People are also interested: How to sign up for FTX is the simplest for beginners

Advertisement

Bitcoin (BTC) has broken out from a long-term descending resistance line and is within the process of reclaiming its 200-week moving average (MA).

Throughout its price history, the 200-week MA has acted because the price bottom for bitcoin numerous times (green icon). Additionally, the value failed to reach a detailed below this MA for a sustained period of your time. So far, BTC has reached five weekly closes below this MA. Historically, this can be the longest period that BTC has spent under the 200-week MA.

Currently, the MA is near $22,700 and bitcoin is attempting to reclaim it. the primary attempt is currently ongoing and failure to reclaim could force the worth down further.

Ongoing breakout

The daily chart indicates that Bitcoin will likely achieve success in moving above this MA. There are two prime reasons for this:

- Bitcoin has broken out from a descending resistance line that had been in situ since the start of April

- The daily RSI has moved above 50 and is following an ascending support line (green)

If the upward move continues, Bitcoin would be expected to succeed in the 0.382 Fib retracement resistance level near $29,400.

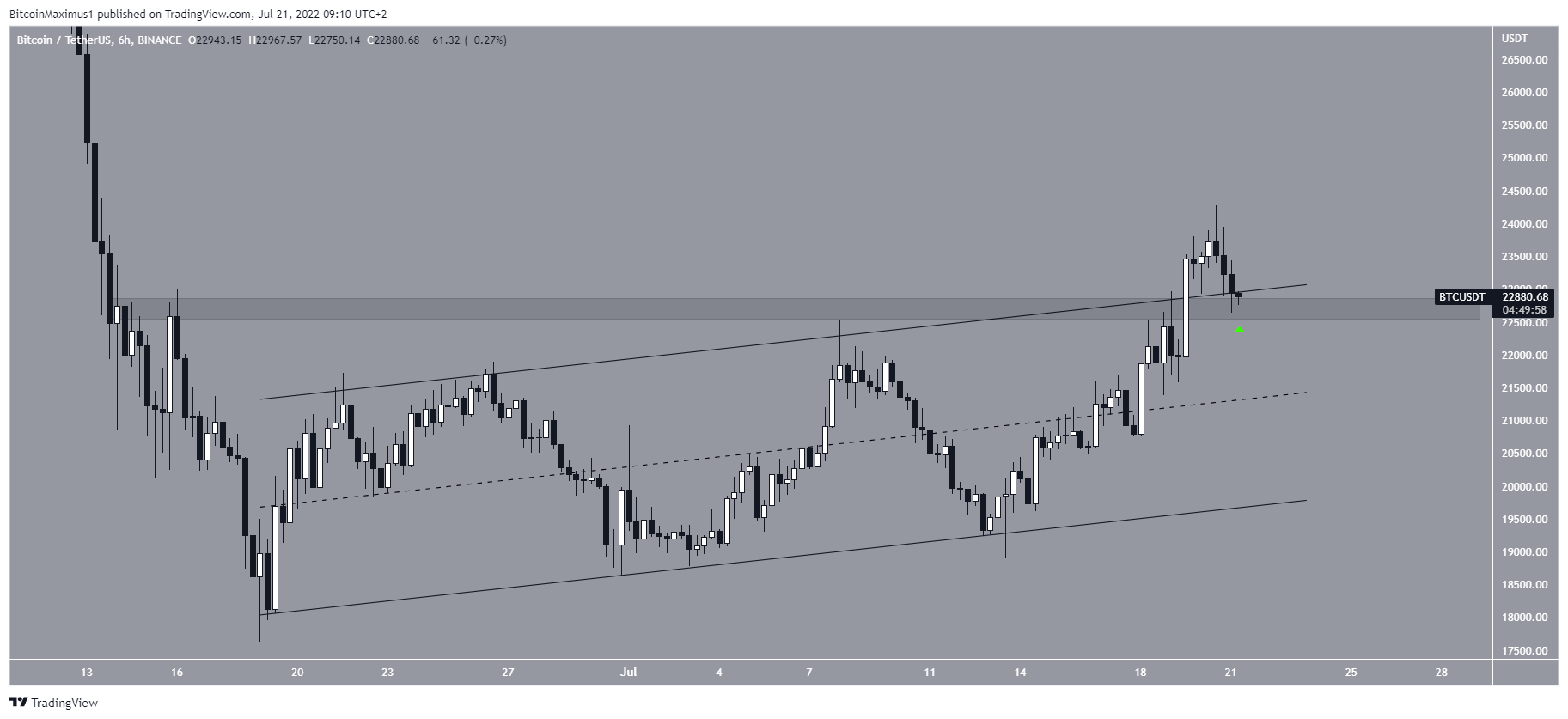

On July 20, the worth broke out from a short-term ascending parallel channel and therefore the $22,700 resistance area. However, the decrease that followed caused it to fall back inside the channel and area all over again.

If the upward movement is to continue, it’s crucial that Bitcoin quickly moves above the channel confines.

BTC wave count analysis

The most likely wave count suggests that Bitcoin has completed the five-wave downward pattern (yellow) that began in April. If this is often true, then wave five was truncated because it did not move below the underside of wave three.

If the wave count is correct, it could mean that Bitcoin has begun a brand new upward move that may take it towards the $29,500 resistance area and potentially higher.