Advertisement

What is order book?

An order book is an electronic list of buy and sell orders of a particular asset arranged by price. The order book represents the interests of buyers, sellers and the ever-changing relationship between them. It visually illustrates the list of opening orders of a particular asset in real time. This electronic list is used by almost exchange for different asset classes (stocks, bonds, currencies, and also crypto).

It can be considered as a tool visualizing the orders placed for any asset class. It gives investors a specific perspective on market sentiment and how the law of supply and demand works in the trading market.

The number of buy and sell orders at each price point (market depth) is listed in the order book. That provides important information about trading and increases market transparency. Market depth and liquidity play a role in determining the price of orders.

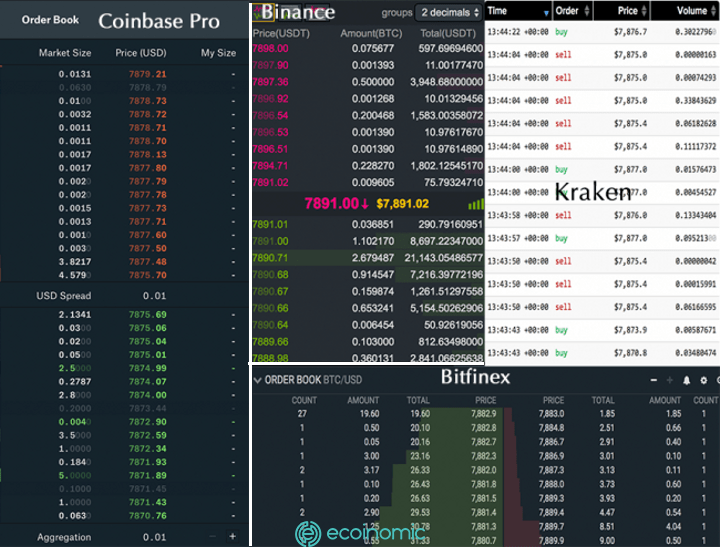

In general, regardless of the trading platform, the purpose and features of the order book are the same. However, their interface on each exchange is adjusted to suit the will of the exchange developers.

How does order book work?

The order book is constantly updated in real time throughout the day. That means it’s always changing and reflects the real-time intentions of market participants.

To be able to understand and read the order, the investor must basically grasp four main concepts:

- Bid: Buyer’s information, including all buy price, the number of cryptocurrencies the buyer wants to buy

- Ask: Information about the seller, including the ask price and the number of cryptocurrencies the seller wants to sell

- Amount: Each price will show the number of orders the investor is willing to buy or sell

- Price: The highest bid price and lowest ask price offer shown at the top of order book

Through the above information, investors can see an imbalance between buy and sell orders. It’s an important clue about the fluctuation of an asset in the short term. Understanding this rule, investors can consider making informed trading decisions.

See also: Margin And Futures On Binance – What Are The Differences?

Real wall and fake wall

Real Wall

Real walls are created from information related to the project (new partnerships, new products, utilities,…) and actual fluctuations in the market (attacks, new coin listings,…) or the psychological impact of investors.

Real wall is divided into two types: Real buy wall and real sell wall. The figure below depicts the ascending trend of the real buy wall and the descending trend of the real sell wall.

Fake Wall

Fake walls are created from inaccurate sources from sharks or trading bots for the purpose of manipulating the market. Real walls are divided into two types: Real fake wall and fake sell wall.

Unlike real walls, fake walls do not show an ascending or descending trend, but have a rigid drawing as follows:

See also: What Is Liquid Staking? Breakthrough In DeFi Development

How to read order book on crypto exchange

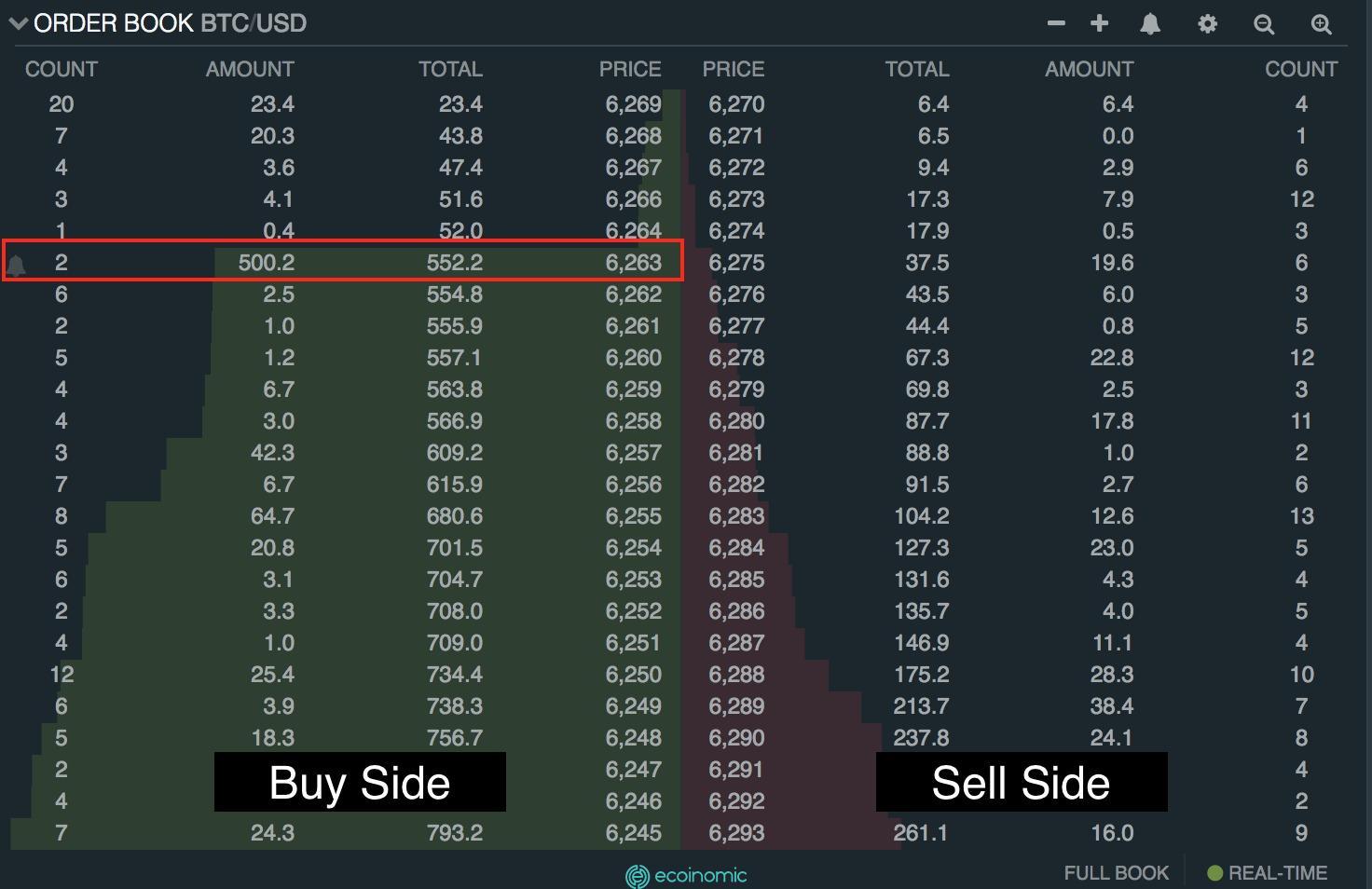

The information about buy orders, sell orders, prices, quantities will be indicated on two sides above an order book, called buy-side and sell-side.

Price and quantity

Price and quantity (also known as order size) are common information for both buyers and sellers. This information gives investors the total number of cryptocurrencies and the price they want to trade.

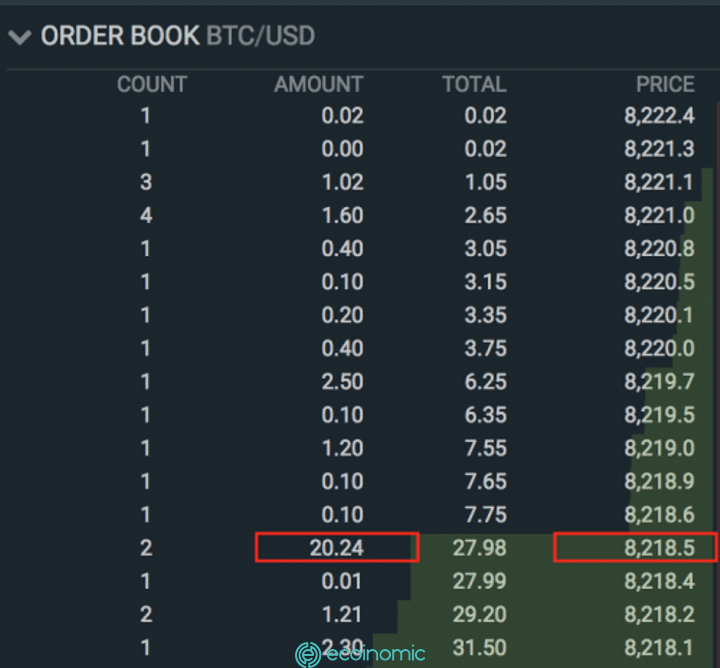

- Count: represents the total number of orders along with a bid price.

- Amount: the total value of orders.

- Total: the total sequence that accumulates amounts together.

For example, the following figure is Bitfinex’s order book, with the parameters shown on the screen, the investor wants to buy 20.24 BTC units at $8218.50/BTC.

Buy-side

Buy-side represents all the opening buy orders and the nearest price to be traded. A transaction will be executed when the bid price match with the corresponding sell order.

When a series of purchases appear at a single price, the order book screen will form a buy wall. This affects the price of an asset class. The reason is that if large-sized orders cannot be filled then investors cannot place order at a lower price. The price of the asset cannot fall further and the price of the orders below the buy wall cannot be matched until the order at the buying wall is completely executed. At this time, the buy wall acts as a support in the short term.

For example, on Bitfinex order book, there is a 500.2 BTC buy order waiting to be matched at the price of $6,263. This order size is quite large compared to the Bitcoin supply level in the market and forms a buy wall. Therefore, orders with a lower bid price below the buy wall will not be matched until the order above is filled. The buy wall at $6,263 serves as a short-term support in order to prevent the bitcoin price from falling further.

Sell-side

Sell-side is list of all sell orders and the latest price to be traded. And a sell wall will be formed if a large number of sell orders are placed at a single price. Sell orders at higher prices cannot be executed if all sell orders at the sell wall is not matched. At this time, the sell wall creates a short-term resistance zone.

Conclusion

In short, an order book is a tool that helps crypto investors get an overview of the balance between buy and sell orders, and the correlation of price in the market. A good knowledge of order book helps investors master trading decisions effectively.