What is GMX Exchange? Detailed user manual of GMX . exchange

GMX is a decentralized spot and perpetual contract exchange that offers low transaction fees and no price impact to traders on the Avalanche and Arbitrum networks.

To do this, trading on GMX is supported by separate liquidity pools that use Chainlink Oracles to integrate prices from the largest volume exchanges.

- The project aims to become an exchange that can combine the advantages of DeFi and centralized exchanges like Binance or Bybit.

Basic information of GMX

- Website: gmx.io

- Supported Chains: Arbitrum, Avalanche,,….

- Supported Wallets: Metamask, Coinbase Wallet, Wallet Connect,…

- Feature: Swap, Perpetual futures, Earn, Provide Liquidity

- Audit: ABDK Consulting

- Availability: Website

Highlights of GMX Exchange

- Buy/sell properties easily with a simplified user interface.

- Close/open Futures position without slippage or price impact.

- Prices are aggregated from top volume exchanges to give users the best prices while minimizing the risk of liquidation.

- Low latency and gas fees thanks to the launch on Arbitrum’s network – Layer2 of Ethereum.

- Position opening/closing fee is only 0.1% of trading volume.

- Provide stable passive income for token stakers thanks to the revenue stream from a product that already has a certain number of users and is expanding.

The mechanism of action of GMX

How can GMX provide users with even zero slippage and price impact?

It is thanks to the combination of the novel liquidity provision mechanism through GLP and the integration of Chainlink Oracles to track the best market prices for users.

When users provide liquidity for the GMX protocol , they will need to use assets accepted by the protocol (ETH, WETH, BTC, LINK, UNI, USDC, USDT, DAI, FRAX) to buy GLP. The GLP token will now be like an asset index in the GMX protocol, its value will be calculated based on the formula:

(Total value of assets including profit and loss of open positions in the protocol) / (total supply of GLP in the market)

After using assets to buy GLP, those assets will be stored in an independent pool instead of pairing with another token like the AMM model.

At this time, when a user opens a long/short position, or performs a swap on GMX, the protocol will use Chainlink Oracles to aggregate the price of the asset that the user is looking to trade from many different markets and returns the best result. The protocol will then match the order that the user places at the price reported by Chainlink Oracles and use the token in the pool with a volume corresponding to the volume of the user’s order. Since then, GMX has solved the problem of Arbitrage in traditional AMM, or order-book models.

User manual for GMX . products

Perpetual futures and Swap

- Go to: https://app.gmx.io/#/trade and connect wallet

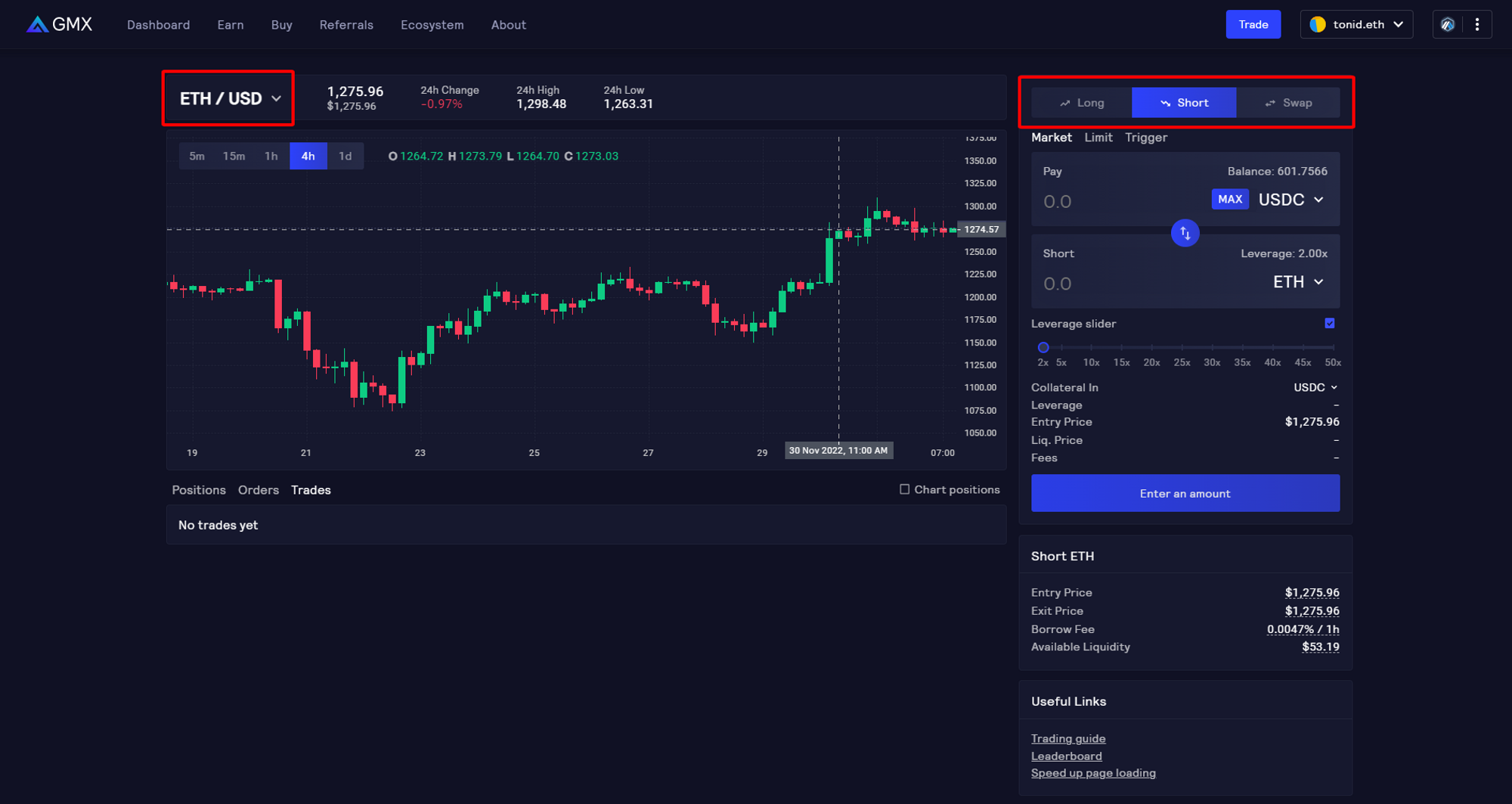

- In the trading interface, you will see there are 3 features: Long , Short and Swap and graphs with corresponding assets.

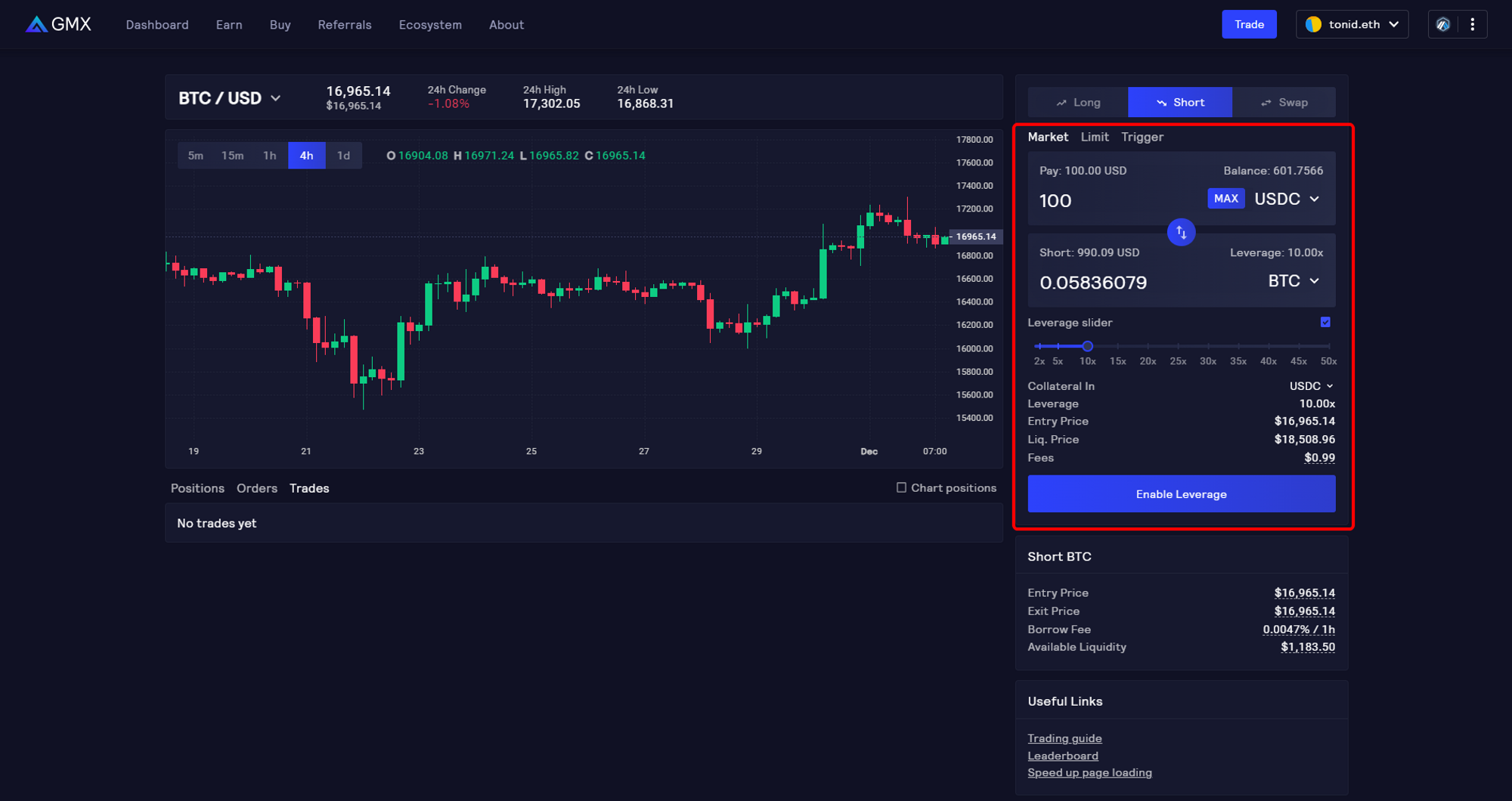

Trading features of GMX - Ecoinomic will try to open a Short BTC position with collateral of 100 USDC with 10x leverage (Note this is not investment advice). You will have to pay attention in the Pay section (the asset you use as collateral when opening a Future order or the asset you want to sell for swap), Leverage (the leverage you want to use for your future position).

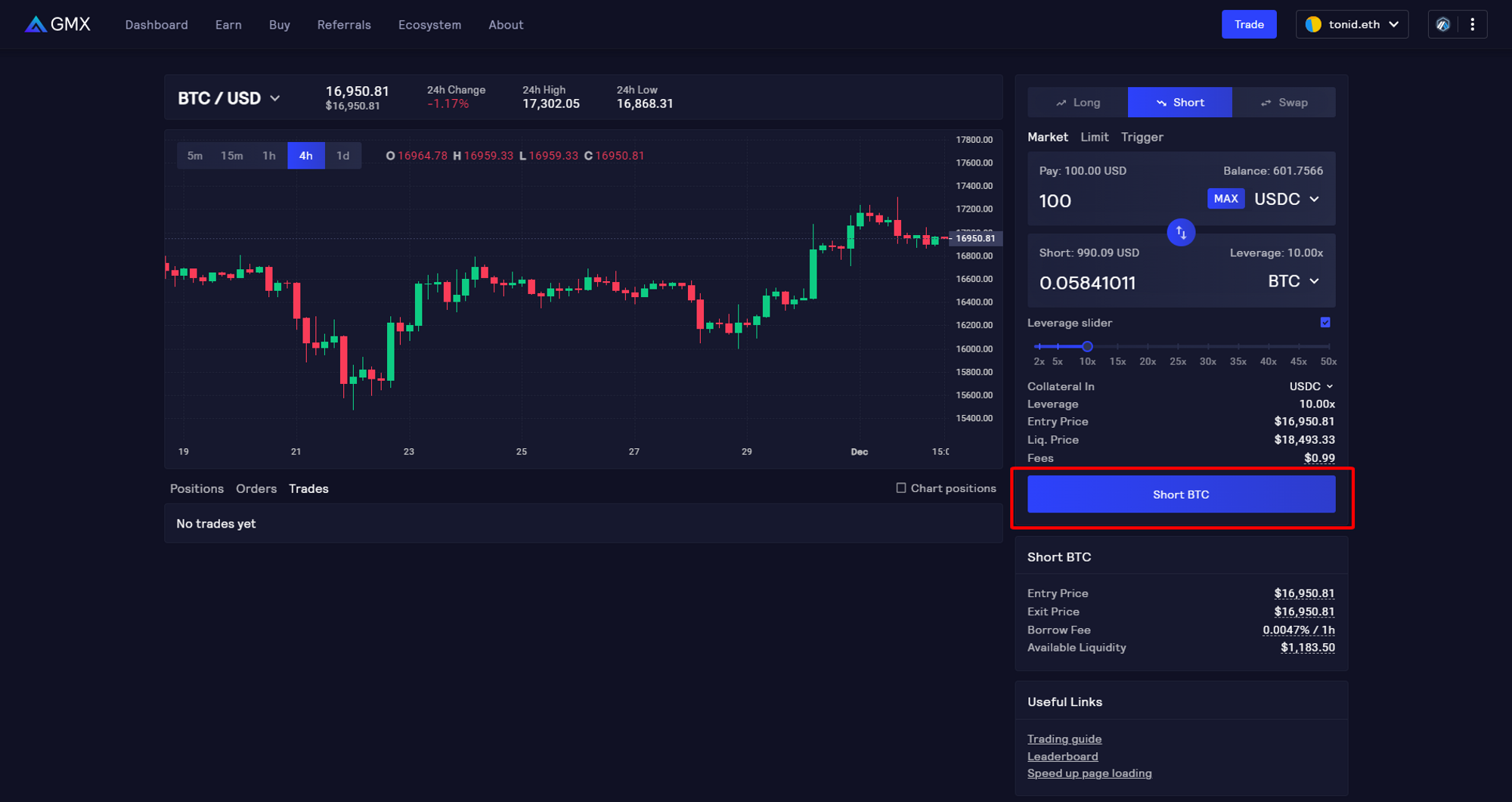

Customize your position - After Enable Leverage and Approve Collateral (Only for First Time Use). Users will be able to open orders with Short BTC option

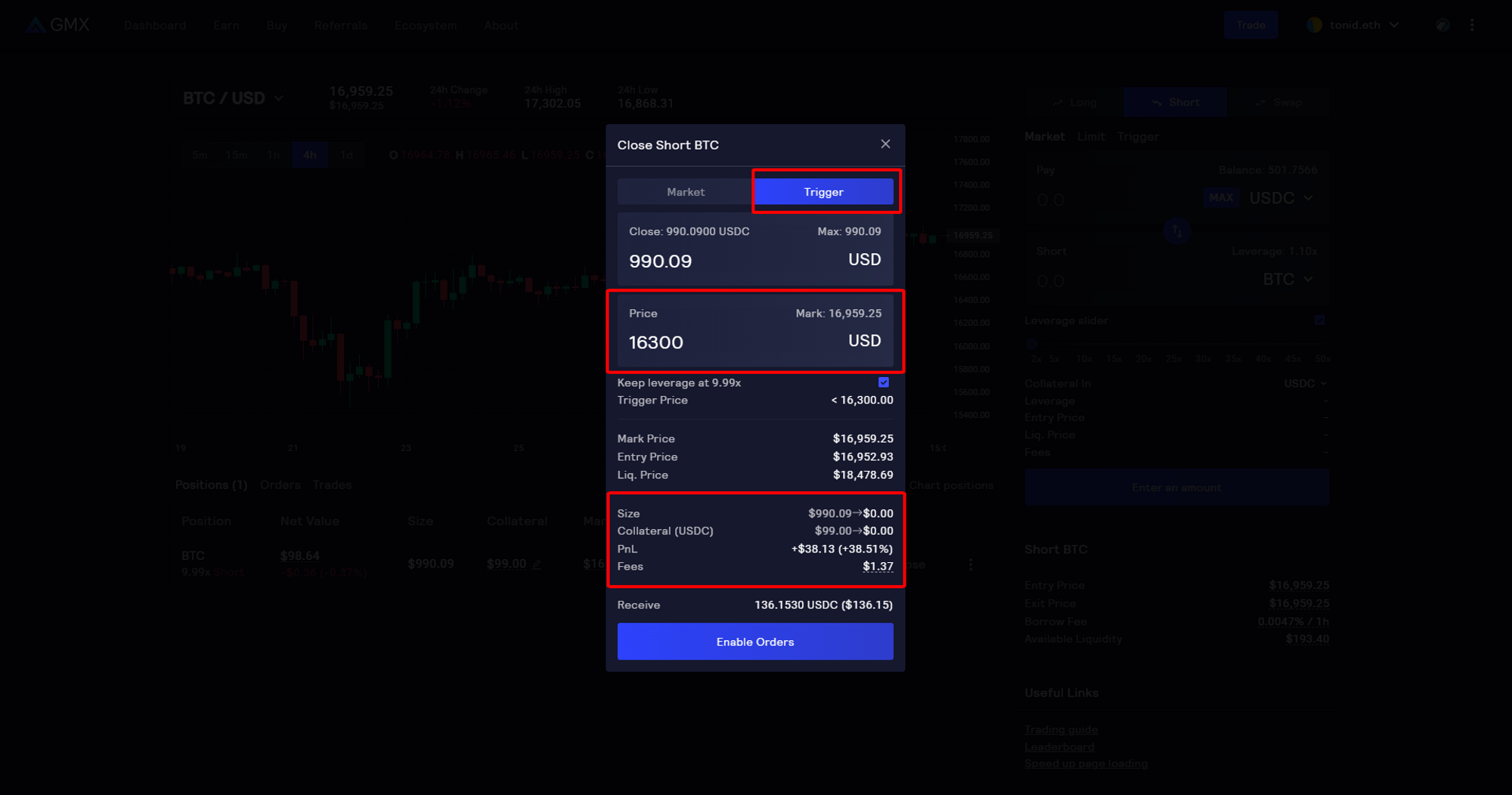

Confirm your position - After opening the order, the user can control his position in the Positions section . Select Close and close the order at Market price if you want to close the position immediately.

- If you want to close the order with the limit price (stoploss/take profit), the user can choose Trigger and enter the price you want to place the order and select Enable Orders . The protocol calculates the user’s PnL according to the set price.

-

Set limit orders (Take profit/Stoploss)

Provide Liquidity

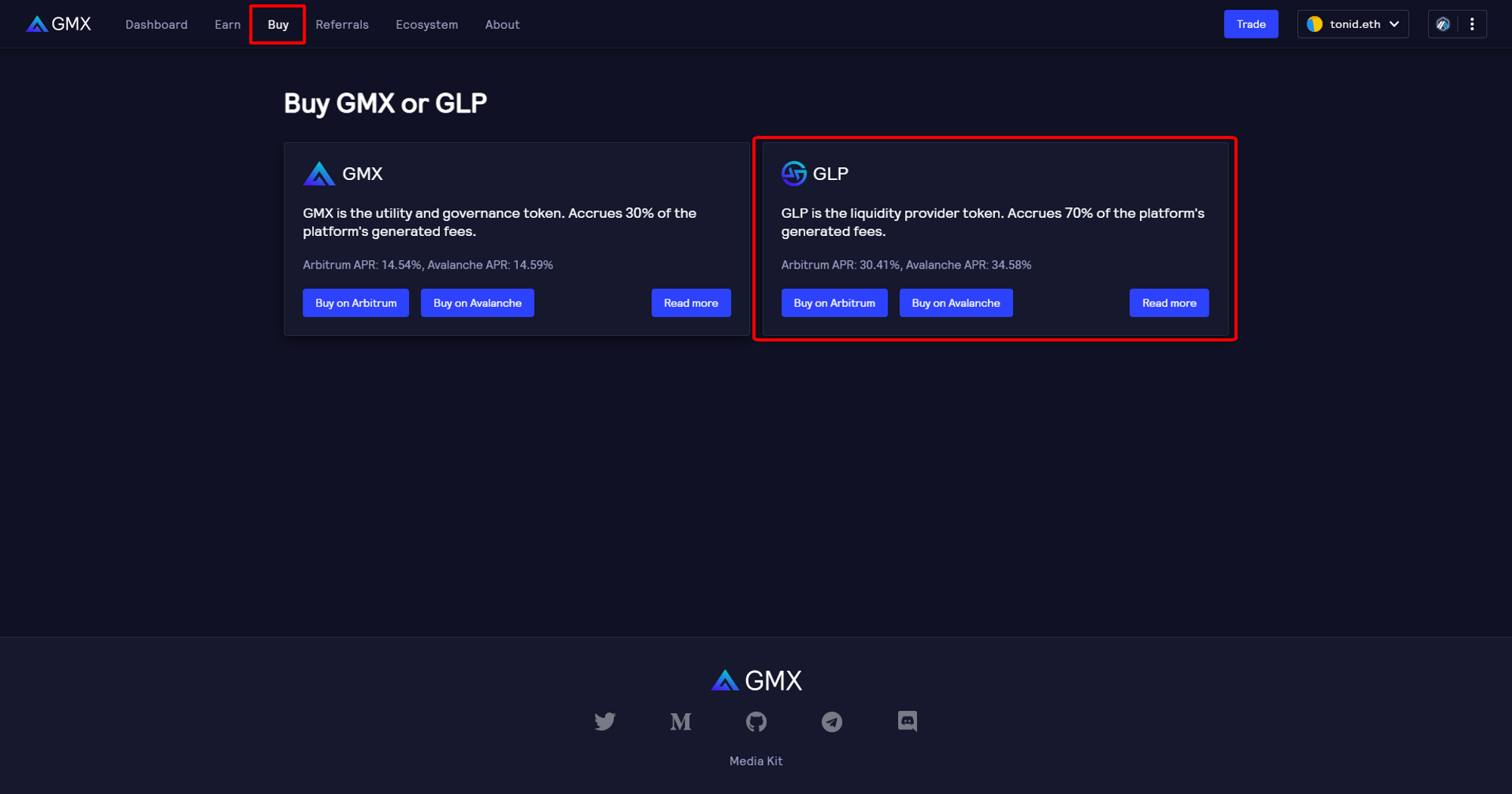

- Providing liquidity in GMX will choose Buy to Buy GLP or you can access the link: https://app.gmx.io/#/buy_glp

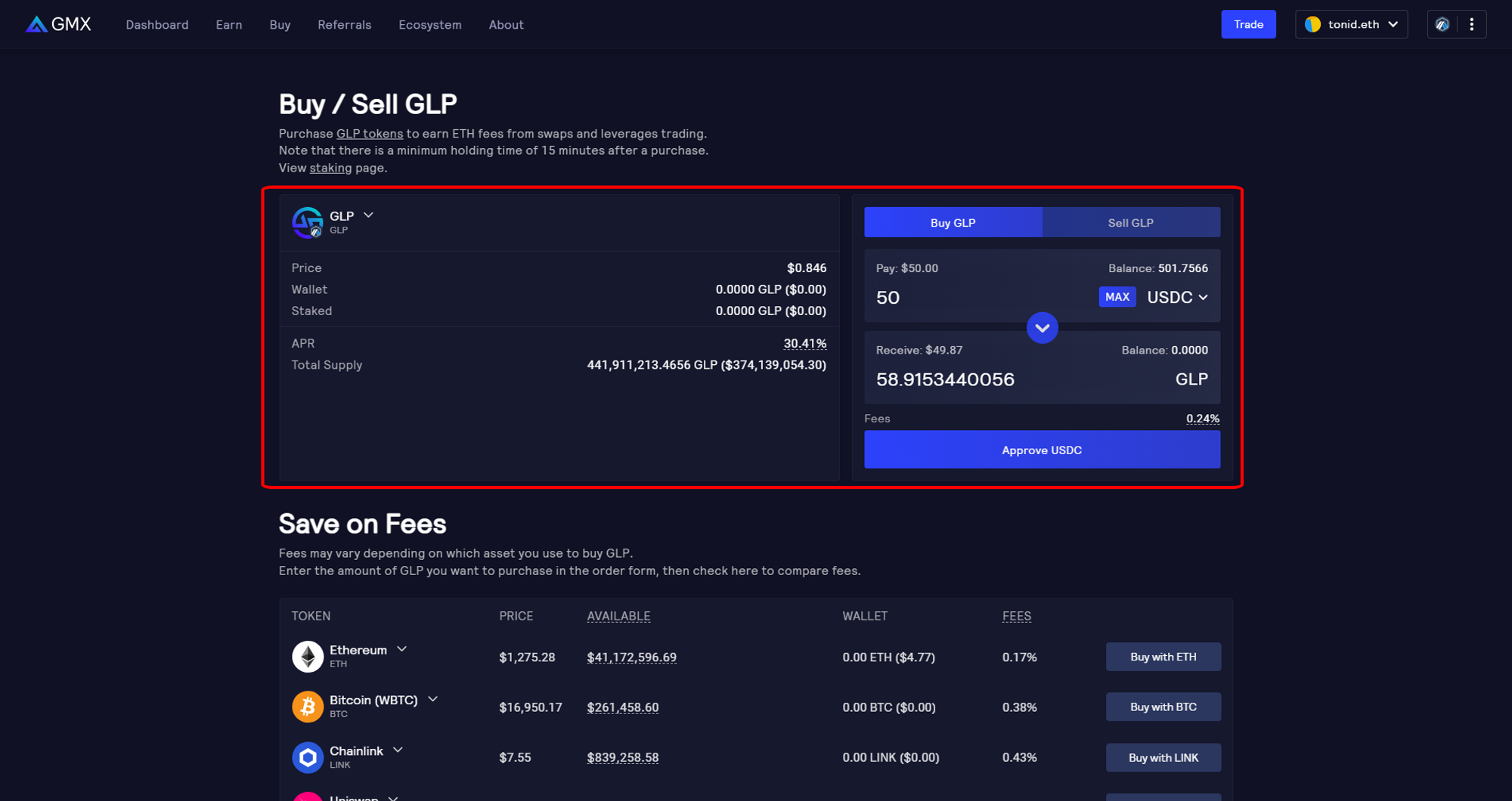

Provide Liquidity feature through Buy GLP - Users can check the price of GLP, APR when holding GLP to be able to make decisions in accordance with each person’s investment strategy. Then, select the asset you want to provide liquidity (used to buy GLP) to execute the trade.

Customize when Buy GLP

Note: Each asset class will have a transaction fee and fluctuate from time to time based on the asset value in the pool.

Earn

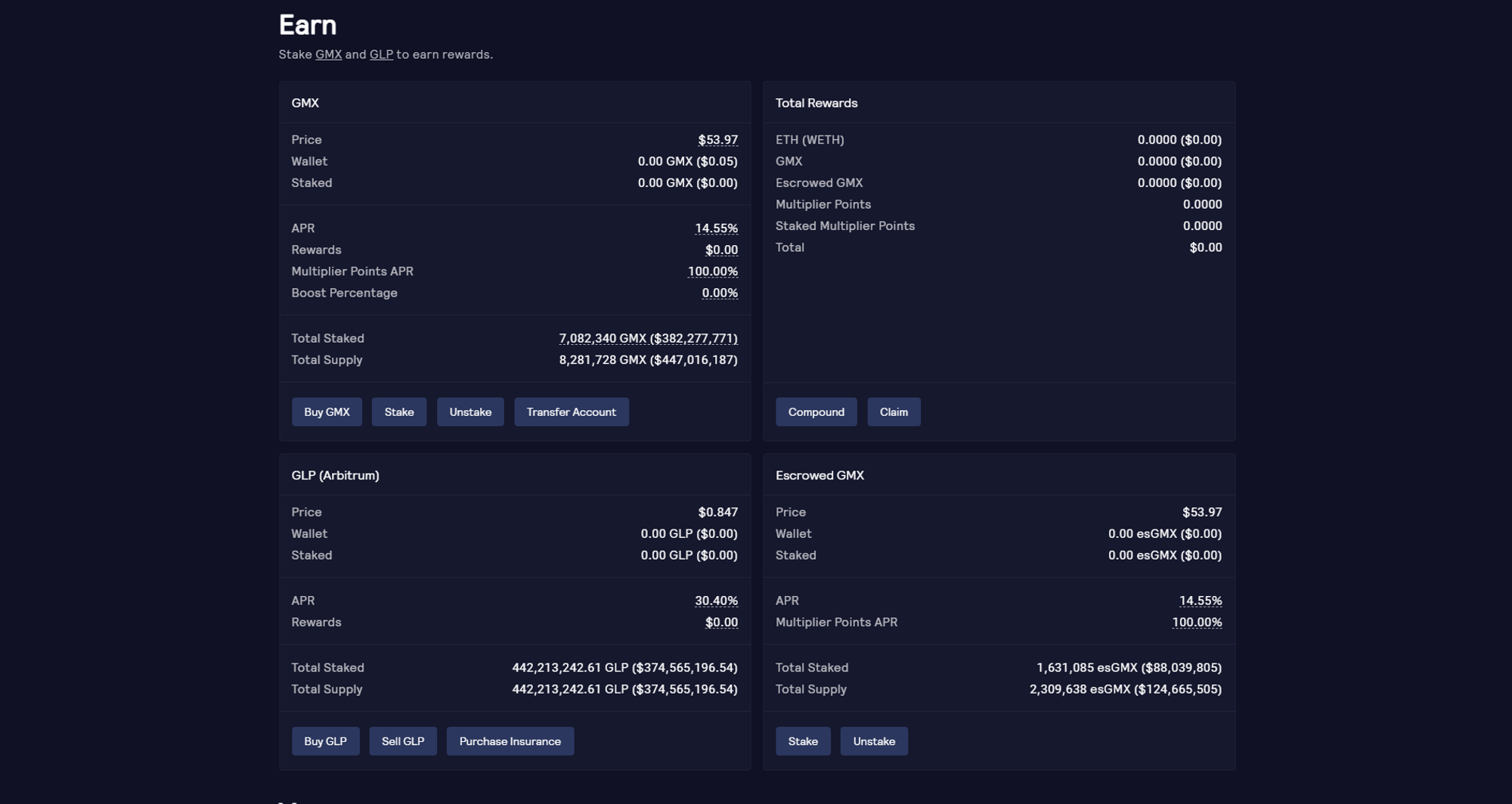

Users can stake both GMX and GLP tokens to receive rewards from project revenue and esGMX tokens. Each token will have a different APR and fluctuate according to the performance of the protocol.

- Go to https://app.gmx.io/#/earn

- User can view APR of each asset class and participate in Stake, Unstake, Claim, Compound.

Interface of Stake options

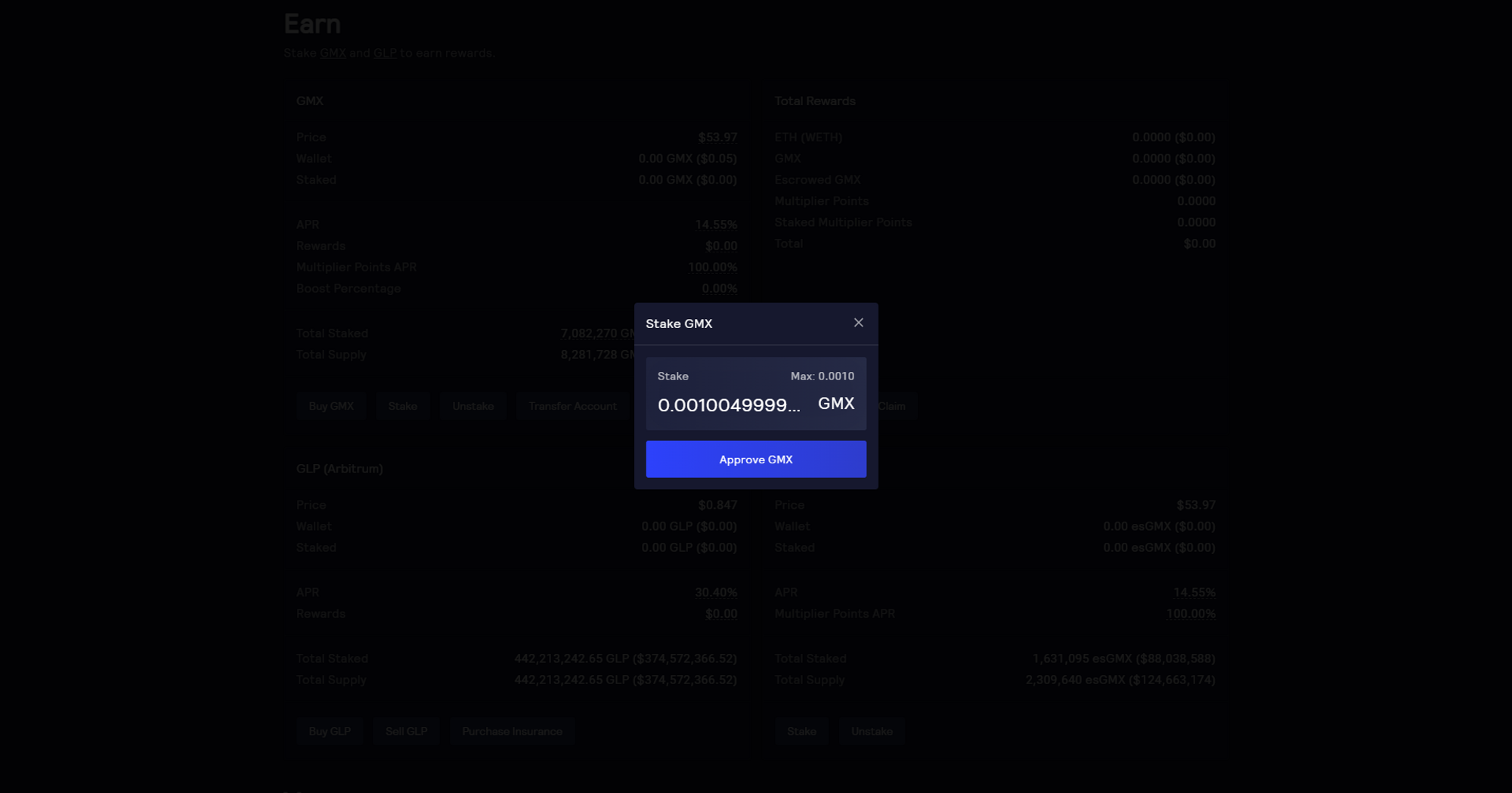

- Select Stake and enter the amount to complete the task.

Staking Execution Process Frequently asked questions about using GMX

Is GMX safe? How to ensure safety when using GMX

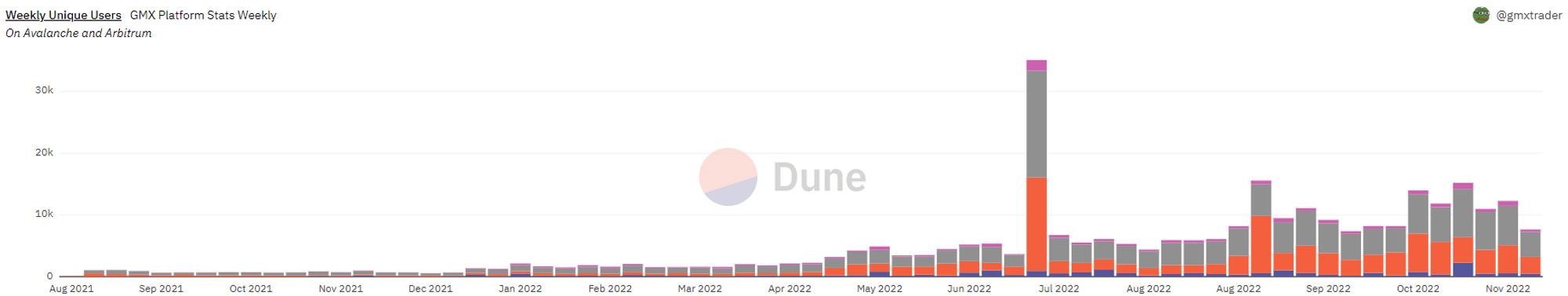

GMX is a leading protocol on the Arbitrum ecosystem, it is attracting a relatively stable user base and tends to grow steadily.

Users of GMX Weekly The project has also been audited by ABDK Consulting and has not encountered any attacks since its official operation. Users can rest assured when trading on GMX.

However, any DeFi protocol carries risks that the community does not expect, especially with a protocol with many assets in circulation like GMX. To ensure the safety of assets, users should use their own wallet to interact with GMX, should not store large amounts of assets in a DeFi participating wallet unnecessarily. If the protocol goes down unexpectedly, the user’s risk is minimized.

Similar apps to Ecoinomic

- dYdX

- Synthetix Network

- Gains Network

- Perpetual Protocol

- MUX Protocol