Advertisement

What is leverage in crypto?

Leverage is an investment strategy that uses borrowed money – namely, the use of various financial instruments or loans – to increase the potential return of an investment. From there it is possible to expand the asset base, amplifying your buying or selling power, allowing you to trade for larger amounts. Simply put, leverage is a position size multiplier.

For example, a company wants $25 million to invest in its business and has more opportunities to add value to shareholders. If this amount is too large, the company can use the leverage strategy to get this money. Under the operating mechanism only need to spend $ 5 million and a amount of leverage in a ratio of 1:5 (5x) i.e. with 5 times the leverage, your $5 million will have the purchasing power equivalent to $ 25 million.

How to use Leverage

The concept of leverage is used by both investors and companies. Investors use leverage to significantly increase the returns that can be offered for investment. They promote their investments using various tools, including options, futures contracts, and margin accounts. Companies can use leverage to finance their assets. In other words, instead of issuing shares to raise capital, companies can use debt financing to invest in the business to increase shareholder value.

Investors who are uncomfortable using direct leverage have many different ways to access indirect leverage. They can invest in companies that use leverage in the course of their business to finance or expand operations without increasing their costs.

The best cryptocurrency leverage trading platform

Binance is the best electronic leverage trading platform, for two reasons. First, Binance offers an extremely wide range of tokens. In addition, Binance is known for its relatively low fees, which can save you a lot of money in the long run, especially when trading with leverage.

cryptocurrency leverage trading platform

Some other great exchanges for leveraged trading that might consider are:

- OKX (formerly known as OKEx) – the second largest exchange globally by volume with a fee equivalent to Binance in Asia

- ByBit – the convenience of being integrated as a mobile application

- Delta Exchange

Leverage vs. margin

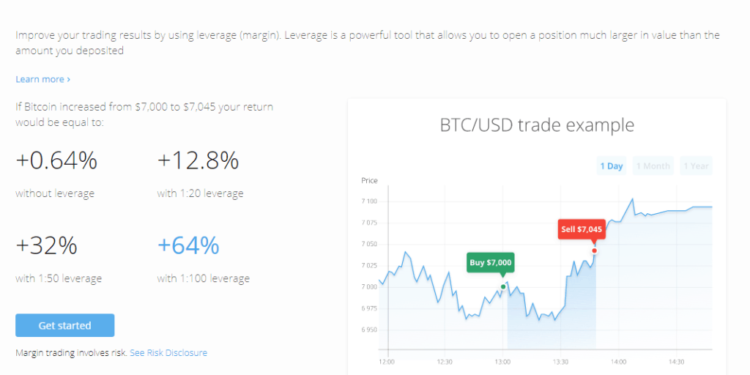

Margin is a special type of leverage that involves the use of cash or an existing securities position as collateral used to increase a person’s purchasing power in the financial markets. Margin allows you to Borrow money from a broker for a fixed interest rate to buy securities, options or futures contracts in anticipation of getting significantly high returns.

Therefore, you can use margin to create leverage, increasing your purchasing power with the amount that can be deposited – for example, if the collateral needed to buy $10,000 worth of securities is $1,000, you will have a margin of 1:10 (and 10 times the leverage).

Disadvantages of Leverage (leverage)

In essence, leverage is a complex, multifaceted tool, the use of leverage can be profitable, but leverage can also exaggerate both profits and losses. If used by inexperienced investors who lack a solid understanding of risk management then leverage can wipe out the entire portfolio in just a few minutes.

Related: What Is Binance Futures? How To Use Futures On Binance