Advertisement

Block-based decentralized applications can do anything that web or mobile apps can do, while maintaining privacy, keeping immutable records, and bypassing middlemen.

What is DApp?

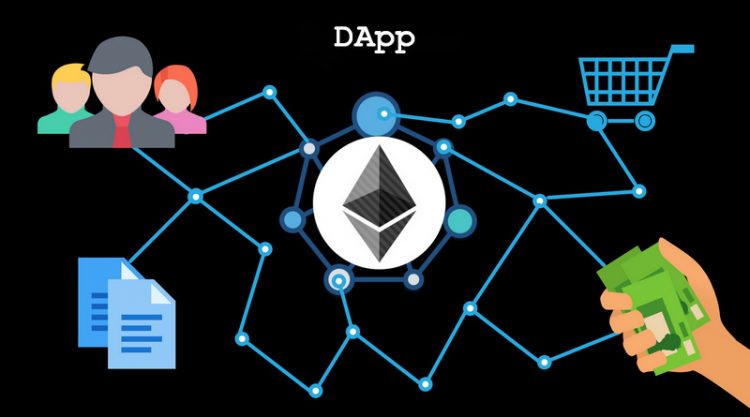

Dapp is an acronym for Decentralized Application, which means decentralized application. It is a new model created by Blockchain technology and Smart Contracts.

DApps are just as diverse as regular apps: they can provide social networking, games, entertainment, and productivity tools, designed as a tool to help consumers access decentralized financial services, also known as DeFi.

DApp first appeared on Ethereum on April 24, 2016. Ethereum has so far remained the dominant server. When it was first established, one of the main goals of the network was to make it easier to create DApps.

If there is an app that meets all 4 criteria, then the application is DApps:

- Open source: The app’s source code is available to everyone.

- Decentralization: Use blockchain-like encryption technology.

- Bonuses: The app has cryptocurrencies/digital assets for self-fueling.

- Algorithm/Protocol: Create tokens and have consensus mechanisms available.

DApp Classification

If divided by application, DApp can be divided by use purpose such as exchange, game, finance,…

If divided by blockchain, DApp will be divided into 3 categories:

- Type I will work on their blockchain. For example, Bitcoin and Ethereum.

- Type II are protocols that work on the blockchain of type I. These protocols themselves have the tokens needed for their functionality.

- Type III are protocols that work using protocols of type II. Similar to Type II, type III also has the tokens needed for their functionality.

Xem thêm: Market Capitalization Là Gì? Ý Nghĩa Của Giá Trị Vốn Hóa Thị Trường

Does DApp depend on smart contracts?

Basically, users can use DApp in a variety of ways. Perhaps the simplest method is that users can exchange Ether (the currency of the Ethereum platform) to settle a financial contract with another user.

Other forms involve information that is not just stored on a blockchain. For example, an insurance application may verify and adjust the terms of the agreement, but it is up to a number of factors to verify the authenticity of the insurance claim.

To do this effectively, some of them use Smart Contracts based on external information provided by “Oracles” – trusted specific information provided to inform about how and whether the contract was executed. These are self-made agreements with terms between the buyer and seller written into code. Smart contracts are resolved automatically when meeting predetermined conditions, eliminating intermediaries and reducing costs and risks when trading.

In recent years, some interesting DApps have emerged. The Golem project, for example, aims to create a market where users can rent, use, or lease backup computing to form a decentralized global supercomputer. Augur intends to create a decentralized forecasting tool for traders. Or CryptoKitties – a game in which players can own, breed, and sell virtual cats to acquire Ether.

Finally, perhaps the most ambitious form of them is a decentralized self-governing organization (DAO). In a DAO, users around the world use Ethereum to form an organization without leadership. In the past, DAO has been used as a form of decentralized Venture Capital fund, in which users can vote to issue funds for specific projects.

The term will continue to evolve as developers will create new technologies within the blockchain platform and aim to decentralize the day-to-day services found on the internet.

See Also:

Ethereum Killers

Ethereum has suffered major losses in 2020, with DApps from two booming segments overwhelming it, often making transactions slow and very expensive.

The first of these to overwhelm Ethereum is DeFi, with DApps from protocols such as Compound, Aave, and Uniswap leading the way. Next up is the irreplaceable token, or NFT, which is used for everything from digital art like NBA Top Shots and Beeple’s nearly $70 million collage to real estate and merchandise.

While Ethereum seeks to solve its problems by moving from a Proof-of-work consensus mechanism to proof-of-stock proof — also known as Ethereum 2.0 — it’s a long and slow process that allows some other blockchains to compete like the DApp platform, Notably Cardano, EOS, Polkadot and more recently Binance Smart Chain (BSC).

In fact, BSC surpassed Ethereum in the number of single active wallets in Q1 2021, with Ethereum’s 105,000 to 75,000, according to DappRadar.

Ethereum, however, is the clear leader, doubling its total locked value (TVL) to $54 billion in the first three months of 2021. And it has some benefits when it comes to DApps, starting with Solidity, a well-established language for writing DApps for Ethereum Virtual Machines. EVM is complete Turing, which means it can perform any operation that a conventional computer can do.