The Bear market is taking its toll on some of the industry’s largest VCs.

A16z’s flagship crypto fund dropped 40% in value in the first half of this year, according to a Wall Street Journal report citing people familiar with the matter. This compares to the end of last year, when the company’s first crypto fund, launched in 2018, saw 10.6x paper returns on its investments.

To date, the company has raised more than $7.6 billion in crypto and web3 startups across four funds, the most recent of which launched in May. At the time, general partner Arianna Simpson said that “bear markets are often when the best opportunities come about” — but the company’s recent investment track record doesn’t seem to back this up.

In Q4 2021, a16z participated in 26 cryptocurrency and blockchain VC deals. This dropped to 17 apiece in Q1 and Q2 2022. By Q3, they invested in just seven, according to data published by Fortune.

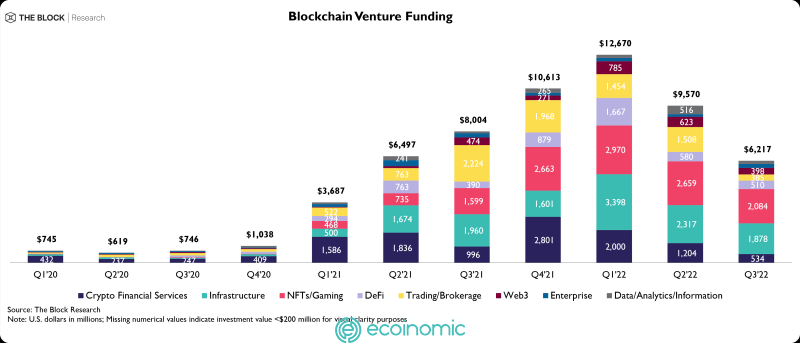

It’s not just a16z that’s feeling the bite of the bear market. Venture funding has decreased 35% to approximately $6.2 billion between Q2 and Q3 2022.

Update: Clarified that a16z has raised more than $7.6 billion, as opposed to having invested that amount.