What is 1inch?

1inch is an aggregator of decentralized exchanges.

The protocol provides users of decentralized products with choice and the best rates for swaps by pooling liquidity in leading exchanges such as Uniswap, SushiSwap, PancakeSwap, Curve, and Bancor, … Similar to other DEXs, users do not have to complete the KYC process or have an account to use the platform.

1inch was founded by Sergej Kunz and Anton Bukov in 2019 during the ETHNewYork hackathon. Since then, 1inch has raised about $15 million in funding from companies like Binance Labs, Galaxy Digital, and Pantera Capital. The platform allows participants to buy and sell cryptocurrencies in a variety of ways similar to UniSwap.

The information of 1inch

- Website: https://1inch.io/

- Supported Chains: Ethereum, BNB Chain, Polygon, Optimism, Arbitrum, Avalanche, Fantom,…

- Supported Wallets: 1INCH Wallet, Wallet Connect, MetaMask, BNB Chain Wallet, Trust Wallet, Coinbase Wallet,…

- Feature: Swap, Limit Order, giao thức tổng hợp, Provide Liquidity

- Audit: OpenZeppelin, Consensys diligence, SlowMist, Haechi Labs, Coinfabrik, Certik, Hacken, Scott Bigelow, Mix Bytes và Chainsulting.

- Availabilities: Website, Android, iOS

The salient points of 1inch

- User-friendly interface

- No additional transaction fees: Users only pay transaction fees on the blockchain without any additional fees for the 1inch exchange.

- Low transaction fees: Users can choose between different exchanges and can actively choose the best price and gas.

- LP tokens can be used in yield farming

- High security

- Good Cryptocurrency Rates: Users can easily find the best rates available for crypto exchange through the 1inch Pathfinder feature.

- High liquidity: Thanks to the integration with more than 50 different exchanges, it is possible to increase the efficiency of liquidity use.

1inch exchange working mechanism

In a normal AMM exchange, users will often suffer from slippage, especially when the trading volume is too large compared to the liquidity in a pool. To avoid this, users are forced to split orders or search for exchanges with better liquidity. This is quite difficult and time-consuming for ordinary users.

However, when a user makes a trade on the 1inch exchange, the protocol searches for the best price for that order by retrieving liquidity data from the top exchanges. At the same time combine them to offer the best price in the market for its users.

How to use the production of the 1inch exchange?

At the homepage of the 1inch exchange, select Launch dApp, at this point, you will be redirected to the page to use the products of this exchange. To use the exchange’s products, you must connect your crypto wallet, then you can choose to use different products.

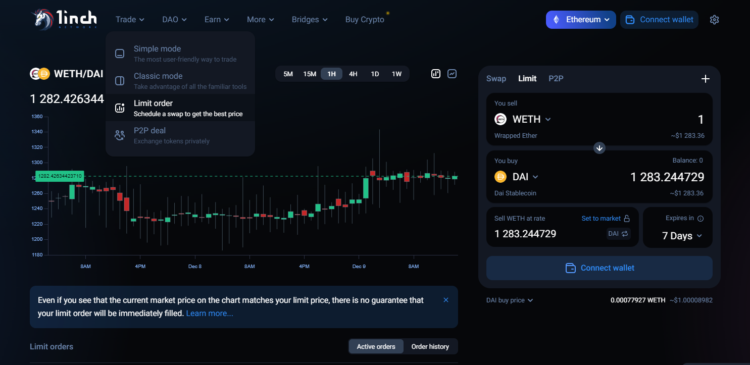

Trading with Limit order

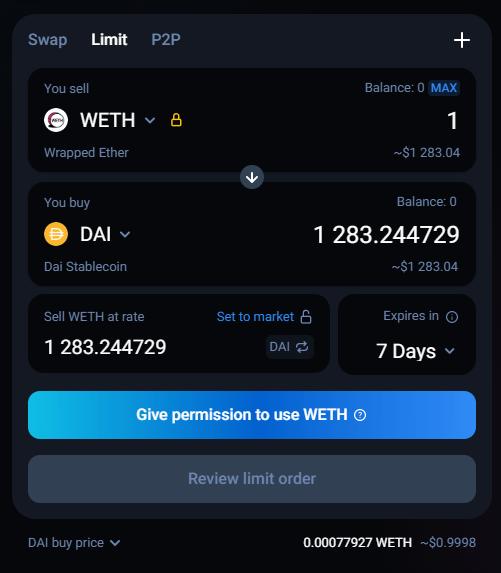

- At 1inch’s DApp page, select Trade, then select Limit order, and the Limit order trading interface will appear.

2. In the You Pay section, you choose the coin you want to sell. At the You Receive section, enter the coin you want to receive, and the amount you receive will be calculated automatically. Then enter the price you want to sell and the duration.

3. You can select Review Limit Order to review the information about the trade order you have placed. Then go to your crypto wallet and confirm the order placed.

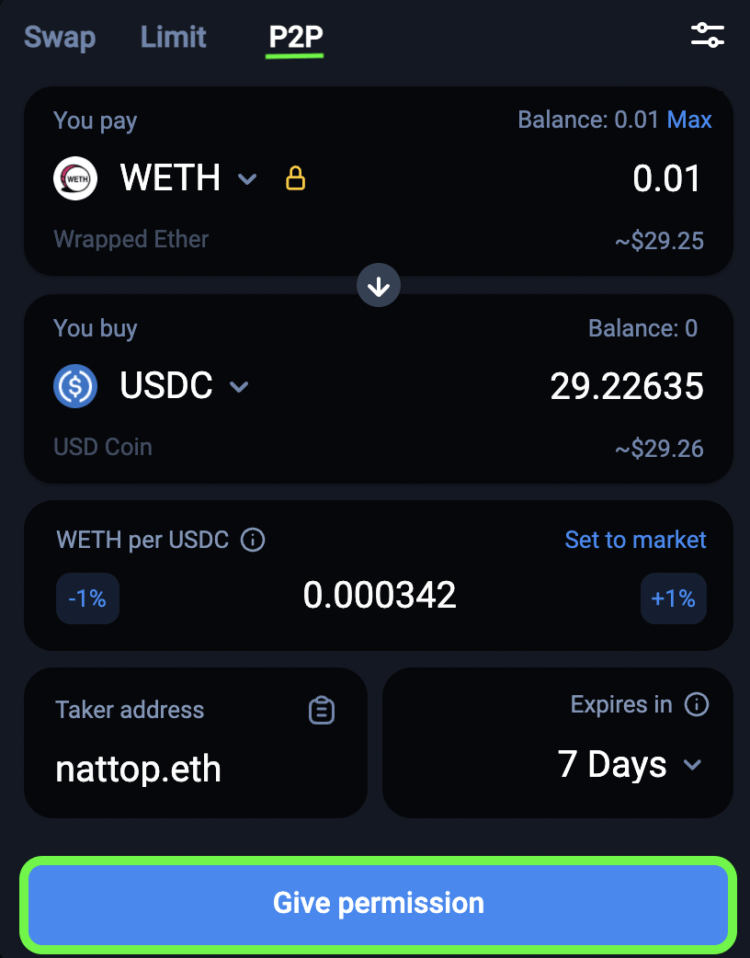

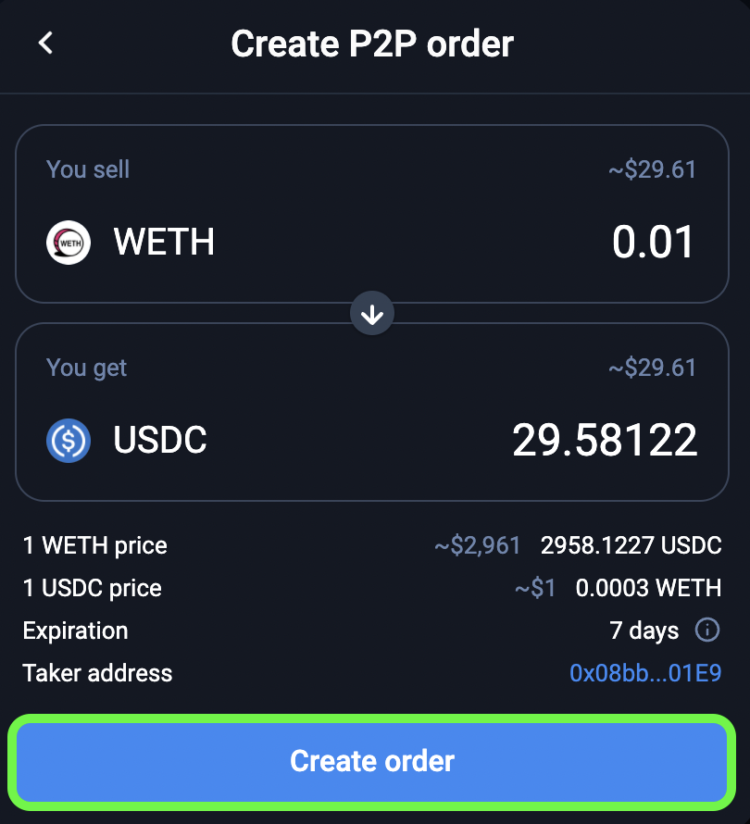

P2P Trading

1. At 1inch’s dApp page, select Trade, then select P2P deal. At this point, the P2P transaction window will appear

2. Select the token you want to trade, then you need to approve the token used on the Smart contract by clicking Give permission.

3. Confirm transactions in your crypto wallet.

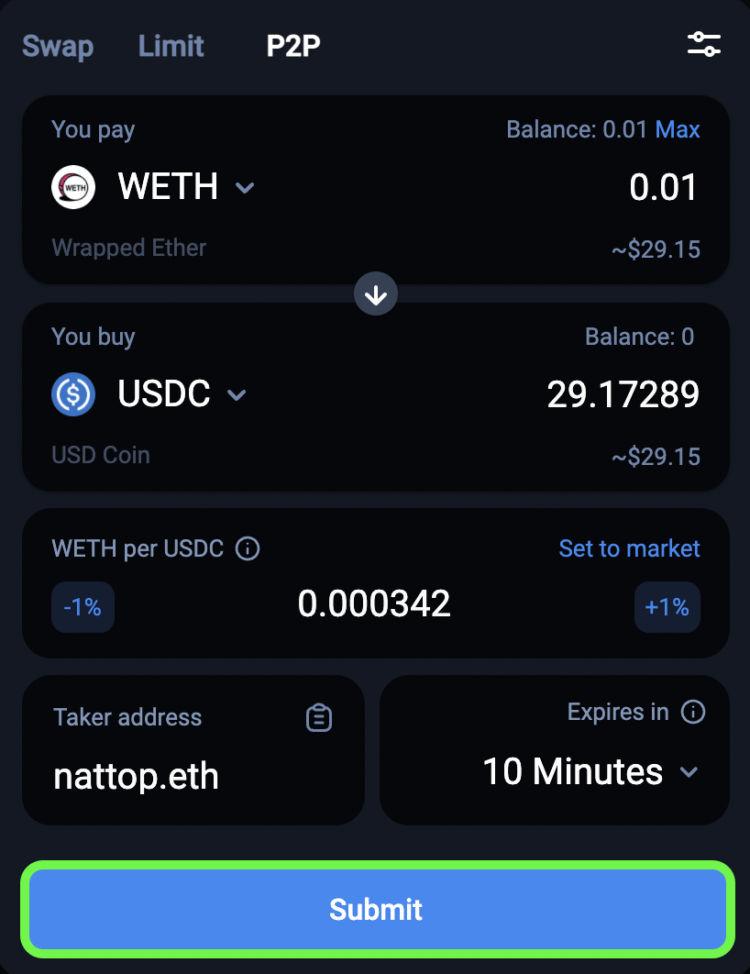

4. Then enter the type of token you want to trade and the duration. Here you will be able to set the amount at the current market rate or change the spread. Then click Submit.

5. Double-check the order information and click Create order.

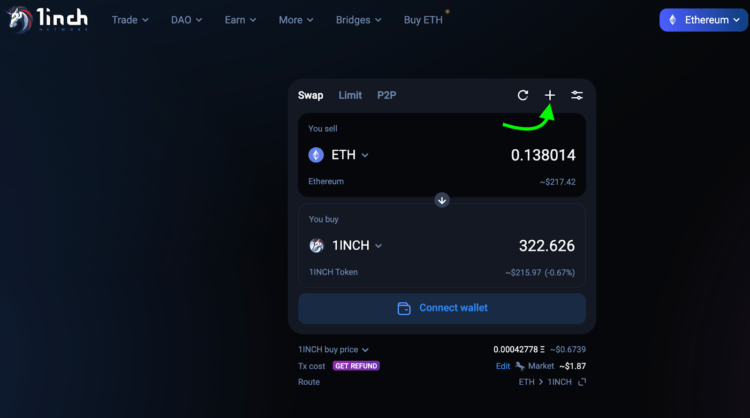

Swap

1. On the exchange’s swap window, select the token pair you want to swap. If the token you want to swap is not on the list, you can add it manually by clicking the plus sign.

2. Enter the number of tokens you want to swap.

3. You need to make sure your wallet balance is enough to complete the transaction and pay the blockchain gas fee.

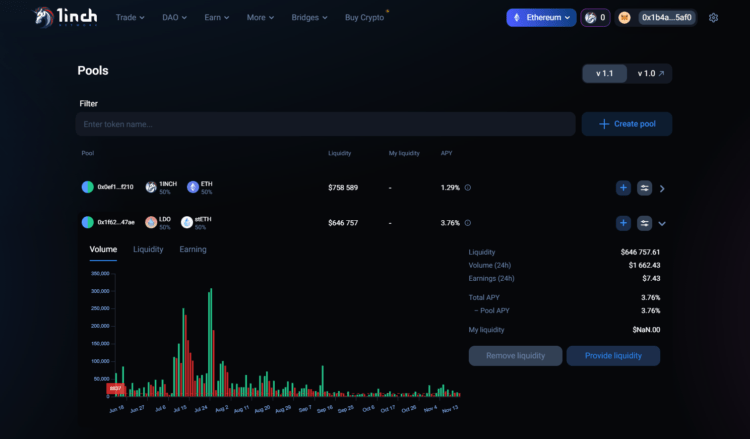

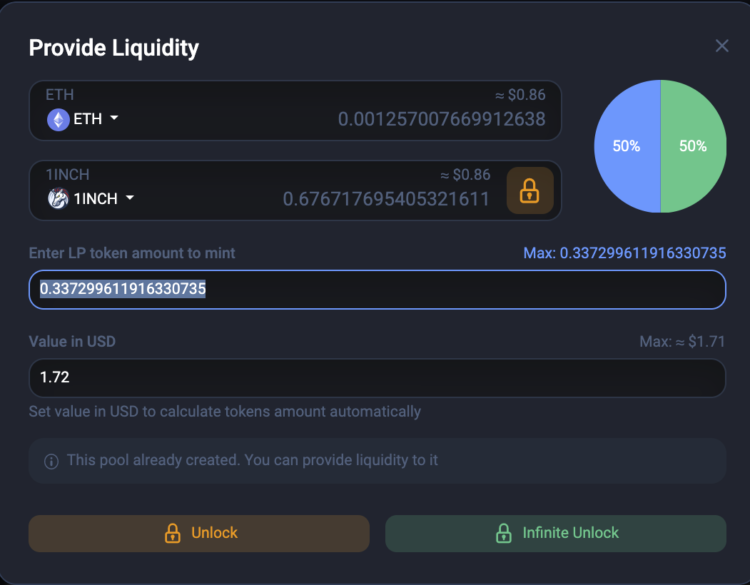

Liquidity Provide

1. At 1inch’s dApp page, select Earn, then Pools. At this point, the list of Liquidity Pools will appear. Select the pool that is right for you or click Create pool if there is no matching pool.

2. Choose Provide Liquidity

3. Adjust the amount of tokens you want to give by entering the amount of LP tokens you want to mint.

4. Click Unlock to unlock the property. Then confirm the transaction in your crypto wallet. You can repeat the above operations to provide another pair of liquidity tokens.

Farm

If you are already a liquidity provider on 1inch exchange, you can use LP tokens to stake and earn APY farming on the platform.

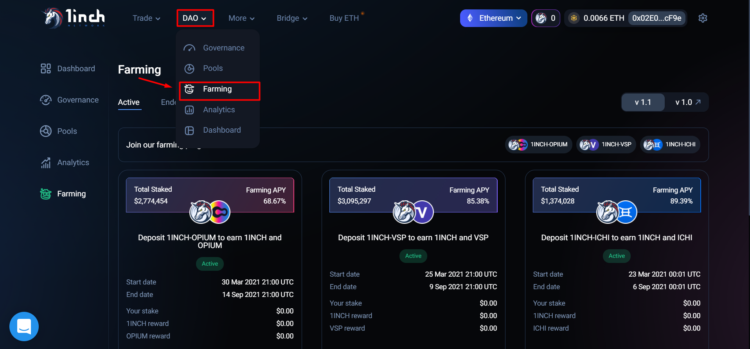

1. At the dApp page, select DAO, select Farming. At this time, the farming interface will appear

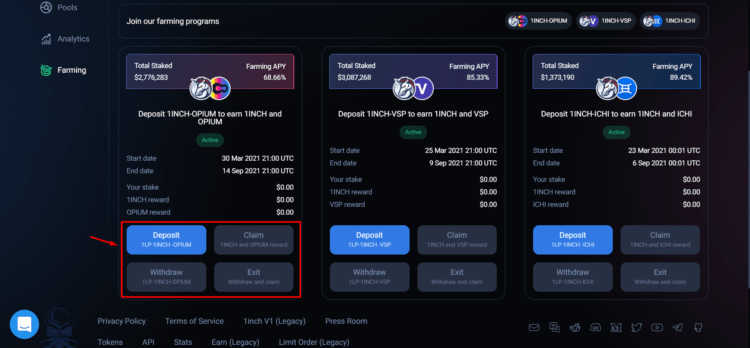

2. Choose the Farming Pool that matches the Pool for which you provide liquidity. Then select Deposit to deposit your LP tokens into the Farming pool. After depositing liquidity tokens, you can claim your farming rewards at any time.

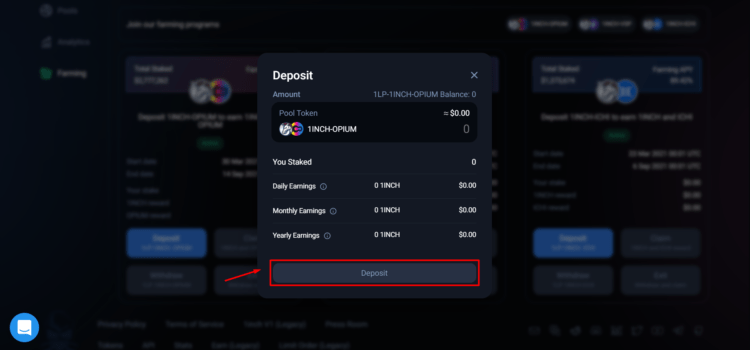

3. Select Deposit and confirm the transaction in your cryptocurrency wallet is complete.

Staking

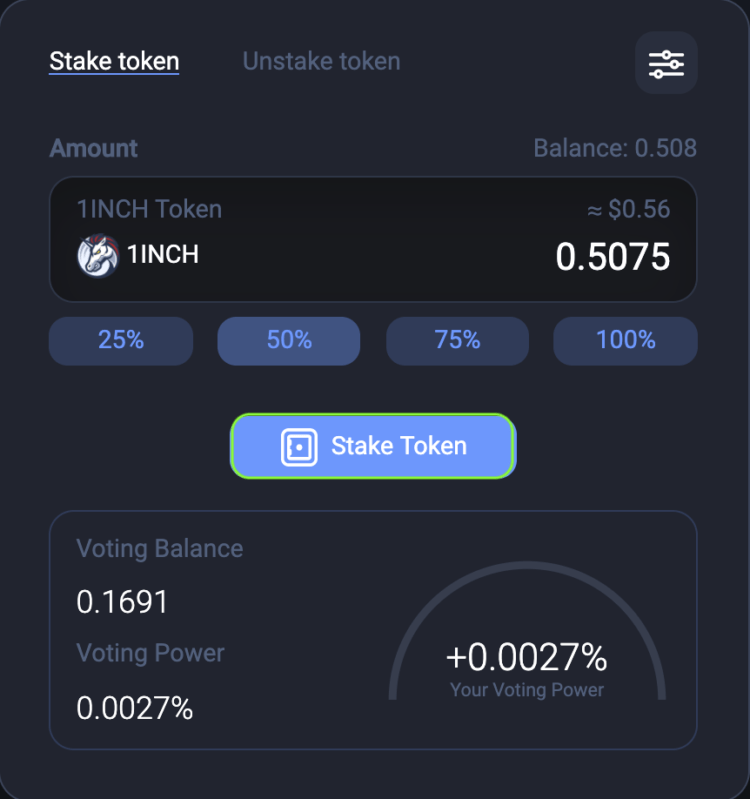

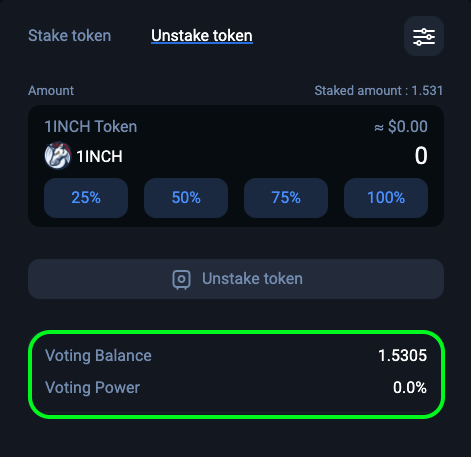

1. At the dApp page, select DAO, then select Staking. At this point, the Staking window will appear

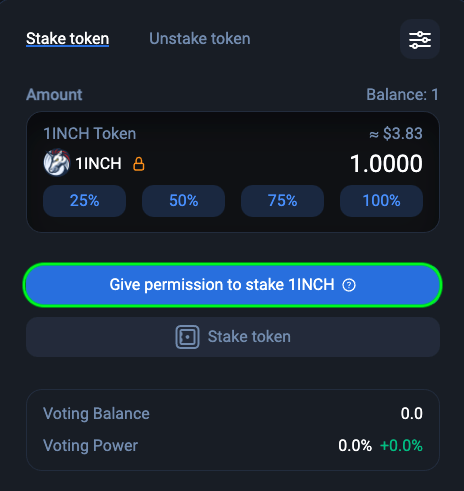

2. Enter the amount of tokens you want to stake in the Amount section, then click Give permission to stake 1INCH.

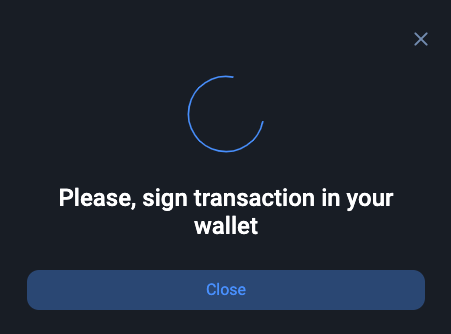

3. Confirm the transaction in your crypto wallet.

4. Then, press Stake Token. Once staked tokens, they will show up as st1INCH tokens in the wallet and on the block explorer.

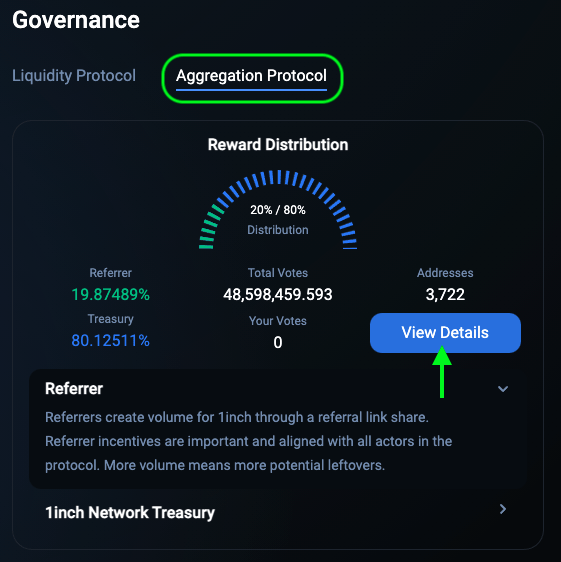

Aggregation protocol governance

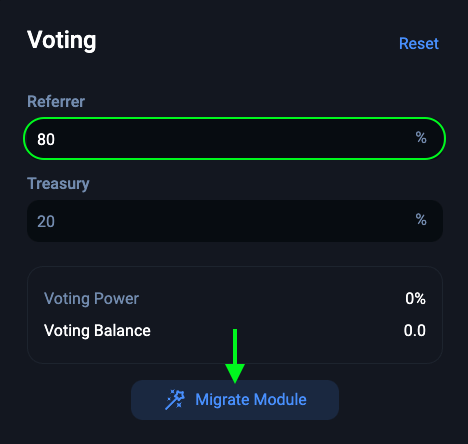

1. Once you have staked your tokens, you can see your staking stake in the Voting balance section. Below you can see your voting power.

2. You can vote for both the liquidity protocol and the aggregation protocol. The aggregation protocol allows users to view the current distribution ratio between referral rewards and treasury allocation.

3. Choose the tab Aggregation protocol, then click View Details to view all information.

4. Then enter desired referral reward % against treasury allocation. Finally, click on Migrate Module and confirm the transaction in your wallet. (You can also access it from the dApp page, select DAO, then select Aggregation protocol.)

Conclusion

In short, 1inch is an exchange that provides convenient features and tools for traders. In fact, it can be claimed that 1inch Exchange has solved the liquidity and gas fee problems in the DeFi ecosystem.

In the above article, Ecoinomic.io has introduced in detail the 1inch exchange and instructions on how to use basic products. We wish you the best experience on this exchange.