Advertisement

With a strong growth, cryptocurrencies are becoming increasingly popular and approved globally. What makes a cryptocurrency project or a blockchain network attractive? In addition to the key elements such as advanced technology platform, professional team, high practical application,… strong community is one of the important factors determining the success of the project. The more people involved, the more impact the community will make in the market. This is the impact of network effect.

But what is network effect? In the following article, Ecoinomic.io will give you an overview and analyze the role of network effect in the development of the blockchain ecosystem.

What is network effect?

Network effect is an economic effect refers that a network becomes more valuable to each users when the amount of users of a product or service increases. User’s acceptance will increase the value of products and services to previous users and attract new users.

On the blockchain ecosystem, the network effect reflects the value of blockchains based on the amount of users and transactions in the network.

In addition, network effect determines the value and assesses the development potential of a project in the long term.

For example, when more and more people accept Bitcoin as a means of storage or payment, Bitcoin’s widespread popularity and applicability increases, driving an increase in the value of Bitcoin as well as the entire cryptocurrency ecosystem. The adoption will increase the value of the product for previous users and attract other investors to the project.

According to data from Chainalysis, worldwide cryptocurrency adoption has increased by more than 880% in 2021.

According to Metcalfe’s law, Bitcoin’s network value is directly proportional to exponent 1.69 of the number of users.

Classification of network effect

Direct network effect

The direct network effect describes the increase in new users leads to an increase in the value of the network, users directly benefit.

For example, Uniswap applies an AMM model, liquidity provider offers liquidity and profits from a portion of trading fees, swapper trades on AMM and pays 0.3% fee. Users participating in liquidity provider positions can directly create liquidity for trading pairs without a market maker. The more liquidity provider, the higher the liquidity, the less the risk of slippage of large trading orders, the more trading volume on the platform.

Indirect network effect

Indirect network effect refers the increase in new users using additional utilities, products or services that increase value of network.

For example, Uniswap V3 is an upgraded version of V2, improving liquidity provider’s capital efficiency with many improved features such as: providing more centralized liquidity, applying various flexible fees, easy-to-integrate V3 Oracles, Uniswap LP tokens in the form of NFTs.

Many other DeFi projects have integrated these features in various fields, such as Trading Tools, LPs Position Management, Capital Efficiency, Liquidity Mining,… Indirect network effects have enhanced the application and popularity of V3.

Bilateral network effect

The bilateral network effect refers an increase in the group of people using an additional product benefits users of that product and vice versa.

For example, the number of users of DEX Aggregators increases, DEX charges more transaction fees, and liquidity provider and market maker income increases.

Local network effect

The local network effect occurs when user’s benefit is affected by the increase of a small group of new users, rather than the entire user.

Network effect in the cryptocurrency market

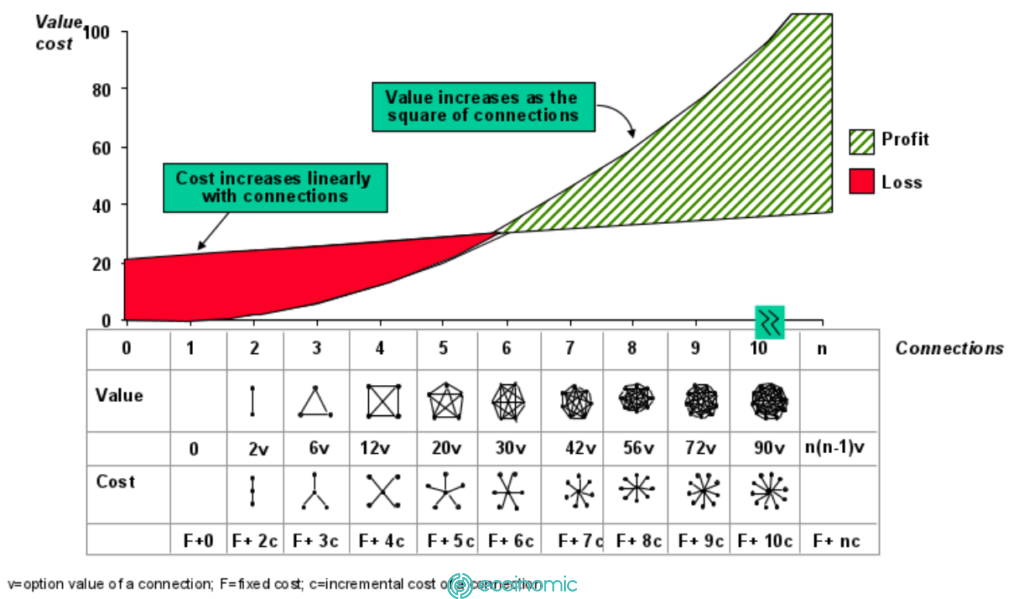

In the cryptocurrency market, network effect is like a magnet that attracts investors. The image below will depict the correlation between value and cost in making a network profitable.

It can be seen that network value increases faster than the cost of maintaining the network. As the network size increases, the value increases exponentially that strengthens the power of the network effect.

Airdrop is a popular way to attract users in the cryptocurrency market. The project’s tokens are listed on the exchange as ICO, users need to make sure to hold a minimum amount of tokens in the wallet and participate in certain tasks to receive token rewards or NFT from the project.

That motivates new entrants to the cryptocurrency market, increasing the popularity of the token in the community.

Besides, the power of network effect is clearly shown through the upgraded versions of the application. One of examples is the development of Uniswap. When it first launched in 2018, the V1 had not attracted many users.

Subsequently, V2 was upgraded in May 2020 with many add-ons that quickly created a strong effect in the community and became the most popular application on Ethereum. While Uniswap V2 achieved a total trading volume of $1 billion in just one month, V1 took nearly two months to reach a trading volume of $100 million.

Negative network effects

A negative network effect refers an increase in additional users reduces the value of the network.

Usually, a well-functioning network will attract investors. However, in some cases, when the amount of participating investors increases, the value of the network decreases. Ethereum’s gas fees are a good example.

Ethereum gas fees are designed for users to bid on transaction throughput. This bid is used as a payment to Ethereum miners to verify the transaction.

Adding users to the Ethereum network has led to an increase in gas fees as users tend to pay higher prices to speed up transactions. As gas fees increase due to contractor activity, many users leave the network due to high transaction costs.

How to apply network effect in cryptocurrency analysis and investment

The cryptocurrency market is constantly volatile with different cycles of increase and decrease, which can be short-term for a day, a week or last up to a year, several years. Capturing market trends helps investors stay ahead of trends and make accurate judgments and predictions.

Therefore, it is extremely necessary to analyze the positive or negative impact of network effect on the market.

Investors need to consider the growth potential of a trend or project based on user’s usage and evaluate the benefits of the network from the increase in the amount of users.

Investors can then seize investment opportunities based on a detailed understanding of the aspects and related projects. For example:

- Derivatives ⇒ Options contract, perp, Synthetic Asset ,…

- Lending ⇒ Yield optimizer, money market,…

- DEX ⇒ Orderbook, hybrid model, AMM,…

>>> Sign up for a trading account to start your investment journey right here: [Kichback rate 20%] – Binance registration guide update 2022

Conclusion

Network effect is a powerful determinant of the level of adoption of cryptocurrencies, paving the way for scalability and the development of the blockchain ecosystem. Through this article, hopefully you will understand more about the nature of the network effect and the application of the network effect in the field of cryptocurrencies in particular and the financial economy in general.

To apply network effect in cryptocurrency analysis, investors need to have a good knowledge of crypto market to analyze the positive or negative impacts of network effects, so they can create portfolio diversification strategies suitable for risk appetite.