Advertisement

Treasury Bills (T-Bills)

What are Treasury bills?

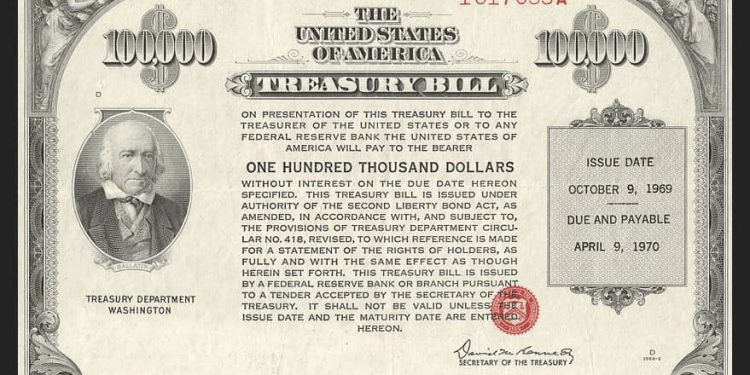

Treasury bills (T-Bills) are basically certificates that recognize short-term U.S. government borrowing covenants supported by the Treasury Department for a term of one year or less.

Treasury bills are typically sold for $1,000 face value, and some can even reach a maximum face value of $5 million when bidding is not competitive.

As such, these securities are considered a low-risk as well as safe investment.

The U.S. government issues Treasury bonds to fund various public projects. For example, when building a highway and having an investor buy a Treasury bill i.e. the U.S. government is writing a letter “I owe you” to investors. This means that Treasury bonds are considered safe investments because the U.S. government supports them.

Maturity of Treasury bills

Treasury bills are kept until the due date; however, some owners may want to withdraw money before maturity and realize the short-term interest rate return through the resale of the investment to the secondary market.

Treasury bills can be valid for just a few days up to a maximum of 52 weeks, and the longer the maturity date, the higher the interest rate that Treasury bonds will pay investors.

Treasury bills are issued at a discounted price from the face value of the invoice, which means that the purchase amount will be less than the invoiced face value.

Over time, when the Treasury bill ends up maturing, the investor is paid the face value of the invoice they bought. If the denomination amount is greater than the purchase price, the difference is the interest earned by the investor. Keep in mind that Treasury bills do not pay interest rates as often as they do with discounted bonds; however, a Treasury bill has an interest that is reflected on the amount paid when due.

See also: Crypto’s Uses And Misuses: Quarrel Between Reuters And Binance

Treasury Bonds (T-Bond)

What are Treasury bonds?

Treasury bonds (T-Bond) are issued by the U.S. Treasury Department to raise money or raise funds for the federal government to meet the costs. With Treasury bonds, you lend money to the government for a certain period of time. In return, you receive half-year interest payments until the bond matures or is repurchased by the government at face value.

They differ from T-Bills in that they have long maturity dates, ranging from 10 to 30 years.

T-Bond bonds have provided a safe haven in times of financial uncertainty, and they complement well any portfolio you want to have fixed income assets.

Buying and selling Treasury bonds

Treasury bonds do not trade on exchanges like stocks. Instead, they are bought and sold directly on the secondary market. This means that an investor can buy or sell Treasury bonds at any time the investor wants, as opposed to stocks that trade on exchanges during specific hours of the day.

You can buy Treasury bonds through an online auction organized by the Ministry of Finance.

You can hold the bond until maturity and receive interest every six months or sell it before it matures. If you are looking to sell Treasury bonds, it is best to do this through a broker on the secondary market. When selling before maturity, the seller may receive a lower amount than the investment made initially.

Advantages of Treasury bonds

Treasury bonds are considered reliable investments. They offer a consistent interest rate and are supported by the government. The government does not guarantee that it will always be able to pay the debt in full, but it is rare for the federal government to default.

Treasury bonds are over-the-counter (OTC) traded and can be purchased directly from the Federal Reserve Bank, brokerage firms registered with regulators, such as the SEC or CFTC, or mutual fund companies or agents authorized by them.

It’s one of the surest ways to establish a steady stream of income. Treasury bonds pay half-year interest until they mature.

Treasury bonds can be sold at any time on the secondary market, which means there is a lot of liquidity for them.

See also: What Is DEX – An Important Role In The Crypto Economy?

Disadvantages of Treasury bonds

Treasury bonds are known to be a very safe investment, but they have some drawbacks. Treasury interest rate payments provide a stream of income, but they may not be enough to keep up with Inflation or other forms of investment income.