Advertisement

In this article, Ecoinomic.io will guide you to trade Margin and Futures on Kucoin.

What is Kucoin Margin Trading?

- Allows users to Borrow funds from the exchange.

- Users are able to access to greater capital so they will be in a greater position.

What is Kucoin Futures Trading?

This is Kucoin’s trading platform for investors who want to bet on the future of an asset. You make a profit by placing orders and predicting the rise or fall of the price of a contract representing a cryptocurrency over a certain period of time.

To have a better understanding of Kucoin Futures, let’s assume that you anticipate the price of Bitcoin to rise, you execute a long order. Then the BTC price meets a resistance zone and turns bearish that results in losing your funds.

Changes in prices will be often affected by supply and demand. However, in some cases it is also influenced by external factors (crowd psychology, economic policy, macro situation…).

Pros and cons of Kucoin Margin and Kucoin Futures

Advantages of Kucoin Margin and Kucoin Futures

- On both Margin and Futures, users can use leverage. They will have an amount of funds to trade many times larger than the amount of capital.

- Diversify your portfolio, you will have more investment options.

- Investors can choose the Cross Margin or Isolated Margin mechanism when opening a position

- High liquidity

- Smooth trading system, fast order execution

– Kucoin Cross Margin is a mechanism that allows using all funds in futures/margin accounts for the purpose of keeping your assets from being liquidated. Using Cross Margin helps you make huge profits.

However, if you suffer losses and reach the maintenance margin level in the process of trading, the system will automatically send you a message that requires to add more funds to your account to maintain your position. This is called Call Margin.

If there is no funds left to deposit, the system will help you liquidate the position and you will burn your account.

For example, you invest $300 and the Margin balance in your Futures/Margin wallet account has $3,000. When the position is at risk, it will automatically deduct from $3,000, which will be liquidated when the funds in the account run out.

– Isolated Margin Kucoin is a mechanism that limits the amount of coins traded each transaction. This mechanism makes it easier for you to control risk and lower risk than Cross Margin.

When you lose assets and fall below the maintenance margin, you will only lose the amount that you used to open the previous order without affecting the total balance on the wallet.

For example: Futures/Margin wallet balance is $1000, you open a Short TRX position with the amount of $200. If you deal with a risk, you only lose $200 and will not be deducted from the remaining $800 in your account.

Disadvantage of Kucoin Margin and Kucoin Futures

- You will deal with a high risk of burning your account if you use large leverage, using leverage is very dangerous when the market is highly volatile

- Prone to price manipulation: The price of a crypto asset will sometimes be changed suddenly and unexpectedly by those who hold cryptocurrencies in large quantities. Therefore, your prediction is wrong and your assets will be liquidated.

>>> Related: What is Futures? What is margin? Compare Margin and Future.

Kucoin Margin Trading Guide

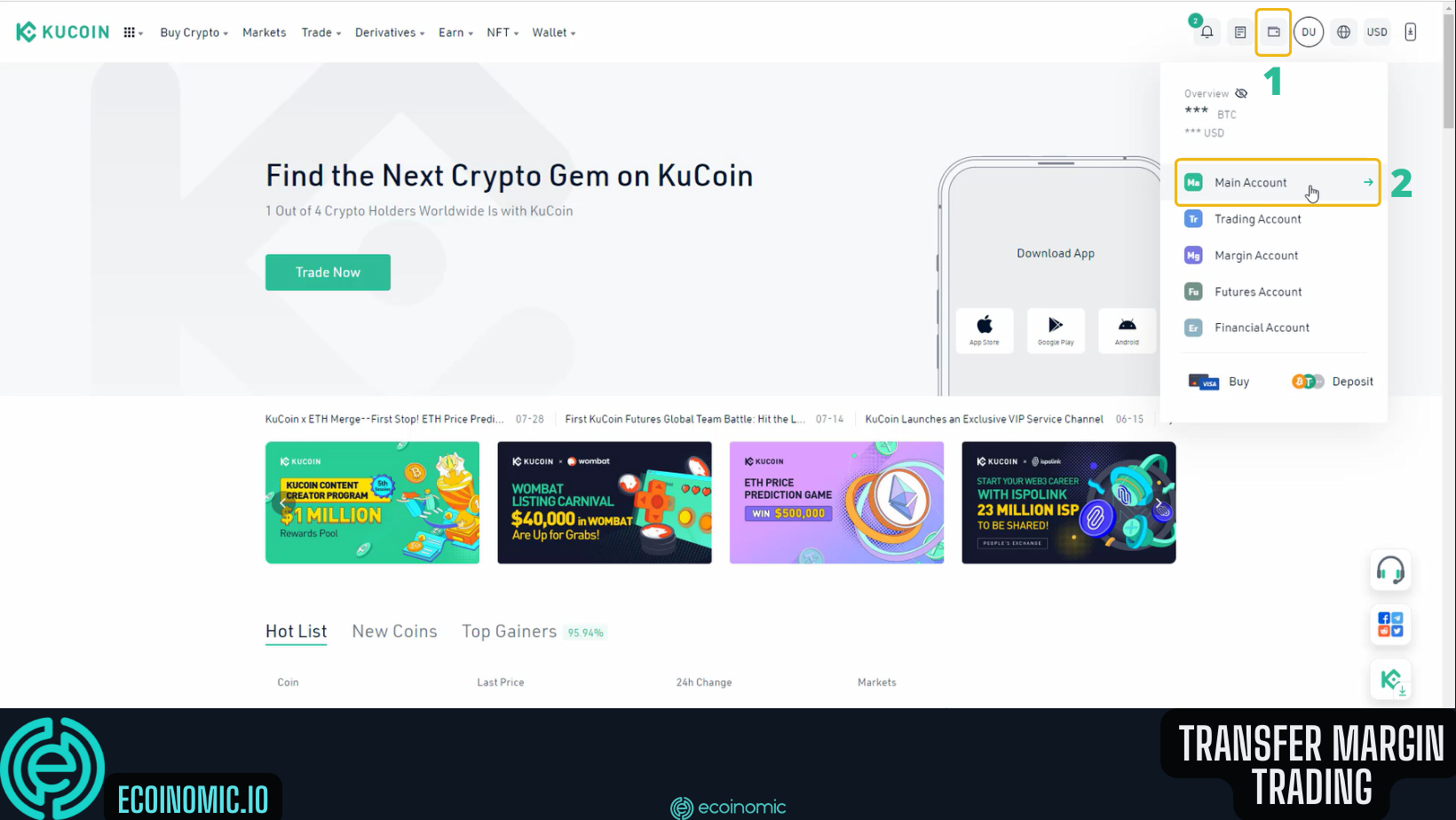

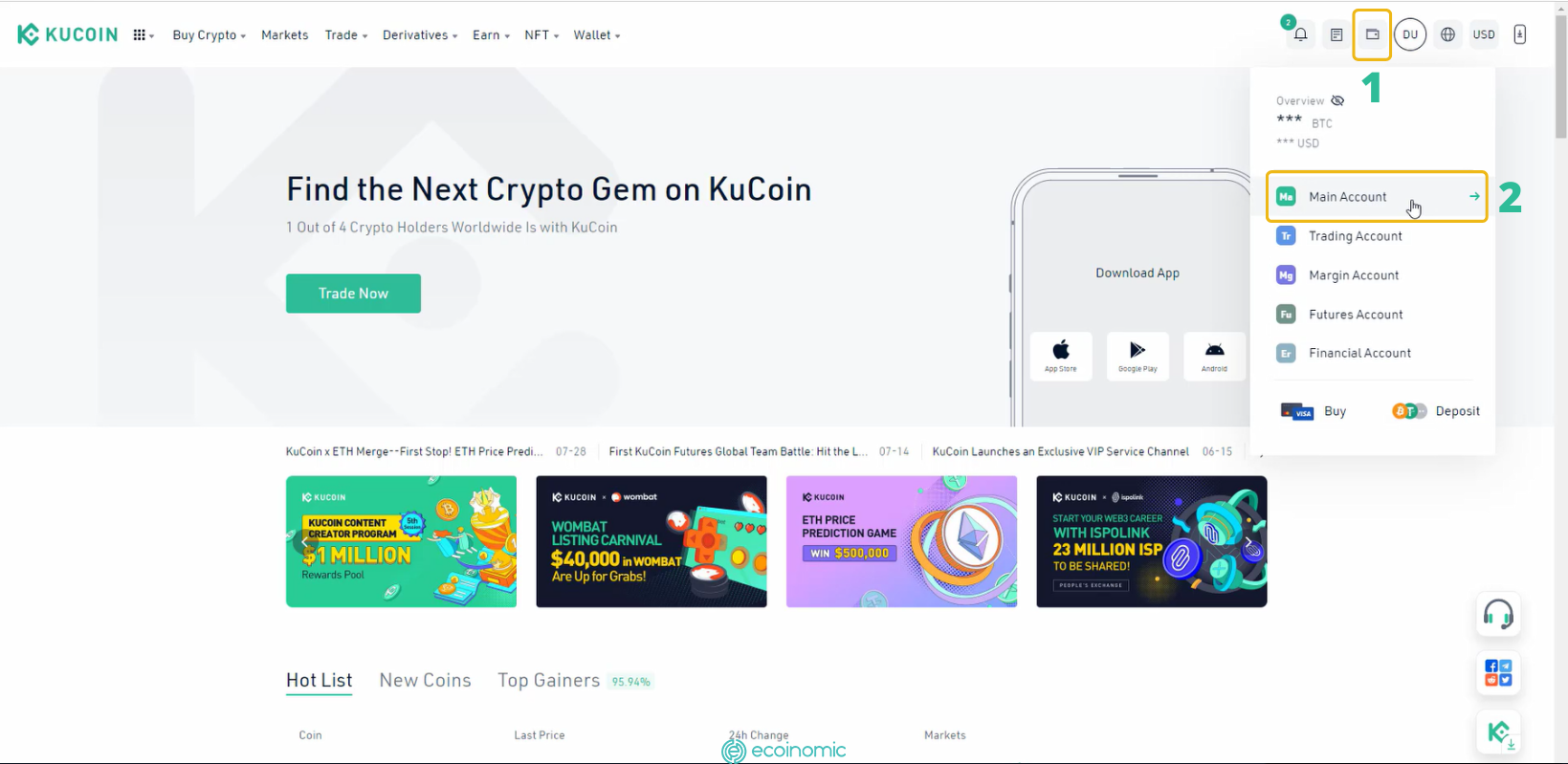

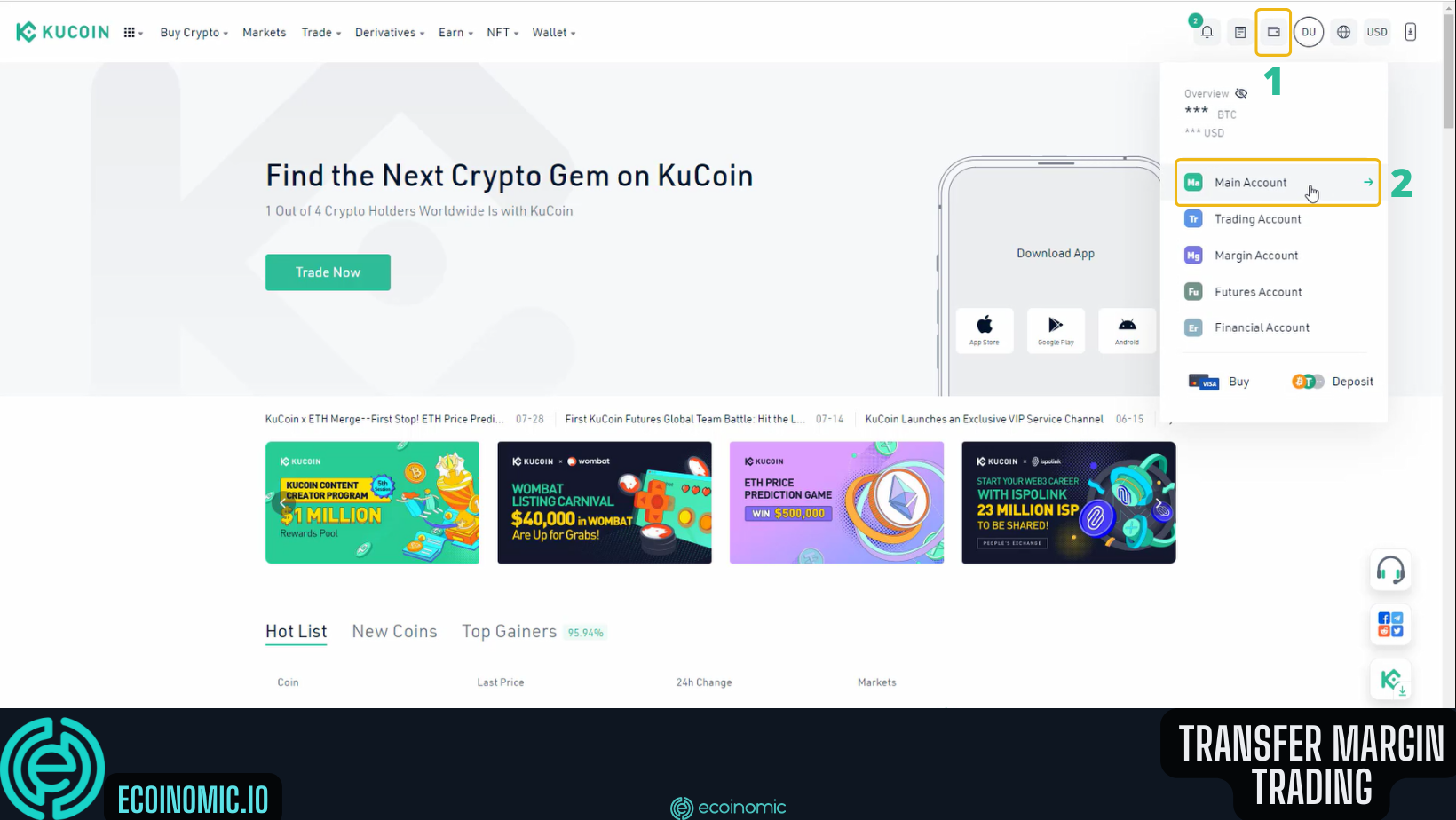

Step 1: After successfully logging into your Kucoin account. Click on the “wallet” icon, select “Main Account”.

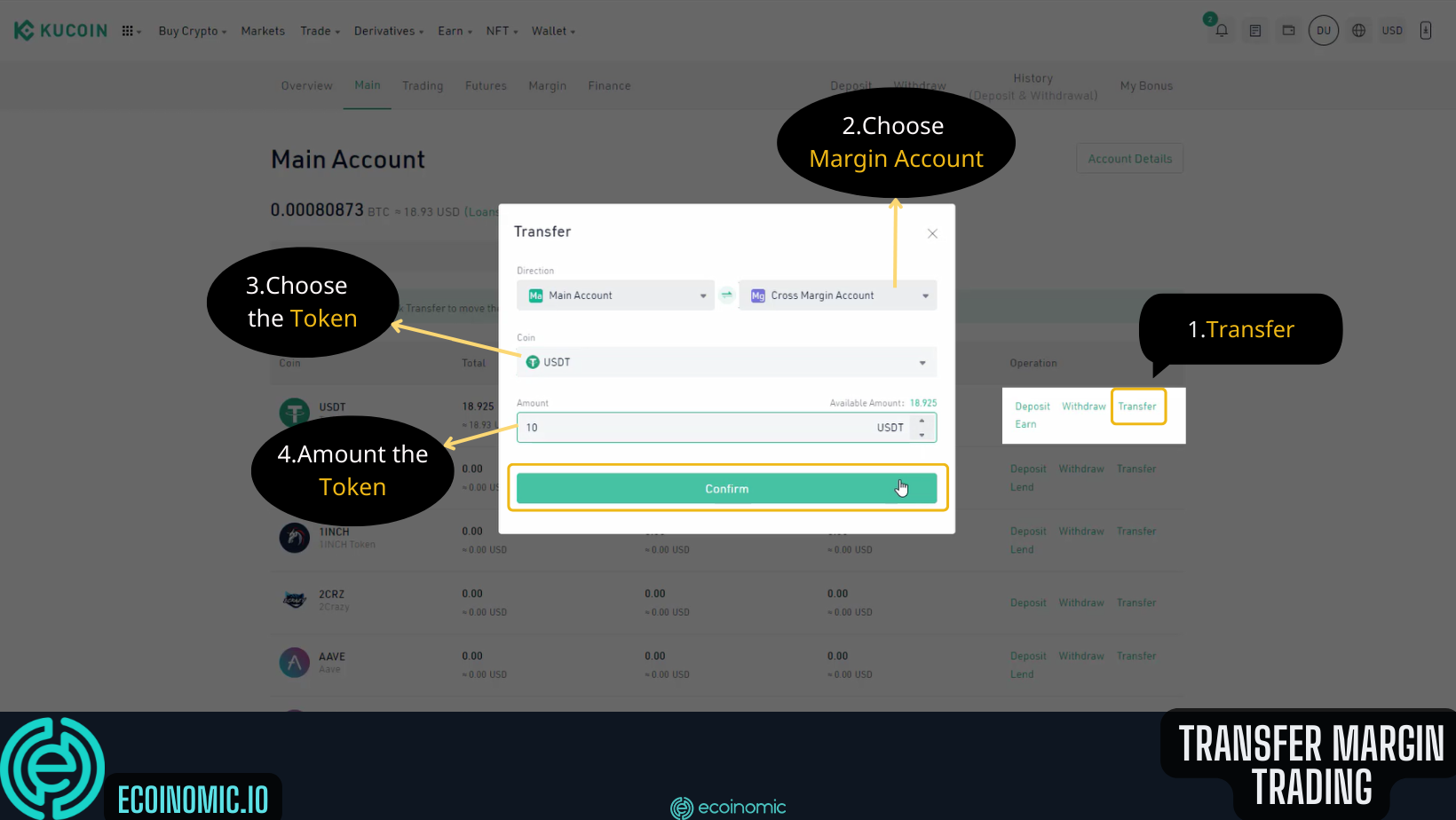

Step 2: To start Margin trading, you must transfer funds to Margin wallet. First, select “Transfer”.

Select the Margin account you want to use at “Margin Account” section.

Select the coin/token you want to trade at “Coin” section.

Select the amount you want to trade at “Amount” section.

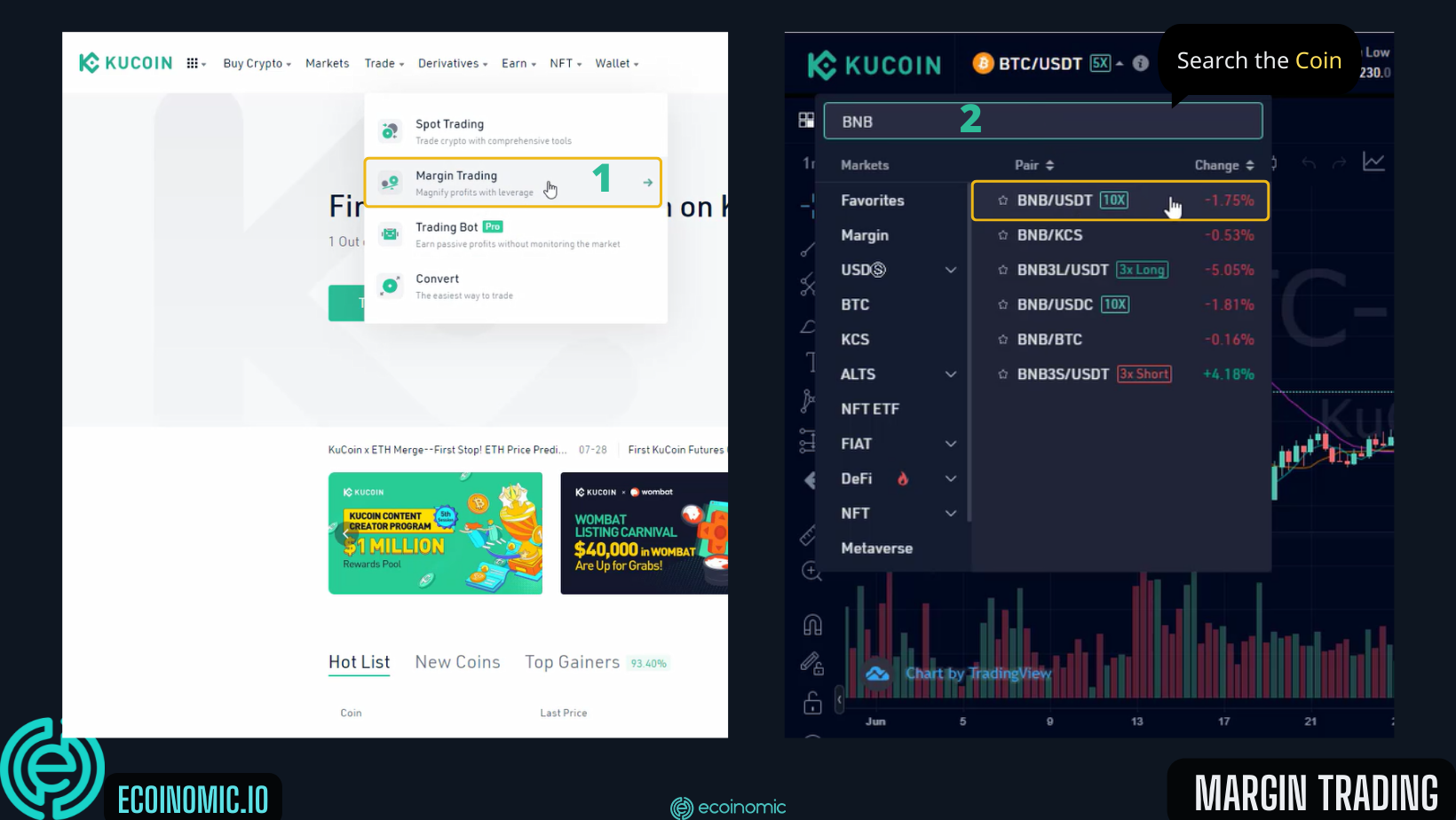

Step 3: Select “Trade” ⇒ “Margin Trading”, then choose the trading pair you want.

Step 4: Open a sell position by placing a Limit order

Choose between Cross Margin and Isolated Margin.

At “Price” section, select the price you want to buy.

At “Amount” section, select the amount you want want to buy.

Open a sell position by placing an Limit order

Select “Limit”.

Choose between Cross Margin and Isolated Margin.

At “Price” section, select the price you want to sell.

At “Amount” section, select the amount you want to sell.

Step 5: To cancel the order just placed, select “Open Order” click “Cancel”.

Kucoin Futures Trading Guide

Step 1: After successfully logging into your Kucoin account. Click on the “wallet” icon select “Main Account”

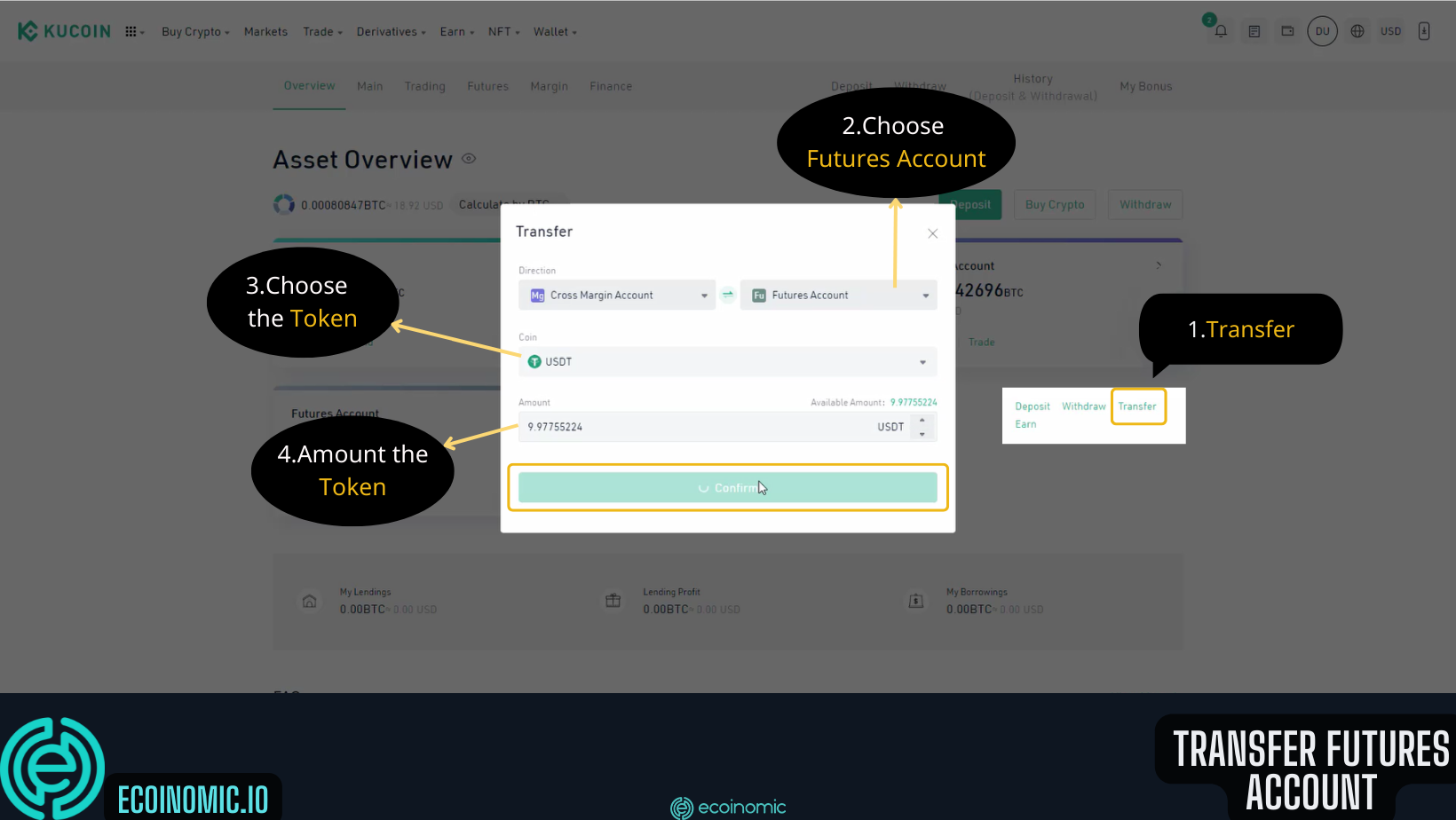

Step 2: Transfer funds to your Futures wallet to start trading futures contracts.

First, select “Transfer”.

Select “Futures Account”.

Select the coin/token you want to trade at “Coin” section.

Select the trade amount at “Amount” section.

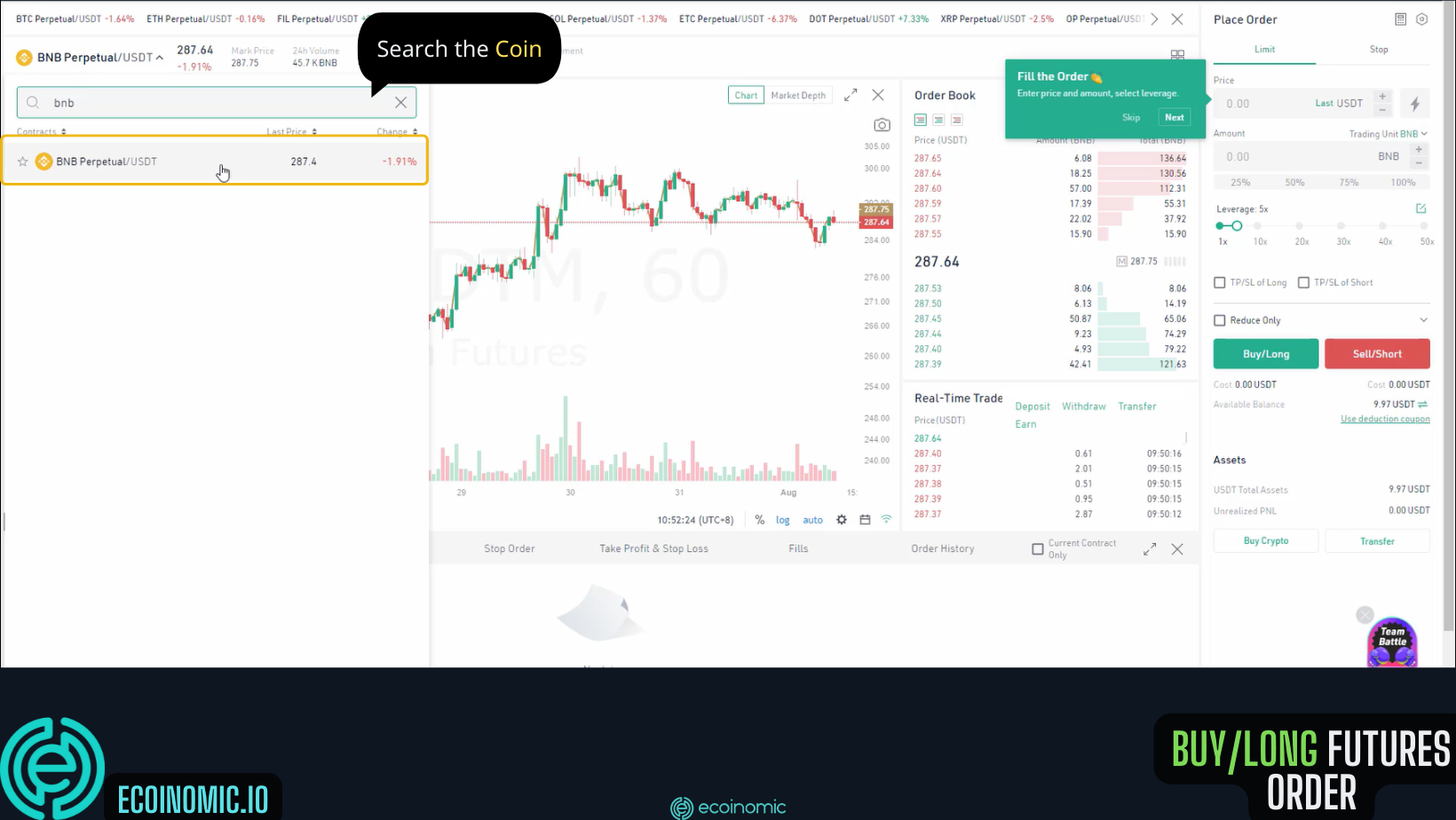

Step 3: Select “Trade” – “Futures Trading”

Select a coin contract you want to trade.

Step 4: To open a Long position at the limit price on Kucoin Futures, select “Limit”order.

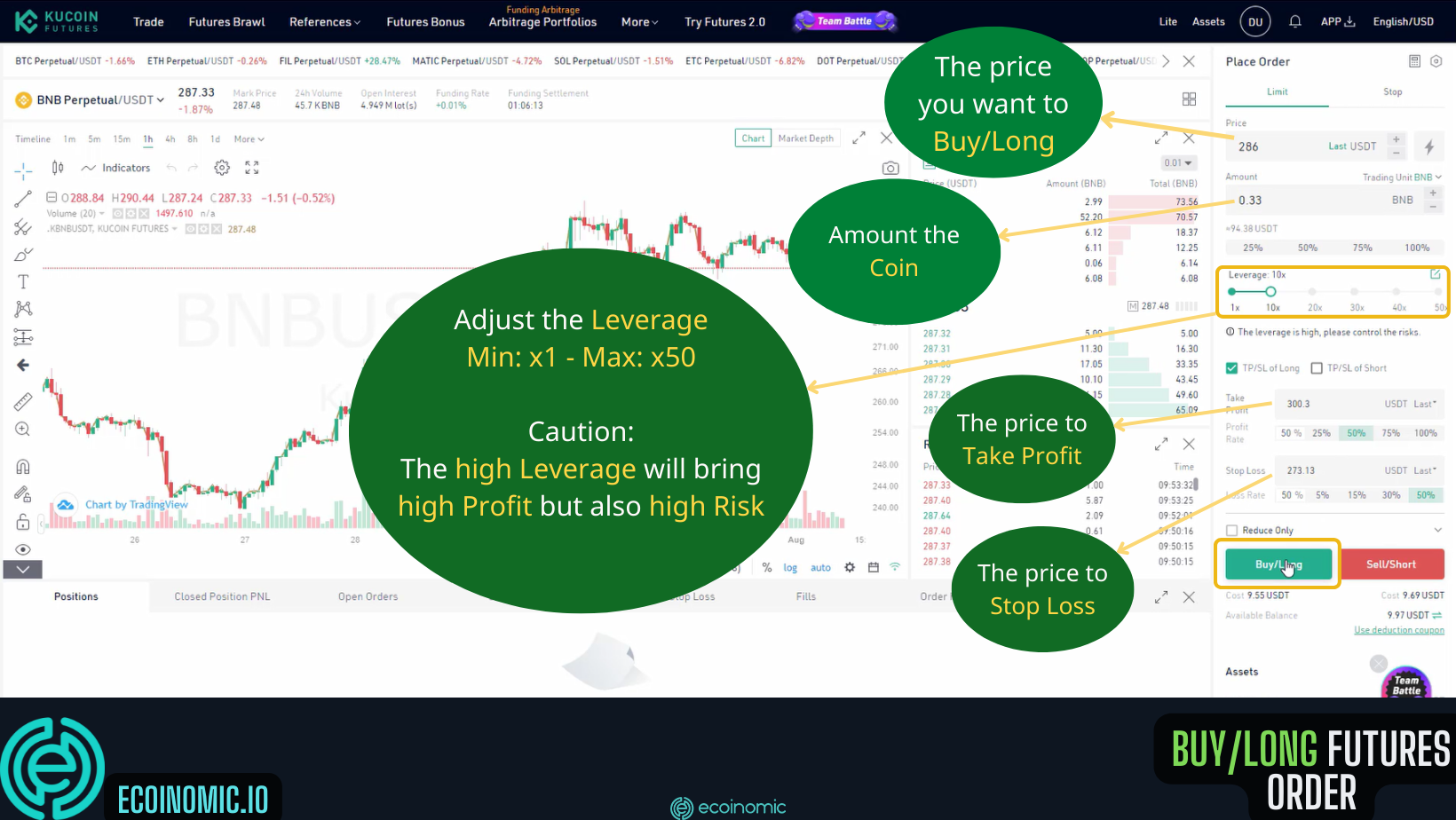

In the “Price” section, select the price you want to buy. When the market price matches the selected price, the system will automatically execute the order.

In “Amount” section, select the amount you want to buy.

“Take profit”: select the price you want to take profit when the rising market price reaches this price, the system will automatically take profit for you.

“Stop loss”: when the market price drops to the price you want to stop loss, the system will automatically sell immediately.

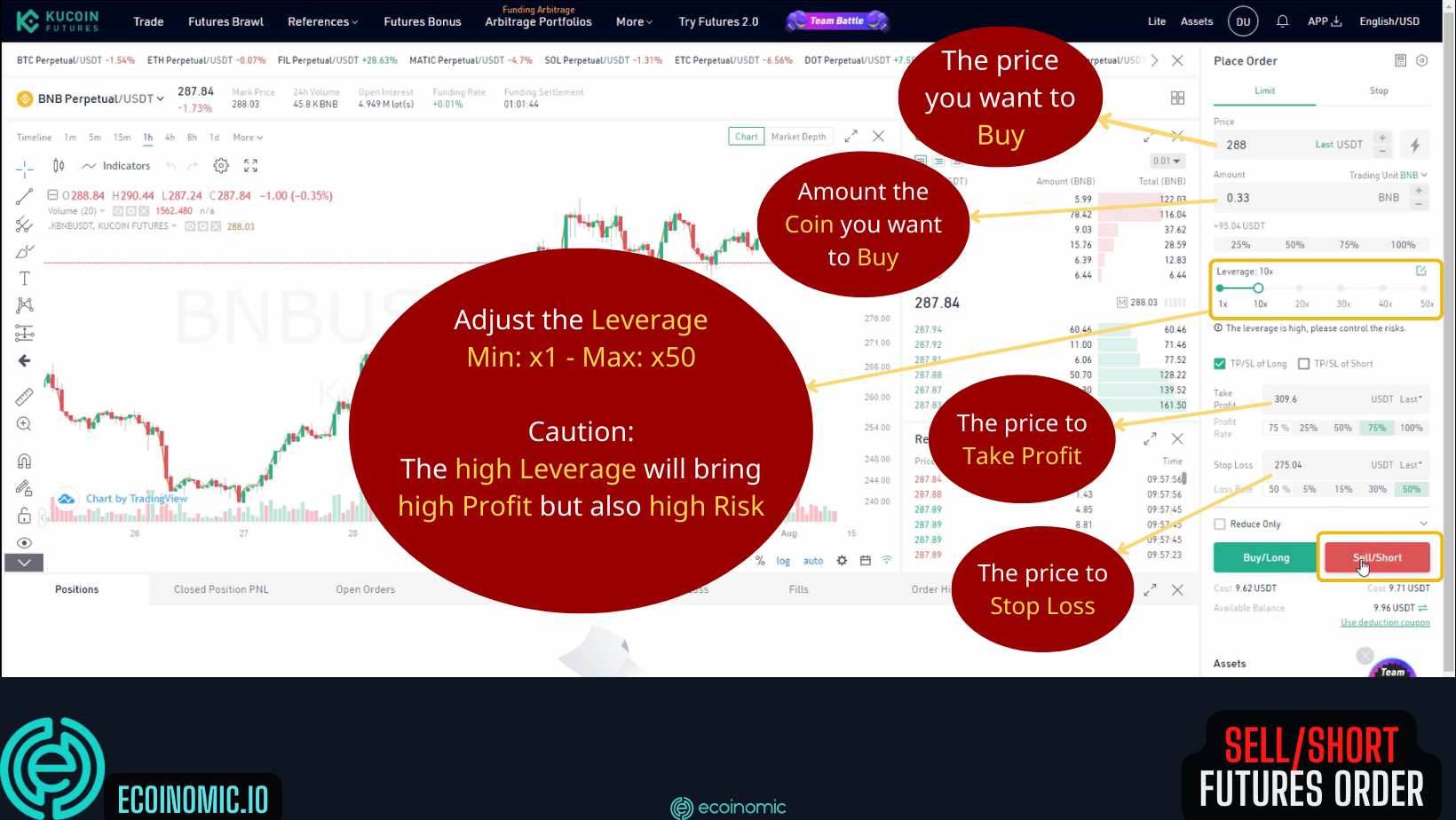

Select the desired leverage.

Note that the higher the leverage, the higher the probability of increasing profits, but the risk is also very high.

To open a “Short” position on Kucoin Futures, select “Limit” order.

At the “Price” section, select the price you want to sell. When the market price matches with the selected price, the system will automatically execute the sell order.

At “Amount” section, select the amount you want to sell.

“Take profit”: select the price you want to take profit. When the market price decreases and reach this price, the system will automatically take profit for you.

“Stop loss”: when the market price rises to the preset price, the system will close the open position Select the desired leverage level on the crossbar.

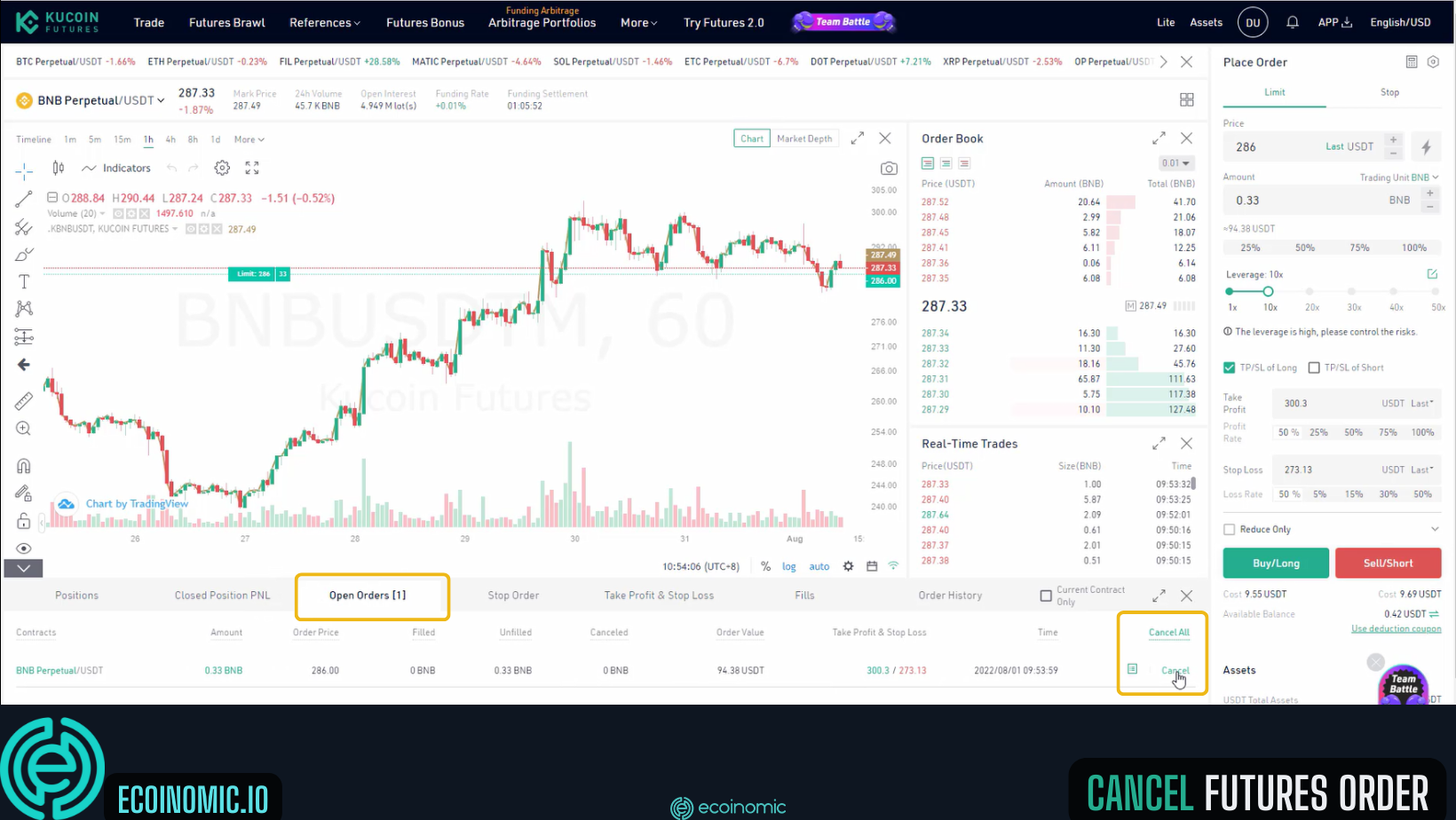

Step 5: To cancel the order just placed, choose “Open Order” and click “Cancel”.

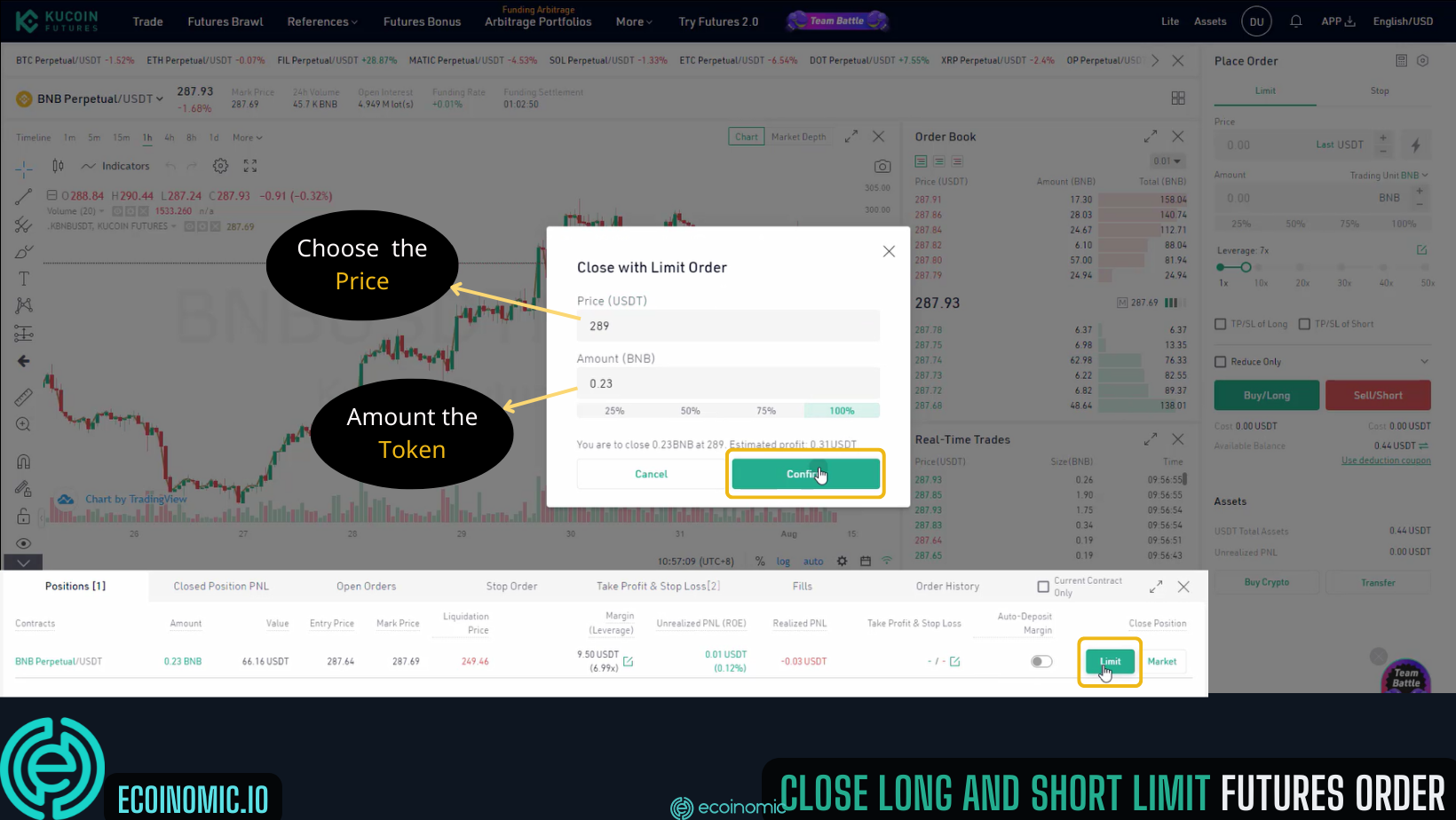

To close an open order on Kucoin Futures, select “Position”

At the Close Position section, click Limit/Market to close the order at the limit price or market price

Conclusion

The above article is Kucoin Futures and Kucoin Margin Trading Guide. Despite their huge profit, they are also extremely risky, especially for inexperienced traders. Therefore, you need have a good knowledge of cryptocurrency market to make long-term profits.

>>> Related: A complete guide to sign up for Binance account for newbies (20% Lifetime Trading Fees discount)