Advertisement

According to CoinShares, hedge funds sold off $101.5 million worth of digital assets last week due to concerns the U.S. Federal Reserve raised interest rates at its upcoming meeting.

The U.S. Labor Department said on Tuesday the consumer price index rose 8.6 percent last month from a year earlier, higher than the 8.3 percent increase over the same period in April, marking Inflation not seen since 1981. As a result, the market is expecting the Fed to take significant action to turn around inflation, while some traders expect the Fed to raise rates by 0.5% on three more occasions in October.

According to the latest report by digital asset management firm CoinShares, from June 6 to June 10, U.S. regional investors led capital outflows from the market with $98 million, followed by European investors with $2 million.

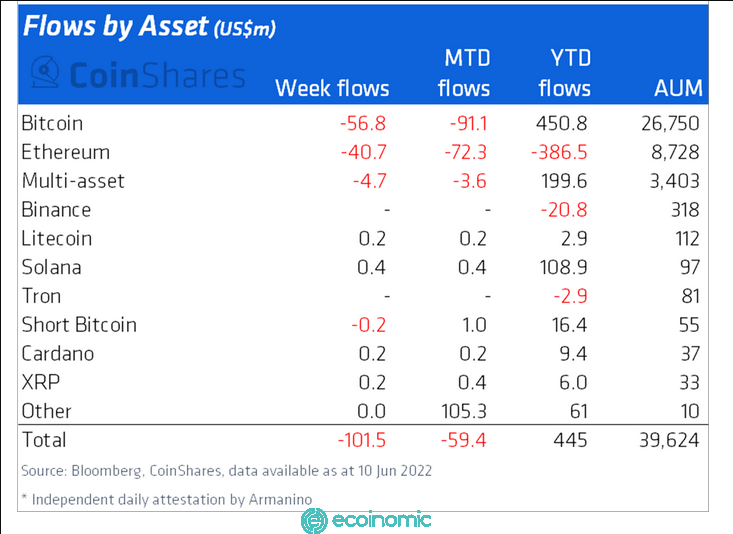

Risk assets sold include Bitcoin (BTC) and Ethereum (ETH), which account for nearly all outflows at $56.8 million and $40.7 million each. The figures to date also show an incredible figure with outflows of $91.1 million for BTC products and $72.3 million in total outflows for ETH products.

While CoinShares claims that Bitcoin has fallen into crypto winter, the investment inflows so far this year (YTD) for BTC investment products remain at $450.8 million. Meanwhile, funds providing financial risk services with ETH have seen huge cash flow inflows since the start of the year amounting to $386.5 million, indicating that the sentiment of large institutional investors remains supportive of digital gold.

*Crypto Winter refers to a sharp drop in the price of cryptocurrencies, followed by declining trading and a gloomy market for months on end. The report also highlights that the total managed assets (AUM) of Ether funds have fallen from a peak of US$23 billion in November 2021 to US$8.7 billion last week. Notably, it seems that institutional investors have sold off their BTC and ETH in the face of the price instability of both of these assets.

According to data from CoinGecko, from June 6 to June 10, the price of BTC and ETH decreased by 4.7% and 5.9%. However, since June 11, BTC and ETH have fallen by about 25.7% and 33.2%, respectively.

In addition to cash flows withdrawn from BTC and ETH, multi-asset investment funds sold about $4.7 million, and short-term financial products related to Bitcoin were sold for a minimum amount of $200,000. At the same time, investors also stay away from buying more altcoins.

>>> See also: Celsius transferred $320 million of cryptocurrencies to FTX, suspending transfers, swaps and withdrawals.