Advertisement

Bitcoin price fall below 0.5 MM in bear market

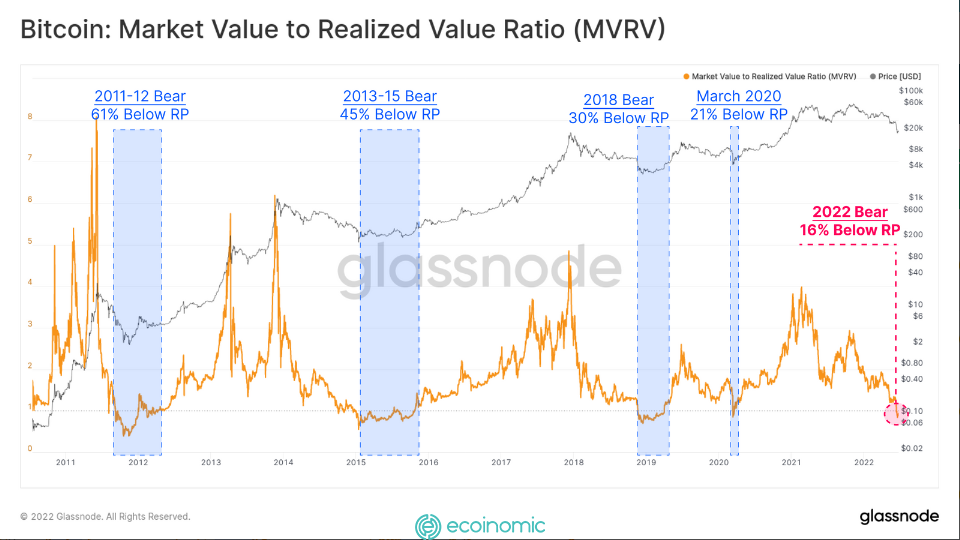

A report on Saturday by the blockchain analytics firm titled “A Big Bear of Historic Predictions” outlined Bitcoin’s decline below the 200-day moving average (MA), negative deviations from actual prices, and actual losses that conspired to make 2022 the worst year in history. of Bitcoin:

“Full is the first time in the history of Bitcoin and Ethereum to trade below their previous cycle ATHs levels.”

The first and most obvious sign of the Bear market is when the spot price of Bitcoin (BTC) falls below the 200-day MA, even the 200-week MA. To highlight how rare current prices are, Glassnode pointed out that in the bear market in 2022, Bitcoin has fallen below half the 200-day MA level.

The fall below 0.5 Mayer Multiple (MM) is an extremely rare occasion that has occurred since 2015. MM factors in prices vary above and below the 200-day MA to indicate overbought or oversold status.

“Only 84 of the 4160 trading days (2%) recorded a closing MM value below 0.5. For the first time in history, the 2021-22 cycle recorded a lower MM value (0.487) than the low of the previous cycle (0.511).”

>> See also: What Are The Differences Between Investment And Speculation?

Confirming the severity of the current market conditions is that the spot price falls below the actual price, which has forced traders to increasingly have to sell their money at a loss. Such a waterfall effect is a sign “typical of bear markets and market speculation.”

According to the analysis, cases of spot prices trading below actual prices are uncommon and this is only the third time this has happened in the past six years and the fifth time it has happened since Bitcoin launched in 2009:

“The spot price is currently trading at an 11.3% discount to the actual price, indicating that the average market participant is now below their position.”

Bitcoin spot price fall below the actual price

The rarity of this event is illustrated by Glassnode’s model showing that only 13.9% of all Bitcoin trading days have seen the spot price fall below the actual price.

These conditions are exacerbated when investors lock losses on the largest cryptocurrency by market capitalization. When Bitcoin fell below the $20,000 mark in June 2022, Glassnode wrote that BTC investors closed “the largest dollar-denominated daily loss in history:”

“Investors ended up losing $4.234 billion in just one day, up 22.5 percent from the previous record of $3.457 billion set in mid-2021.”

BTC is now down 70% from its November 2021 high, trading at $21,207, according to CoinGecko.

>> See also: MEXC Global registration guide