Advertisement

The DeFi space is becoming increasingly tight on blockchain networks. Even the strong development of products related to entertainment such as GameFi or NFTs also uses a lot of the application features of DeFi such as exchanges, and transactions. This makes blockchain networks congested and not really optimal for financial activities that need reliability, speed, and high accuracy.

Sei is a Layer1 that came to Cosmos as a solution to this problem, by being technologically optimized, thereby providing an optimal infrastructure for DeFi and Trading.

What is Sei Network?

Sei is a blockchain that aims to solve the problem of reliability, speed, and scalability of DeFi applications, especially trading. Every aspect of blockchain is designed to optimize exchanges that can operate more efficiently while providing the best user experience to end users.

- Native order matching engine: Expanding DEXs order book products on Sei

- Breaking Tendermint: Fast transaction speeds with ~600ms

- Twin-turbo consensus: Improved latency and throughput

- Frontrunning protection: Protects users from malicious transactions such as frontrunning

- Market-based parallelization: Separate parallel market for DeFi

Sei’s on-chain order book creates an architecture that can synchronously combine applications on the network with each other and share liquidity efficiently through the native order-matching engine.

See also: What is Sui Blockchain? – New elements in the Web3 ecosystem

Uniqueness of Sei

Most of today’s Layer1 blockchains are built on two different objectives: General Purpose Chains (Solana, Ethereum) and App-specific Chains (dYdX, Osmosis).

For General Purpose Chains, their advantage is that they allow multiple applications to develop on the same layer. This allows applications to support and complement each other easily. However, this is also a weakness when the blockchain will be overloaded when it has to process many transactions, making it congested. Especially for DeFi applications, under a conventional structure, transactions will have to share resources with other unrelated applications such as NFTs or GameFi. It causes the latency in transaction processing to increase affecting the user experience.

App-specific Chains have the advantage of customization in design to suit different goals. However, DyDx or Injective’s trading products choose to handle off-chain order books, which will be limited to decentralization.

Sei opens up an entirely new design space by combining the advantages of the two to become a sector-specific chain, allowing developers to build optimal DEX applications.

- Decentralization: Sei provides a completely decentralized and permissionless order book tool that overcomes the weaknesses of conventional AMMs or specific products such as DyDx or Injective

- Low spreads: Guaranteed prices for MMs with low spreads and deep liquidity for assets with large trading volumes

- Deep liquidity: The CLOB (Central limit order book) tool allows applications to provide traders with an optimal source of liquidity.

- Lightning-fast transactions: Block times on Sei are expected to be only 1-3s, while there may be less than 13k orders per block.

- Extremely low fees: Cheap transaction fees

- Purpose-built: Product components can be built directly on the chain

- IBC interoperability: Development on Cosmos makes Sei benefit greatly from Cosmos SDK and Tendermint allowing easy interaction with other IBC chain

- Prevents MEV: Sei’s technology helps prices to be synchronized in the same block, thereby minimizing risks from frontrunning

Sei’s technology

Unlike DEX AMM exchanges, Sei focuses on developing order books to process transactions, and as the goal has been to raise issues of transaction speed, block times, and latency must be prioritized. For trading, prices need to be updated exactly every block, so low block times will offer users and market makers low slippage, minimizing risks for traders. Sei’s goal is to improve the consensus mechanism so that the transaction speed can improve as quickly as possible (~300ms – 600ms). To do this, Sei focuses on developing the following three technologies:

- Optimistic block production

- Intelligent block propagation

- Parallel order execution

ABCI (Blockchain Application Interface) is a technology from Cosmos that helps provide a simple interface between the blockchain of consensus tools through multiple computers. Sei optimized it to ABCI++ to fit its mission. ABCI++ adds improvements to all steps of the consensus mechanism, allowing applications to reorder, modify, drop, delay, or add transactions to improve the speed of block times.

Optimistic block production

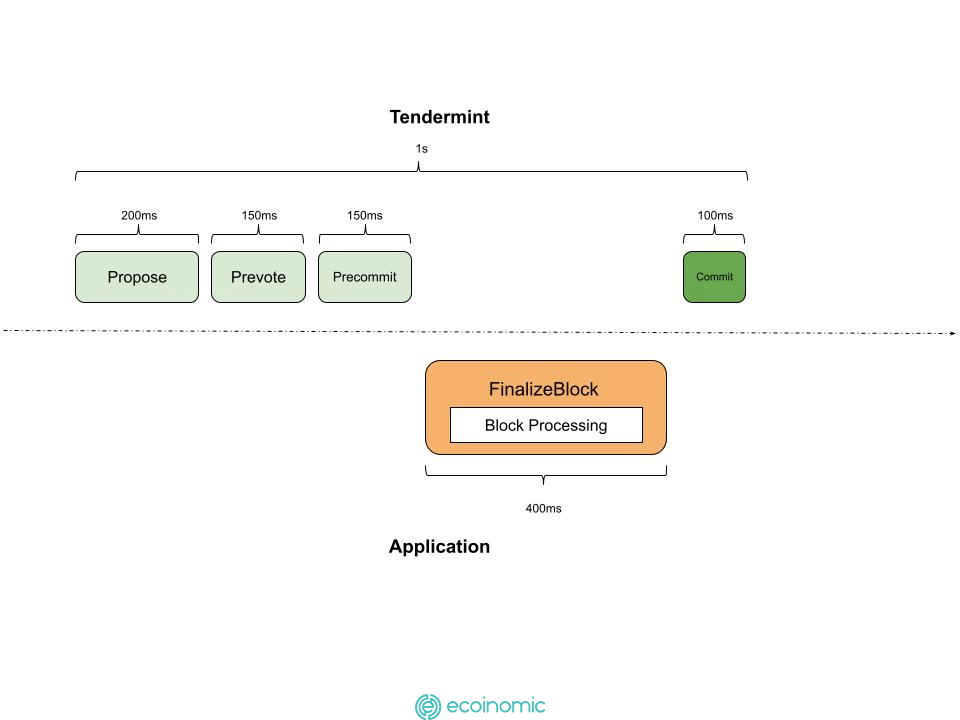

During Tendermint’s block proposal process, it will be passed on to other validators and continue to send data to prevote and precommint. After the precommit message is sent, validators will continue to process each transaction in the block and implement the necessary changes. If the block has too much data to process, it will take more time and eventually reach the Commit.

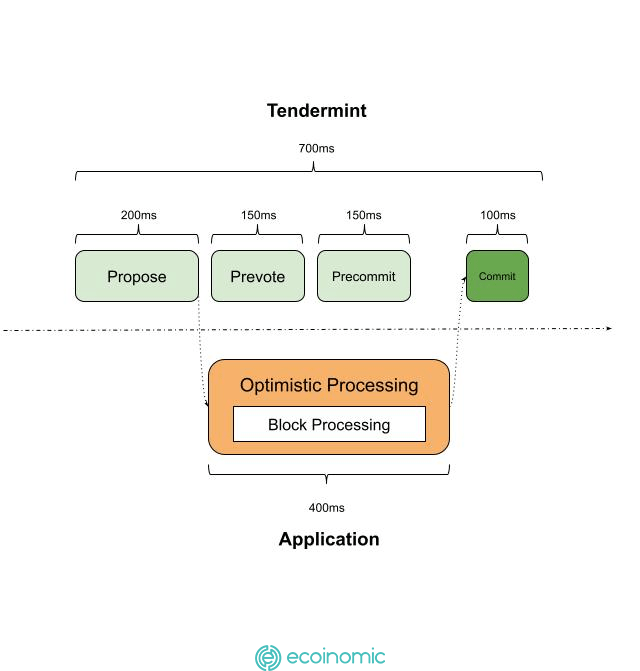

Sei’s team realized that the network could process prevote and precommit at the same time as block processing (it’s called optimistic processing) and apply it to a temporary candidate state. If the proposed candidate is accepted (in most cases), the provisional candidate will also be approved. On the contrary, if rejected, it will be discarded. This improvement helps to block times of the network and significantly reduces latency (up to 30%).

Intelligent block propagation

For Tendermint, when blocks are proposed, it will include a lot of data. But most validators already know up to 99.9% of the transaction’s data through mempool. Therefore, instead of sending out the detail of the block, Sei’s block proponents now simply send the hash of all transactions in the block and validators can quickly reconstruct the block with the data available from their mempool. Sei calls both of his innovations Optimistic block production and Intelligent block propagation by the name Twin-Turbo Consensus. It makes the network up to ~83% faster.

Parallel order execution

Cosmos’ blockchain uses ABCI to process data sequentially regardless of whether the transactions may not be related to each other. This mechanism slows down the speed significantly if the network has multiple transactions occurring at the same time. With parallel order execution, unrelated transactions can be processed at the same time. For example, instead of contract B having to be processed after the transaction comes from contract A, it can be processed in parallel. However, transactions involving each other, still have to be processed in sequence to avoid conflict. In the test, the parameters of block times, latency, and throughput were all significantly improved.

- Block times: from 0.89-2.62 down to 0.46-1.58

- Latency: from 204-1368 reduced to 47-121

- Throughput: from 6000-9500 increased to 8900-15300

In addition to the three main technological innovations mentioned above, Sei also added other features to its platform such as:

- Native Price Oracle: Sei’s Oracle is set right at the platform layer, which means validators need to accept the price every time they validate blocks, allowing elements on the network to access with high accuracy in relation to price.

- Single Block Order Execution: Allows a trading order to be created and executed in the same block.

- Order Bundling: Market Maker can update prices in many different markets in just one transaction

- Frequent Batch Auctioning: Aggregate all orders in the market when validating at the end of the block to synchronize the price to be homogeneous, minimizing risk from frontrunning.

Sei’s ecosystem

Unlike other Layer1 blockchain platforms, they allow any developer to develop their own project easily. For Sei, the network has traded this for the desired effects, only projects with permission through on-chain governance can build. Although it is still only a Testnet version, there are more than 20 projects ready to move to this potential ecosystem:

- Leap Wallet: The first wallet to support Sei

- Axelar: Cross-chain protocol between IBC and EVM

- UXD Protocol: Fully collateralized delta-neutral stablecoin

- Nitro Labs: Layer2 of Sei, using Sealevel (Solana’s virtual machine, Solana VM), allows applications on Solana and their liquidity to interact with Sei.

- Pharaoh: Offers synthetic assets focused on commodities and forex

- Synthr: Allows the creation of synthetic assets from real assets

- Vortex: Perpetual Contract Exchange

Investors

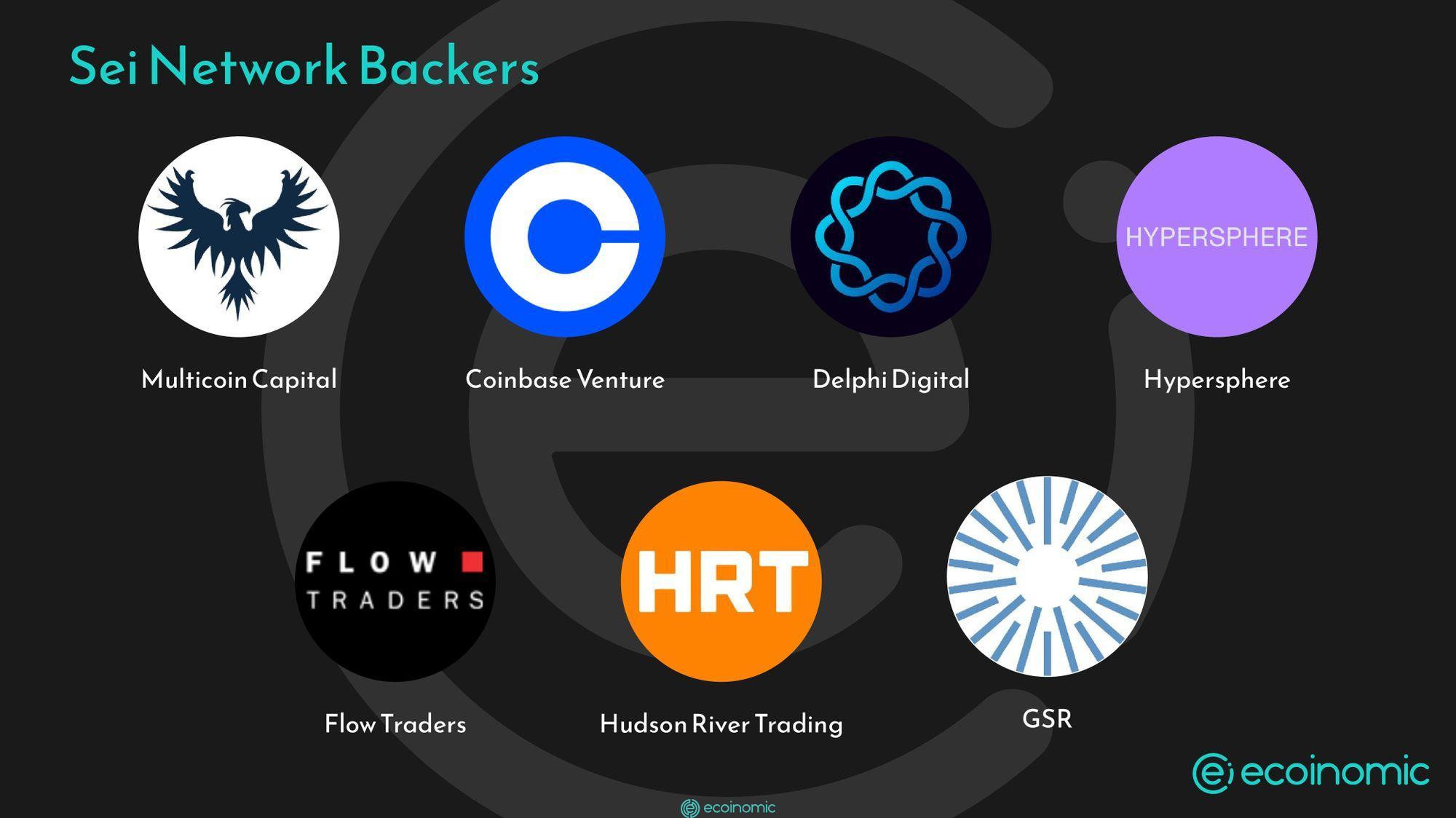

Sei has invested $5M since the first funding round by many large investment funds to develop the ecosystem such as Multicoin Capital, Coinbase Venture, Delphi Digital, Hypersphere, Flow Traders, Hudson River Trading, GSR. In addition, there are some individuals from major projects who are also directly involved in this investment round including Nathan McCauley, Sam Kazemian, Gabby Dizon, 0xMaki, Jason Choi, Darryl Wang, State.

Conclusion

Sei promises to be a platform that gives users the best experience in DeFi and Trading, they even consider the protocol itself as Decentralized NASDAQ. However, Sei also needs to face a lot of technological challenges to achieve its goals, as well as other strong competitors such as DyDx or Injective.

An ecosystem with a lot of potential and promise often brings a lot of opportunities, hopefully, through this article on Ecoinomic, you can have an overview of the ecosystem.