Advertisement

Along with the advancements of financial instruments on the blockchain, tokenization has become an important part of the cryptocurrency industry. If you are wondering what tokenization is, please refer to the article below!

What is tokenization?

Tokenization is the process of replacing sensitive data with unique identifiers (usual sequences of digits) by using cryptography to store the necessary information while maintaining and ensuring information security.

In particular, tokenization provides an effective solution in the transaction payment process, improving security when paying by credit card.

The purpose of tokenization is to minimize data costs and exposure, improve data security, make the storage and operation process simpler.

Tokenization application

Tokenization technology can be used to encrypt all types of necessary data such as:

- Medical records

- Electoral votes

- Banking

- Stock Trading

- Criminal record

In fact, tokenization is often used to protect credit card data, bank account information, and other sensitive data:

- Store customer information in companies

- Mobile payment wallets (Apple Pay, Android Pay)

- Online payment on e-commerce sites

Difference between tokenization and encryption

| Encryption | Tokenization | |

| Process | Transform information into characters using encryption algorithms and secret keys | Replacing sensitive data into random tokens |

| Decryption capabilities | Data can be exchanged with a third party who has encryption key (depending on the private or public key) | It is difficult to exchange data due to direct access to a token vault mapping token value |

| Application | Direct transaction

Phone payment Ensure data-at-rest security on storage devices (even if the storage media is negotiated or lost, attackers cannot see the actual data without a key) |

Online payment

Recurring payment E-commerce transaction Store customer data across multiple location Reduce PCI scope by transferring tokens to downstream software |

| Risk of data theft | Hackers can use the data if decrypting successfully | Hackers can’t access data |

| Output | Format data or length conservation (Exception: FPE) | Data formatting and length conservation |

| Support data | Structured data (payment cards) and unstructured data (entire files and emails) | Structured data (payment cards, social security books,…) |

Asset tokenization in crypto

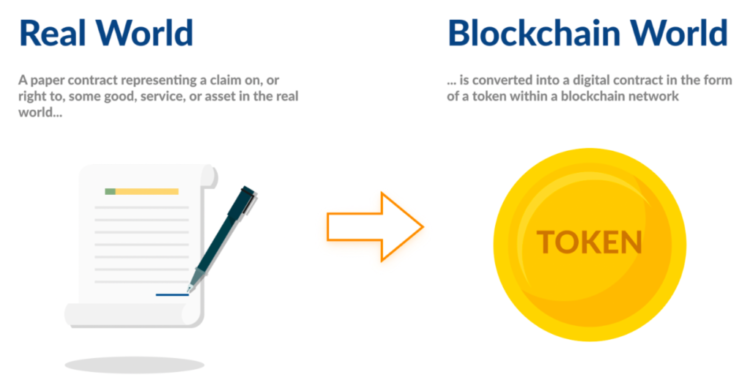

Asset tokenization is the encryption of assets into tokens by blockchain technology.

Asset tokenization represents ownership of assets in the form of NFT through the application of the feature of smart contracts.

Physical or immaterial assets in real life can be tokenized in the blockchain world, from financial products such as stocks, and gold,… to works of art such as pictures, and music,…

After that, NFT holders will profit from the sale and auction of assets on NFT exchanges.

Asset tokenization provides a decentralized alternative, improving the usefulness of assets and enhancing asset value.

Benefits of asset tokenization

For investors

- Accessibility

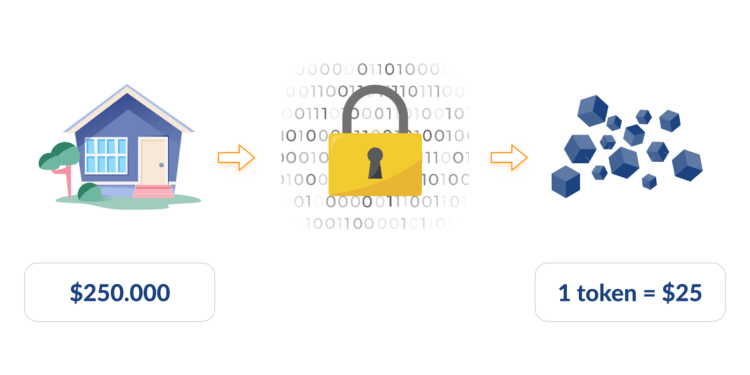

By tokenizing assets into multiple NFTs, asset tokenization gives all traders the opportunity to invest and own a portion of the asset. Even retail investors can invest in a large-value asset with only a small amount of capital.

Therefore, investors can build a strategy to diversify their portfolio, and optimize profits.

- Transparent Process

The data is publicly available so that investors can track, check and validate information easily.

In addition, the immutability of encrypted data improves security, reduces the risk of investment impersonation, and limits the risk of fraud and piracy for artworks or high-value financial assets.

For asset owners

- Liquidity

As assets are tokenized into multiple NFTs, it is easier for investors to access assets. It becomes simpler to transfer ownership, owners can liquidate assets quickly.

Besides, tokenized assets such as houses, land,… can be used as collateral when borrowing ETH, USDT, DAI on lending platforms such as Aave, Compound,… that increases the applicability of asset encryption.

- Reduce management costs

Asset encryption will reduce administrative costs than actually when transferring or buying and selling assets: issuance fees, asset management fees, intermediary procedure costs,…

When assets are encrypted and traded on decentralized platforms, automation shortens the asset exchange process, saving time and costs.

>>> Related: How to exchange assets between ETH, ETHS, ETHW on MEXC

Conclusion

Tokenization technology has ushered in technological advances in the field of cryptocurrencies in particular and the financial market in general. It enhances online transparency and security, contributes to increasing liquidity for the market, improving trading efficiency.

Hopefully, the information Ecoinomic.io provided in the article has helped you understand what tokenization is so you can take advantage of benefits of this technology to make an informed investment.