Advertisement

What is the Blockchain Bridge?

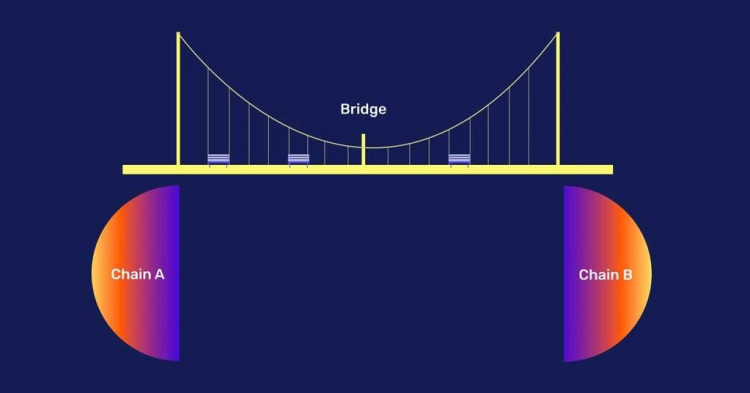

A Blockchain Bridge is a connection that allows the transfer of tokens or data at will from one chain to another. Both chains may have different protocols, rules, and governance models, but the bridge provides a compatible way to interact securely on both sides.

What is the Blockchain Bridge?

There are many different designs for bridges, but in general, they can be divided into two camps: more focused bridges based on trust or alignment and the so-called “unreliable” bridges that are more decentralized.

The centralized bridge relies on some kind of central agency or system to operate, meaning that the user is required to put their trust in the mediator to use a certain application or service.

In contrast, unreliable bridges are bridges that users do not trust in an organization or authority. Instead, beliefs are placed in mathematical truths that are integrated into the code. In a decentralized Blockchain system, this truth is achieved by many computer nodes reaching a general agreement according to the rules written in the software. This eliminates many of the problems of centralized systems, which are prone to corruption or abuse of power, by using transparency and encouraging broad participation.

Bridges can be created to suit a variety of purposes. Not only do they have the potential to allow tokens on one network to be used on another, but they can also be built to exchange any type of data, including Smart contract calls, decentralized identification numbers, off-chain information from algorithms such as feedstock market prices, and more. For example, a fixed chain of verifiable credentials on Polkadot can be used for KYC (Identity Verification) requests by a gaming company built on Ethereum. Bridges allow applications to be even more decentralized, as they are no longer limited by their network of origin.

Some bridges, called one-way or one-way bridges, only allow you to transfer assets into the target blockchain, not vice versa. For example, Wrapped Bitcoin allows you to send Bitcoin to the Ethereum blockchain – to convert BTC into an ERC-20 Stablecoin – but it doesn’t allow you to send Ether into the Bitcoin blockchain.

Other bridges like Wormhole and Multichain are two-way bridges, which means you can freely convert tokens to and from blockchains. Just as you can send Solana to Ethereum’s blockchain, you can send Ether to Solana.

Why use a blockchain bridge?

The transfer of assets from one blockchain to another comes with a multitude of benefits. First, the blockchain you transfer assets to may be cheaper and faster than its original blockchain. This is true for Ethereum, where high transaction fees and slow throughput make it difficult for newcomers to the decentralized financial sector (DeFi).

If investors move assets to a class 2 network — a faster blockchain located atop the Ethereum blockchain, like Arbitrum or Polygon, they can trade ERC-20 tokens at a fraction of the cost without sacrificing exposure to Ethereum tokens.

Other investors can use the bridge to make the most of markets that exist only on another blockchain. For example, the DeFi Orca protocol is only available on Solana but supports the included version of ETH.

The bridge is becoming easier to use. Many DeFi protocols have built-in bridges to allow their users to swap tokens from different protocols without having to leave the platform. This makes the token conversion process through bridges less complicated.

See also: What Is A Node? How Nodes In Blockchain Work

Is the blockchain bridge secure?

Currently, some newly launched decentralized bridges have not been inspected and even those that have been inspected can be exploited. The most notable recent example of BNB Chain’s Solana Wormhole Bridge and Qubit Financial Bridge has been mined for more than $400 million by 2022. The largest hack in cryptocurrency history occurred in August 2021, when PolyNetwork Bridge was mined for $610 million, although the stolen funds were later returned.

According to an analysis from elliptic, the Wormhole attack occurred because Wormhole allowed the attacker to mine ethereum worth 120,000 coins without having to deposit any ETH. The attacker then withdrew weth for free. A high-frequency trading company called Jump Trading covered the losses to salvage the protocol.

.@JumpCryptoHQ believes in a multichain future and that @WormholeCrypto is essential infrastructure. That’s why we replaced 120k ETH to make community members whole and support Wormhole now as it continues to develop.

— jump_crypto 🔥💃🏻 (@jump_) February 3, 2022

Reliable bridges have different risk configurations. Instead of the risk that an attacker exploits its protocol and withdraws money, the risk is that the company holding fixed assets is corrupted or negligently loses control of the asset due to incompetence or orders from third parties, such as if the government asks the company to freeze the assets.