enables each blockchain to perform activities on another blockchain without relying upon a trusted third party.”

“The permissionless and trustless communication technology of IBC solves many of the issues presented by trusted bridging solutions that have led to over $1B in funds stolen through bridge hacks.”

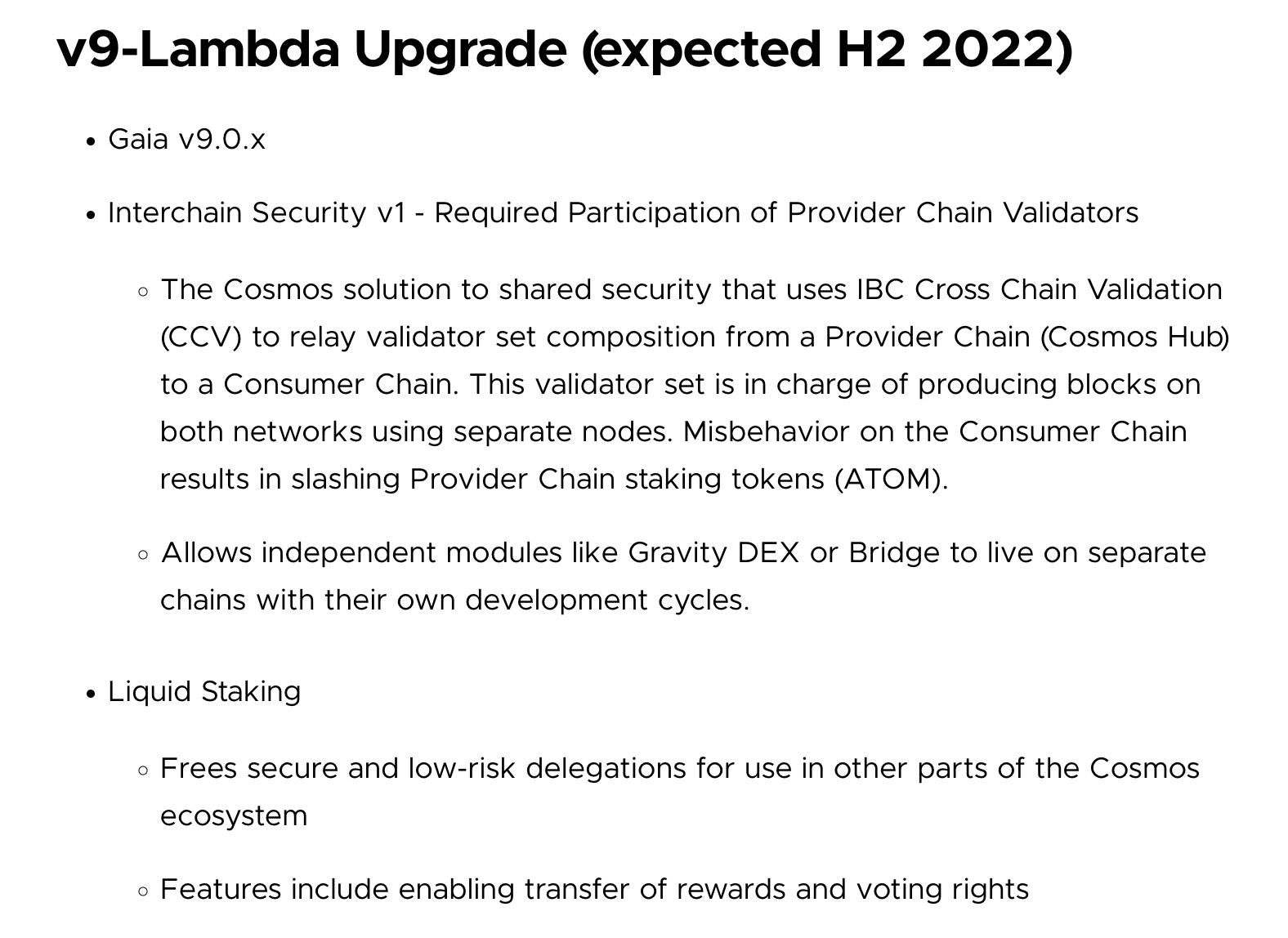

Patrick Bush and Matthew Sigel also cite the Cosmos SDK, clear product-to-market fit and strong token value accrual being partially influenced by Staking and a soon-to-launch “interchain security” mechanism by the Cosmos Hub as reasons for their long-term bullish perspective.

What about Cosmos Roadmap and development?

ATOM is set to become a primary collateral asset in three new stablecoins that will launch within the Cosmos ecosystem.

Why $ATOM is mooning?

The main collateral in three new @MakerDAO inspired stablecoins in the @cosmos ecosystem:$USK by @TeamKujira $IST by @agoric $CMST by @ComdexOfficial

These 3 chains will need $Atom to mint their stablecoins, locking up the supply.

— Ericzoo.eth 🉐 (@ericzoo) August 24, 2022

Minting stablecoins will require the “lock,” or depositing, of ATOM tokens and, according to the Cosmos Hub 2.0 roadmap, Liquid Staking is also expected to roll out in H2 2022.

During DeFi Summer and the post-summer revival, stablecoin issuance and liquid staking were two phenomena that boosted TVL for DeFi-oriented blockchains and, while questionable and somewhat Ponzi-esque, liquid staking adds buy pressure to a protocol’s native token, while also equipping it with utility within various aspects of the lending, borrowing and leveraging wings of decentralized finance.

Current data from Staking Rewards shows that 65.84% of issued ATOM tokens are staked for a minimum yield of 17.85%, and additional data from the analytics provider shows a near 189% rise in the number of ATOM stakers over the past 30 days.

The above appears to align with the thesis that liquid staking and stablecoin minting will soon launch. Despite the confluence of these bullish indicators, it’s important to remember that asset prices do not exist in a vacuum. While there may be a handful of bullish signals flashing from ATOM, the wider cryptocurrency market (including BTC) hangs at a precipice.

>>> Related: What is Aptos? New solution in Layer 1 blockchain